-

A currently under-threat streak of daily gains has catapulted BNX price near its 22nd August high.

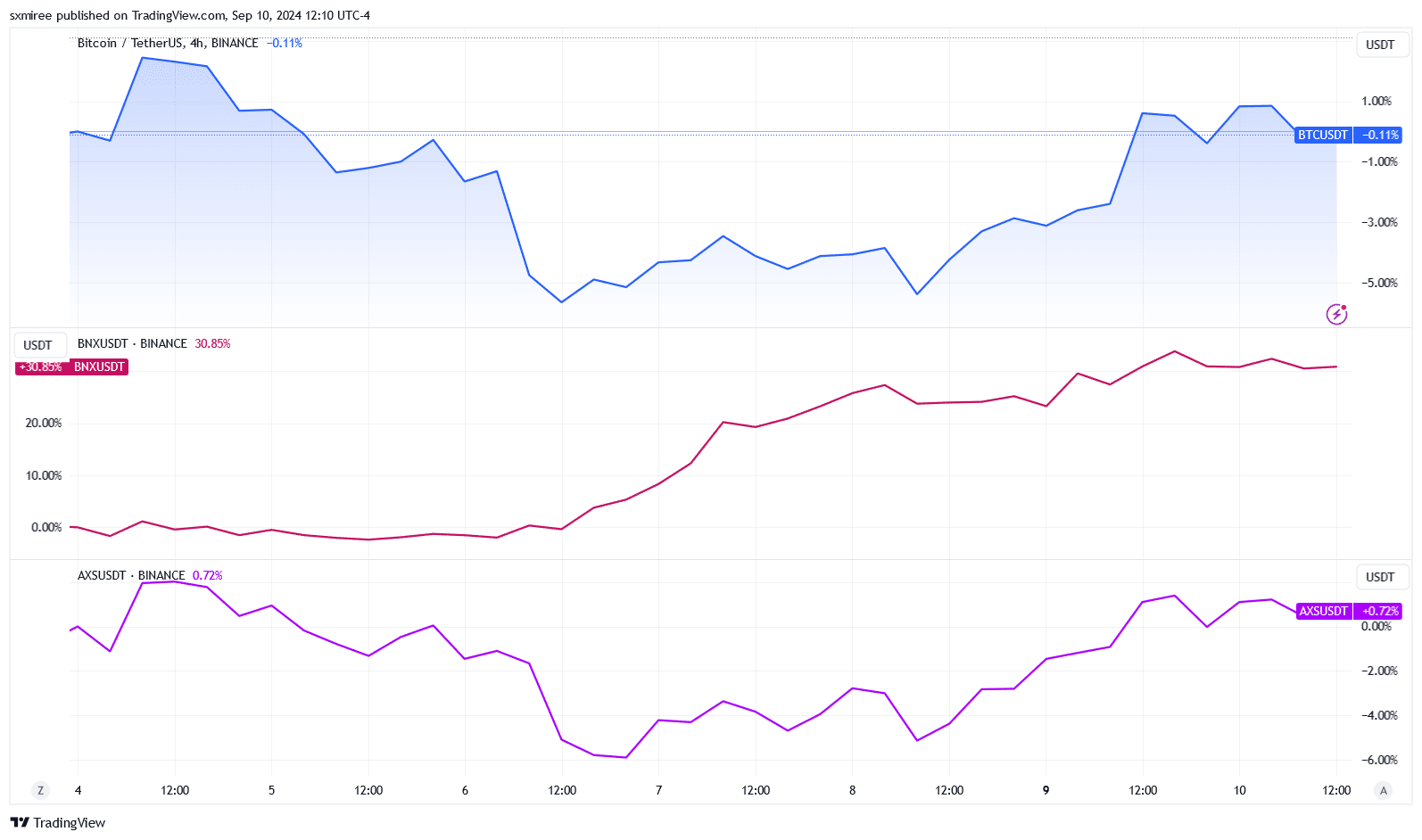

BNX stands to benefit from a recovering Bitcoin whose price action remains influential to smaller cap alts.

As a seasoned analyst with over a decade of experience in traditional finance and crypto markets, I’ve seen my fair share of market ebbs and flows. The recent surge in BNX price, propelled by its daily winning streak, has caught my attention, especially considering it comes amidst the Bitcoin-led recovery in smaller cap altcoins.

The cryptocurrency market has seen a flurry of action, with general increases observed across various platforms, improved trade volume statistics, and a sense of anticipation among investors.

According to CoinMarketCap’s latest update, the overall value of the cryptocurrency market has increased by approximately 3.2% over the past 24 hours, reaching a total of $2.02 trillion. Interestingly, the volume of crypto trading activities has surged by about 26.40% within this timeframe.

