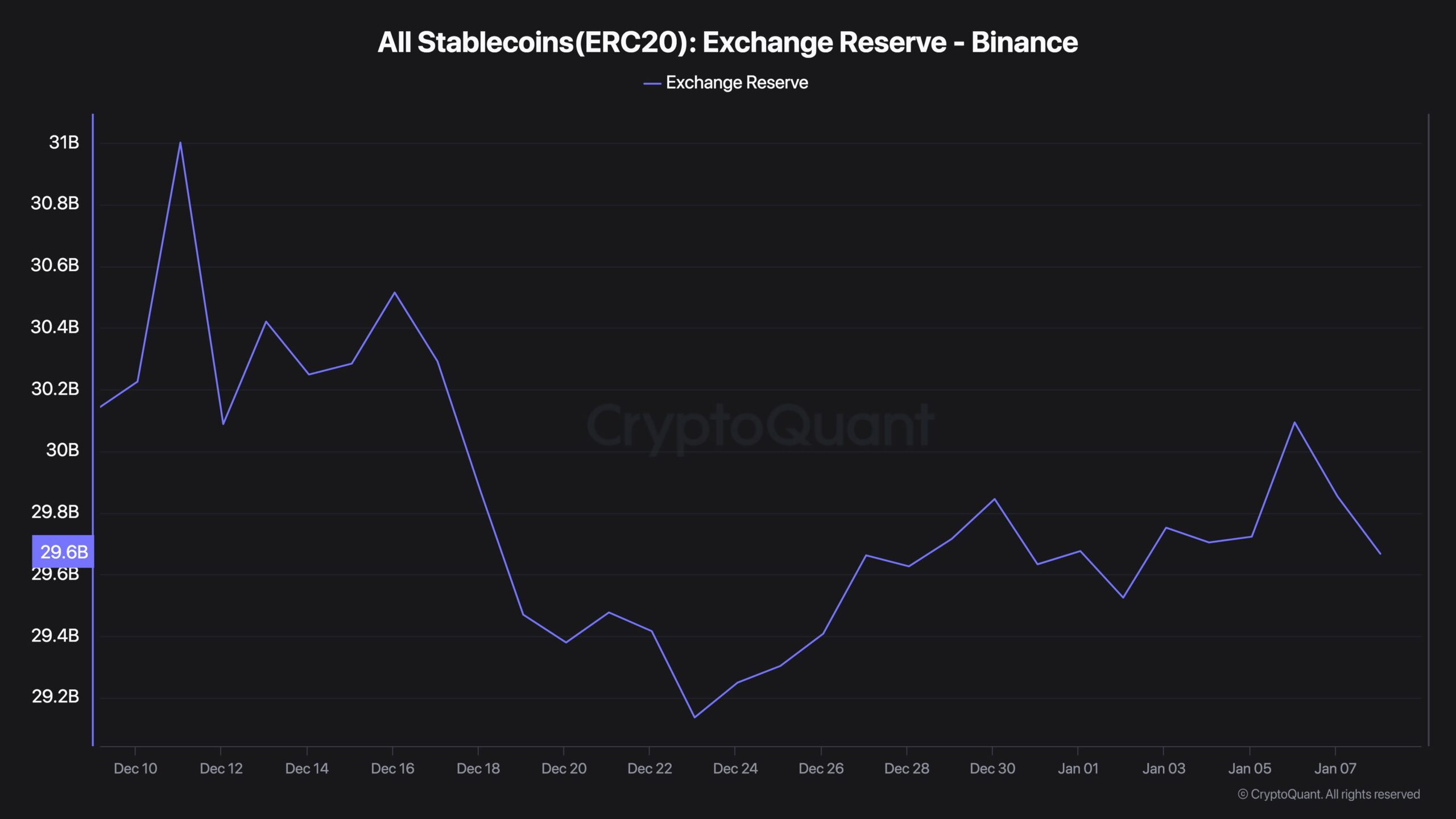

- The recent weak sentiment was marked by extended Binance stablecoin outflows.

