- Binance recorded $1.2 billion in inflows, following a major market recovery.

- Bitcoin and Ethereum prices surged, indicating renewed investor confidence in cryptocurrencies.

As a seasoned analyst with over two decades of experience in the financial markets, I must admit that this recent surge in cryptocurrency prices and inflows into exchanges like Binance is truly intriguing. The resilience of the crypto market following such a dramatic downturn on August 5th is reminiscent of a phoenix rising from the ashes.

After the worldwide crypto market experienced a significant drop on August 5th, there seems to be a substantial recovery, as various digital currencies are currently witnessing an uptick in their prices.

In the last day, Bitcoin (BTC) and Ethereum (ETH) have experienced significant growth, with Bitcoin rising by approximately 4.6%, and Ethereum increasing by around 3%.

It’s worth noting that on the 5th of August, which happened to be one of the more turbulent trading days of the year, Binance Coin [BNB] experienced a significant increase of approximately $1.2 billion in net deposits.

Binance record inflows

On the 5th of August, Binance experienced one of its highest net inflow days in 2024, as reported by CEO Richard Teng, with a massive $1.2 billion flowing into the platform on that day.

This signaled strong investor confidence amidst market uncertainties.

In my latest findings, I’ve emphasized the significant role of these inflows. As I’ve pointed out, the high level of trader involvement indicates a positive outlook, or bullish sentiment, even amidst previous market disturbances.

On Binance, the influxes weren’t simply occasional events, but rather they formed part of a more extensive trend characterizing increased trading intensity and liquidity boosts on multiple platforms.

The complex factors driving these influxes encompass various transactions like direct trades, funds transferred from external wallets, and significant fiat deposits, ultimately leading to a surge in cryptocurrency buying.

