- Bernstein has gone long on ETH, citing likely ETF staking yield approval.

- Other catalysts include positive ETH ETF flows and institutional interest.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself increasingly intrigued by the bullish stance taken by Bernstein on Ethereum (ETH). The potential approval of ETH ETF staking yield under the Trump administration is indeed a compelling catalyst, particularly given the current low-interest environment.

Analysts from Bernstein are optimistic about Ethereum [ETH], predicting that an ETF staking approval in the U.S., possibly during the Trump administration, could serve as a significant boost.

The research and brokerage company pointed out three additional factors driving the altcoin, describing its recent lagging performance as an excellent opportunity for potential gains.

Part of the analysts’ report, led by Gautam Chhugani, read,

“We believe, given the ETH’s underperformance, the risk-reward here looks attractive’

Ethereum ETF staking approval

In contrast to the ETH ETF in Hong Kong that supports staking, the U.S. did not approve staking yields for its products in July.

As an analyst, I believe that under the Trump administration, there’s a possibility for this scenario to shift, offering an appealing return potential, especially given the anticipated Federal Reserve rate cuts.

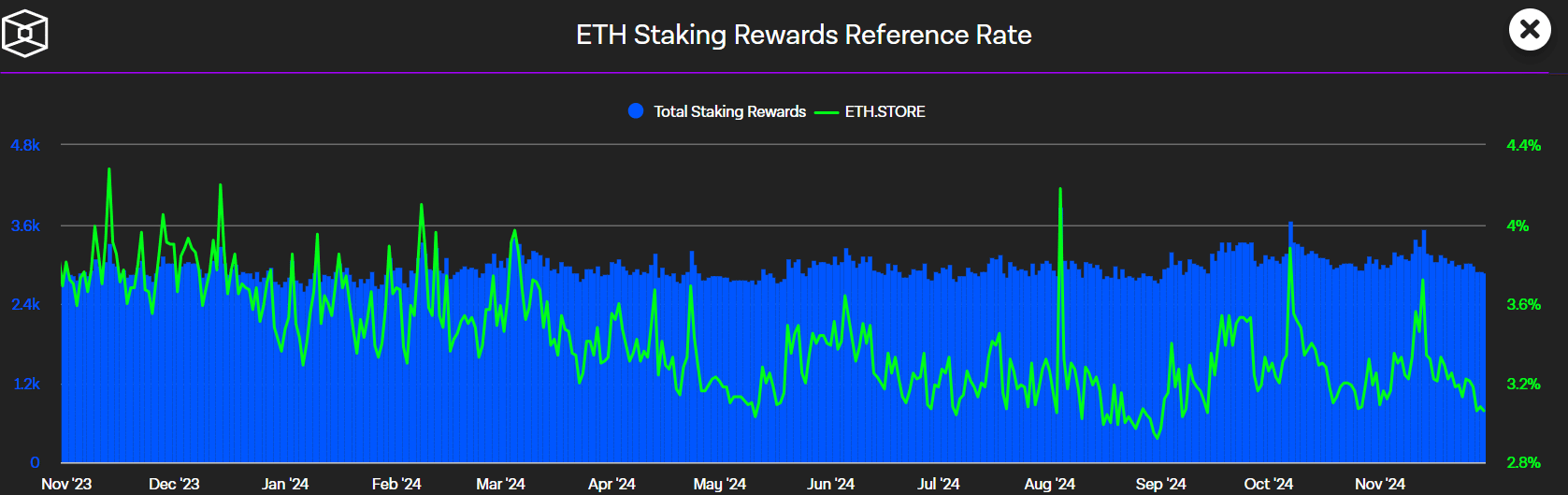

It appears that the potential for earning from staking ETH could become available… We’re optimistic that under a potential new crypto-friendly SEC led by Trump 2.0, ETH staking yield might be authorized. With today’s yield at around 3%, it could prove to be quite appealing in an environment where interest rates are decreasing.

By mid-2025 or 2026, as per Mike Novogratz’s prediction in May, we might see the same scenario unfold.

Analysts also mentioned that the current yield on ETH staking, sitting at 3%, might increase to between 4% and 5% once ETF staking receives approval. Such an increase could potentially draw more institutional involvement towards this digital currency.

As a researcher delving into the world of Exchange-Traded Funds (ETFs), I’ve come to understand that incorporating Ethereum Yield Features (ETH yield) within these funds is advantageous. This setup allows for a residual spread benefiting asset managers, thereby enhancing the overall economics of ETFs. This additional incentive could potentially spur more interest among institutional investors in expanding their digital asset allocations, specifically Ethereum ETFs.

Positive ETH ETF flows

As a researcher, I’ve observed that Ethereum’s robust demand-supply dynamics, coupled with favorable Ethereum Exchange Traded Fund (ETF) inflows, have been identified as additional drivers propelling the growth of Ethereum, according to Bernstein’s analysis.

