- Bitcoin’s holiday rally brings it close to $100K, fueling speculation and heightened volatility.

- Leverage and market sentiment is critical as BTC navigates liquidation zones and key price levels.

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market euphoria and panic. The recent surge of Bitcoin [BTC] to $99.8K on Christmas is undeniably exciting, but it’s also a reminder that history often repeats itself in the world of trading.

This Christmas, Bitcoin (BTC) brought some unexpected joy as it spiked to an impressive $99,800, raising hopes among traders that it might breach the $100,000 mark.

As the market approaches a significant psychological and technical threshold, investors are preparing themselves for increased price fluctuations.

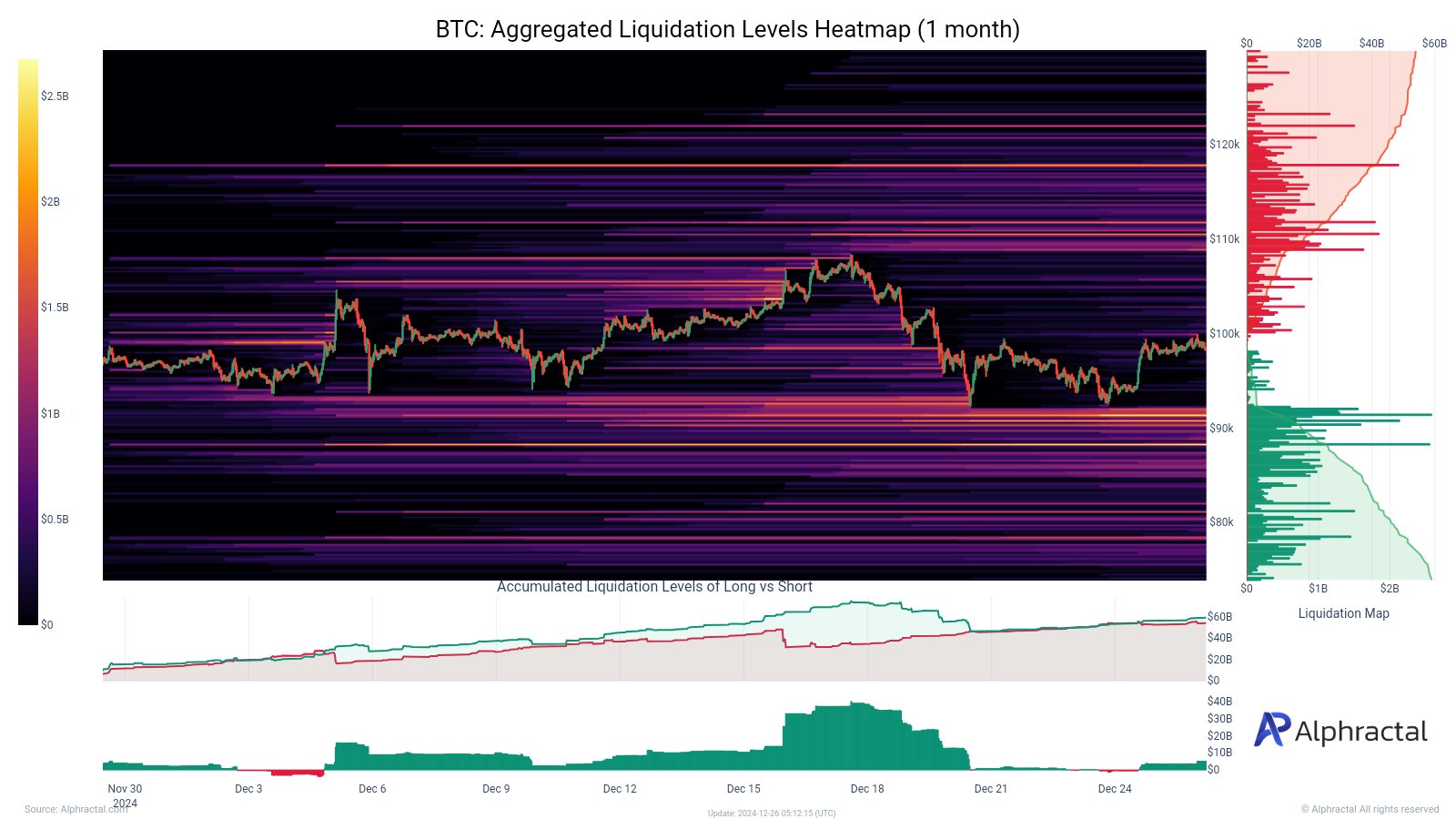

Over $100,000 marks a critical area for liquidation of short positions. If this level is surpassed, it could trigger a swift increase in price, potentially reaching around $110,000.

