- RENDER’s bearish sentiment has grown noticeably, with an increasing number of sellers causing downward pressure.

- This has added to the asset’s struggles as it encounters multiple resistance levels, making further declines likely.

As a seasoned crypto investor with scars from more than a few market downturns, I can’t help but feel a sense of deja vu when observing RENDER’s current predicament. The growing bearish sentiment and mounting resistance levels are all too familiar signs that have often preceded corrections in the past.

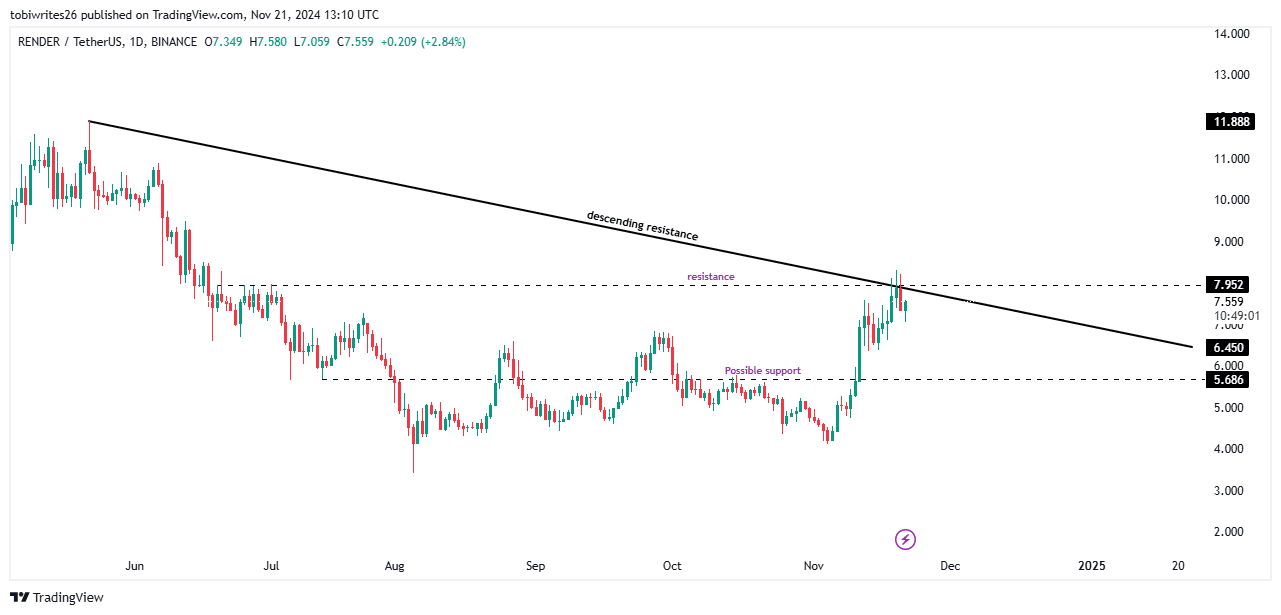

Last month, [RENDER] was one of the leading market performers with a significant increase of 45.28%. However, its upward trend seems to have slowed down after it couldn’t break through crucial resistance levels. As a result, over the past 24 hours, the asset has seen a decrease of 10.01%, sparking worries about its short-term direction.

As a crypto investor, I’m closely watching RENDER’s performance. If it fails to rekindle market enthusiasm, its ongoing slump might persist, casting doubt on its potential for recovery.

