-

BNB liquidations cause instant local reversal.

Price action and key indicators point a correction might be on the horizon.

As a seasoned crypto investor with battle-scars from numerous market cycles, I’ve learned to read between the lines of price action and key indicators. The recent surge in BNB following CZ’s release and subsequent liquidations has me slightly concerned about an impending correction. However, the bullish outlook for Q4 makes me optimistic that any dip could present a golden buying opportunity.

Recently, there’s been a surge of interest in Binance Coin [BNB], currently ranked fourth in terms of market capitalization. This rise can be attributed, in part, to the recent news about Changpeng Zhao (CZ), former CEO of Binance, who was held for four months due to allegations of money laundering in the United States.

His freedom led to a stir in the BNB market, as the growth of Binance promptly triggered a rise in liquidations, resulting in a swift, temporary turnaround for most BNB trading pairs.

As a crypto investor, I find myself pondering if Binance Coin (BNB) might experience a pullback prior to any potential surge in the fourth quarter, a timeframe known for its bullish trends within the cryptocurrency market.

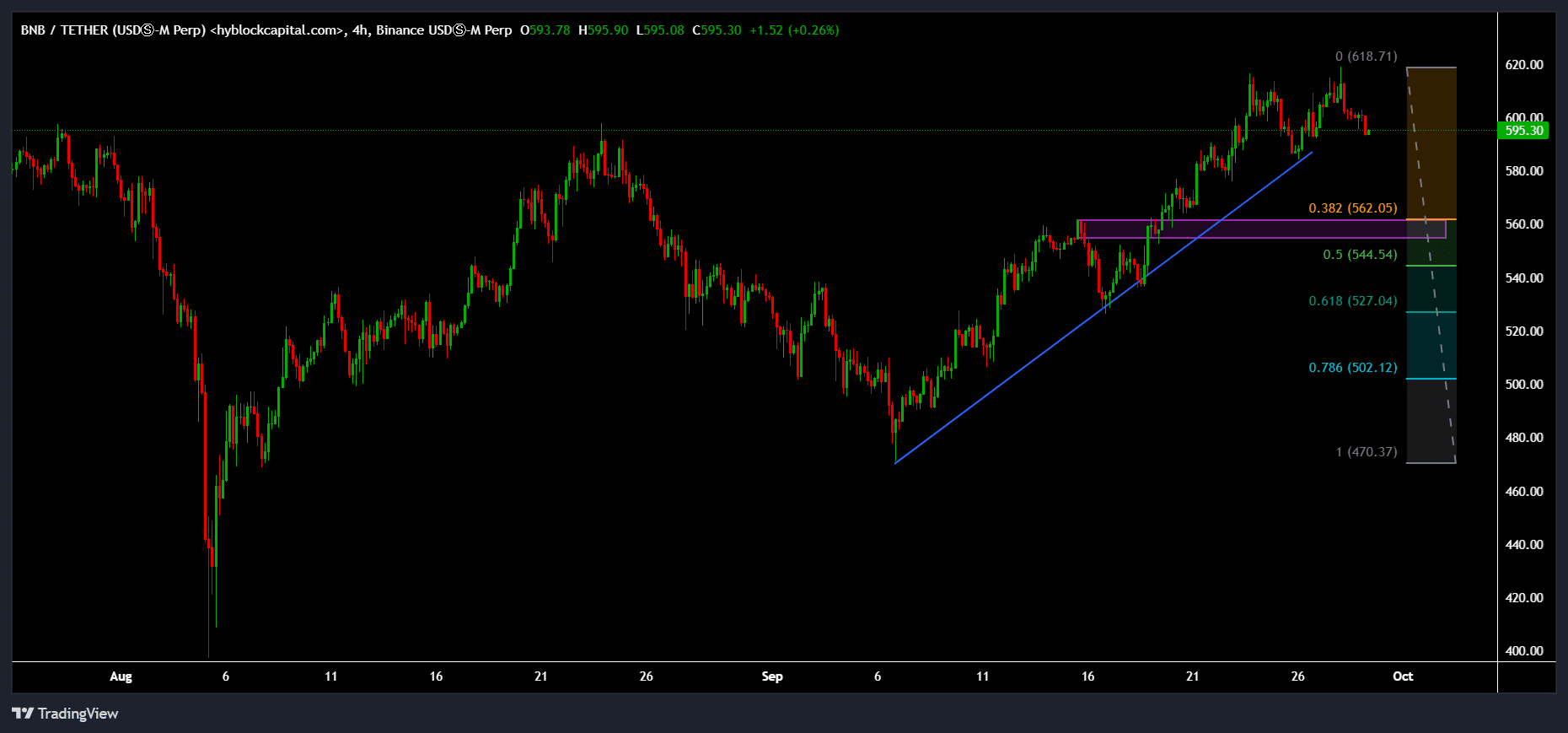

A closer look at the BNB/USDT pair could provide some insights into the potential price direction.

BNB been in an uptrend for 3 weeks

Over the past three weeks, BNB/USDT has been steadily increasing, showing a consistent pattern of reaching new highs followed by higher lows. This upward trajectory is clearly visible on the 4-hour chart, offering an insightful perspective on both immediate and long-term price fluctuations.

