-

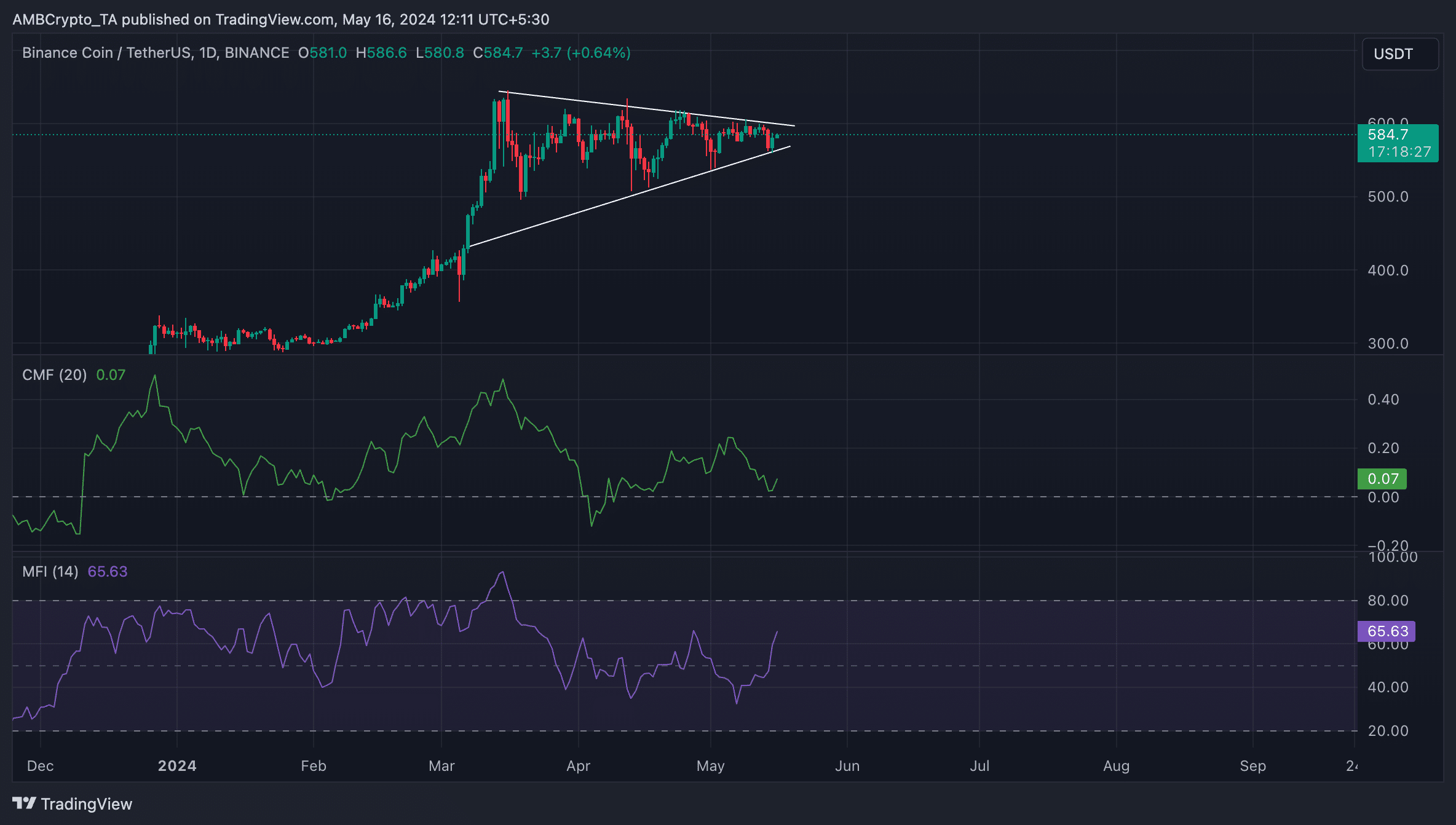

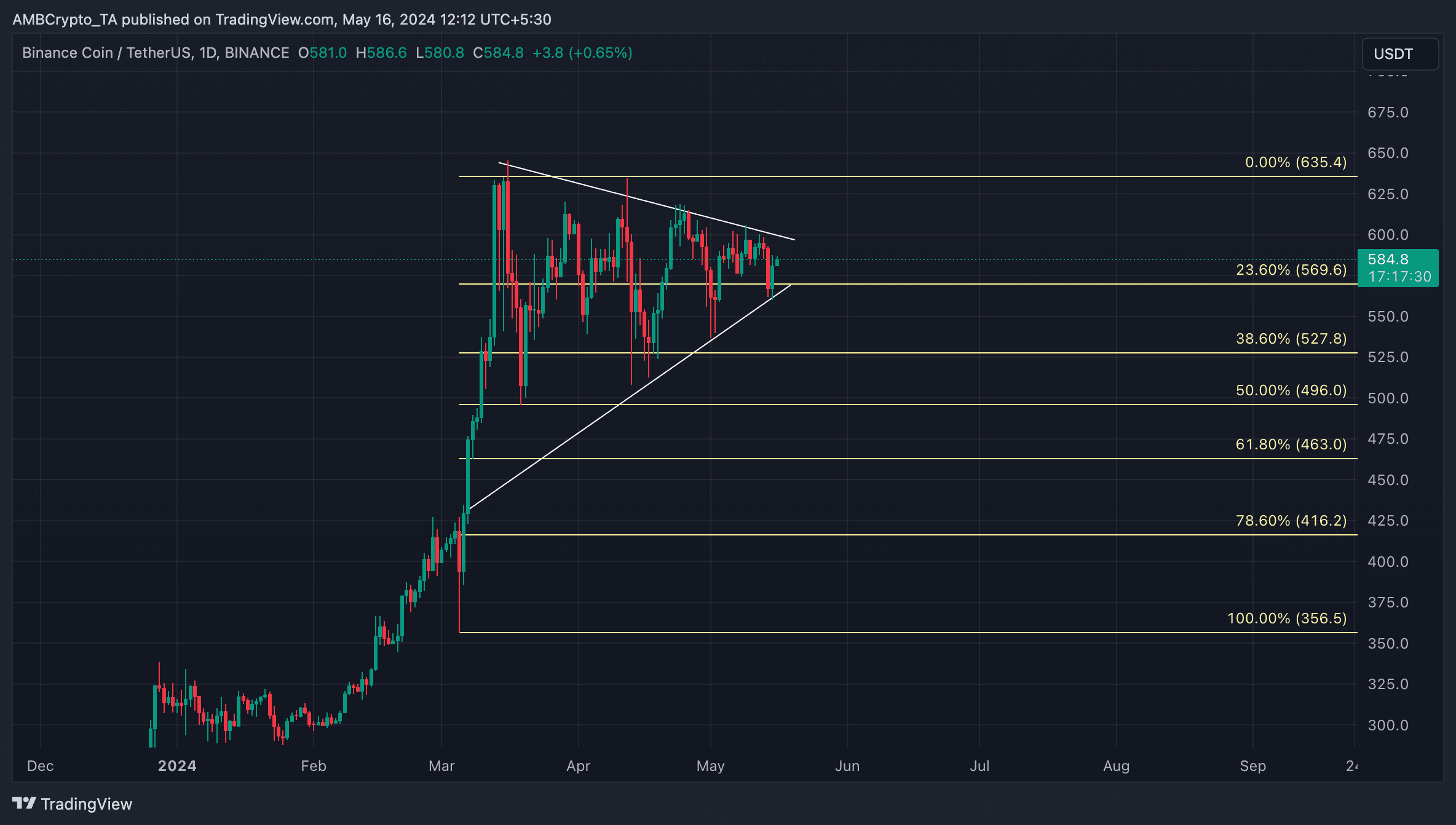

BNB was trading above the support line of its symmetrical triangle pattern

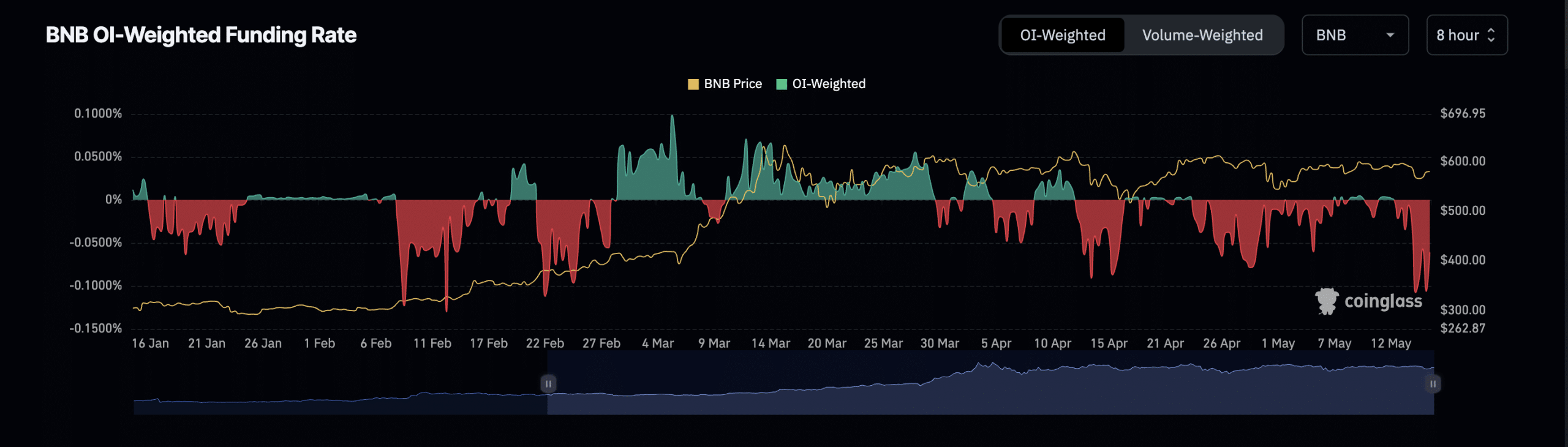

BNB remains at risk of a decline as its funding rate was negative

As an experienced analyst, I believe that Binance Coin (BNB) has shown some promising signs in recent days, but it remains a risky investment due to its negative funding rate. The symmetrical triangle pattern on BNB’s chart suggests consolidation within a range, and the altcoin’s positive weighted sentiment, rising Money Flow Index (MFI), and Chaikin Money Flow indicate a bullish market outlook. However, these bullish indicators are not enough to overshadow the bearish signal given by BNB’s negative funding rate.

The symmetrical triangle pattern supporting Binance Coin [BNB] in the market has been broken due to the latest market surge, resulting in a significant bounce back for the cryptocurrency.

When an asset’s price touches successive lower highs and higher lows in a chart, it signifies a pattern called compression or consolidation. This pattern suggests that the asset’s price is being influenced by both buyers and sellers. Buyers are attempting to push prices upwards towards resistance levels, while sellers are trying to pull prices down to areas of support. The result is a narrowing price range as the asset’s value bounces between these opposing forces.

When this happens, the asset concerned is said to be consolidating within a range.

Will it rally towards its resistance?

As a crypto investor, I’m currently looking at Binance Coin (BNB), which is valued at $583.84 at the moment after a 3% increase from its support level of $566. To determine if BNB can continue to rise and reach the upper trend line of the triangle and beyond, it’s important for me to evaluate the market sentiment.

