-

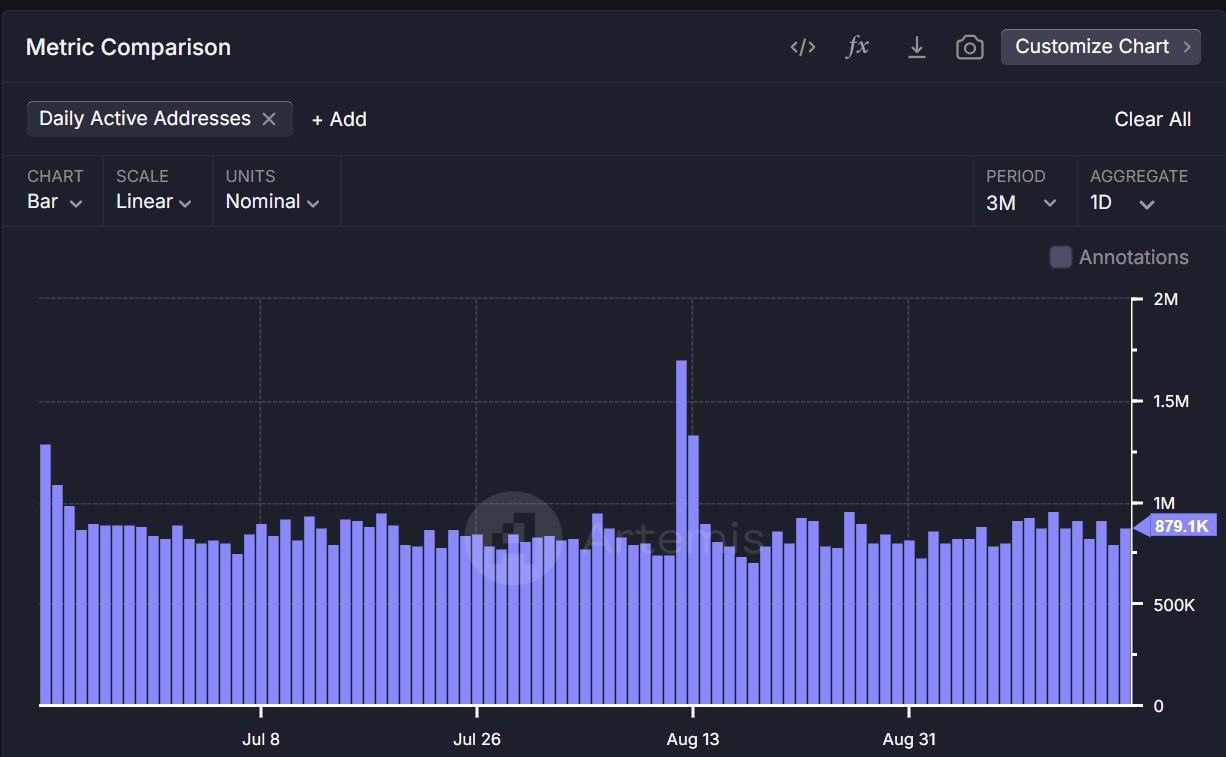

BNB’s daily active addresses surged from 797.3K to 879.1K, signaling rising network usage.

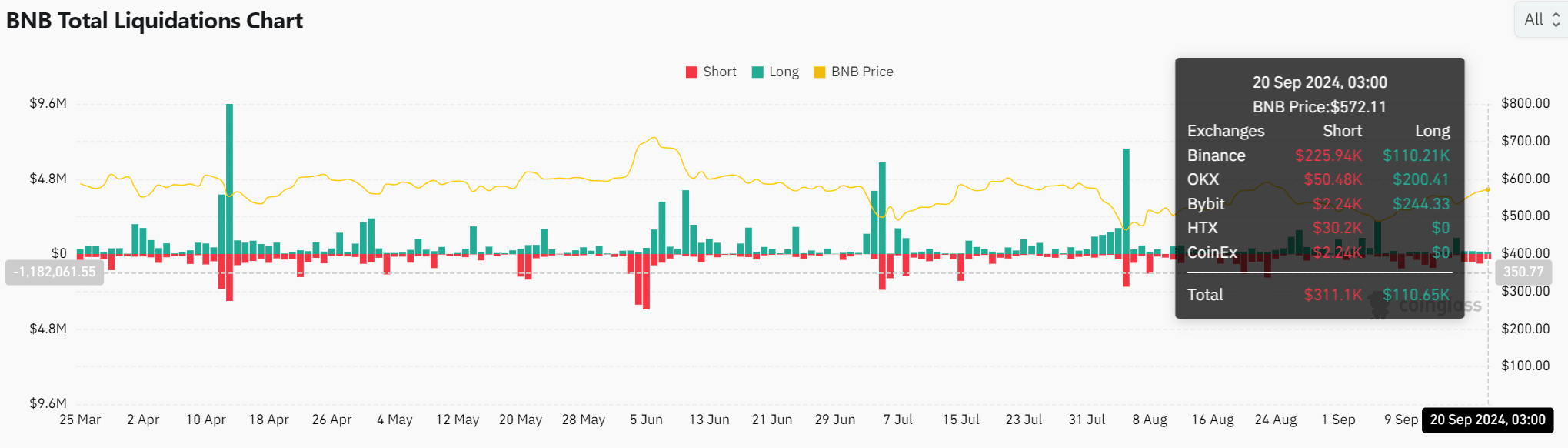

Liquidation of $311.1K in shorts adds bullish momentum as BNB eyes further price gains.

