-

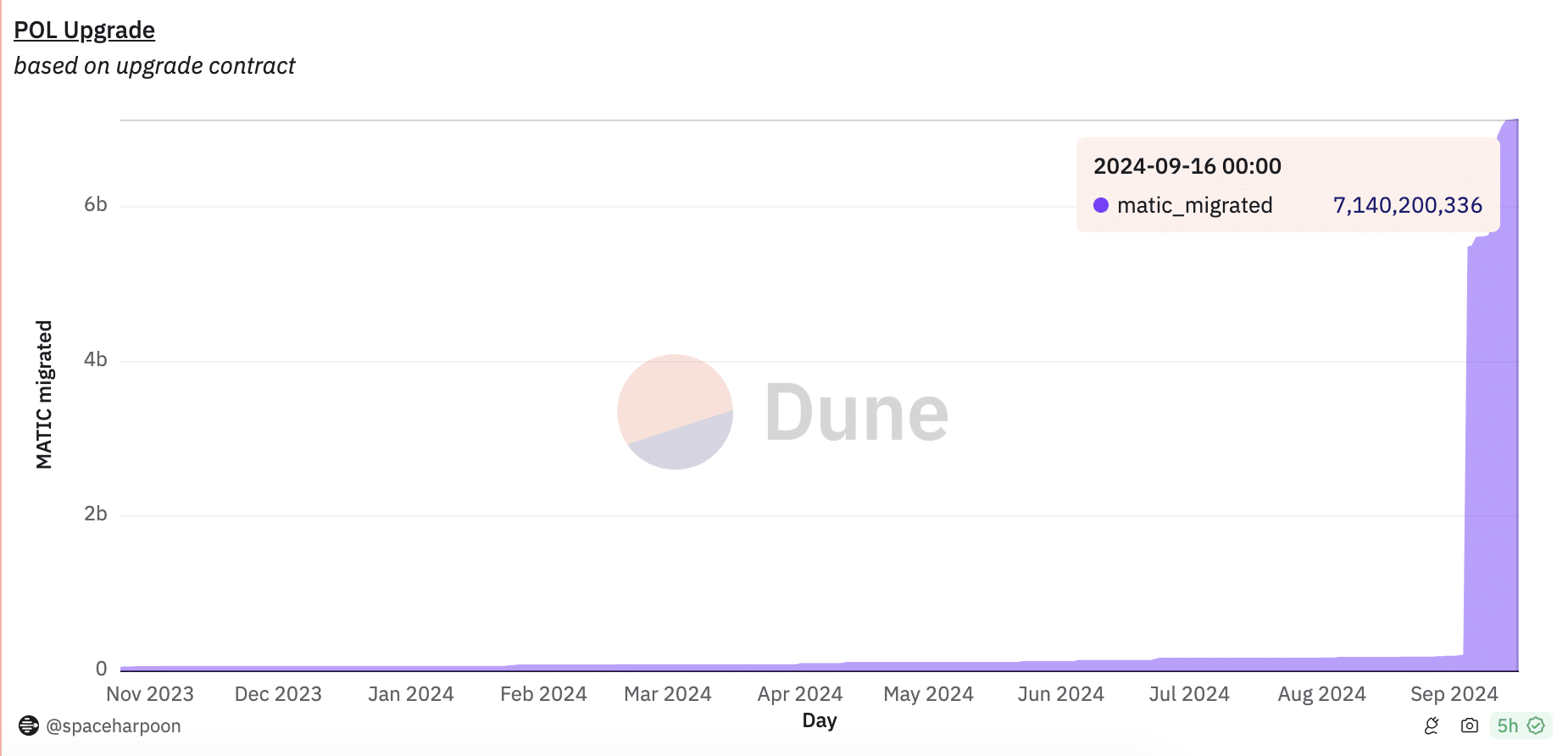

POL trading surged post-listing as $7.14 billion MATIC tokens converted to the new token.

Polygon strengthened its role in tokenized RWAs, holding $868.88 million in Total Value Locked.

As a seasoned crypto investor with a knack for spotting promising projects and a portfolio brimming with digital gems, I’ve been closely following the developments of Polygon (POL). The recent listing on Binance has sent ripples through the crypto market, with MATIC tokens converting to POL at an astounding rate of $7.14 billion.

Binance‘s token [BNB] has successfully wrapped up its shift from Matic to Polygon, sparking curiosity among traders.

Approximately 71.4% of the total MATIC token supply, equivalent to around $7.14 billion, has already been swapped. This significant conversion has sparked interest in the market as it watches closely to see how this transition might influence the price fluctuations of POL, according to Dune’s analysis.

As a researcher immersed in the world of cryptocurrencies, I’m thrilled to announce that the recently introduced POL token is now open for trading on various pairings. These include POL/USDT, POL/BTC, and POL/ETH, with more pairings likely to follow.

POL performance post-listing

According to the data on Binance, Polygon (POL) has shown significant fluctuations and an increase in trading activity. At this moment, the price of POL stands at $0.3794, and its 24-hour trading volume amounts to approximately $77,969,673.

Yesterday, the value of the token dropped by approximately 6.29%, but it managed to grow by about 0.85% over the last seven days. Although there was a temporary decrease in the short term, the token’s market capitalization remained stable at $2.7 billion, largely due to its substantial circulating supply of around 7.1 billion units.