On September 10th, Bitcoin, the top-ranked cryptocurrency based on market value, briefly reached a price point of $57K again. However, it’s currently showing a 3% decrease in value compared to the entire month of September.

As a researcher, I’ve noticed an intriguing trend in the performance of Binary X’s GameFi token, BNX. Over the past four days, it has consistently climbed higher each day, grabbing the spotlight of speculators. This notable daily uptrend is something that I find quite captivating.

Over the past week, BNX has seen a significant rise of 30%, making it the standout performer among popular gaming tokens such as Axie Infinity (AXS), The Sandbox (SAND), Gala Games (GALA), and Decentraland (MANA).

Binary X price prediction shows…

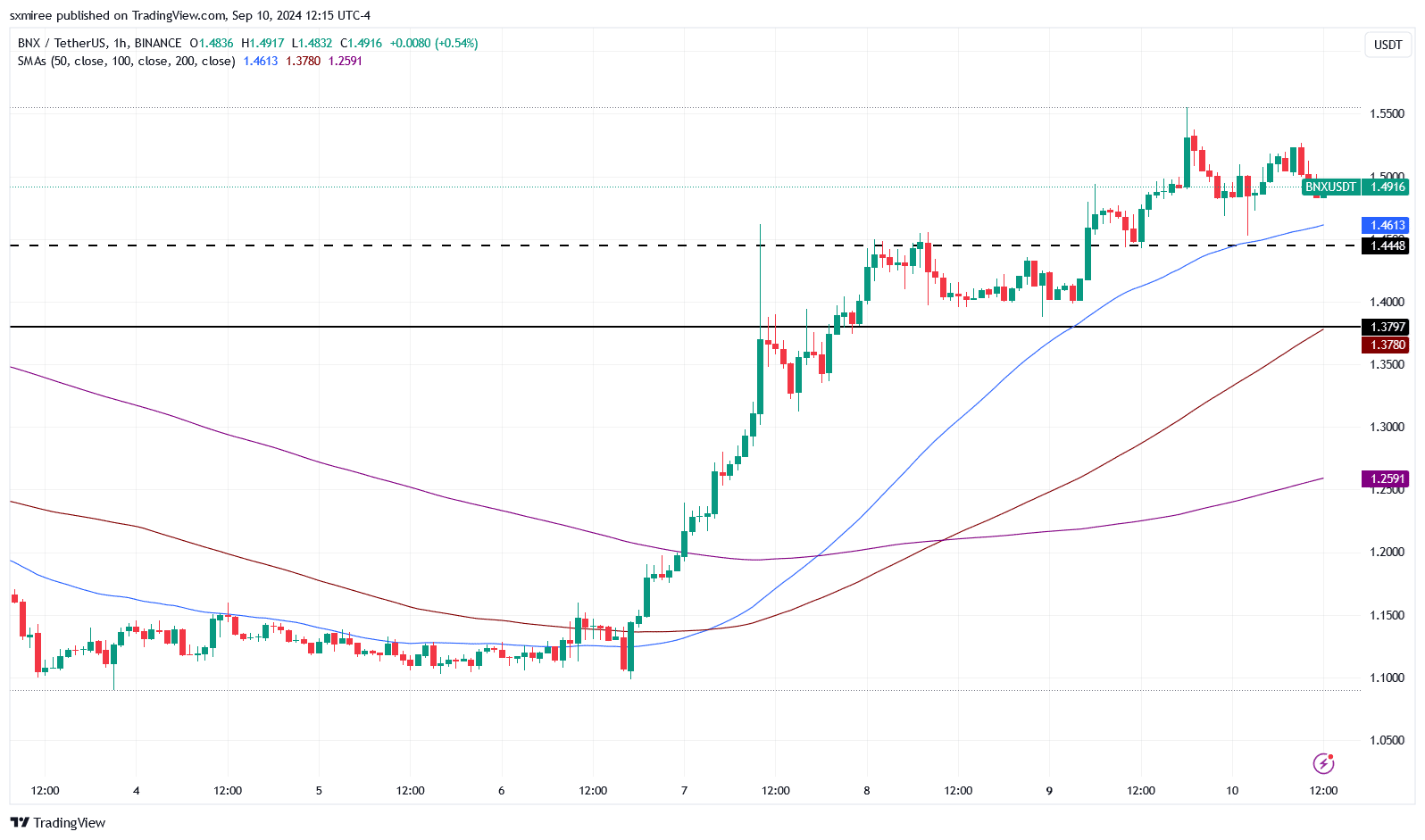

On September 7th, the hourly chart of Binance Coin (BNX) against Tether (USDT) on TradingView indicates that the level of resistance at $1.37 was transformed into a support level for BNX. After this shift, BNX managed to surpass the previous $1.44 ceiling where it had been previously rejected.

