-

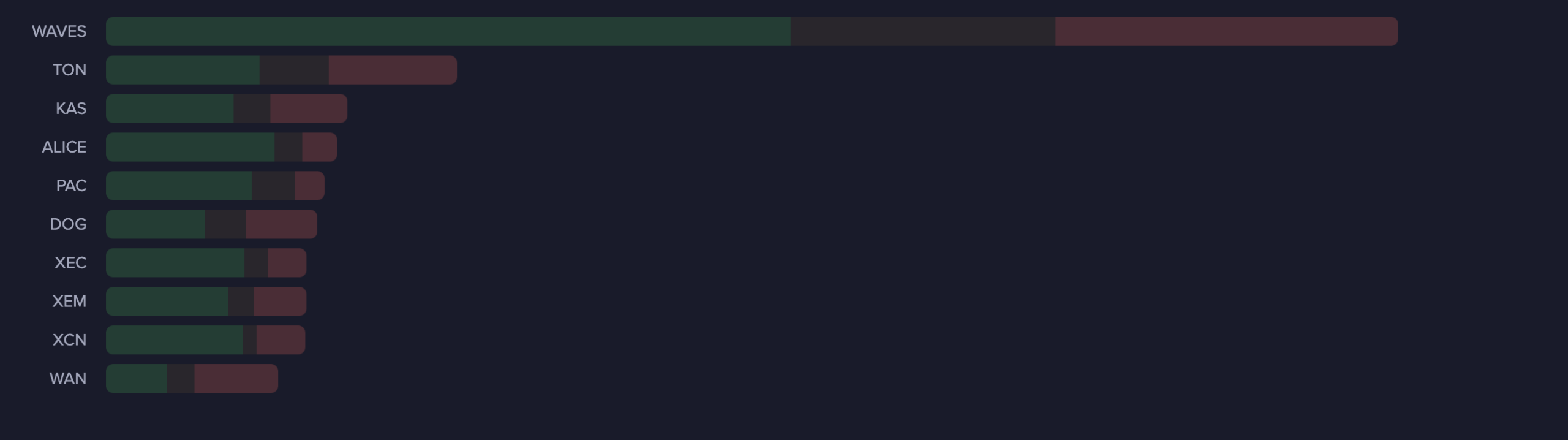

WAVES social activity has risen in the past 24 hours.

The demand for the altcoin has fallen to its lowest point in years.

As an experienced analyst, I believe that the recent surge in social activity surrounding Waves (WAVES) is a result of Binance’s decision to delist the altcoin, which has led to a significant drop in demand and price. The data from Santiment showing WAVES as the most trending coin on social media platforms is concerning, as it suggests that there may be fear or panic selling among investors.

The social media buzz around WAVES significantly increased after Binance announced its plan to remove the altcoin from their platform, according to Santiment’s findings.

Based on the latest data from reputable on-chain providers, I’ve discovered that WAVES holds the top position among trending assets over the past 24 hours in terms of social media buzz.

On June 3rd, Binance, a major cryptocurrency exchange, declared that WAVES, along with OMG Network (OMG), Nem (XEM), and Wrapped NXM (WNXM), would be removed from its marketplace. This announcement resulted in significant price drops for these assets.

As a researcher, I’ve observed that after Binance made an announcement, WAVES experienced a significant decrease in value, resulting in a 30% drop at the time of writing. According to data from CoinGecko, the altcoin was then trading at its lowest price since October 2023, which was $1.53.

