- Bitcoin trading at $67K, above the Spot ETFs average price.

- BTC’s Open Interest was at its highest since 2020.

As a seasoned crypto investor who has weathered multiple market cycles since 2017, I must admit that the current state of Bitcoin (BTC) feels like a rollercoaster ride, but one I’m happy to be on.

The price of Bitcoin (BTC) has climbed over $67,000 again, capturing the focus of both traders and institutional investors on potential support points that may significantly impact the current market surge.

One such level is the average cost of Bitcoin Spot ETFs, excluding Grayscale’s (GBTC). Throughout 2024, this price level has emerged as a significant support, providing stability during volatile periods.

Regardless of occasional drops, Bitcoin has persistently bounced back, highlighting the robustness of Spot ETF investors who have continued to hold onto their investments amidst market adjustments.

The $57K level, representing the average cost of Bitcoin Spot ETFs, has proven to be a crucial support throughout the year.

The ETF was tested just two times: during the market drop on the 5th of August and the significant decline on the 6th of September. Contrary to widespread sell-offs, Spot ETF investors remained steady, experiencing minimal withdrawals.

This demonstrated a strong belief in Bitcoin’s long-term potential, as investors showed no signs of capitulating despite temporary unrealized losses.

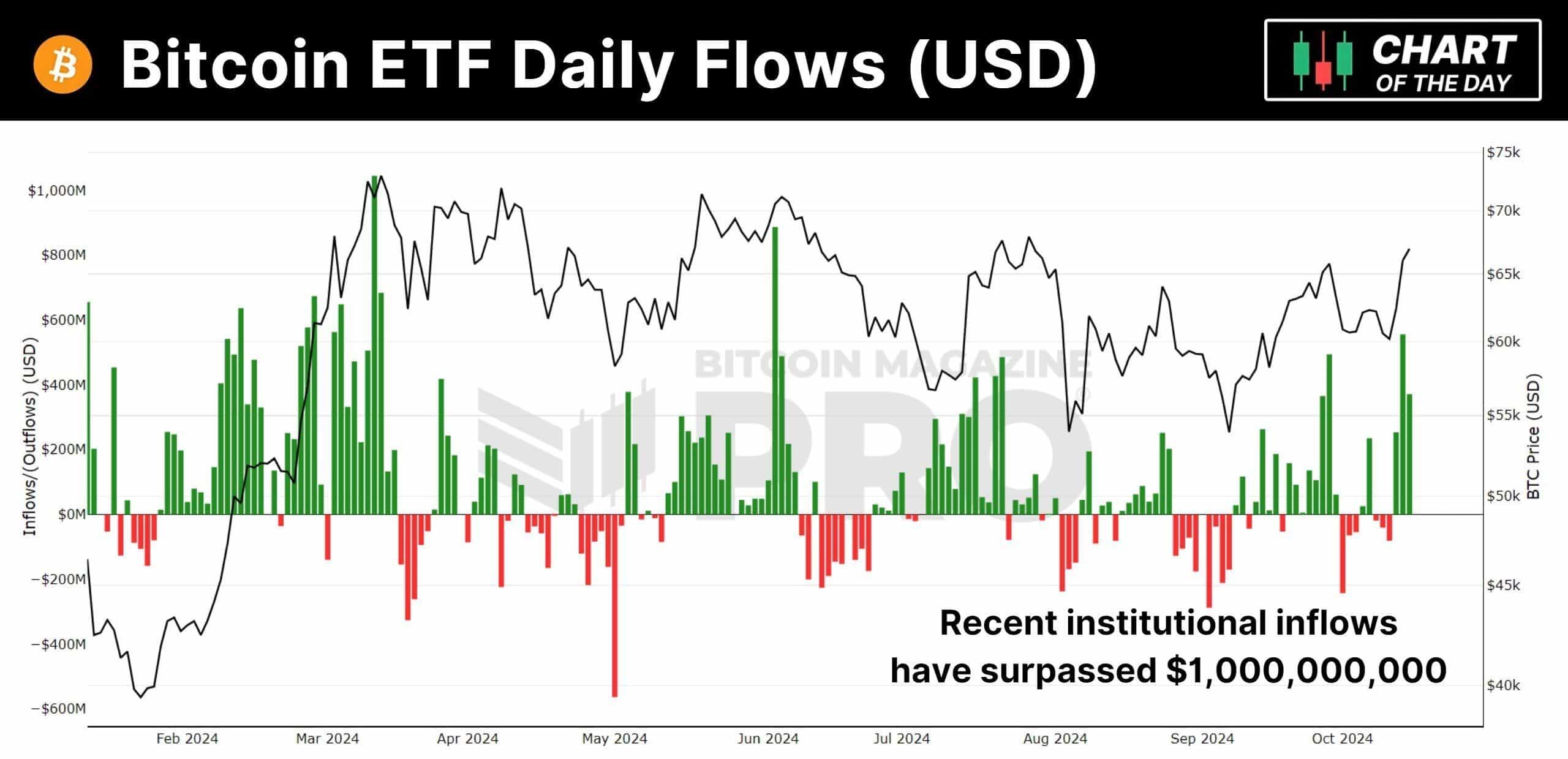

BTC Spot ETFs inflows and OI

Strengthening the $57,000 mark as a base for the continuous Bitcoin surge, the emergence of Bitcoin Spot ETFs offers an officially approved avenue for big-time investors to join, thereby increasing investor trust and market confidence.