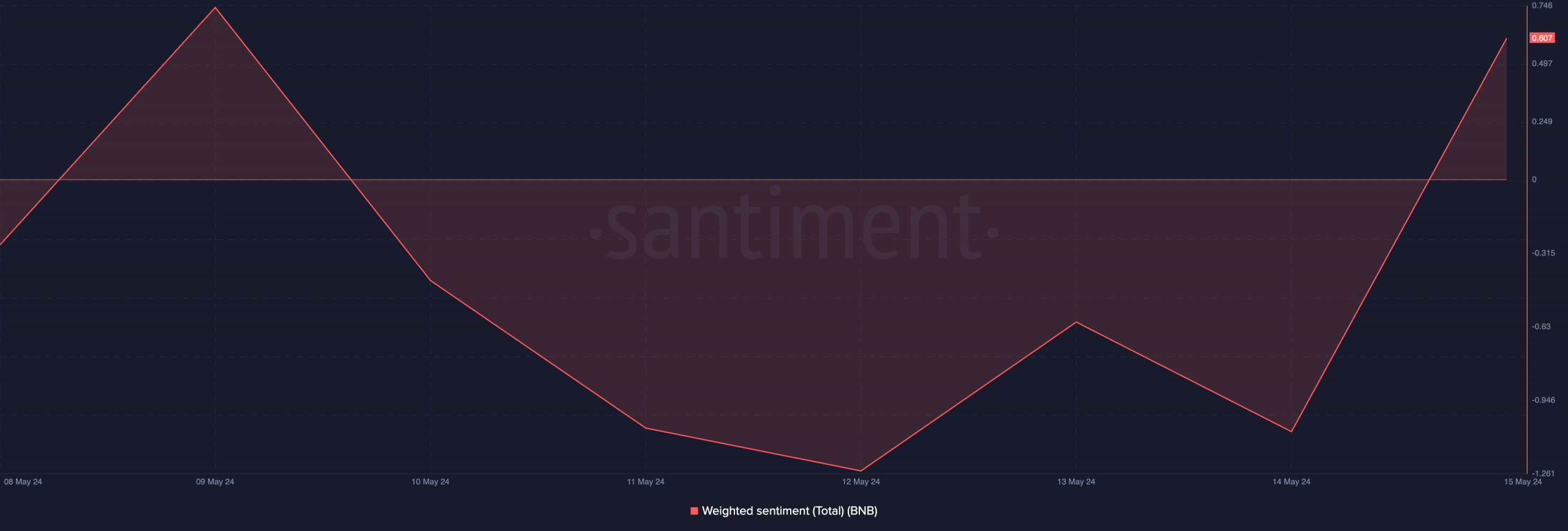

Based on Santiment’s latest findings, the coin’s weighted sentiment stood at 0.607 and was on an upward trajectory as of now. This figure’s positive value indicated that the Binance Coin (BNB) market was experiencing a favorable attitude from its investors.

The Money Flow Index (MFI) of Binance Coin (BNB), which reflects the sentiment of traders regarding the asset, stood at 65.61 and was increasing as of now. This upward trend suggests that more market players are purchasing BNB than selling it, supporting the bullish perspective.

As an analyst, I’ve observed that the Chaikin Money Flow (CMF) of the altcoin was trending upward and hovered above the zero line at 0.07. This signifies a consistent influx of capital into the Binance Coin (BNB) market. If this positive trend in CMF continues, it suggests a surge in demand for the cryptocurrency.

Should the market sentiment remain optimistic, there is a strong possibility for BNB‘s price to break through the triangle’s resistance level. Subsequently, the coin may experience significant growth, potentially reaching $596 first, followed by an upward trend towards $643.

BNB remains at risk

If the bullish outlook proves incorrect and bears gain strength instead, BNB‘s price could drop and potentially fall beneath the triangle pattern, trading near the $520 mark.

The likelihood of this occurrence increases due to the substantial negative funding rate that the altcoin has exhibited during the past few weeks.

Based on data from Coinglass, this particular cryptocurrency has primarily shown unfavorable funding rates starting from the 23rd of April. By the 15th of May, the funding rate for Binance Coin had reached a low point over several months at 0.106%.

The last time the coin’s funding rate was this low was back in February.

As an analyst, I would interpret a negative funding rate for an asset as an indication that there is a higher demand for short positions compared to long ones. This implies that a larger number of traders anticipate the asset’s price will decline and are buying it in the hopes of profiting from a subsequent price increase.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-05-16 22:15