-

XRP saw over $3 million in liquidation in the previous trading session.

It continued to trend below its short moving average.

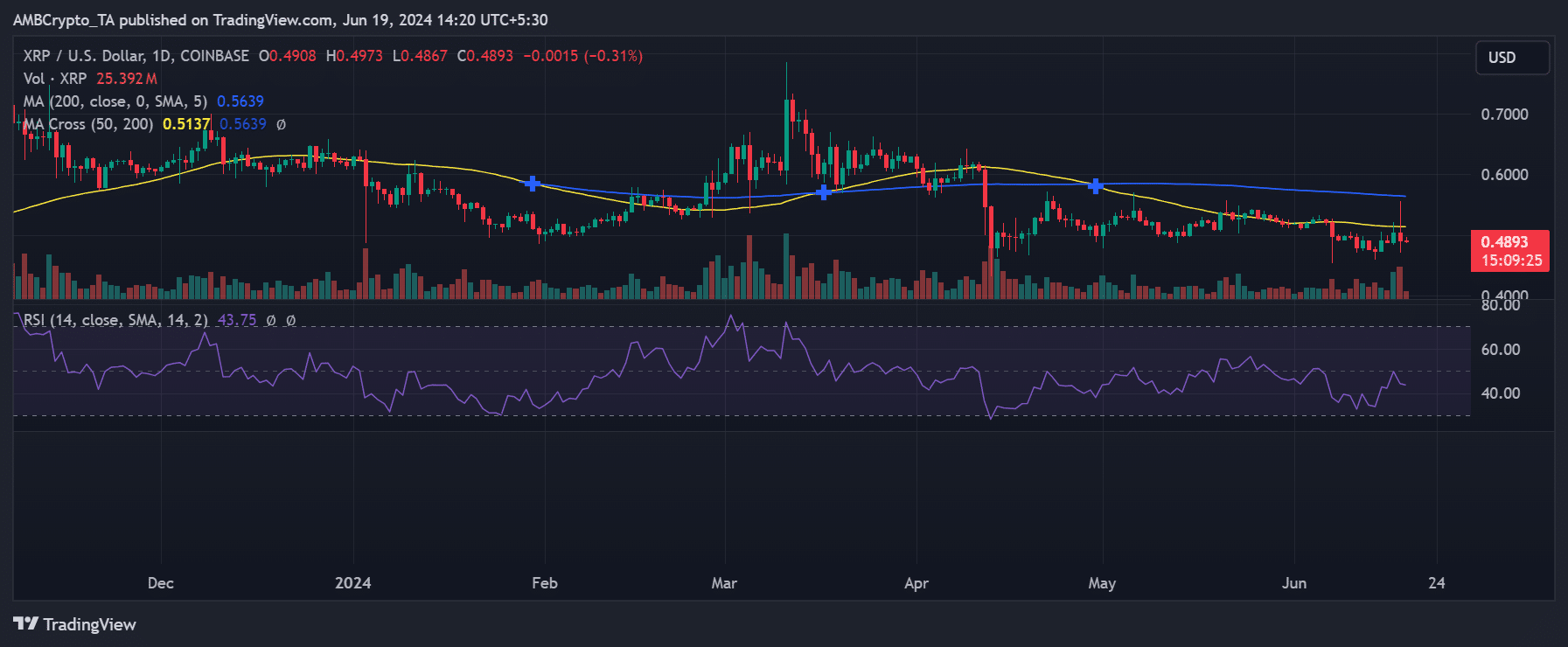

As a researcher with experience in analyzing cryptocurrency markets, I have closely observed XRP‘s recent price trends and market indicators. The previous trading session saw over $3 million in liquidation for XRP, which is a significant amount indicating a high level of volatility and uncertainty in the market. Furthermore, the trend continued below its short moving average, with resistance at around $0.51, adding to the downward pressure on the asset’s price.

In the past few days, XRP‘s price action has shown both upward and downward movements, affecting the degree of investor attention towards it. This price volatility caused a decrease in trading volume and an increase in demand for long positions being closed out.

XRP’s price falls

As a crypto investor, I conducted an in-depth analysis of XRP‘s price movement up until the close of trading on the 17th of June. To my observation, XRP experienced a significant surge, recording a gain of approximately 3.21%. Remarkably, its value reached a milestone of $0.50 by the end of that day’s trading sessions.

However, by the next trading session on 18th June, most of those gains had been wiped out.

On the 18th of June, as observed from the day-to-day chart analysis, XRP experienced a decrease of approximately 2.73%, with its value hovering around $0.49.

The investigation revealed that the trading pattern persisted beneath its short-term moving average, denoted by the yellow line. For some time now, this yellow line acted as a barrier around the $0.51 price point.

From my perspective as a crypto investor, the downturn persisted, and XRP was priced at approximately $0.48 at this moment. Furthermore, an examination of its Relative Strength Index (RSI) disclosed that it was still in a bearish phase since the RSI fell below the neutral threshold.

The graph indicated that the blue line representing the moving average with a longer timeframe hovered near $0.56, acting as a significant resistance level for XRP. The fact that the blue line sat above the yellow line accentuated XRP’s price vulnerability at present.

