- Binance and Polygon saw more unique addresses than other chains.

- TVL and volume reduced despite the number of unique addresses.

As a researcher with experience in blockchain analysis, I find the data on Binance Smart Chain (BSC) and Polygon (MATIC) intriguing. While it’s true that both platforms have seen an impressive number of unique addresses, my initial observation is that this has not translated into significant volume or Total Value Locked (TVL).

Based on the latest data, Binance [BNB] and Polygon [MATIC] have seen a significant number of transactions with the highest number of active addresses. However, it’s crucial to examine the impact on their trading volumes and Total Value Locked (TVL) for a comprehensive understanding.

Additionally, how have BNB and MATIC trended with their networks’ volume of unique addresses?

Binance and Polygon lead rankings

As a crypto investor, I’ve noticed some intriguing findings from the latest rankings by Crypto Rank. The Binance Smart Chain and Polygon took the first and second spots, respectively, based on the number of unique addresses they host.

Based on information from the ranking site, the Binance Smart Chain boasted approximately 444 million distinct user addresses, whereas Polygon counted around 419 million.

The sum of distinct addresses on these platforms is significant, exceeding the number of distinct addresses found on the next three platforms.

As an analyst, I’ve observed that our platform has surpassed Ethereum [ETH] in terms of the number of unique addresses, implying a substantial increase in user base and engagement.

Any impact on volume and TVL?

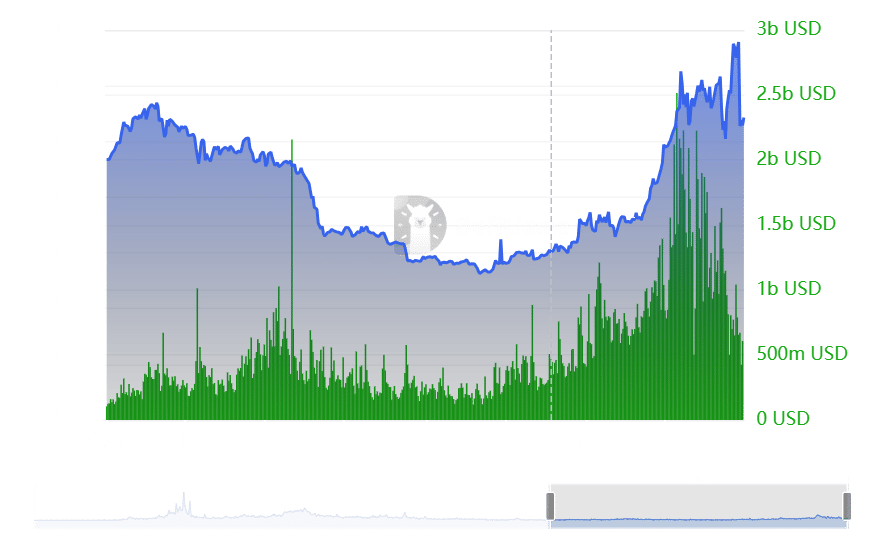

Examining the latest figures from DefiLama regarding the amount of assets and Total Value Locked (TVL) within the Binance Smart Chain (BSC), there hasn’t been any substantial changes observed recently.

Around March, there was significant action observed within the network, signified by a series of surge in transactions, reaching a peak of over $2.5 billion. Nevertheless, recent figures indicate that the transaction volume has dropped down to roughly $614 million.

As a crypto investor, I’ve noticed an intriguing trend with the Total Value Locked (TVL) in the past week. It surged past the $6.7 billion mark, which was quite an exciting development. However, it seems that this growth was short-lived as the TVL has now retreated to roughly $5.4 billion.

