- Binance recently purchased over $596,000 worth of ONDO, showing growing interest.

- However, this move has not swayed broader market behavior, as many participants continued selling.

As a seasoned crypto investor with a knack for deciphering market trends, I find myself both intrigued and cautious by the recent developments surrounding Ondo Finance [ONDO]. On one hand, Binance’s $596,000 investment serves as a bullish signal, suggesting that major players are positioning themselves for potential growth. However, the stark contrast between institutional accumulation and derivative traders’ selling activity gives me pause.

At the current moment, Ondo Finance (ONDO) continues to show optimistic trends. Over the last month, it has risen by an impressive 46.43%, and it experienced a 1.69% growth within the past day.

As a researcher, I’ve noticed an intriguing discrepancy: while prices have been surging, there seems to be a decline in interest. This divergence might hint at an impending shift in trends, potentially pointing towards a possible reversal.

Through their analysis, AMBCrypto offers valuable information about ONDO’s current status and what investors might expect moving forward.

Binance accumulates ONDO

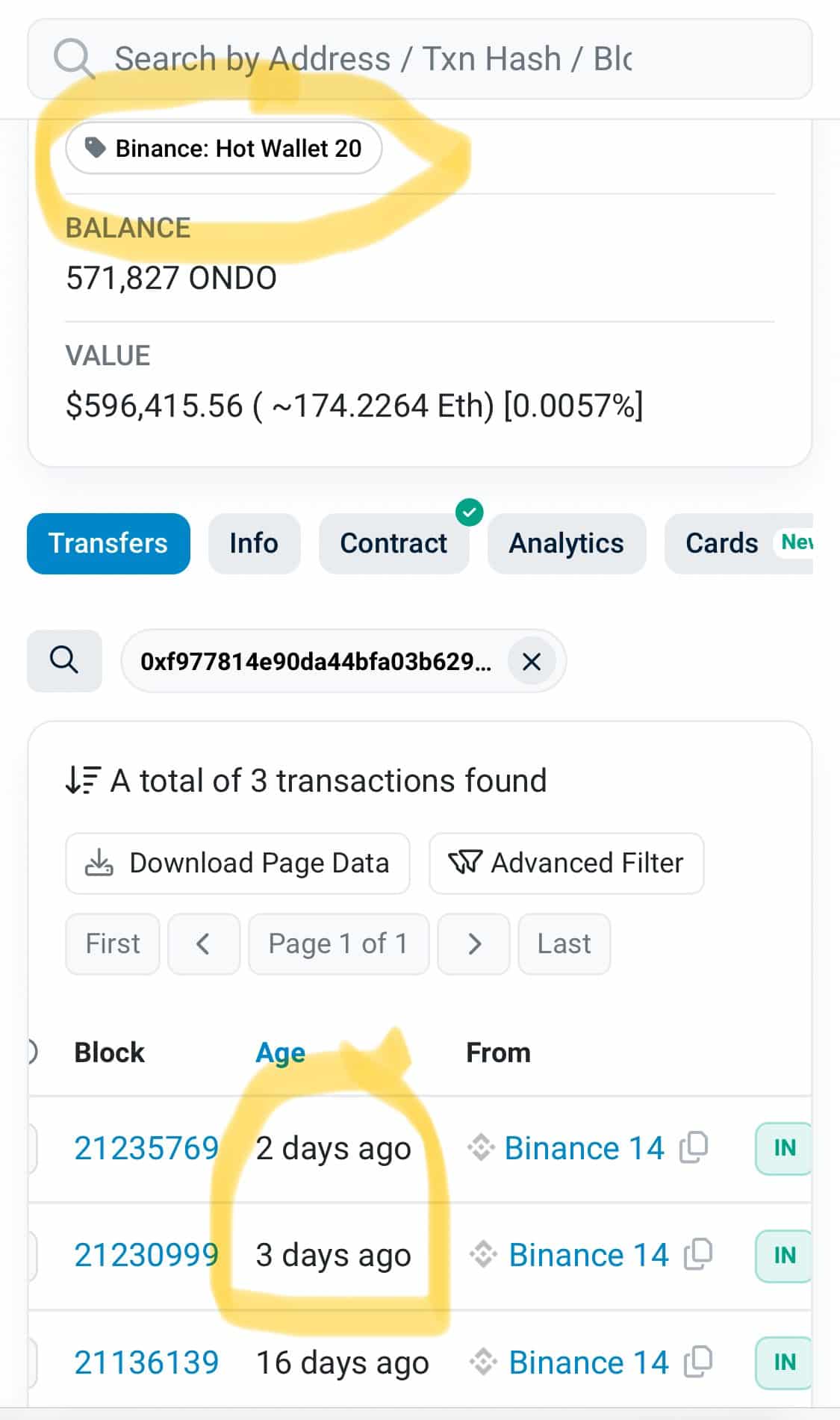

Over the last five days, it’s been reported that Binance, the globally leading cryptocurrency trading platform by market value, has amassed a total of 174.22 Ethereum or approximately $596,415.56 worth of ONDO, another cryptocurrency.