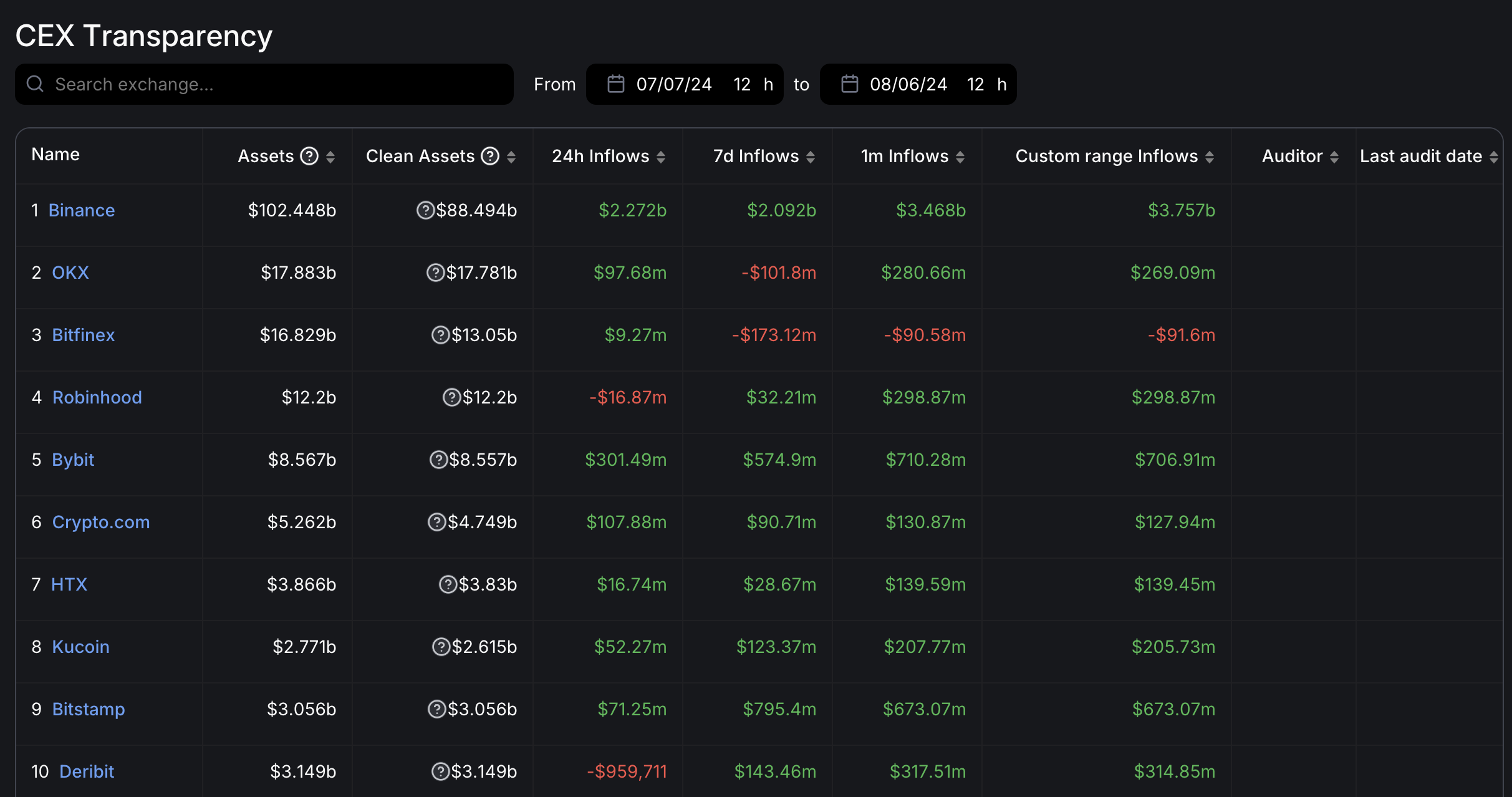

As an analyst, I’ve been closely monitoring the market trends, and today, I noticed a significant surge in Binance’s net inflows. According to DeFiLlama’s CEX transparency dashboard, Binance experienced a staggering increase of over $2.27 billion in assets within the past 24 hours. This influx has pushed the total assets under management to an impressive figure of $102.44 billion. It’s clear that the market confidence in Binance is growing steadily.

On Binance, as well as platforms such as Bybit, Crypto.com, and OKX, there’s been a noticeable surge in deposits – a trend that isn’t limited to just one exchange.

In the last 24 hours, Bybit recorded $301.49, while Crypto.com and OKX both showed a figure of approximately $97.68 million each, as per the provided data.

On the other hand, not every platform saw a surge in funds. For instance, Robinhood faced an outflow of approximately $16.87 million during the time it halted its 24-hour trading system, Blue Ocean ATS.

