-

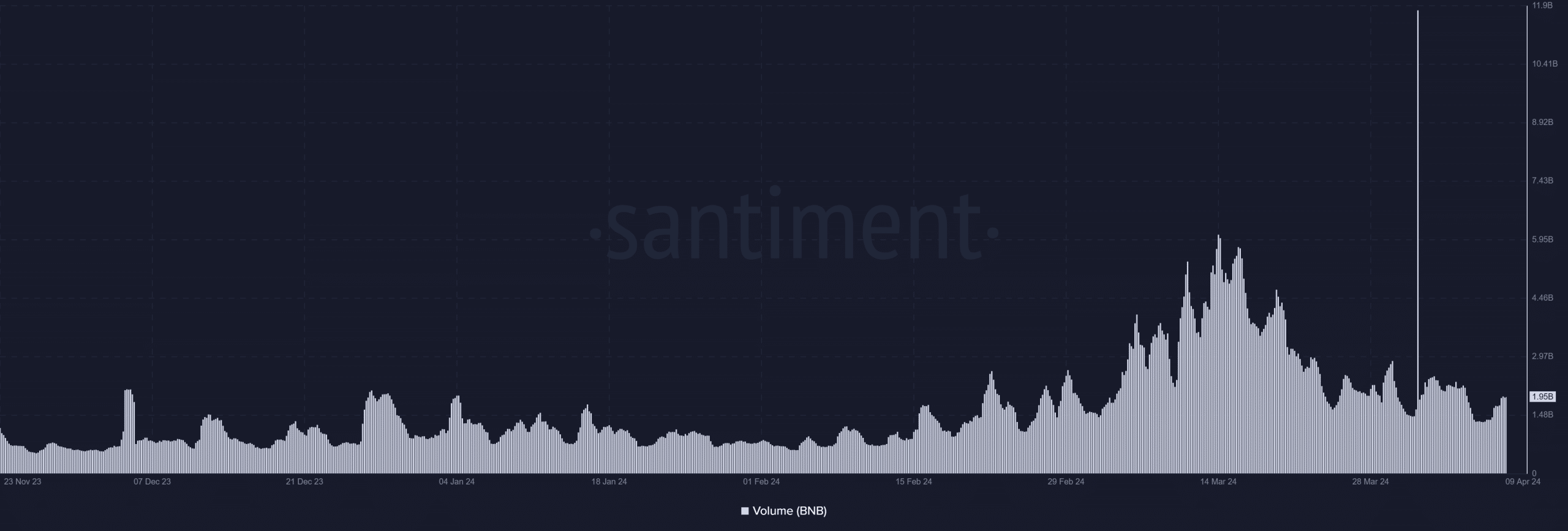

BNB’s volume remains below $3 billion on the chart

Volatility continues to be low too

At the start of the month, Binance Coin (BNB) trading volume experienced a substantial increase, marking highs last observed in 2022. Since then, how has BNB fared, and is there any sign of imminent major price shifts?

Binance Coin’s volume reverts to normal

On April 1st, Binance Coin’s trading volume, as observed through Santiment’s analysis, reached a peak of over $11 billion. Yet, this increase proved to be fleeting, as subsequent examination suggested a return to its usual volume range. The chart shows that the coin’s volume has stayed below the $2 billion mark since the surge.

Currently, the volume is approximately $1.9 billion when I’m penning this down. No significant price fluctuations have taken place since the price surge.

