-

Analysis showed that the coin could see an upswing to $738 by June.

Derivatives market data indicated bullish sentiment, as BNB might favor long positions.

Based on my analysis as an experienced cryptocurrency analyst, I believe that Binance Coin (BNB) is showing signs of potential growth in the coming months. I arrived at this conclusion after evaluating several key indicators, including social dominance and derivatives market data.

Based on analysis of certain on-chain indicators by AMBCrypto, there’s a sign that Binance Coin’s [BNB] price could potentially dip under $600 in the near future. However, it’s worth noting that the value of the coin might rise again come June.

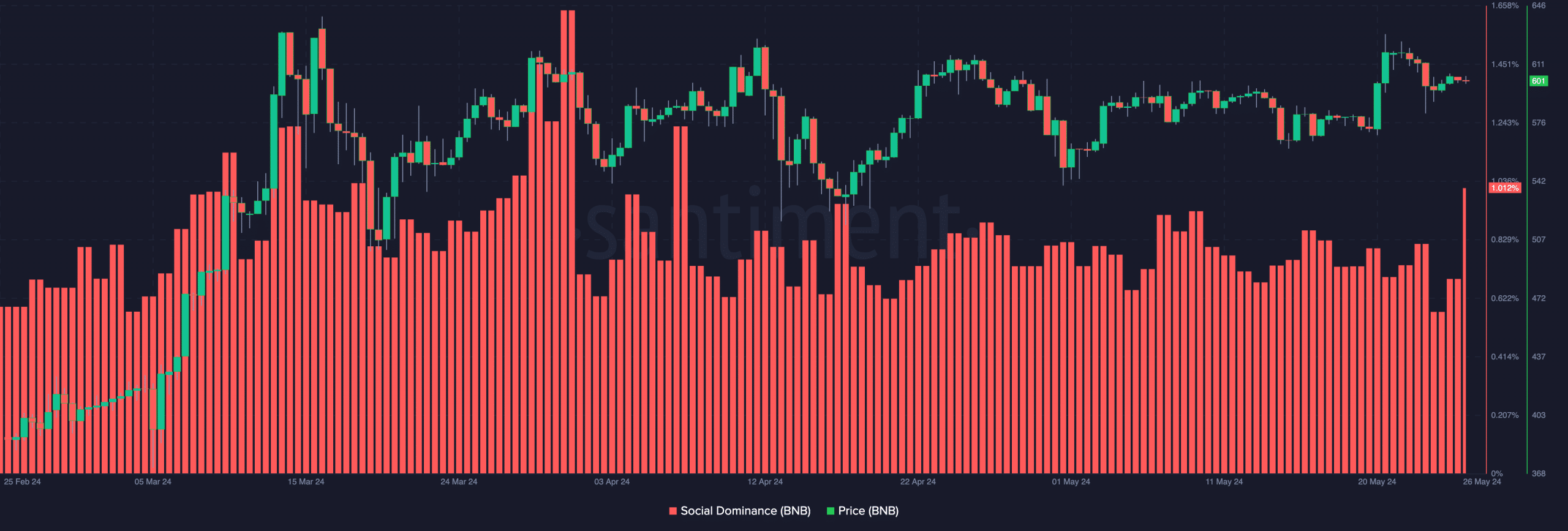

As a researcher studying online sentiment towards various assets, I initially focused on examining the Social Dominance metric. This measurement provides insights into public perception by assessing the general discourse surrounding an asset online.

At press time, BNB-related discussions increased, prompting social dominance to hit 1.012%

Attention is shifting to the coin

Among the top 100 cryptocurrencies, this currency saw a significant surge in value, making it a subject of much interest and discussion. Previously, such a spike in this metric has often indicated heightened demand for the coin.

Also, as long as the dominance does not get too heated, the price can appreciate.

Based on past trends, if the metric reaches 1.641% once again, BNB‘s price may surge from its current level to around $738 within a 35-day timeframe.

As a market analyst, I’d share that at the moment of writing this analysis, the cost of the coin stood at $601 – identical to its value 30 days prior. On the other hand, BNB experienced a 12.96% price decrease from its record high.

As a crypto investor, I’m excited about the current trend and believe that this cryptocurrency has the potential to reach new heights by the close of Q2.

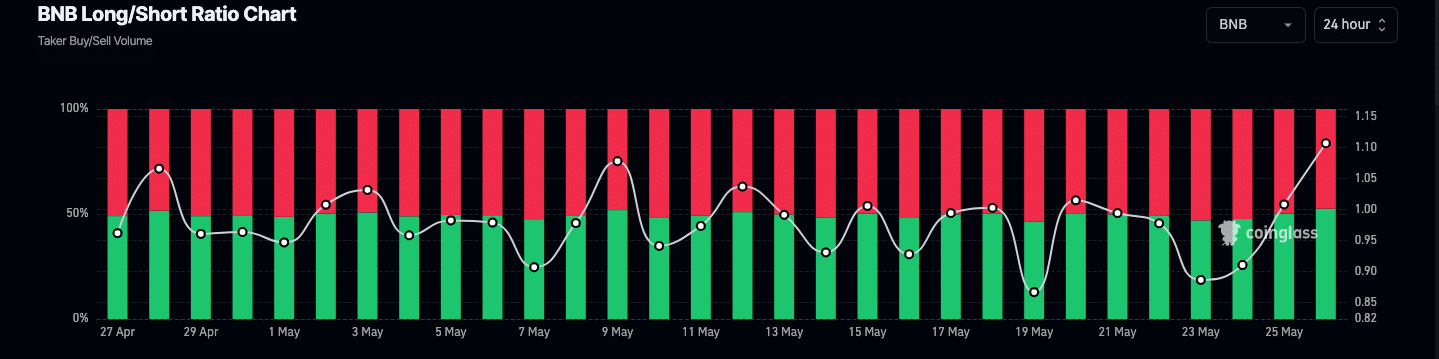

Furthermore, it seemed traders in the derivatives market shared the thought in like manner.