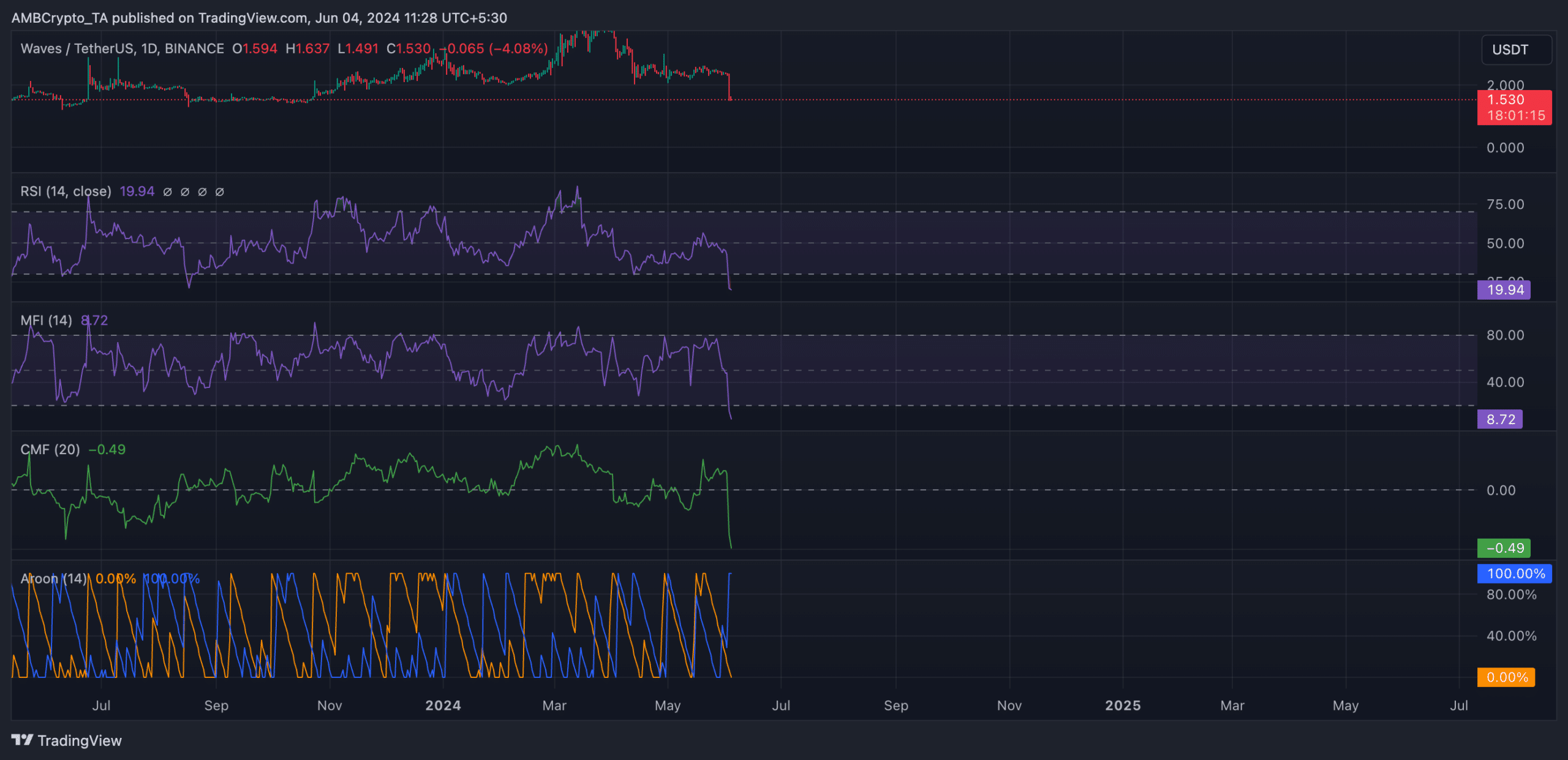

WAVES’ demand crashes

The analysis conducted by AMBCrypto revealed that the one-day chart of WAVES exhibited a significant decrease in demand, reaching record lows. For instance, its Relative Strength Index (RSI) and Money Flow Index (MFI) readings were 19.99 and 8.73 respectively. In simpler terms, the RSI and MFI values indicated that WAVES was heavily sold and experienced little buying interest.

As a researcher analyzing market data, I discovered that selling forces held more weight than any purchasing pressures observed during the given period.

Despite the signs of potential oversold conditions in the token’s key momentum indicators, implying an imminent correction, the Chaikin Money Flow (CMF) figures indicated a limited probability for a short-term price recovery.

As of this writing, WAVES’ CMF was -0.49, its lowest level since the token launched.

At zero or negative values, this metric signifies that more funds are leaving an asset than entering, indicating heightened market liquidity exit. The current Capital Market Flow (CMF) reading for WAVES stands at -0.49, suggesting substantial capital flight from the WAVES market as of now.

The Aroon Down Line of WAVES, represented by the blue line, reached 100% completion, indicating the robustness of the ongoing downtrend. This technical tool helps assess the token’s trend intensity and potential turning points within its price fluctuations.

When the Aroon Down line of an asset approaches 100, it signifies a robust downward trend, suggesting that the latest low point was achieved not too long ago.

Is your portfolio green? Check the Waves Profit Calculator

From a research perspective, I’ve observed that WAVES‘ Aroon Up Line, represented by the orange line on the chart, was at 0% as of now. This implies that there wasn’t any emerging uptrend, indicating that the token’s latest peak had been established quite some time ago.

If demand continues to plummet this way, WAVES might drop below $1 to exchange hands at $0.69.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-04 17:12