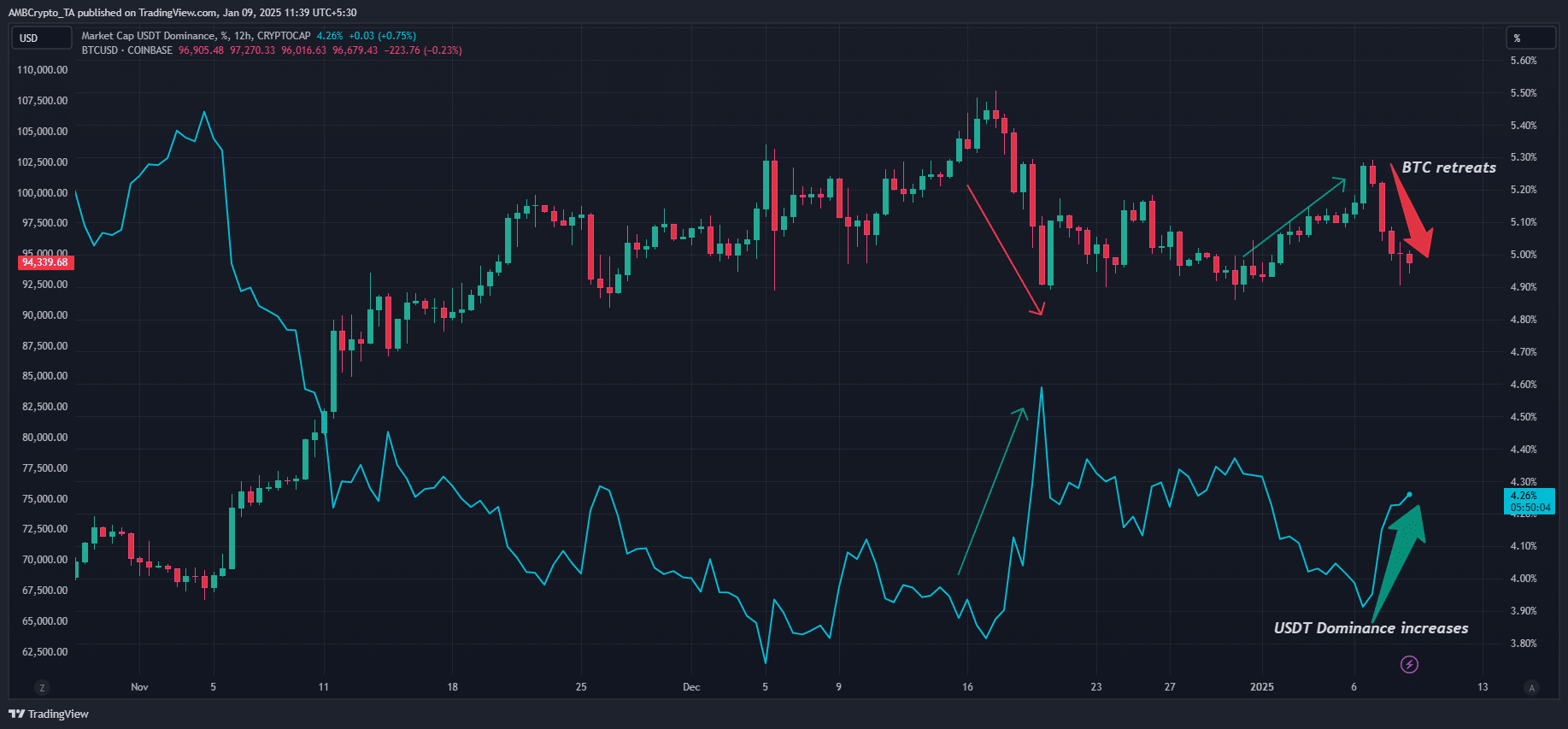

- USDT dominance also spiked as investors opted to preserve capital as markets tanked.

This week’s pessimistic market atmosphere has unsettled many cryptocurrency investors, causing most of them to cash out their profits or withdraw entirely in order to protect their funds.