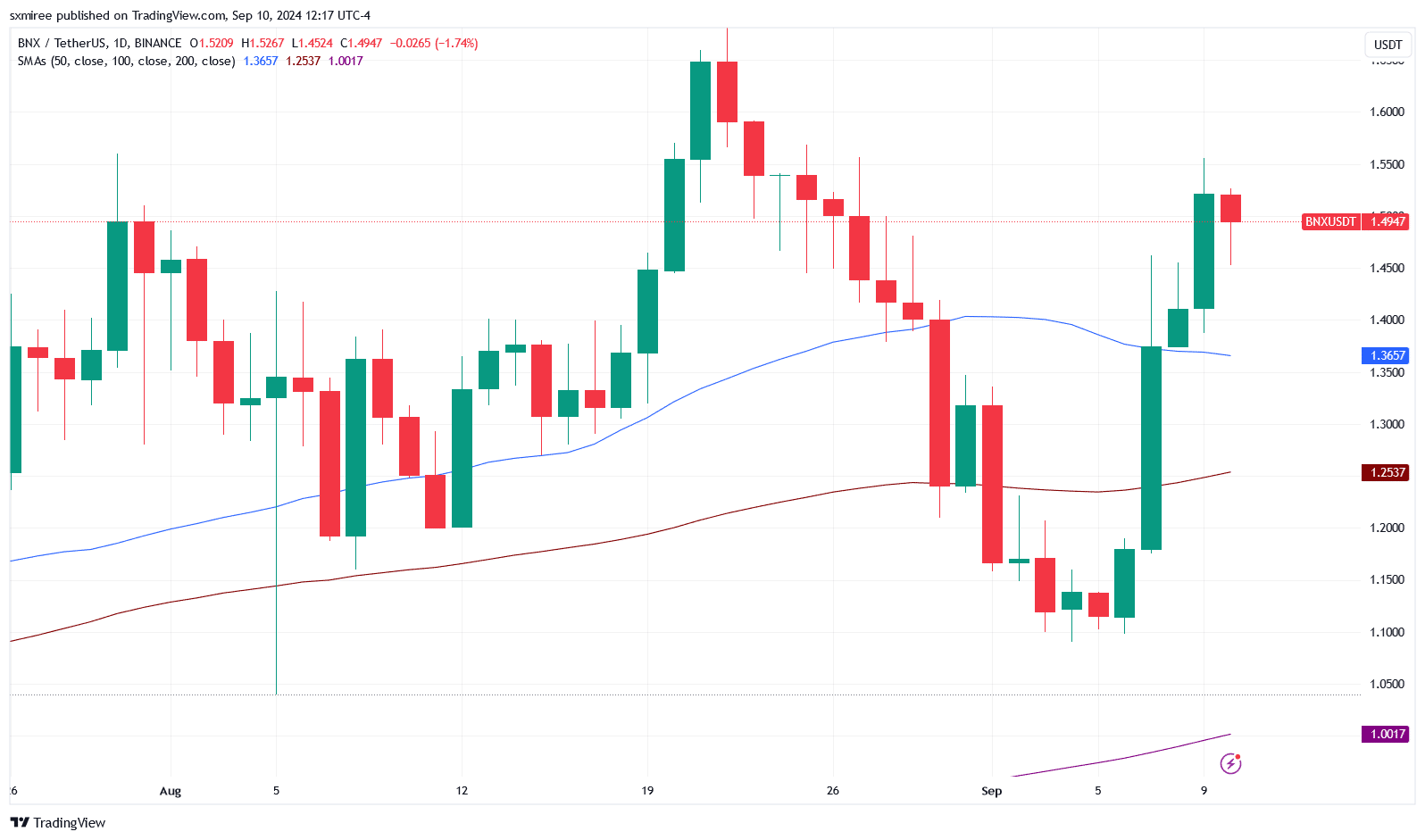

On Monday, the 9th of September, BNX experienced yet another climb, marking its fourth consecutive day with an upward trend, symbolized by a ‘green candle’ in trading terms.

Currently, BNX is being traded at $1.49. If it maintains a steady increase above $1.37, this will strengthen the bulls’ determination to overcome the strong resistance around $1.7. This is the level where BNX faced rejection twice in August.

To reach a new annual peak beyond $1.84, BNX needs to conquer the hurdle at $1.66 and venture into unexplored territory.

As a crypto investor, I’m keeping a close eye on the current price action. If we see a correction, it’s crucial to note the significant support level at approximately $1.38. Should this immediate support break, it could lead to a deeper pullback towards the robust support around the 200-day moving average, roughly at $1.00.