As an analyst, I’ve noticed that blending conventional financial services with Bitcoin seems to be a key factor in broadening its acceptance among more people.

Over the past three business days, there’s been a surge of more than $1 billion in investments into Bitcoin ETFs, suggesting that large-scale investors are rapidly amassing Bitcoin at a pace unlike anything we’ve seen before.

Besides the escalating impact of Spot Exchange-Traded Funds (ETFs), the Open Interest (OI) for Bitcoin Futures contracts is hitting record levels, notably on Binance, where it has soared to an impressive $40 billion.

This showed that traders’ optimism about Bitcoin was unwavering, as they were still keen to purchase even with the rise in price. Such heightened demand might deplete the current supply, potentially pushing Bitcoin’s price even further upwards.

On trading platforms like Bybit and OKX too, the Futures Open Interest (OI) has hit record highs. This suggests that the price of Bitcoin may maintain its position above $57K during this current bull market trend.

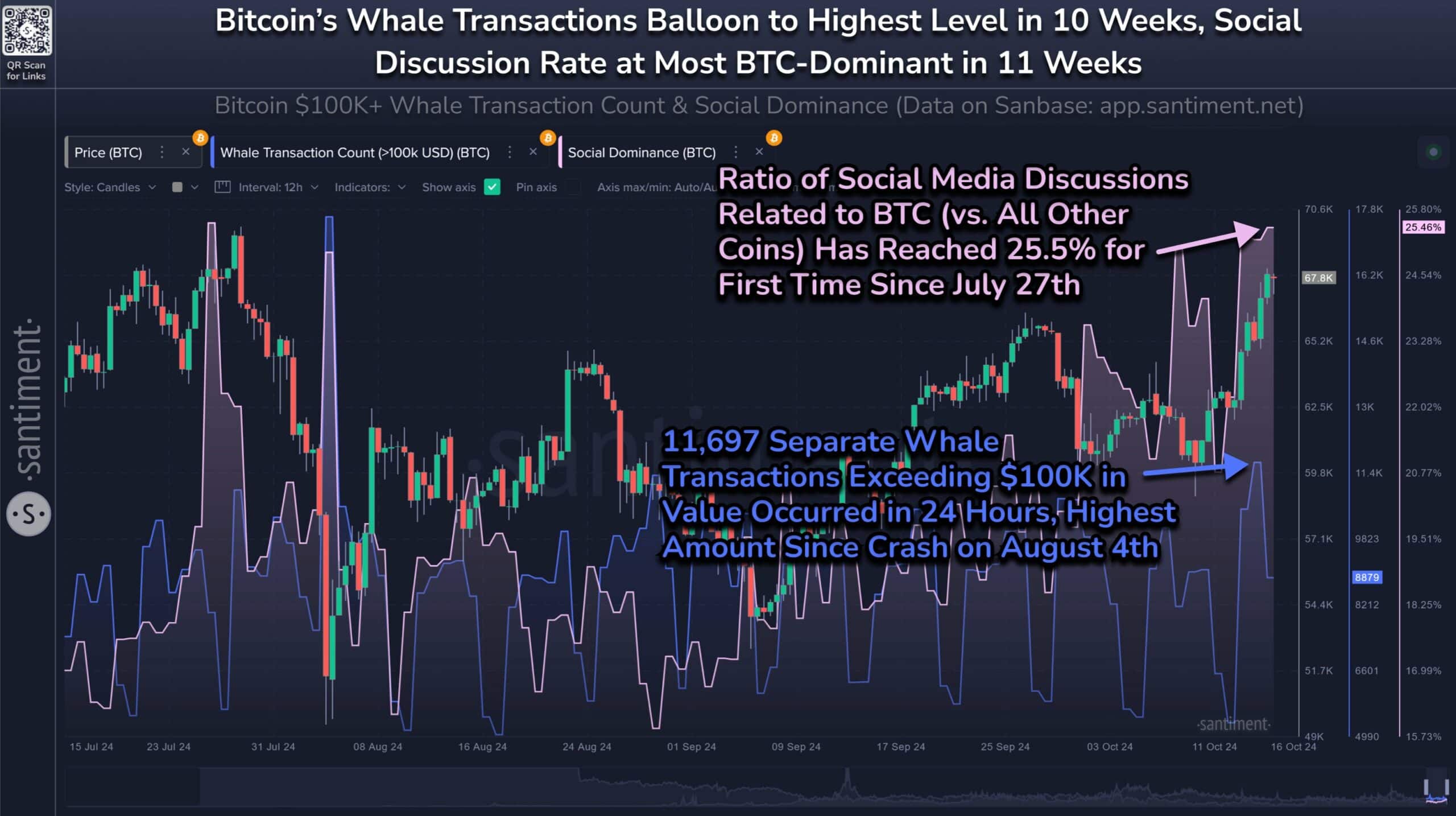

Whale transactions

A significant contributor to the $57K support level is the rise in large-scale transactions by whales. In the last ten weeks alone, we’ve seen a notable increase in these whale transfers exceeding $100K, with a total of 11,697 such transactions taking place.

The increased trading indicates that major investors might be buying up Bitcoin, boosting investor confidence and potentially supporting the market’s continued rise.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Furthermore, Bitcoin is the topic of more than a fourth of cryptocurrency-centered chats on social media platforms.

Even though there might be temporary drops in the price, the overall trends suggest a positive outlook for the mid-term and long-term, increasing the chance that Bitcoin will continue to hold above the $57K threshold during this surge.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-18 06:15