Approximately 34.6 million Ether, which represents about 28% of the total supply, is currently being staked. Meanwhile, around 12 million Ether, or roughly 10%, is kept in deposit and lending services.

In the last year, around 60% of Ethereum’s total supply remained undisturbed, according to analysts, who referred to it as a robust investor community and advantageous market conditions in terms of demand and supply.

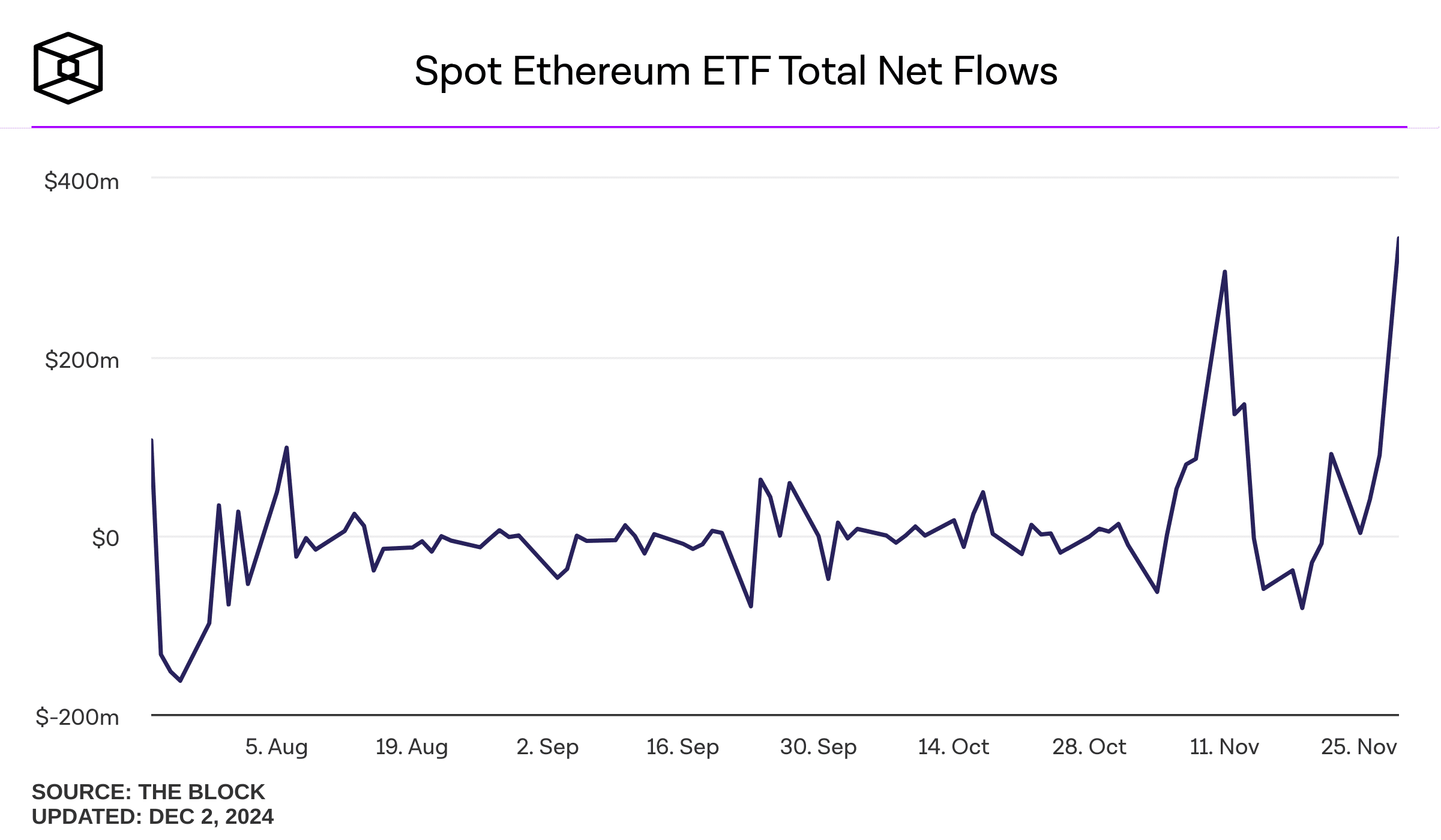

Besides, ETH ETF flows turned positive and even flipped BTC ETFs for the first time.

Since its debut, the ETF’s cumulative inflows have consistently been on the decline. However, this trend reversed in November. According to Bernstein, this shift might bolster the robust demand and supply dynamics of the altcoin.

Ultimately, the strong confidence that major retailers and financial institutions have in the Ethereum platform might significantly increase the value of Ether (ETH).

According to Bernstein’s statement, the total value locked (TVL) in Ethereum, which is approximately $89 billion, demonstrates a strong endorsement from institutional investors. Presently, each Ethereum token is worth around $3,600, marking an increase of 47% over the past month.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-12-03 15:37