-

The BNB price saw uptrends during the past week.

Its RSI has remained below the neutral line despite the uptrend

As a seasoned analyst with years of experience navigating the ever-changing crypto markets, I find myself cautiously optimistic about Binance Coin (BNB). While its uptrend during the past week is certainly noteworthy, I remain mindful of the challenges ahead, particularly the resistance at the key price range around $553.

Over the past week, Binance Coin (BNB) concluded on an optimistic note, demonstrating strength and a significant bounce back. It managed to surpass crucial thresholds due to its upward momentum, yet it continues to encounter hurdles, with significant resistance expected at a vital price band.

Binance ends the week on a high

Analyzing Binance Coin (BNB) over a daily period led to a favorable outlook for the week, according to AMBCrypto’s findings.

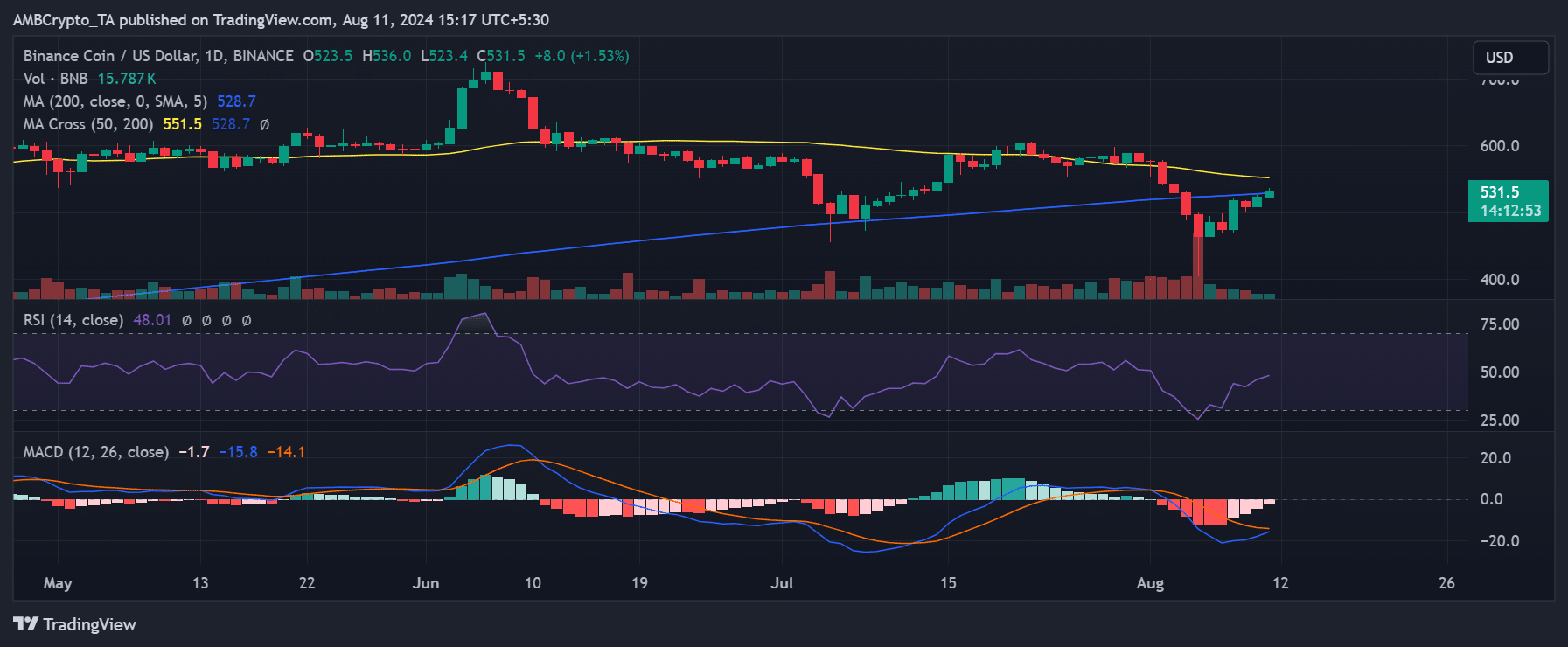

Initially dropping by 6% at the beginning of the week, BNB subsequently bounced back, concluding the week at approximately $523 – a rise of 2.83%. This positive trend persisted into the following week, with BNB being traded around $531, signifying an extra increase of more than 1%.