As a seasoned crypto investor with over a decade of experience navigating the ever-evolving digital asset landscape, I find myself intrigued by the recent performance of Binance Coin [BNB]. The surge in daily active addresses and trading volume coupled with the liquidation of shorts paints an optimistic picture for BNB’s future.

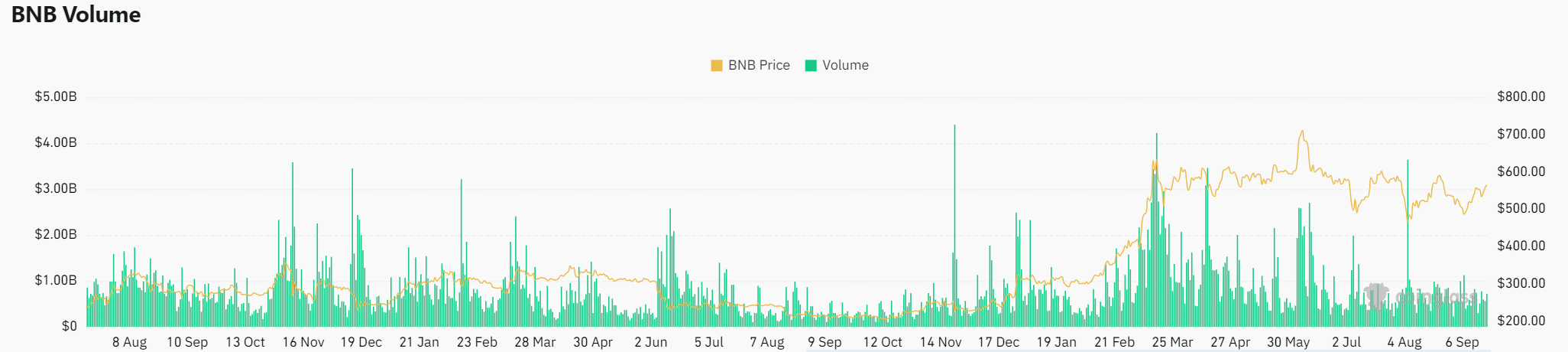

Binance Coin (BNB) has been drawing the attention of traders due to a substantial increase in trading activity, with a 14.42% rise over the past day, reaching approximately $758.83 million at the time of this writing. This jump occurs alongside a breakout from a notable falling wedge formation on its price chart.

Yet, as BNB currently trades at $571.25, marking a 2.67% increase in the last 24 hours, attention now turns towards on-chain indicators to ascertain whether this growth trend persists. Could this surge be the prelude to a powerful upswing?

Has BNB’s network activity reached new heights?

Among key indicators for BNB, the count of active wallets stands out as crucial. This count surged from approximately 797,300 to 879,100 day by day, suggesting a substantial boost in network usage and interaction.

An increase in the number of active addresses on the Binance Smart Chain tends to signal increased engagement, which is typically associated with a growing appetite for the Binance Coin (BNB). This surge in active users suggests that both institutions and individual investors are showing interest in BNB.

As more addresses interact with BNB, its utility and potential for growth increase.

How strong is BNB’s transaction volume?

Market sentiment can also be gauged by analyzing trading volume, and today, BNB‘s volume experienced a significant surge of 14.42%, amounting to $758.83 million. Such a notable increase in trading activity could signal upcoming price changes. Moreover, elevated volume tends to suggest that investor confidence is on the rise.

An increasing number of individuals are becoming actively involved in trading BNB, potentially fueling additional price surges. If this trading volume pattern persists, it might indicate a prolonged upward trend for BNB, with even more market players joining the fray.

What do liquidations reveal about market sentiment?

Market sentiment can be insightfully viewed through the lens of liquidation data. Specifically, BNB witnessed a total liquidation of approximately $311,100 for short positions and $110,650 for long positions on significant platforms like Binance, OKX, and Bybit.

In simpler terms, when prices rise quickly, it means that pessimistic traders (who had bet on a price drop) were compelled to sell their holdings. This mass selling could have contributed to the recent increase in price, as many of these bearish bets were canceled.

Consequently, given that BNB is currently priced at approximately $571, the closing out of short positions might set off a chain reaction of price fluctuations, fostering a surge of optimistic feelings among traders.

Is BNB positioned for a bull run?

According to on-chain data, Binance Coin (BNB) appears to be growing stronger, as shown by an increase in active addresses, robust transaction volumes, and a decline in exchange reserves. These trends may suggest a bullish future for BNB. Moreover, the liquidation of short positions is contributing additional momentum to the ongoing price surge.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Should these tendencies continue, Binance Coin (BNB) might continue to increase significantly, potentially leading to an extended period of price rise within the upcoming weeks. Nevertheless, it’s crucial for traders and investors to closely monitor essential indicators, given BNB’s steady growth trajectory.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-21 11:36