- Analysts expect Fed and U.S Treasury moves to affect the market in a slow, but positive way

- Hayes eyes Solana, “doggie coins” for momentum trading as liquidity improves

As a seasoned crypto investor, I closely follow market trends and news to make informed decisions. The recent dovish stance by the Fed and U.S Treasury has brought some relief to the market, with analysts predicting a positive impact on Bitcoin and other assets. While the bullish sentiment is encouraging, I remain cautious as the liquidity improvement is expected to be mild.

As a market analyst, I anticipate a relatively positive influence on Bitcoin [BTC] and other markets following the latest “dovish” Federal Reserve interest rate decision and the U.S. Treasury’s Quarterly Refunding Announcement.

Based on the assessment of QCP, a cryptocurrency trading firm situated in Singapore, both the U.S. Federal Reserve and the Quantitative Research Associates (QRA) exhibited a more accommodative stance than anticipated.

At the Federal Open Market Committee (FOMC) meeting, Powell indicated that the Federal Reserve has no plans to increase interest rates and announced a decrease in the pace of Quantitative Tightening (QT) from $60 billion monthly to $25 billion. Regarding Quantitative Research and Analysis (QRA), the Treasury will maintain its issuance of longer-term bonds at current levels, easing concerns about an upward shift in long-term yields. This development could help curb the US dollar‘s advance, which is advantageous for risk assets.

Arthur Hayas, a co-founder of BitMEX, expressed views aligned with others, yet emphasized that the effects on market liquidity would likely be subtle as depicted by the price charts.

“This Quantitative Risk Assessment (QRA) has a moderately favorable effect on dollar liquidity….It’s expected to gradually increase the value of our investments in the long run.”

Hayes eyes Solana, “doggie coins” for momentum trading

As a researcher studying the cryptocurrency market, I believe that the current downturn in Bitcoin’s price will gradually lessen as liquidity progressively improves each month. In my opinion, Bitcoin is likely to recover and settle within the range of $60,000 to $70,000 until August.

As a researcher, I’ve discovered that the executive isn’t content with just monitoring Bitcoin’s performance. He also anticipates other altcoins, such as Solana (SOL), Dogecoin (DOGE), and WIF (dogwifhat), to outshine it in terms of momentum trading. According to his statement, these digital assets hold potential for substantial growth.

“I’m buying Solana and doggie coins for momentum trading positions.”

Momentum trading is a strategy where assets with significant price trends are bought or sold, followed by selling when clear indicators of price reversals appear. For instance, investment firm Franklin Templeton holds a positive outlook on Solana.

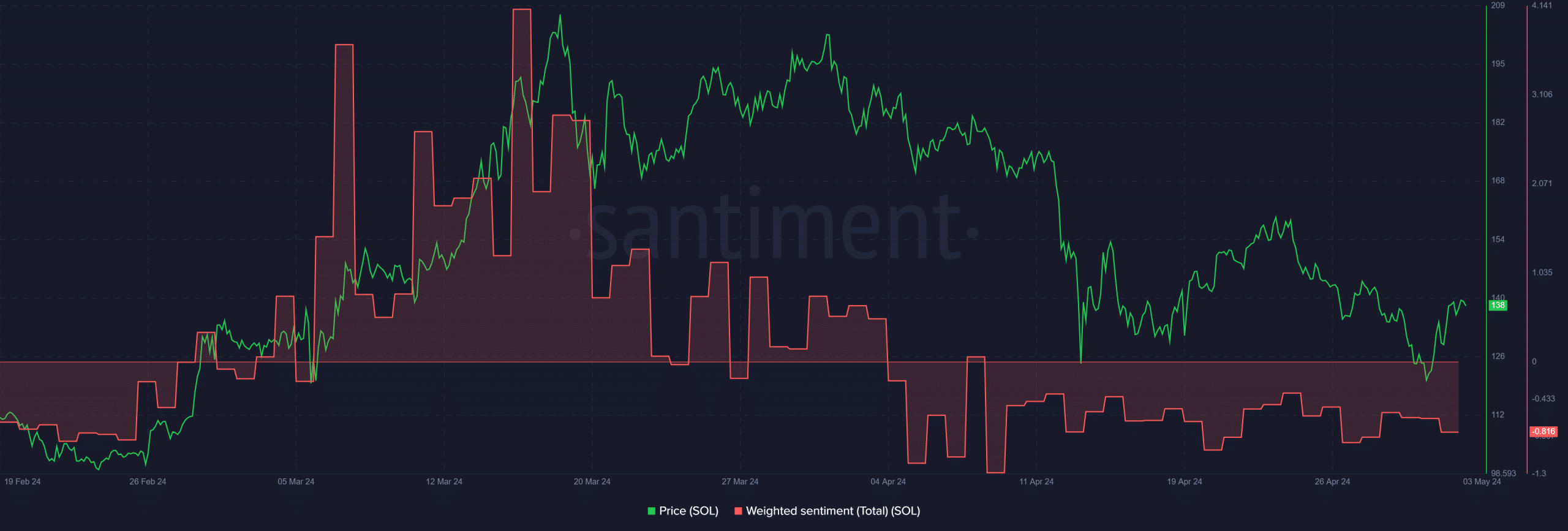

The most recent price movement of SOL by SOL has resulted in a decline and indicated that short sellers have made gains from the market’s slide. At present, it is priced at $136, representing a 35% decrease from its peak of $210 reached in mid-March.

As a researcher studying the behavior of bull markets, I’ve noticed that the $126 level has served as a strong support for the short-term price movements on two occasions in April and May. Nevertheless, for a clear trend reversal to occur, it is essential that the price surpasses the previous lower high of $160.

Based on Santiment’s analysis, the sentiment towards Solana (SOL) remains generally pessimistic, with a negative weighted sentiment score. Consequently, a significant bullish turnaround may not occur imminently.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-03 20:07