As reported by DefiLlama, the Total Value Locked (TVL) on the Polygon network stood at approximately $868.88 million when last checked, suggesting strong user participation within the platform.

Moreover, the network’s stablecoins boast a market capitalization of approximately $1.982 billion, and over the past 24 hours, their trading volume has amounted to around $58.59 million.

In the past day, Polygon experienced deposits worth approximately $1.49 million and carried out about 2.84 million transactions. During this timeframe, there were around 606,572 active addresses, with a rise of 55,169 new addresses compared to the previous period.

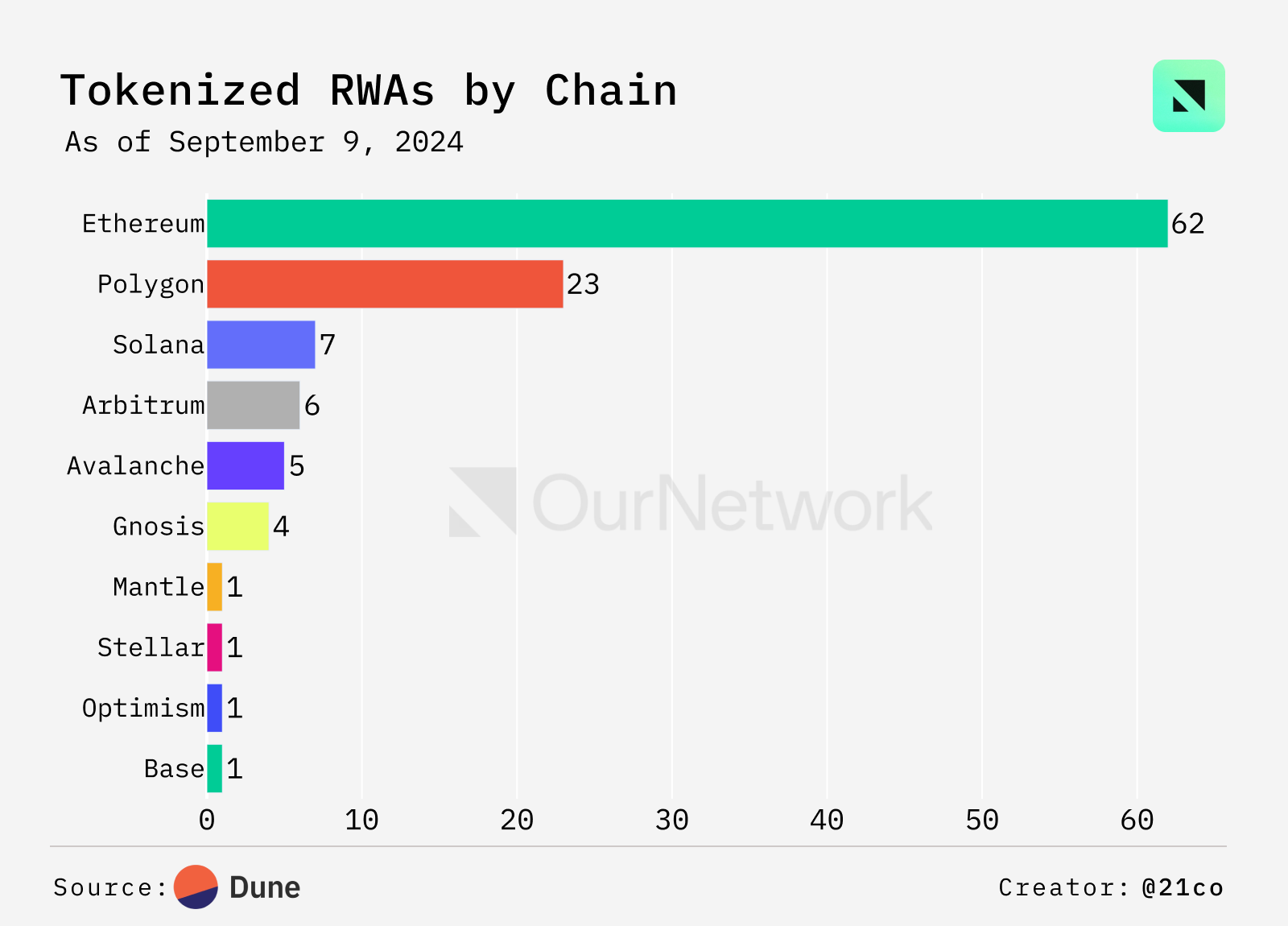

Polygon’s role in tokenized RWAs

Polygon has solidified its position as the second-largest player in the realm of tokenized Real-World Assets (RWAs), boasting 23 assets on its network. This is just behind Ethereum‘s [ETH] count of 62 assets, according to recent market assessments.

The significant role Polygon plays within the Real World Asset (RWA) sector, boasting a market cap of $531.58 million, underscores its prominence in the broader blockchain landscape.

Read Polygon’s [MATIC] Price Prediction 2024–2025

Possessing a considerable market stake empowers Polygon significantly as it moves towards the POL epoch.

As the platform continues to expand within the Real-World Asset (RWA) market, it’s likely to draw in even more projects. This influx might impact the long-term worth of POL.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-09-17 11:35