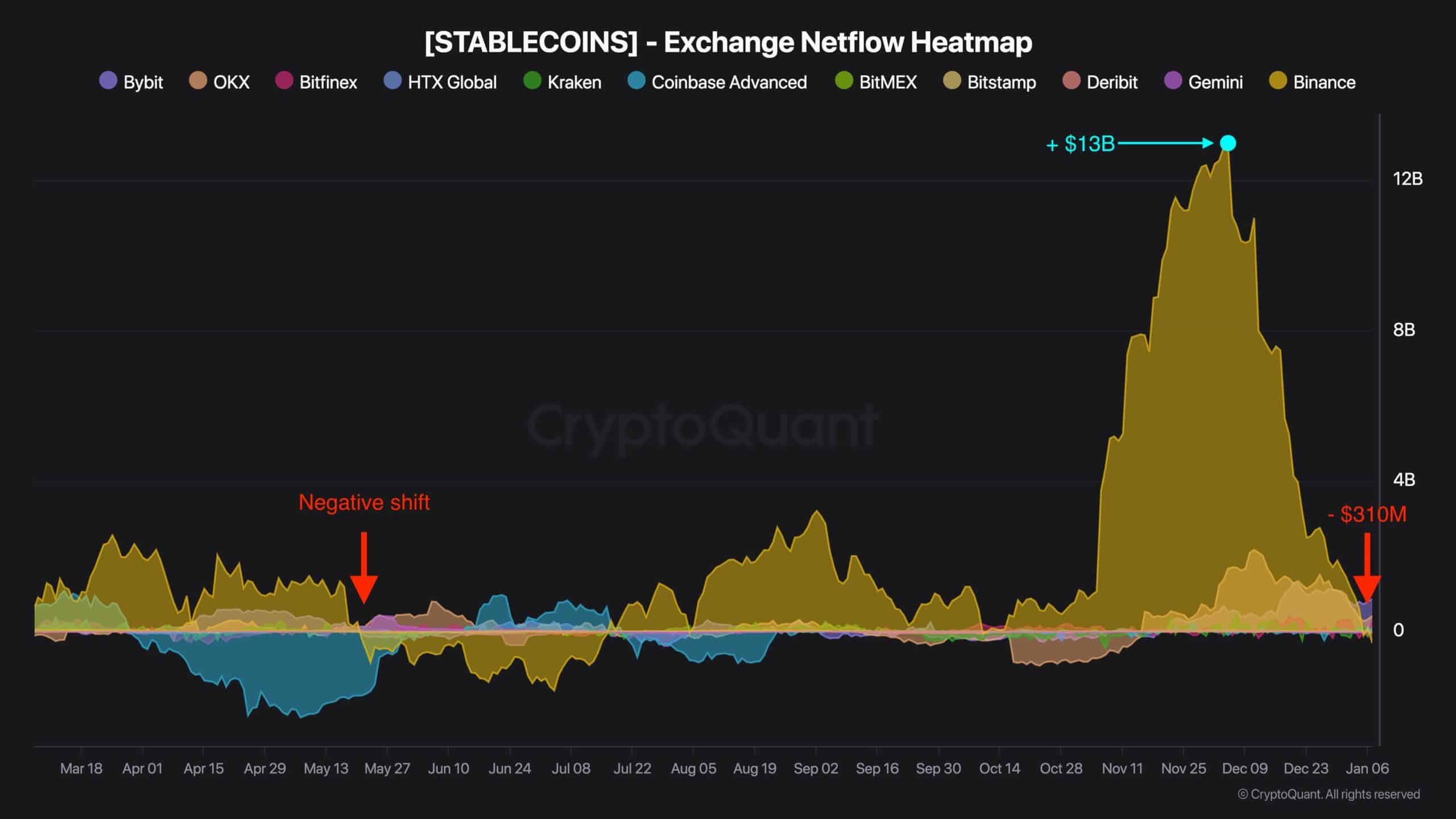

As per the analysis of the anonymous CryptoQuant expert known as Dark Fost, the change from a $13 billion influx of Binance stablecoins in November to a $310 million outflow in early January has echoed the Bitcoin market dip that occurred last summer.

He stated,

presently, there’s a change in the direction of stablecoin movement on Binance, which resembles a pattern we saw back in May 2024. It is important to note that this same pattern occurred just prior to Bitcoin experiencing a significant price drop during the following summer months.

Bitcoin market on edge

Fost added that a lukewarm stablecoin inflow typically indicates weak buying strength.

On the other hand, he cautioned that ongoing withdrawals, noticeable since mid-December, reflect a sense of market caution and potentially impact the future of Bitcoin [BTC].

A decrease in the flow of stablecoins suggests less buying demand, but a reverse flow, where stablecoins are leaving, points to a stronger change in the market, implying that investors are becoming more cautious.

The pessimistic outlook in the market arose due to persistent American inflation, making it more likely that the Federal Reserve will take a gradual approach to lowering interest rates, potentially hindering growth in riskier investments.

Furthermore, the FOMC Minutes that suggested a more aggressive monetary policy stance, along with reports of the U.S. government being granted permission to auction off Bitcoin seized from Silk Road, appeared to dampen market enthusiasm.

The increasing influence of Tether (USDT) has supported Dark Forest’s worries. This correlation runs counter to Bitcoin’s price, and the latest surges around $108K and $102K suggest these levels as local peaks.

As a crypto investor, I’ve been keeping an eye on the predictions of experts like Peter Brandt. He’s suggested that if Bitcoin’s inverted head-and-shoulder pattern were to break through the support at $90K, we might see it soaring towards $75K.

Whether the USDT dominance will top out again above 4% and allow BTC to rebound remains uncertain.

On the contrary, Benjamin Cowen and James Van Straten of CoinDesk, in their assessment, considered the latest drop in Bitcoin’s price as a regular dip that often occurs during the year following the halving event.

At press time, the asset attempted to stabilize above $94K.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-09 16:07