An essential part of the current recovery involves BNB surpassing its extended moving average (represented by the blue line), an obstacle that had earlier functioned as a barrier for price increase.

As a crypto investor, I’m picking up signs that could indicate a transition in the market mood, moving away from the bearish stance and potentially leaning towards a more optimistic or at least neutral standpoint in the near future.

Although BNB is approaching the $553 mark, there seems to be a barrier as indicated by its yellow line representing its short-term moving average.

What the indicators say about the Binance move

Examining the technical signals of BNB shows its Relative Strength Index (RSI) standing at 48.01, implying that the asset doesn’t show signs of being excessively bought (overbought) or sold (oversold).

The Relative Strength Index (RSI) being close to the no-trend area suggests that there’s not much force propelling prices up or down at the moment. This could imply that ongoing price rebounds may face obstacles unless the demand for buying picks up.

Furthermore, when the Moving Average Convergence Divergence (MACD) line surpasses the Signal line, it typically indicates a possible bullish turnaround or a decrease in downward pressure.

As a seasoned investor with years of experience in the market, I have learned to read trends carefully and make informed decisions based on various indicators. In this case, the shrinking negative histogram bars suggest to me that the downward momentum may be slowing, but I remain cautious because the MACD remains in negative territory, indicating bearish overall momentum. I’ve seen situations where a similar pattern has led to unexpected market movements, so I will continue to closely monitor the situation before making any moves in my portfolio.

BNB traders get more cautious

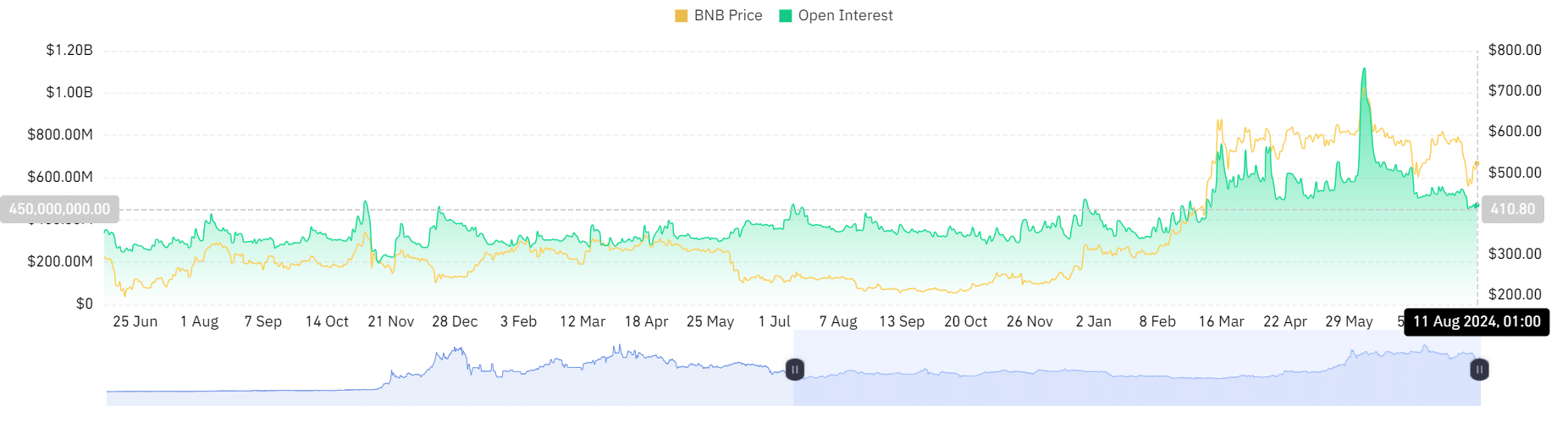

Examining the current situation with Binance Coin (BNB), there’s been a noticeable drop in open interest. According to information gathered from Coinglass, BNB’s open interest has decreased from roughly $500 million down to about $400 million over the past period.

As of this writing, the open interest was about $470 million.

Read Binance Coin (BNB) Price Prediction 2024-25

Based on the current level of open interests, it seems that although people are still actively involved in BNB derivative trading, the pace has slowed down a bit compared to its earlier peak rates.

A decrease in open interests might suggest less leveraged trading within the market, and it could be indicative of traders adopting a more prudent stance, perhaps as a response to market unpredictability or price fluctuations in Binance Coin (BNB).

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-12 01:12