Profit-taking and downside risks

On a day-to-day graph, BNX exhibited indications of a potential price downturn following its strong upsurge from an early slump, causing the token to drop below $1.12 on September 7th.

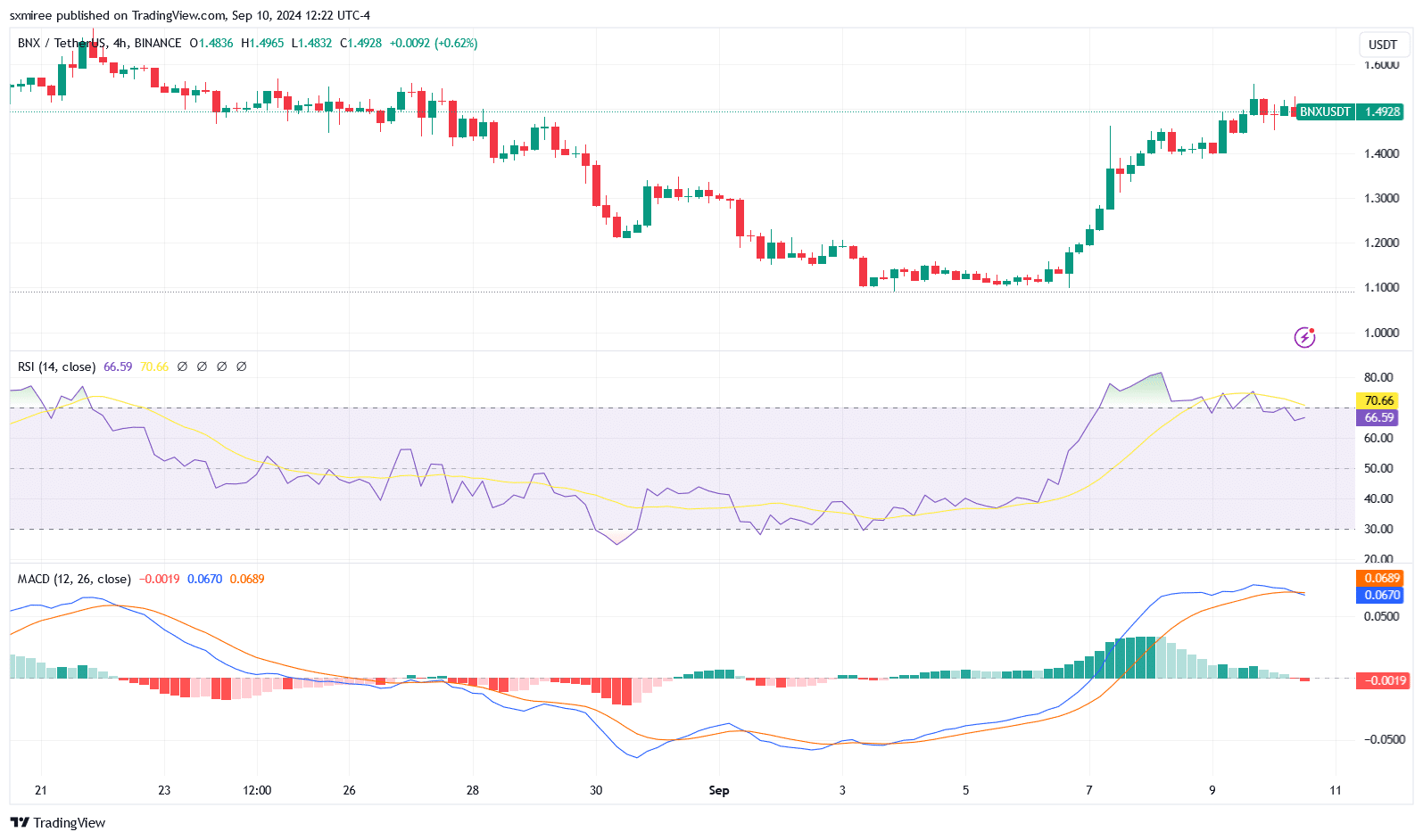

On the 4-hour chart for BNX/USDT, both the Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence) seem to suggest a possible change towards bearish trends.

The RSI reading has been ranging outside the overbought zone above 70 and was hovering just under 67 at writing. Meanwhile, the MACD line is approaching the signal line from above forming a bearish crossover, which suggests an impending price downtrend.

Such a pessimistic perspective might encourage traders to realize their gains, potentially leading to increased selling activity within the current price range.

Moreover, the absence of quick self-supporting triggers might draw short bets from pessimistic investors, while optimistic investors concentrate on narrowing stop-losses on their long investments.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-11 09:43