Bitcoin as a case study

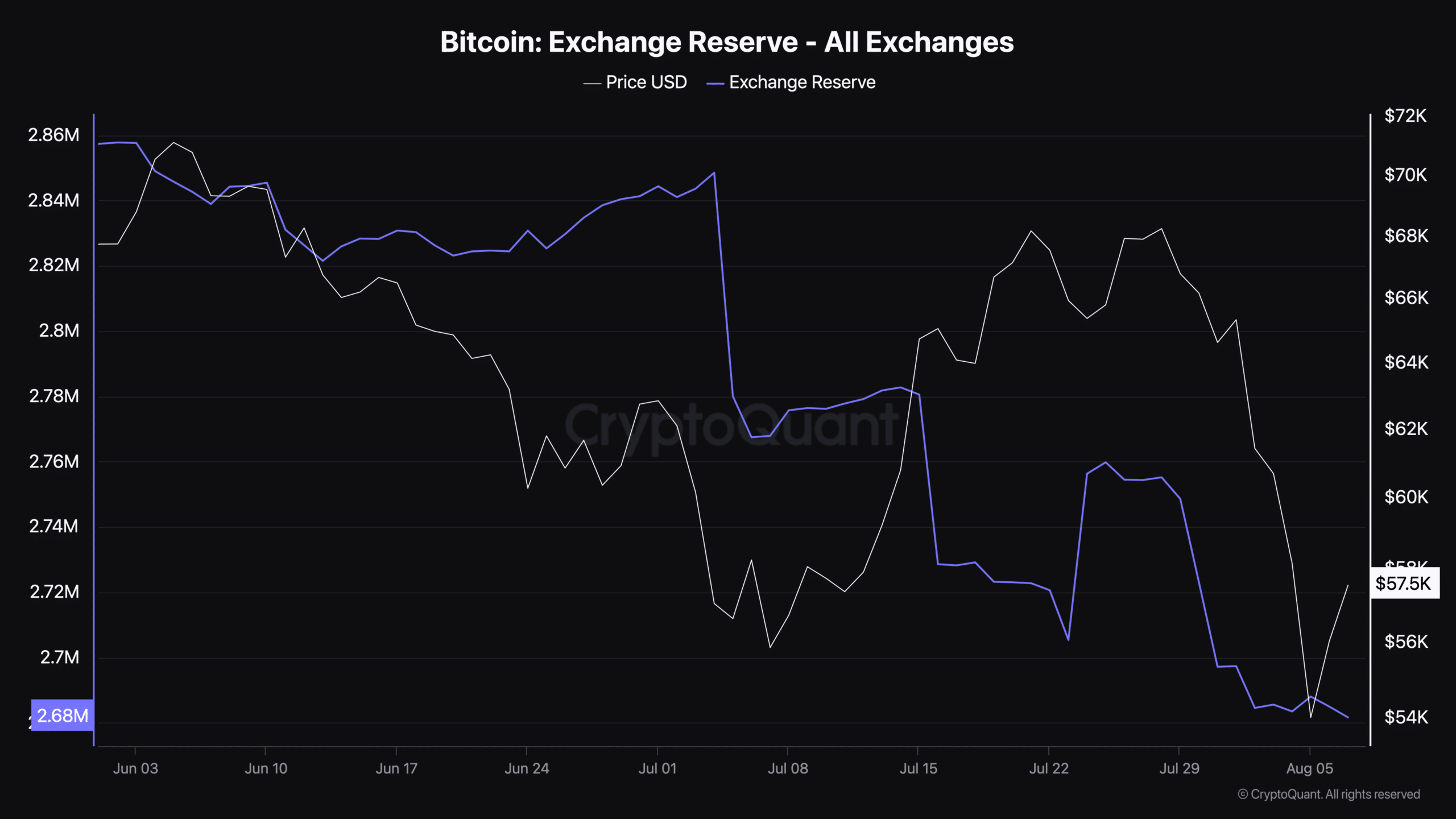

Additionally, you can assess the general well-being of the cryptocurrency market by looking at the trending patterns of Bitcoin’s reserves held on exchanges.

Lately, data from CryptoQuant reveals a significant drop in the amount of Bitcoin stored on exchanges. Initially at around 2.8 million BTC in early July, it has decreased to approximately 2.6 million BTC as of now. This trend suggests that the supply of Bitcoin available for trading on exchanges is diminishing.

In my analysis, it appears that following the market’s initial jolts, investor actions have tended more towards holding onto their investments instead of offloading them. This trend, in turn, seems to be causing a squeeze in liquidity, potentially building up pressure for prices to rise.