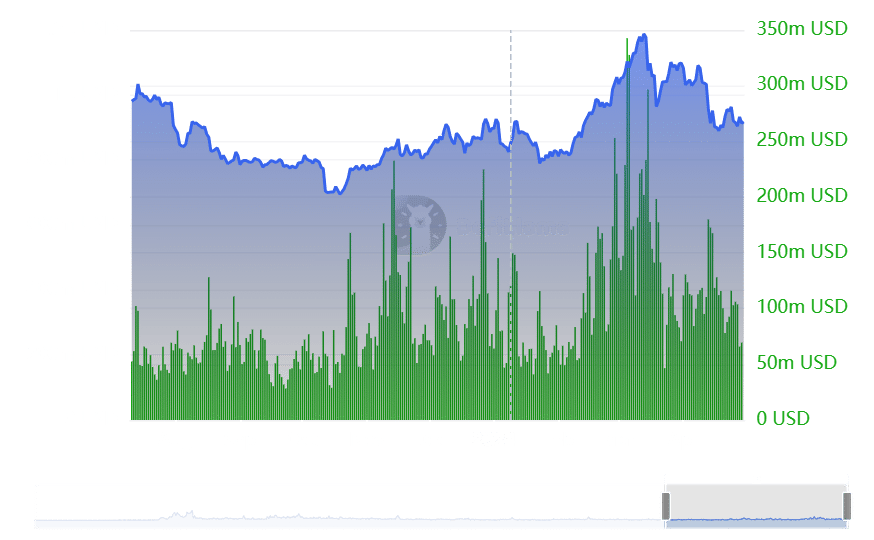

In their analysis of Polygon, AMBCrypto observed that both the volume and total value locked (TVL) had not shown any significant recent fluctuations.

As I delved into the data during my investigation, I discovered that the volume amounted to roughly $69 million. However, I noticed a recent downturn in this figure. Similarly, the Total Value Locked (TVL) was approximately $917 million, indicating a similar trend of decline in this metric as well.

Based on the data, it seems that even though there is a significant rise in the number of unique accounts, there hasn’t been an equivalent uptick in user interaction or involvement on these platforms.

BNB and MATIC see a negative start to the week

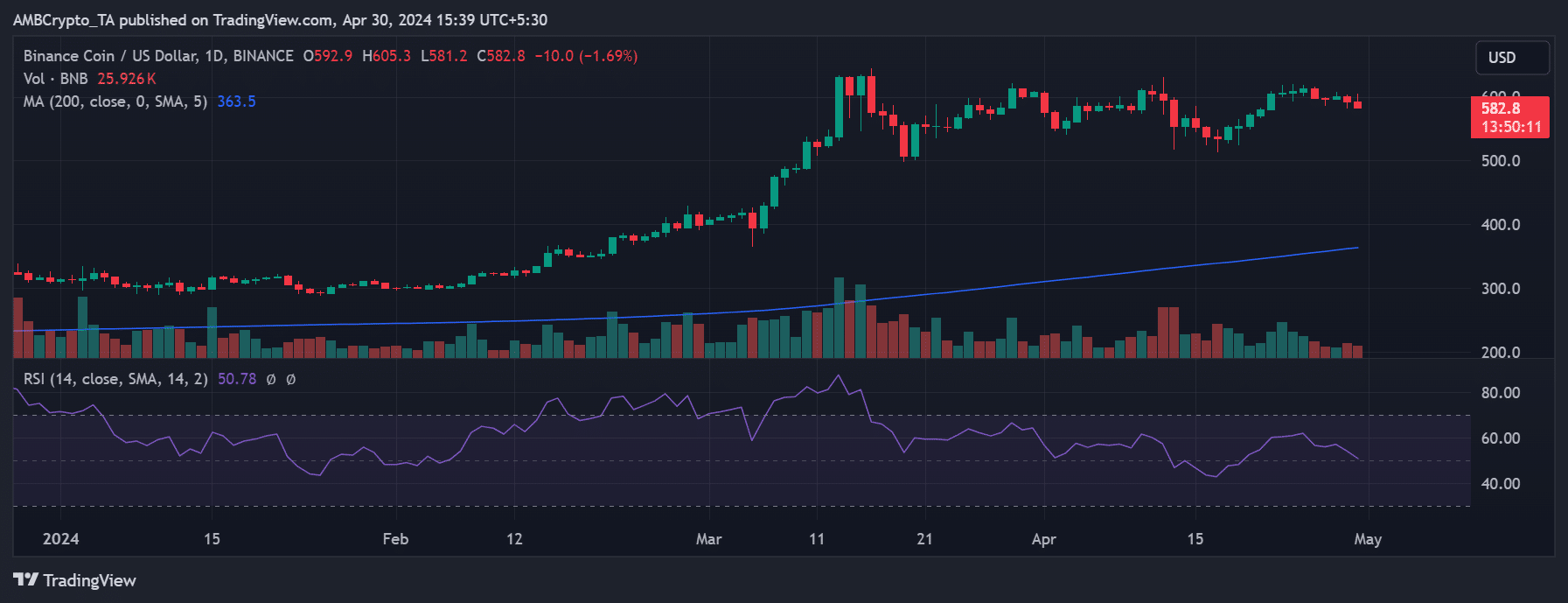

Based on AMBCrypto’s assessment, BNB showed a shift from its promising beginning to the week, with the coin undergoing a drop in trading activity.

