- BEAM saw a 10.83% price rise and a 217.05% increase in trading volume.

- High concentration by large holders at 85% could impact BEAM’s market stability, reflecting significant control by a few entities.

As a seasoned crypto investor, I’ve seen my fair share of price swings and market volatility. The recent surge in BEAM’s price and trading activity has caught my attention. With a 10.83% increase in the last 24 hours, reaching $0.01863 at press time, and a significant rise in trading volume, there seems to be growing interest and investment in this token.

At present, BEAM (BEAM) is experiencing a significant price surge, with each token priced at $0.01863 according to CoinMarketCap data. This represents a substantial 10.83% climb in value over the past 24 hours.

As a crypto investor, I’ve observed an impressive price rise for BEAM that has significantly boosted its market capitalization to a staggering $921,524,187. This represents a noteworthy 10.90% growth, which is a clear sign of heightened interest and investment in this cryptocurrency.

The 24-hour trading volume is $36,608,453, a 217.05% rise, suggesting heightened trading activity.

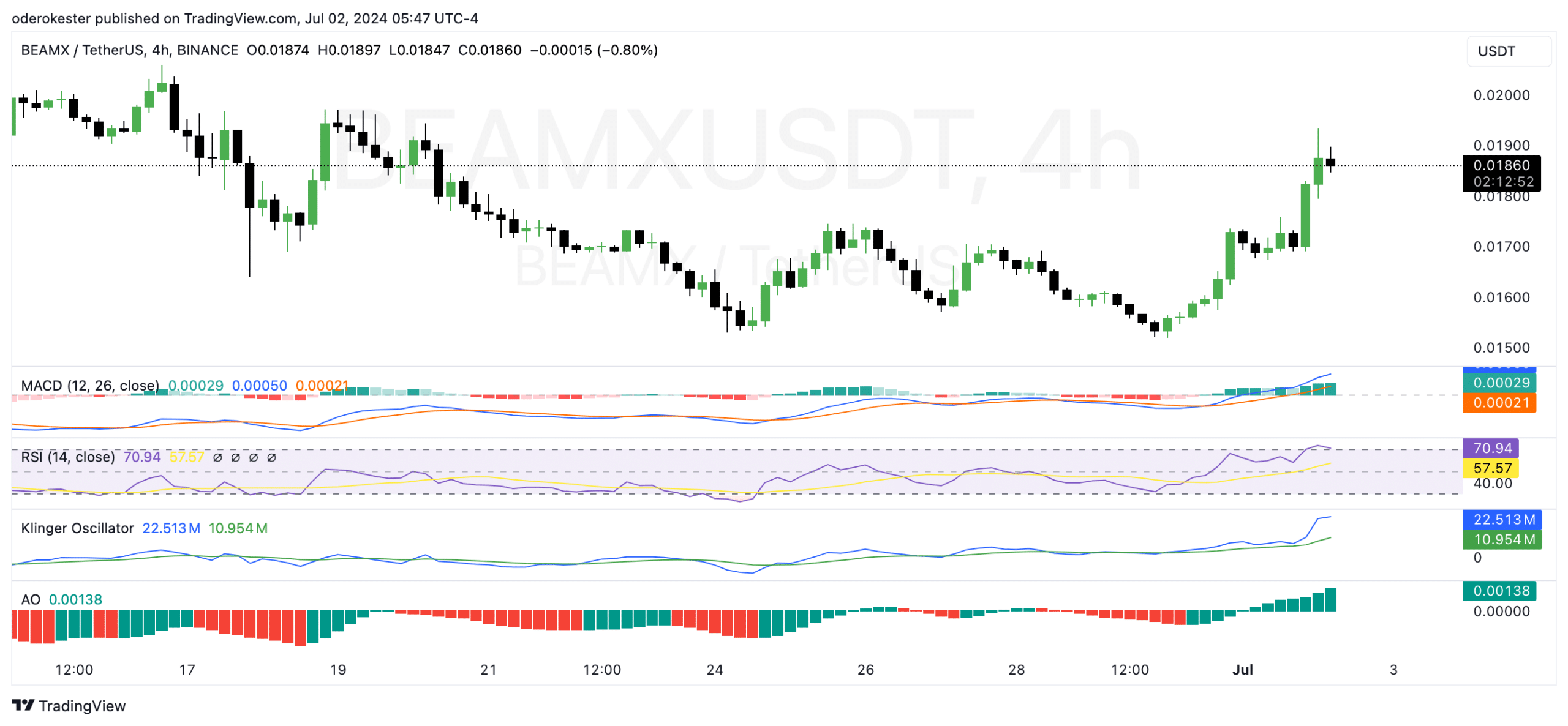

Based on current market data, I’ve noticed that the MACD for Beam has a positive value of 0.00029. This is an encouraging sign as it indicates growing buying pressure. On the other hand, the Relative Strength Index (RSI) stands at 70.94. While this level suggests that Beam might be approaching overbought territory, it’s essential to remember that RSI readings don’t necessarily cause price reversals on their own.

The Klinger Oscillator indicated a robustly positive reading of 22.516M, adding credence to the prevailing uptrend. Meanwhile, the Awesome Oscillator (AO) lent further support to the bullish outlook, registering a value of 0.00138.