RENDER price under pressure

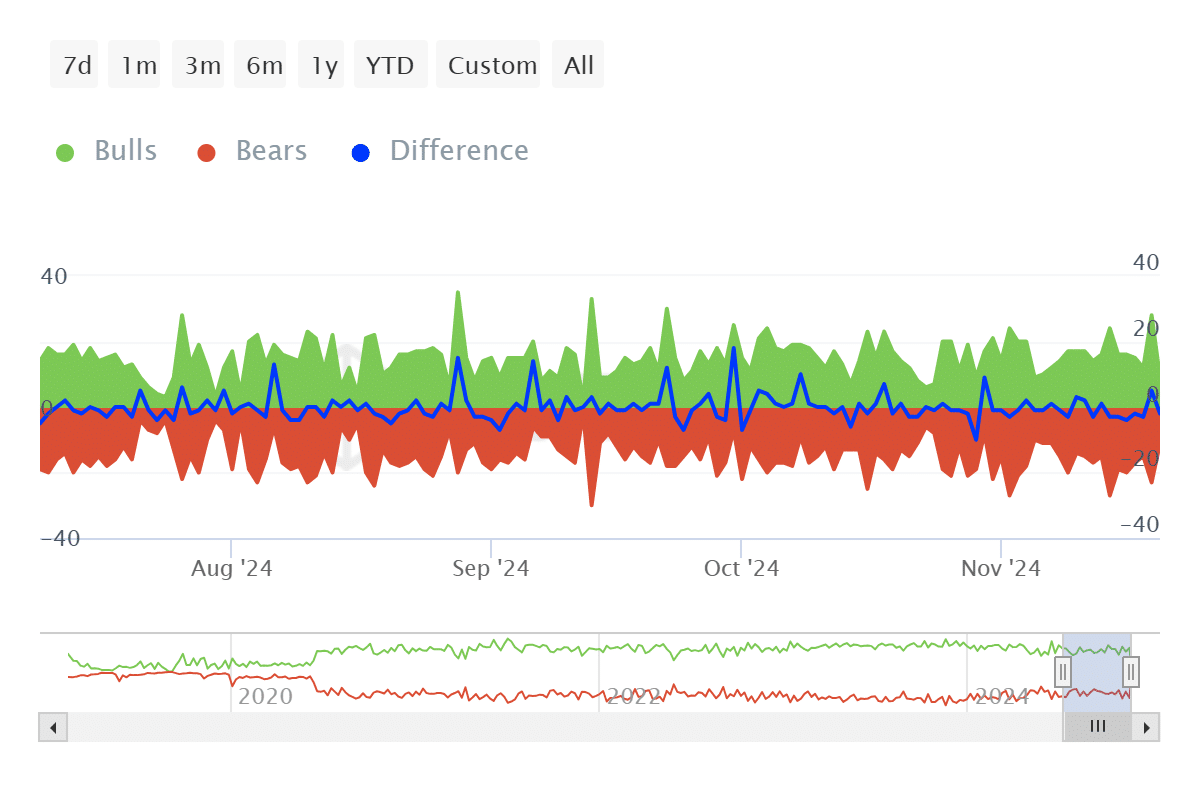

In simple terms, the bear investors have gained dominance in the RENDER market, with a greater number of them being active compared to the bull investors. This imbalance has resulted in a noticeable decrease in prices, as reported by IntoTheBlock, where 132 bearish accounts were active over the last week, while only 120 bullish ones were.

Here, ‘bulls’ and ‘bears’ refer to entities that make up at least 1% of the overall trades in either buying or selling actions. The significant difference we see now indicates an increasing impact from those with a bearish stance.