On the 29th of April, BNB‘s trading ended with a 1.23% decline, valuing it at roughly $592.7. At present, there is an additional decrease of 1.72%, causing its trading value to be approximately $582.9.

Realistic or not, here’s BNB market cap in BTC’s terms

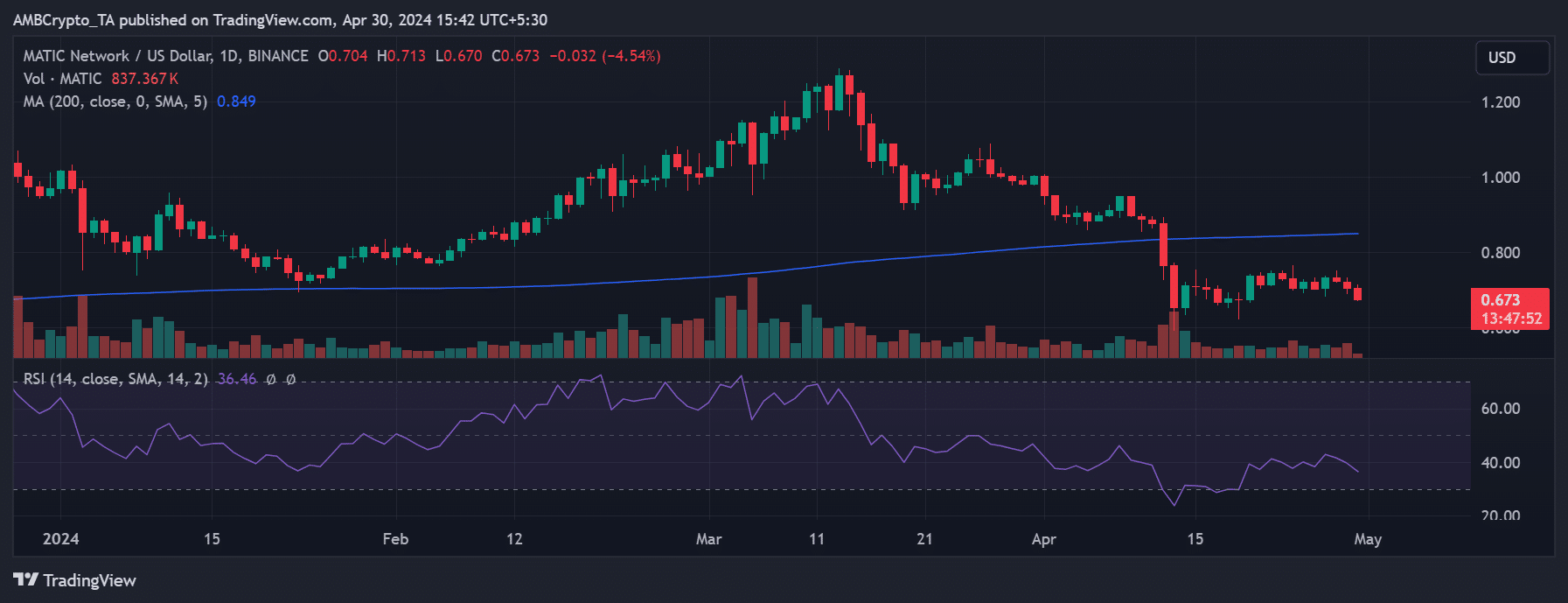

As a crypto investor, I’ve noticed that MATIC has been following a less favorable path lately. Since the start of this week, its value has been on a downturn.

When I examined it, MATIC was priced around $0.67 during the assessment, representing a drop of more than 4% in value.

Read More

2024-05-01 04:07