XRP sees over $3 million in liquidation

The decrease in XRP‘s price led to a significant increase in the amount of positions being closed, totaling over $3 million according to the liquidation data displayed on Coinglass by the close of business on the 18th of June.

The chart revealed approximately $2.79 million worth of long liquidations contrasted with about $343,000 in short liquidations.

Interest in Ripple drops

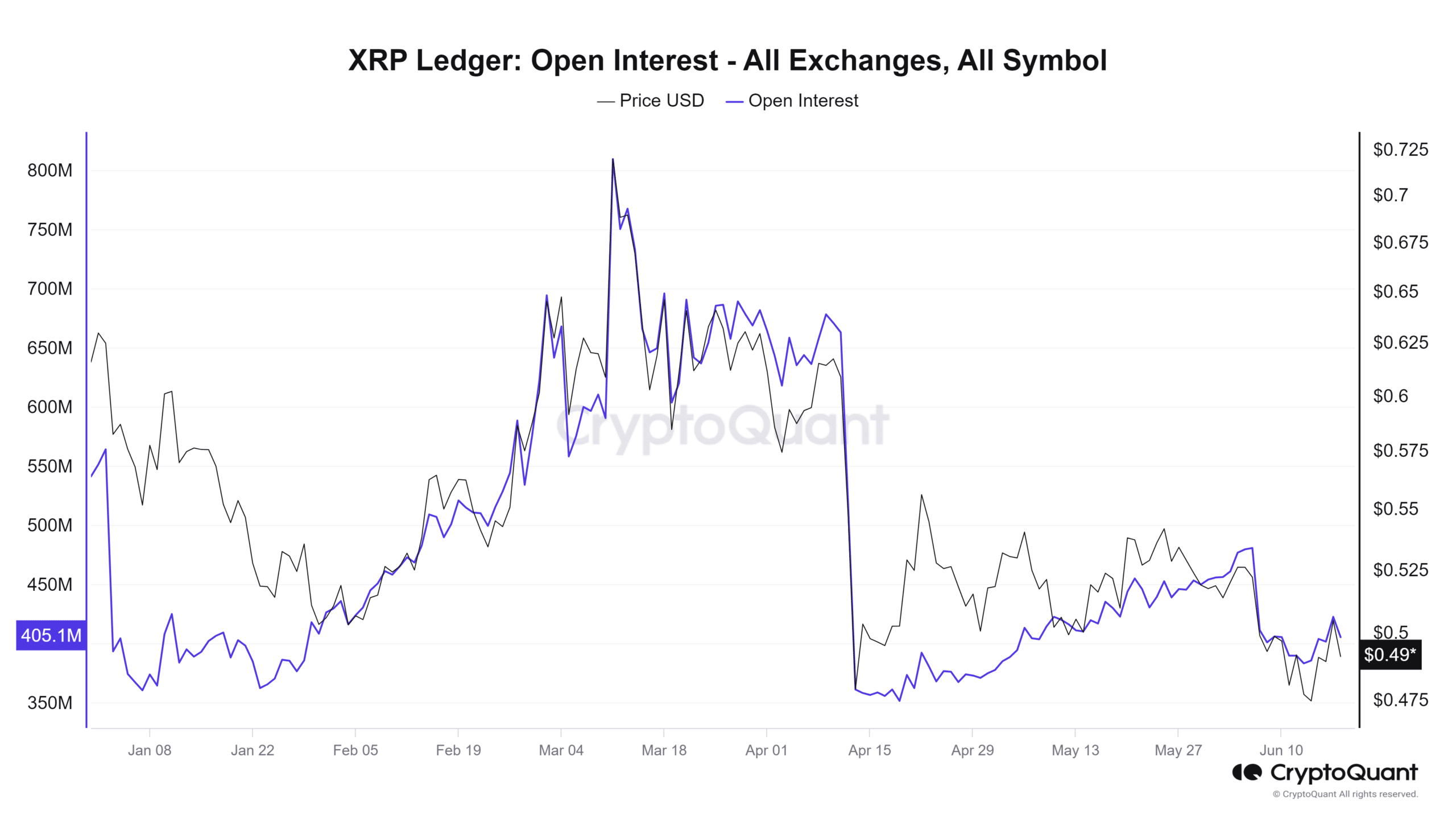

As a crypto investor, I’ve noticed that the price drop of XRP seemed to influence its trend as well, based on my analysis of its Open Interest. A glance at the chart on CryptoQuant revealed an interesting pattern: whenever XRP’s price experienced a surge of over 3% and hit the $0.50 mark, its Open Interest would spike accordingly.

The chart indicated that Open Interest rose to over 422 million.

Realistic or not, here’s XRP market cap in BTC’s terms

As a crypto investor observing the market trends, I’ve noticed that the Open Interest has been on a downward spiral along with the dropping prices. At present, the Open Interest hovers around 405 million according to the latest chart data.

Some traders have chosen to exit their trades as the price dropped, leading to a decrease in Open Interest despite the generally upward market trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-20 01:11