Yet, this route is filled with potential dangers, since the $90K mark beneath acts as a delicate foundation. A test of this level might lead to substantial liquidation of long positions, causing significant market movements.

The way Bitcoin manages to move through these stages will significantly determine its path, as it heads towards the end of the year with extraordinary speed and energy.

BTC’s performance — A holiday miracle!

In late December 2024, Bitcoin’s price spiking up to $99.8K was a significant turning point in the last quarter, as public opinion and market trends combined to drive the digital currency nearer to the symbolic $100K milestone.

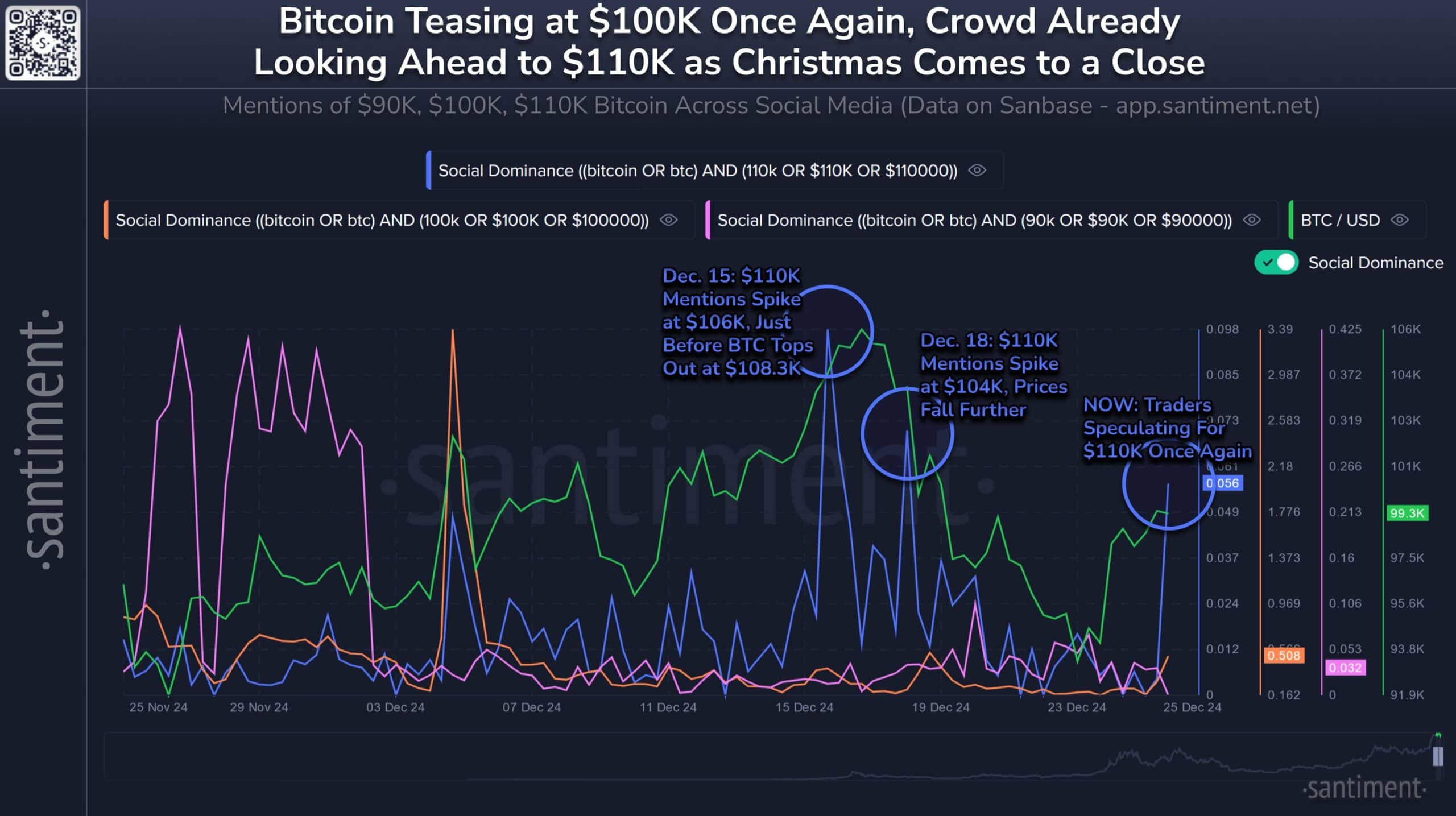

On December 25th, references to $100,000 spiked as Bitcoin’s value increased, demonstrating the significant psychological impact that this figure holds.