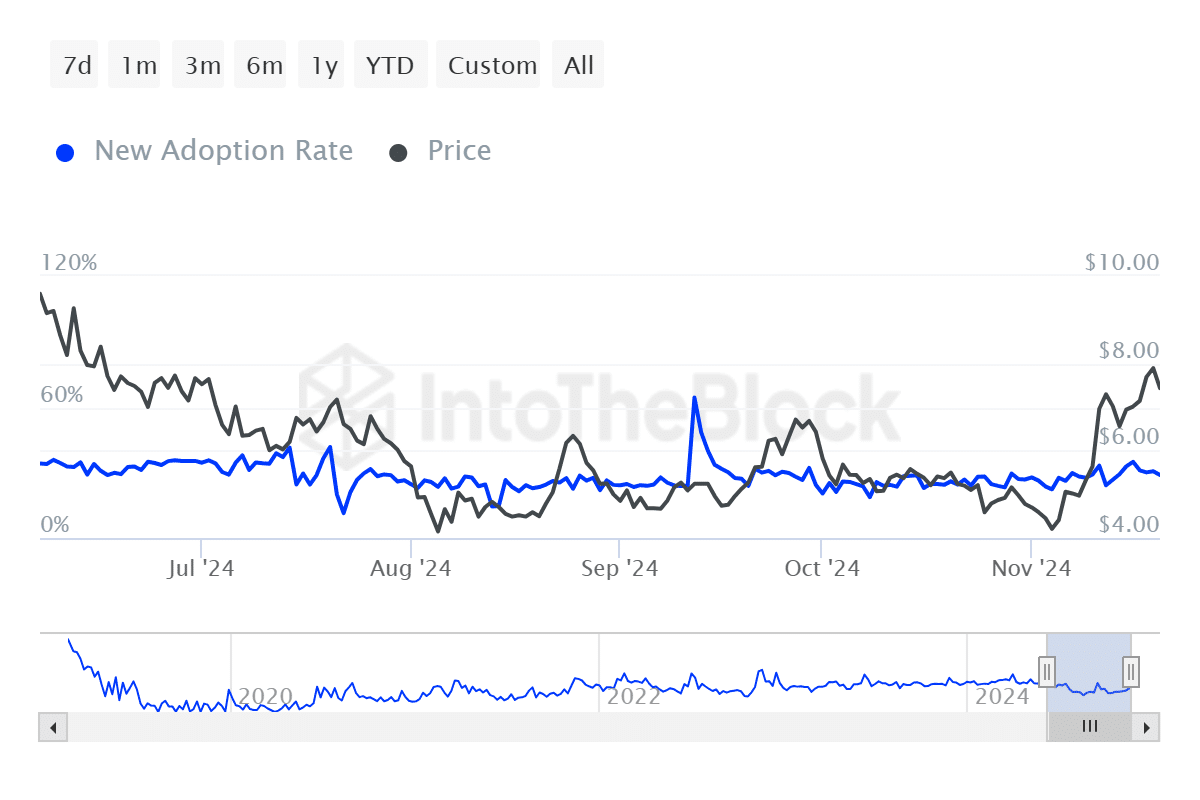

Increasing the gloom, the Active Address Percentage (a measure comparing active addresses to those with a balance) has dropped to just 1.09%. Normally, such a decrease signals a prevailing negative attitude in the market.

Currently, the initial usage rate for RENDER’s new adoption, measuring first-time transactions with the asset, stands at 28.82%. This decrease suggests a decreasing level of enthusiasm for the asset and may indicate difficulties in its future recovery process.

Resistance levels weigh on RENDER

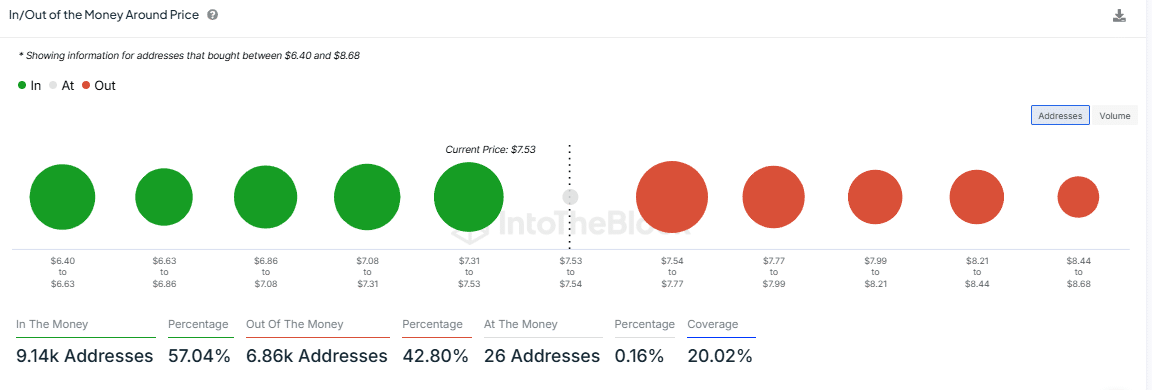

The “In/Out of the Money Around Price” (IOMAP) indicator shows that RENDER is facing a substantial barrier zone, which may slow down its progress or even reverse it. This metric pinpoints crucial support and resistance points, revealing potential triggers and hurdles that could potentially impact price movement.

Yesterday’s peak price at 8.211 appears to coincide with a potential resistance level in the IOMAP data, ranging from 7.99 to 8.21. This area is further bolstered by a large sell order for approximately 3.28 million RENDER tokens, adding strength to the downward pressure.

Technical analysis underscores the difficulties that RENDER is encountering currently. The token has simultaneously touched two significant resistance barriers: a downward slope trendline and a horizontal barrier at 7.97, which coincides with the IOMAP resistance zone’s upper limit.

Is your portfolio green? Check the Render Profit Calculator

These overlapping barriers make a further decline increasingly likely.

As a crypto investor, I’ve noticed the selling pressure is strong and might continue. If so, my RENDER holdings may dip towards the significant support level that lies around 5.686.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-11-22 10:15