- Binance has agreed to pay a $1.7 million to the Brazilian Securities and Exchange Commission.

- CMV accused Binance of providing derivatives trading services without proper compliance.

As a seasoned researcher who has closely followed the evolution of the cryptocurrency market and its regulatory landscape, I find this latest development between Binance [BNB] and the Brazilian Securities and Exchange Commission (CMV) quite intriguing.

Recently, it has been determined that crypto exchange Binance [BNB] must fork over a sum of approximately $1.76 million to the Brazilian Securities Commission (CMV), following a recent legal ruling.

According to CMV, the exchange has conducted illegal derivatives trading in Brazil.

2020 saw the Commissions, Markets, and Valuation Authority (CMV) launch an investigation against Binance, alleging that the platform was offering derivatives trading without fully adhering to legal requirements.

After completing the probe, the agency requested that Binance halt these specific actions or face penalties should unauthorized trading persist.

Last year, the exchange proposed a settlement of $370k following an initial caution, but this proposal was turned down by the regulatory body.

Now, showing a sense of relief for Binance, CMV (China Merchants Venture) has agreed to the recent plan following the green light from the country’s Term Commitment Committee.

According to the agreement, Binance will operate and the law and pay $1.7 million for violations.

Binance’s legal battles

As a analyst, I’ve observed significant challenges that Binance has faced with regulatory bodies due to non-compliance issues. For instance, operations of Binance were temporarily halted in India owing to non-compliance concerns, as reported by AMBCrypto.

In addition to the more recent instances where rules were broken, there have been numerous such occurrences at this exchange. To illustrate, the organization consented to a penalty amounting to $4.3 billion due to infractions related to anti-money laundering and sanctions regulations within the U.S. jurisdiction.

Similarly, these violations led to the imprisonment of the previous CEO, Changpeng Zhao, of the company. Consequently, this settlement in Brazil comes at a time when the exchange is under heightened international scrutiny from regulatory bodies.

As a market analyst, I find myself constantly observing the global landscape of cryptocurrency exchanges, and in this case, my focus is on Binance – one of the top players in the industry. It’s worth noting that the company has encountered challenges regarding compliance with local regulatory standards as it navigates the complex and ever-evolving legal landscape.

What does it mean for Binance and BNB?

Obtaining this legal agreement with Brazilian officials represents a triumph for our platform, as Brazil is among the top countries embracing digital assets.