Volatility tightens on the chart

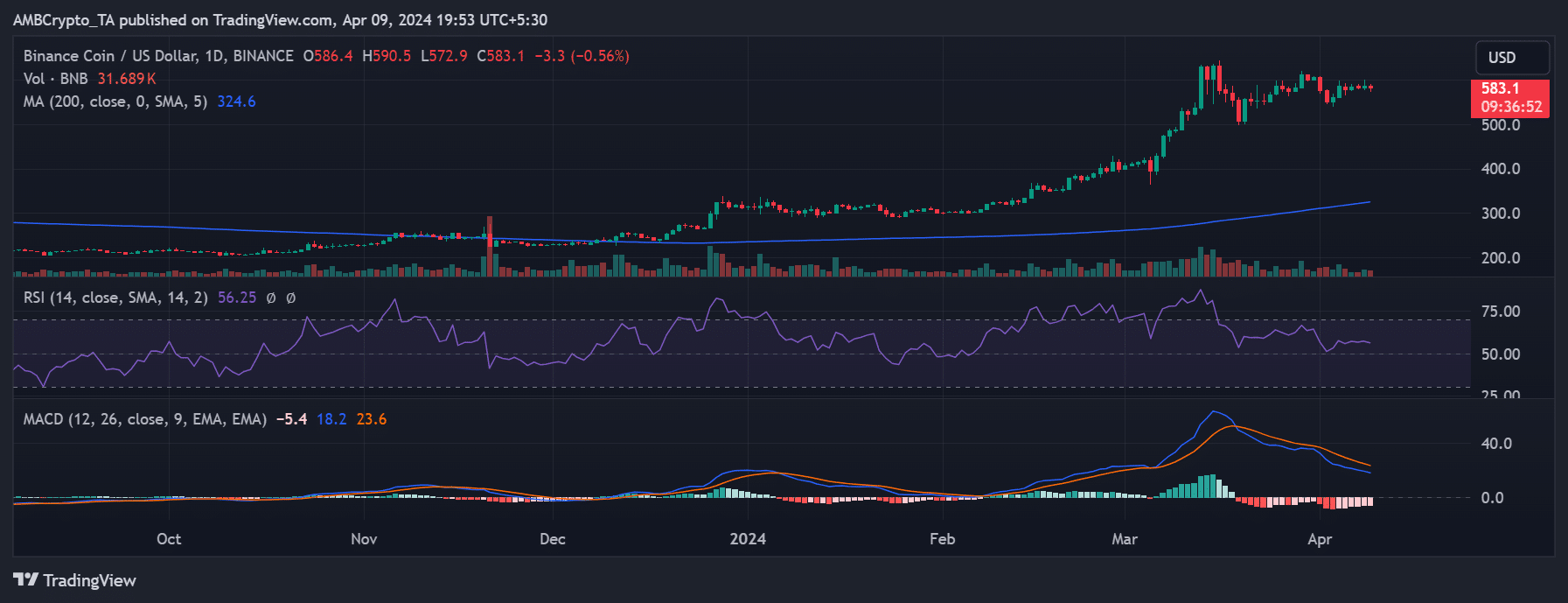

Examining the daily chart, it was observed that Binance BNB‘s price did not respond notably when its trading volume peaked. Contrarily, the chart demonstrated a downward trend with a decrease of more than 5% in price, causing it to dip from approximately $600 to around $570.

After that, the price around $580 tried to stabilize. Currently, Binance Coin (BNB) is being traded at approximately $583 with only a slight decrease of less than 1%. The Relative Strength Index (RSI) analysis showed that it was still in an uplifting bullish trend. Moreover, the Bollinger bands review suggested minimal price swings, which means that significant price changes are unlikely to occur suddenly.

Traders are cautious because…

Looking at the funding rate trend on Coinglass, we noticed a steady climb back into positive territory, implying that BNB market buyers were once again in charge. Currently, the funding rate is approximately 0.02%, but this figure also signaled a rather subdued investor sentiment despite expectations of a price increase.

In the end, the price action didn’t reveal any notable changes, while open interest remained stable near $600 million, indicating a decent amount of money flowing in and out of the market.

Based on the combined data from these indicators, it appears that traders have yet to show strong commitment to BNB. As a result, significant price shifts for BNB may not be imminent based on current market trends, as suggested by the price chart’s historical patterns.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-04-10 11:03