As a researcher studying market trends, I’ve observed that a Long/Short ratio exceeding 1 suggests a bullish outlook among traders. This means that they are purchasing more of a particular asset than they are selling, indicating positive expectations for its future price movement.

As a crypto investor, I would interpret a reading below 1 for BNB‘s Long/Short ratio as a bearish sign. Currently, the Long/Short ratio of BNB is at 1.10, based on data from Coinglass.

As a researcher analyzing financial data, I can explain that this ratio signifies a 1.10-to-1 balance between long and short positions. It’s an uncommon scenario where there are slightly more long positions than shorts. Typically, the bullish interpretation of such an indicator doesn’t reach these numbers.

The support levels have landed

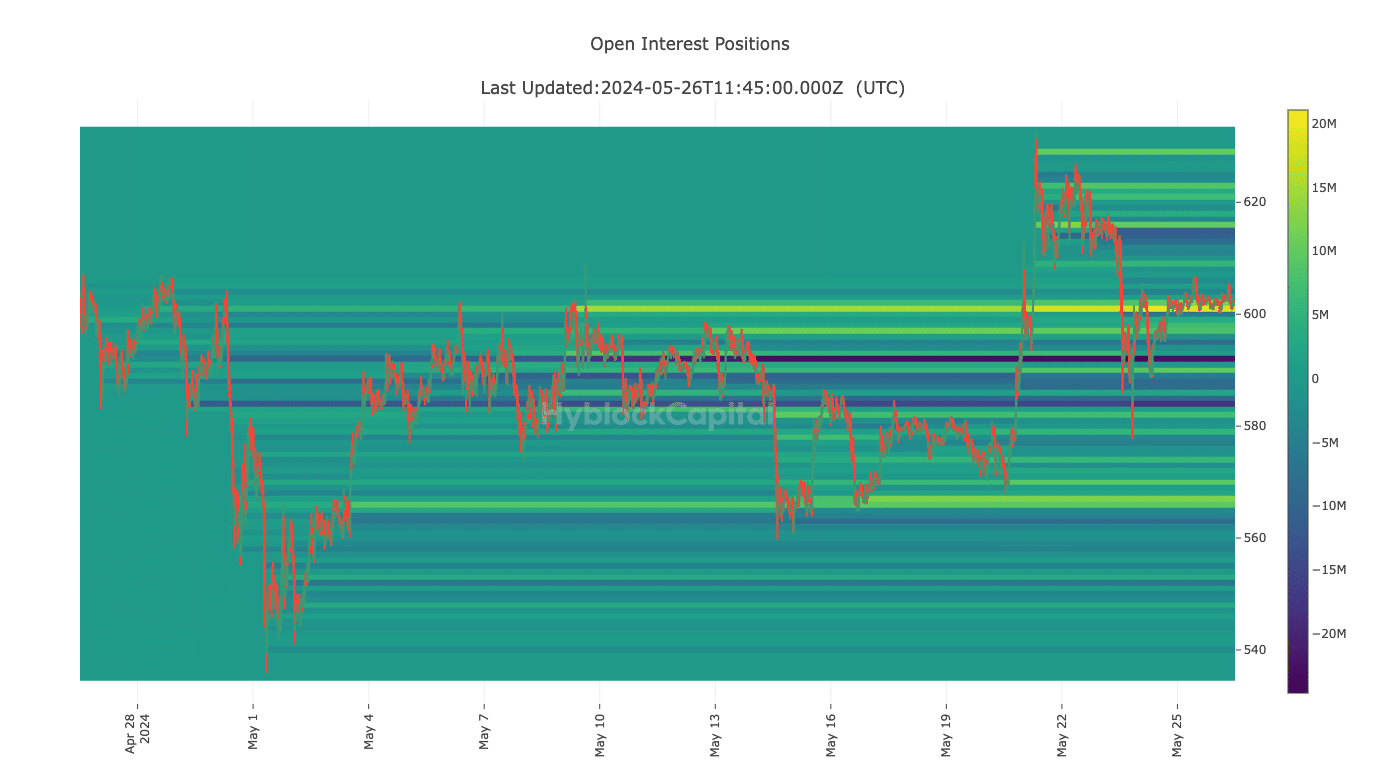

Based on my analysis, the significant increase in value indicates a rising belief among investors that BNB could exceed $700. Furthermore, I examined the Net Positions Heatmap from AMBCrypto’s perspective.

As a crypto investor, I would describe the Net Positions Heatmap as follows: Instead of volume, this tool focuses on the number of positions taken by traders in the market. It uniquely showcases the distribution of these positions, providing insights into the prevailing sentiment and market strength.

As of the publication deadline, there had been a rise in the frequency of prolonged dips at $601, $616, and $630 on the price chart. For traders, these levels might function as potential support points for the cryptocurrency.

Read Binance [BNB] Price Prediction 2023-2024

As a market analyst, I would note that should buying pressure resurface when BNB reaches those specified levels, there is a potential for the price to rally and potentially reach the projected level of $738. However, it’s essential for traders to exercise caution as market conditions can change rapidly.

A decrease in demand for the coin may result in it trading within a narrow range. In a extremely pessimistic market scenario, the cost could potentially drop down to $565 – representing the subsequent significant level of support.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-27 05:12