Lately, BNB has reached the $620 point, indicating it might temporarily halt its upward trajectory and potentially experience a decrease instead. The emergence of a double top at $620 hints at a possible reversal, which could be verified if the price drops below the neckline of this double top formation.

If this breakdown happens, it’s possible that the BNB price could drop to around $560 or potentially fall further to $540. This lower range seems to be the balance point for the past three weeks’ 4-hour price action.

In simpler terms, the cost reaching $560 aligns with the 0.382 Fibonacci Retracement point, a place that frequently functions as a support during robust market movements such as the current trend.

Considering the generally optimistic forecast for the cryptocurrency sector during Q4, a dip down to around $560 might offer a fantastic purchasing point, potentially leading BNB to soar as high as $800. This could result in a substantial 40% profit on your investment.

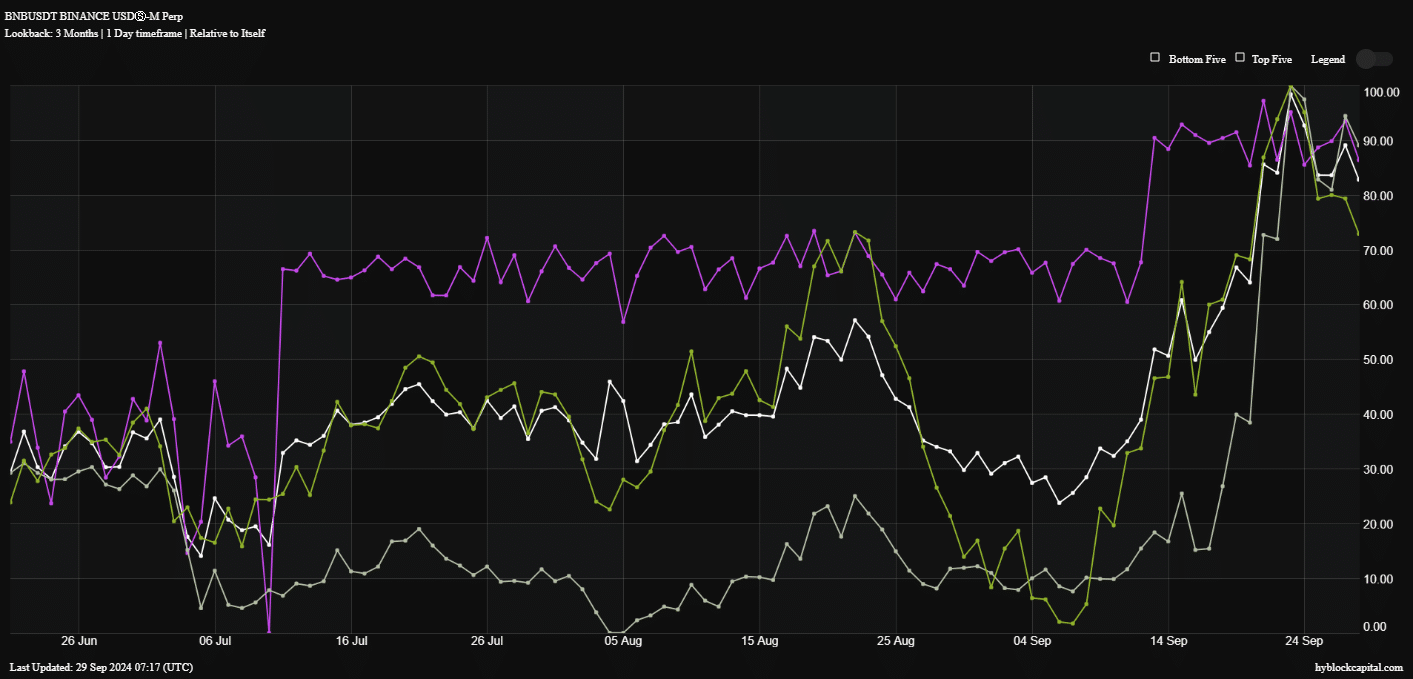

Net longs, shorts delta & open interests

Beyond just monitoring the movement of BNB prices, other relevant factors like net longs-shorts differential, open interest, and whale vs retail differential seem to hint at an upcoming adjustment. These measurements, which peaked at a staggering 100%, have seen a decrease in recent times, with the global average now hovering around 82%.

The difference between long and short positions on BNB (as reflected by its net long/short delta) has dropped significantly from its highest point and now hovers around 86%. This suggests a lessening in the force of buyers’ enthusiasm.

Meanwhile, open interest has dropped to 89%, further supporting the possibility of a correction.

In simpler terms, there’s been a significant decrease in the difference between the whales (large investors) and regular traders in the retail market when it comes to buying. Over the past three months, the influence of whales on retail traders has decreased by approximately 40%.

This indicates that whales might be reducing their activity levels, typically a sign that a market downturn is approaching. The latest trends in BNB‘s price fluctuations and market data suggest that a potential correction may occur in the near future.

However, a strong uptrend suggests the $560 level might present a good entry point for traders. From there, BNB has the potential to rise higher, possibly reaching $800.

Read More

2024-09-30 02:15