Holder profitability and market concentration

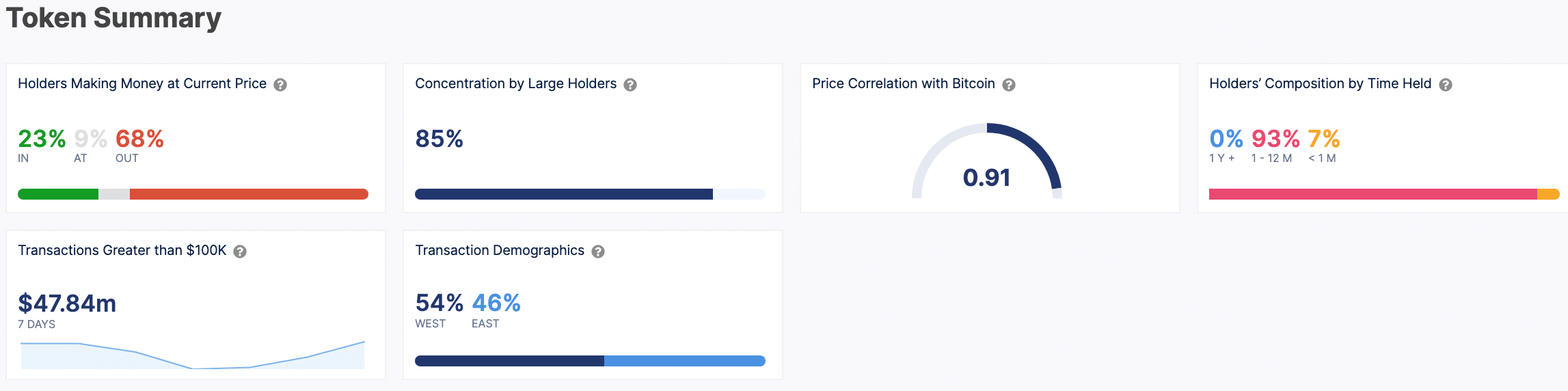

As a BEAM investor, I’ve observed an uptick in the cryptocurrency’s price recently. However, not everyone is reaping the benefits of this rise. In fact, only about a quarter (23%) of us have seen profits, while a substantial majority (68%) are still bearing losses based on the latest data from AMBCrypto and IntoTheBlock.

A substantial proportion, approximately 85%, of the token supply was held by a small number of entities, implying significant control over the token market.

The relationship between BEAM’s price and that of Bitcoin [BTC] was robust, with a correlation coefficient of 0.91. This signifies that the price fluctuations of BEAM tended to mirror those of Bitcoin.

Many altcoins often follow Bitcoin’s price movements closely. So, if Bitcoin recovers its $62,500 support and market sentiment becomes optimistic, it’s likely that BEAM will continue to experience a bullish trend as well.

As a crypto investor, I’ve recently taken a closer look at the holder composition of a particular token. Surprisingly, I found that an impressive 93% of token holders have owned their assets for between 1 to 12 months. On the other hand, only a small fraction, 7%, have held onto their tokens for less than a month. Remarkably, none of the holders have been in possession of their tokens for over a year.

This reflected relatively short-term investment behavior.

BEAM on-chain analysis suggests…

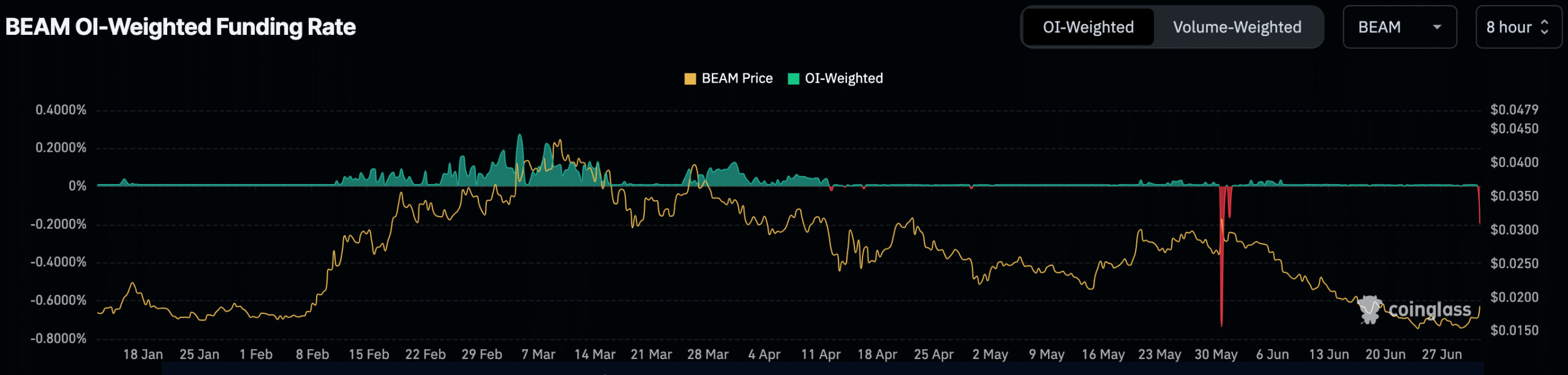

The funding rate for BEAM’s Open Interest-adjusted contract, depicted next to its price, exhibited oscillations near the zero mark.

The given rate signifies the expense of maintaining long or short stances in continuous Future contracts. A positive value implies that holding long positions is costing less than short ones, while a negative value suggests the reverse situation.

Realistic or not, here’s BEAM’s market cap in BTC’s terms

Between early January and late June, BEAM’s price predominantly declined, moving from roughly $0.0450 to nearly $0.0180. Throughout this timeframe, the OI-Weighted Funding Rate exhibited only slight variations, punctuated by a few notable peaks.

The spikes in the chart frequently aligned with significant price fluctuations, demonstrating the intricate relationship between investor attitudes in the futures market and BEAM’s current spot price.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-03 06:15