The transactions were made using both the hot and cold wallets provided by Binance, split into two distinct transfers. This increased their possession of ONDO tokens up to a total of 571,827 units.

Massive purchases like these typically indicate increasing institutional curiosity, implying that significant players might be strategically preparing for a possible market surge.

A more detailed examination uncovers a striking difference: while institutions are amassing, derivative traders are instead offloading, suggesting a possible disconnect in market opinion.

Divergence amid ONDO accumulation

As I write this, there’s a growing pessimistic outlook (bearish sentiment), contrasting with the optimistic undertones (bullish) that had been established earlier due to large-scale buying activity.

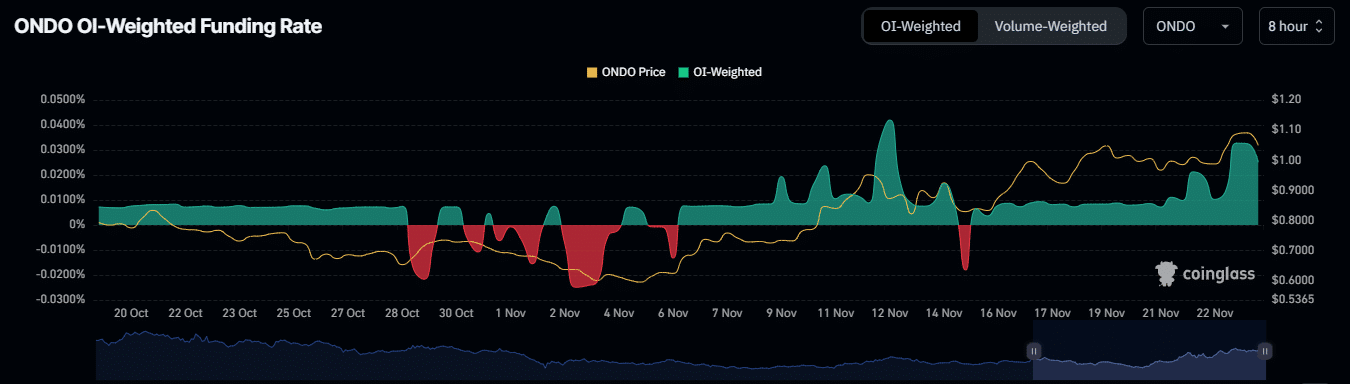

As a crypto investor, I find that the OI-Weighted Funding Rate offers a more transparent perspective on the overall market sentiment. This mechanism takes into account the Open Interest (OI) to refine the Funding Rate, making it easier for me to understand and interpret the market’s direction and dynamics.

As a crypto investor, when I see a positive rate, I understand that we’re witnessing a bullish market where the majority of traders are going long, or betting on an increase in price. On the flip side, a negative rate indicates a bearish market dominated by short sellers, who believe the price will decrease.

Currently, as we speak, the Funding Rate for ONDO seems to be consistently dropping, dipping into the negative territory at -0.0251%. This suggests an increasing level of bearish sentiment in the market.

An analysis of prolonged market data suggested that conditions were less advantageous for long-term traders, as they followed the stockpiling patterns of major investors, implying a potentially challenging market scenario.

Approximately half a million dollars’ worth of long positions have been forcibly closed, suggesting the potential for further price decline in ONDO as market pressure seems to be moving it downwards.

Increase in short contracts

As long positions are being closed out and the overall market mood is turning more pessimistic, we’ve noticed a substantial rise in the use of short contracts at AMBCrypto.

Read Ondo Finance’s [ONDO] Price Prediction 2024–2025

As reported by Coinglass, the current long-to-short contract ratio stood at approximately 0.8734, suggesting that there are more short contracts being used. This could imply a market bias towards bearish positions, or “shorts.

Should the pattern of increasing short positions persist, it might intensify the drop in ONDO’s value, postponing any impending surge and moving the asset even farther away from its present position.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-24 17:11