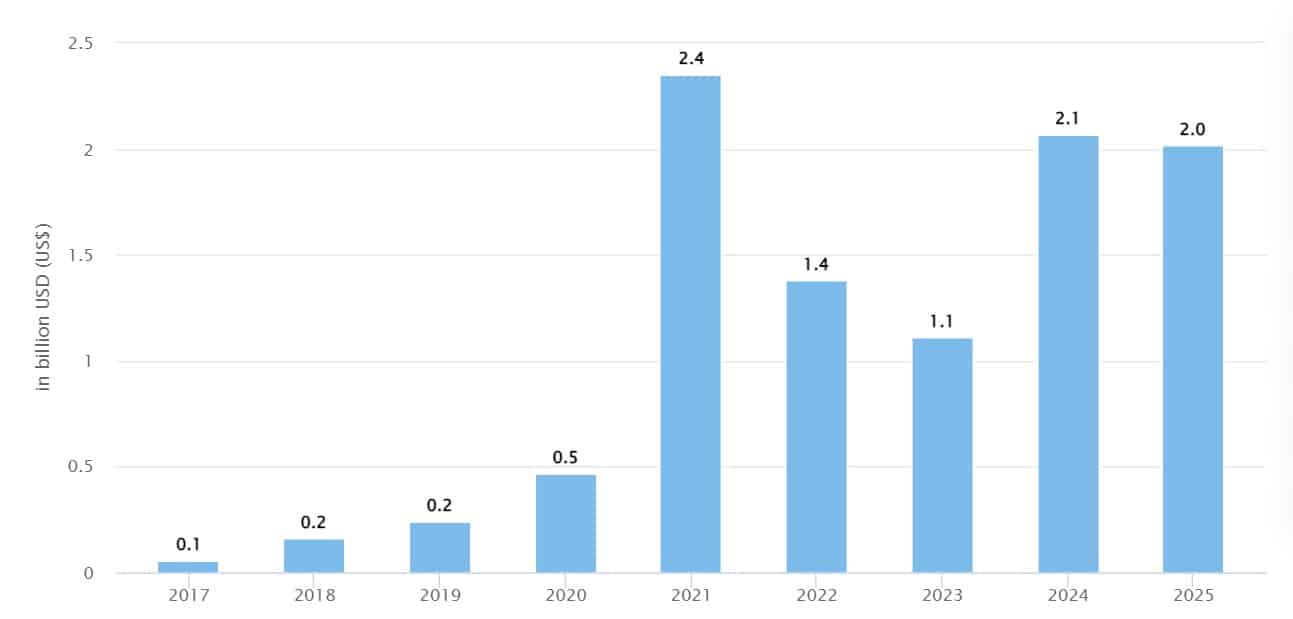

Based on predictions, it’s anticipated that cryptocurrency revenue in Brazil will surpass $2.1 billion by the end of this year. Additionally, it’s expected that the user base will grow to approximately 31.9 million users by 2025, with a slight increase from 14.57% to 14.58%.

Given unrestricted market access under compliance conditions, Binance is likely to expand its user base, leading to a rise in both income and profitability.

In a similar fashion, wider usage will significantly increase the trading volume of BNB, its native token. Due to its volatile nature, an expansion in acceptance for the exchange will positively impact the value of BNB as its coin.

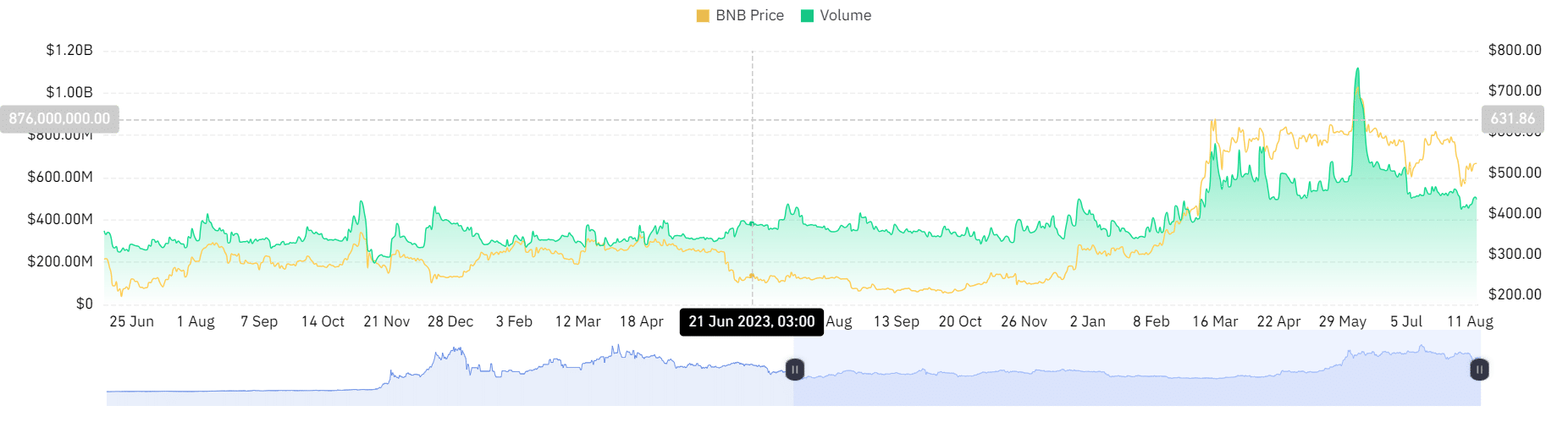

Presently, Binance Coin (BNB) is being exchanged at approximately $515.91 following a 2.11% decrease within the last 24 hours. Simultaneously, its trading volume has decreased by 5.1%, reaching about $1.6 billion during the same timeframe.

Read Binance Coin’s [BNB] Price Prediction 2024-25

On a daily scale, it appears that the latest news hasn’t influenced the altcoin’s price fluctuations. Despite this, according to Coinglass, there’s been a slight decrease in trading volume from approximately $508 million to $495.9 million.

Regardless of the current downturn, the ongoing trading activity remains a encouraging sign for Binance, as it’s expected to bring about beneficial outcomes in the long term.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-08-15 12:50