Read Binance Coin’s [BNB] Price Prediction 2024-25

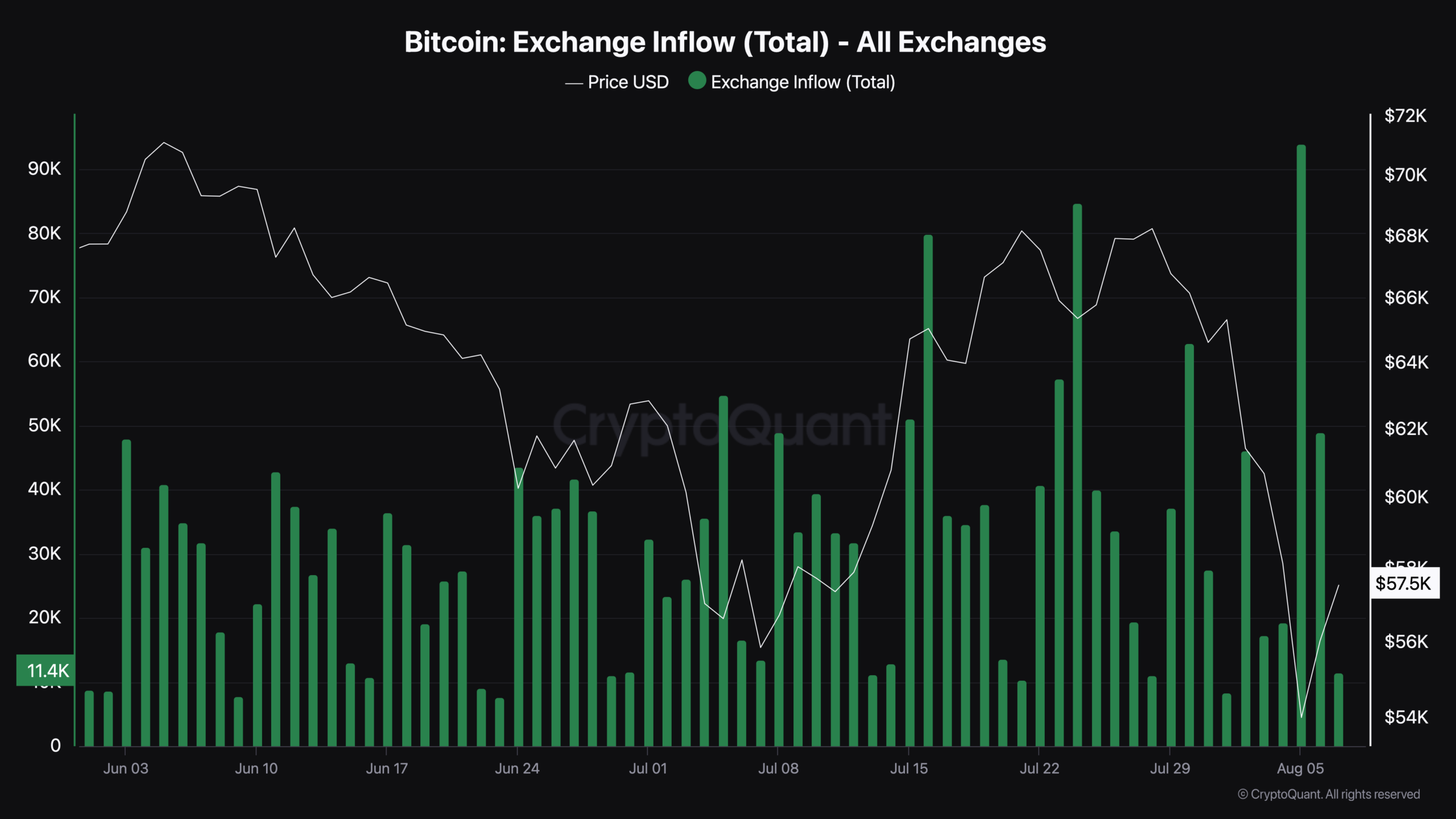

Contrarily, there has been a revival in the inflow of Bitcoins into exchanges. The amount increased from around 40,000 BTC to approximately 94,000 BTC on the 5th of August.

The rise in incoming trades indicates a resurgence of enthusiasm for trading, possibly suggesting that traders are stockpiling assets in preparation for future price hikes.

Read More

2024-08-08 03:04