Attention among traders is now heavily centered on the price point of $110K, as there has been a significant rise in discussions about this level. This trend echoes the pattern seen in late December when Bitcoin surged towards $106K and $104K.

This month, historical trends indicate that the collective enthusiasm among social groups may have significantly influenced Bitcoin’s market behavior.

For example, On December 15th, there was a substantial increase in discussions about $110,000, coinciding with Bitcoin reaching its peak value of $108,300.

On the 18th of December, Bitcoin’s effort to hold steady at $104K was mirrored by a spike in social conversations, followed by another dip.

These patterns suggest that excessive optimism can result in temporary peaks, especially when significant price thresholds are reached.

With Bitcoin approaching the $100K milestone, its fluctuation continues to be influenced significantly by the forces of liquidation.

A positive aspect is that surpassing the $100,000 mark might lead to a series of automatic sales (liquidations) of short positions, potentially pushing the price of Bitcoin up towards $110,000.

Nevertheless, the $90,000 area below is significant to keep an eye on, since potential sell-offs in this region might trigger a swift turnaround.

The market’s current behavior signals cautious optimism.

Traders are making bold predictions about whether Bitcoin can continue its upward trend, yet its pattern of temporary drops after sentiment-fueled high points hints that reaching $110K might demand more than just online excitement.

Maintaining a steady need for the product and robust underlying technological foundations are essential for reaching and maintaining elevated positions.

Bitcoin: Key liquidation zones

Bitcoin’s latest surge towards $100,000 marks two significant levels that might shape its short-term course.

110,000 dollars appears to be the main area where short positions might be forced out, serving as a possible turning point. If this level is surpassed, it could trigger a swift upward trend.

From another perspective, the $90K mark is now a vital floor for long-term investments. Dropping below this threshold might trigger massive sell-offs, intensifying the existing bearish trend.

Keep a close eye on the market, as the interaction between these areas is expected to significantly influence Bitcoin’s price movements over the next few weeks, given the increased market volatility.

Role of leverage and market sentiment

Leverage amplifies both the upside potential and downside risk in Bitcoin’s current price action.

As an analyst, I find myself observing a situation where substantial leverage is at play. This means that when prices reach significant points like $100K and $90K, it may lead to quick, self-amplifying price fluctuations due to the mass liquidation of positions.

Traders who rely heavily on high levels of borrowed funds (leverage) are at a higher risk of being forced to sell their positions quickly (liquidation), and this quick selling can intensify market fluctuations or instability.

Market sentiment remains a crucial factor, driving speculative behavior and price swings.

Discussions about price targets such as $100K and $110K on social media and among traders have been observed to strongly influence short-term price fluctuations.

Nevertheless, although sentiment can spur price surges, it isn’t always a dependable indicator for long-term durability.

The resilience of Bitcoin to withstand sentiment-based fluctuations and keep moving forward depends on robust technical and underlying foundations, along with the overall market’s liquidity situation.

Potential scenarios: Breakthrough or pullback?

Bitcoin’s trajectory hinges on its ability to maintain momentum through critical price levels.

Reaching a milestone over $100,000 could probably cause a flurry of short position closures, potentially pushing Bitcoin up to around $110,000. This is more likely to happen if this surge maintains its momentum even as it approaches the liquidation zone.

However, if BTC fails to hold above $100K, a pullback to the $90K support could become inevitable.

Reaching this stage is vital for holding long-term trades, as a breakthrough might trigger substantial sell-offs, intensifying the overall bearish trend.

Read Bitcoin’s [BTC] Price Prediction 2025-2026

If the market doesn’t regain its high points following a drop, it might weaken investor optimism and potentially lead to more stabilization or declines.

As a crypto investor, I understand that the immediate movement of Bitcoin is influenced by a delicate balance between liquidation dynamics, the use of leverage, and overall market trends. With key levels being tested, it’s clear that market volatility could increase significantly in the coming days, making it essential for me to closely monitor these factors before making any investment decisions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-26 17:12