- Binance founder faces a 36-month prison term, spotlighting illicit activities in the crypto space.

- Legal actions against Binance and earlier FTX raise questions about crypto adoption.

As an experienced financial analyst, I find the ongoing legal issues surrounding Binance and its founder Changpeng Zhao deeply concerning. The potential 36-month prison term for Zhao, who faces allegations of allowing money laundering on the Binance platform, raises serious questions about the crypto industry’s adoption and regulatory compliance.

In the midst of ongoing legal disputes, Changpeng Zhao, the founder of Binance (BNB), now faces a pivotal point.

On the afternoon of the 30th of April, in a Seattle courthouse, Zhao’s sentencing is scheduled to take place, with US prosecutors advocating for a 36-month imprisonment sentence.

What’s the issue?

The claims center on his supposed inability to stop extensive money laundering on Binance, representing a major turn in the ongoing debate about him.

In a filing made by the Justice Department last week, prosecutors stated,

“Zhao’s willful violation of U.S. law was no accident or oversight.”

They added,

As a crypto investor, I’ve come across situations where breaking U.S. laws seemed like an attractive option to rapidly grow my business and amass wealth. However, it’s important to remember that such actions carry significant risks and potential consequences, including legal repercussions and damage to reputation. Instead, focusing on ethical and compliant practices is the best long-term strategy for building a successful and sustainable enterprise.

The Bank Secrecy Act required Zhao to set up a robust anti-money laundering program, but he deliberately failed to do so.

The judge’s ruling for a three-year sentence instead of the suggested 18 months highlights the seriousness of Zhao’s alleged crimes and the necessity of upholding the law rigorously.

Grounds of allegations

Zhao is reportedly believed to have aided Binance in handling transactions suspected of being linked to illegal activities, which involved Americans and prohibited persons.

Prosecutors point the finger at Zhao’s management for neglecting reported suspicious transactions and having weak internal controls. They’ve additionally highlighted the participation of certain identified terrorist organizations, such as Hamas and al-Qaida, in the alleged activities.

Last year in November, I relinquished my role as CEO of Binance in response to the accusations. More recently, I have acknowledged my violation of the Bank Secrecy Act.

He apologized profusely to the presiding judge in a written communication, admitting his shortcoming in setting up robust regulatory measures at Binance, and conceding that there was no valid justification for his negligence.

I’m sorry for my mistakes in judgment and take complete accountability for my actions. Looking back, I ought to have prioritized the implementation of compliance changes at Binance from the start, but I didn’t. There is no justification for my inability to set up the required compliance controls at Binance.

It’s intriguing to note that the founder of Binance reportedly advised his team on occasions of legal compliance: “It’s better to seek forgiveness than permission.”

Observers are left curious as they wait for Zhao’s reaction, while the prosecution maintains its strong position.

Other instances of money-laundering

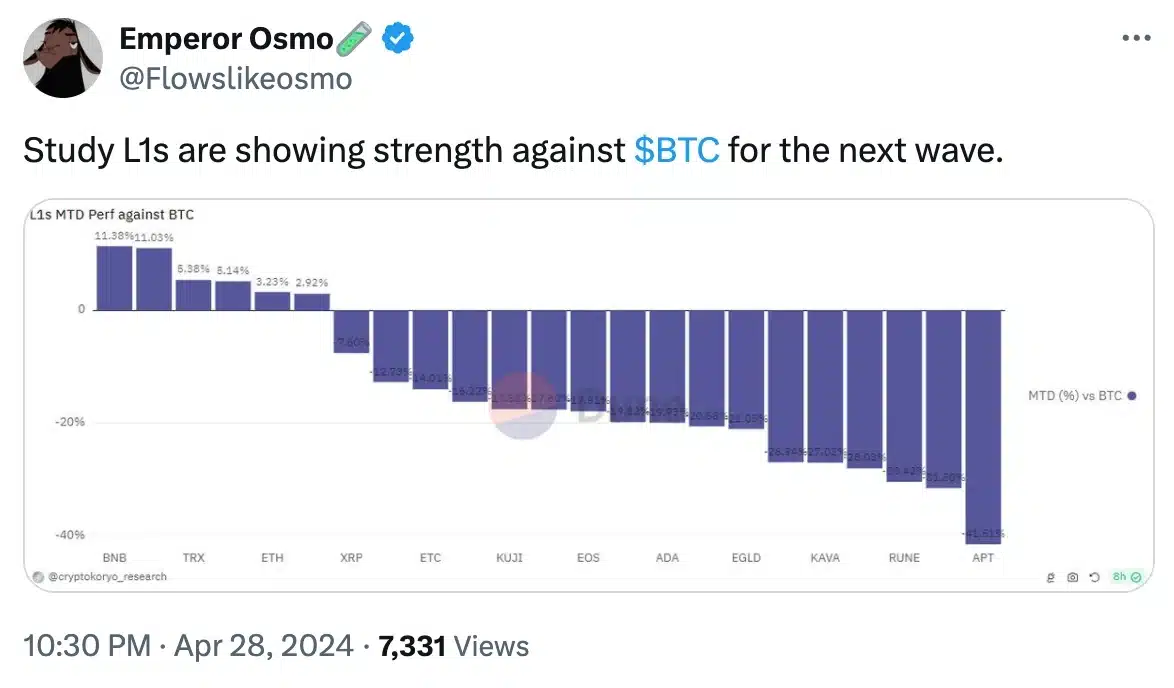

As a researcher observing the cryptocurrency market, I’ve noticed that despite Binance encountering some difficulties recently, the value of its BNB token and other Layer 1 (L1) tokens relative to Bitcoin has held up well.

As a crypto investor, I’ve noticed that Binance isn’t alone in facing accusations recently. In fact, Nigeria has been making waves by intending to pursue Binance and two of its top execs over allegations of money laundering and tax evasion.

In 2022, FTX experienced a significant decline, resulting in Bankman-Fried being found guilty of fraud and receiving a prison sentence of 25 years.

This underscores the regulatory hurdles confronting major players in crypto.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-04-30 17:12