- Bitcoin has edged higher above $63,000 as the new week unfolds several narratives that could influence prices.

- The Federal Reserve minutes, CPI data, and Q3 earnings could drive further price gains.

As a seasoned researcher with years of market analysis under my belt, I can confidently say that the upcoming week is shaping up to be a rollercoaster ride for Bitcoin enthusiasts. The release of the Federal Reserve minutes, CPI data, and Q3 earnings from heavyweights like BlackRock could significantly impact BTC prices.

Over the past week, Bitcoin’s price has been moving back and forth within a band of $60,000 to $64,500, indicating a period of fluctuation in the market without a discernible direction, suggesting confusion among traders.

Looking forward, Bitcoin’s upcoming week might be characterized by volatility due to a 55% surge in trading volumes as reported by CoinMarketCap at the current moment. Over the past day, Bitcoin has experienced a 2.5% increase, currently trading at $63,435.

Based on the increasing trade activity and price increases, it appears that traders might be investing in various stories that could influence prices throughout the coming week.

Federal Reserve minutes

As a crypto investor, I’m eagerly anticipating the release of the minutes from the U.S. Federal Reserve’s September monetary policy meeting, scheduled for October 9th. These insights could provide valuable clues about the central bank’s future actions and their potential impact on the cryptocurrency market.

In the previous month, the Federal Reserve lowered its interest rates for the first instance since 2020. The records of their discussions in September may provide insights into potential interest rate reductions during the gatherings in November and December.

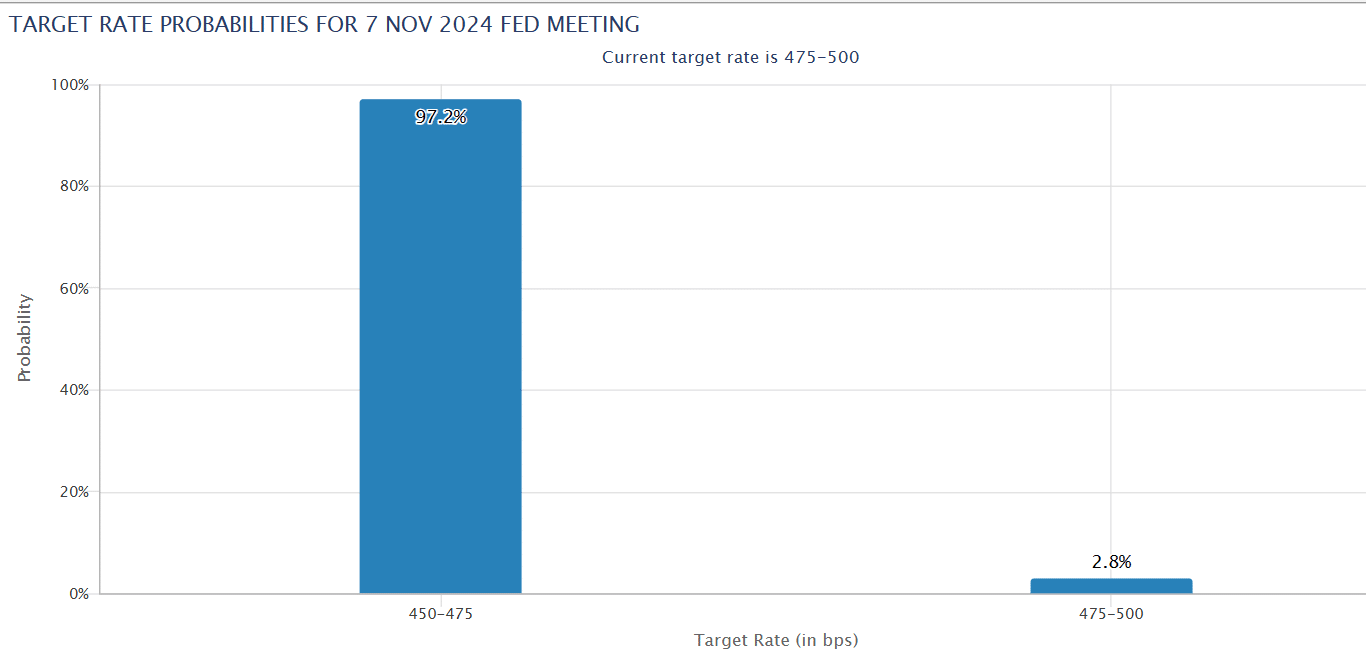

Last month, the decrease of 0.5 percentage points in interest rates during September seemed to influence Bitcoin prices noticeably. According to data from the CME FedWatch Tool, it’s predicted that about 97% of investors are expecting a 0.25 percentage point reduction in interest rates in November by the Fed.

As a researcher studying financial markets, I find myself intrigued by the potential impact of lower interest rates on high-risk assets such as Bitcoin. If the Federal Reserve’s minutes suggest a more accommodating monetary policy, this dovish stance might ignite increased demand for Bitcoin, potentially leading to substantial price increases.

CPI & PPI data

On October 10th, the United States will reveal its inflation figures for September. Analysts expect the yearly inflation rate to be around 2.3%, marking a decrease from the 2.5% reported in August.

As a researcher, I’m anticipating a slight decrease in the annual Core Inflation Rate, from the previously reported 3.2% in August, down to 3.1%.

On October 11th, we’ll get the latest update for the Producer Price Index (PPI), a key indicator often used to anticipate inflation rates. Economists estimate that this year-on-year PPI figure could decrease from 1.7% to approximately 1.3%.

In simpler terms, if the predicted inflation figures are met or fall short, it might boost the value of Bitcoin. Conversely, if the actual inflation data exceeds expectations, it may increase Bitcoin’s volatility and potentially lower its prices.

BlackRock’s Q3 earnings

As a financial analyst, I’m eagerly anticipating the upcoming release of BlackRock’s quarterly results this week. This global titan in asset management, responsible for managing trillions of dollars and one of the entities offering spot Bitcoin and Ethereum exchange-traded funds (ETFs), will reveal crucial insights into its performance over the past three months.

The iShares Bitcoin Trust managed by BlackRock, represented as IBIT, currently owns approximately 367,000 Bitcoins, which are collectively worth around $22 billion. Consequently, the performance of its third-quarter financial results might have an impact on Bitcoin’s market prices.

In simple terms, JPMorgan is planning to disclose its third quarter financial results this week, followed by submitting a 13-F filing to the U.S. Securities and Exchange Commission (SEC). This filing will divulge the bank’s investment in Bitcoin Exchange Traded Funds (ETFs).

In Q2, JPMorgan’s 13-F filing revealed it held $760,000 worth of Bitcoin ETF shares. Given that it is the largest US bank, a change in its Bitcoin ETF holdings could drive volatility.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

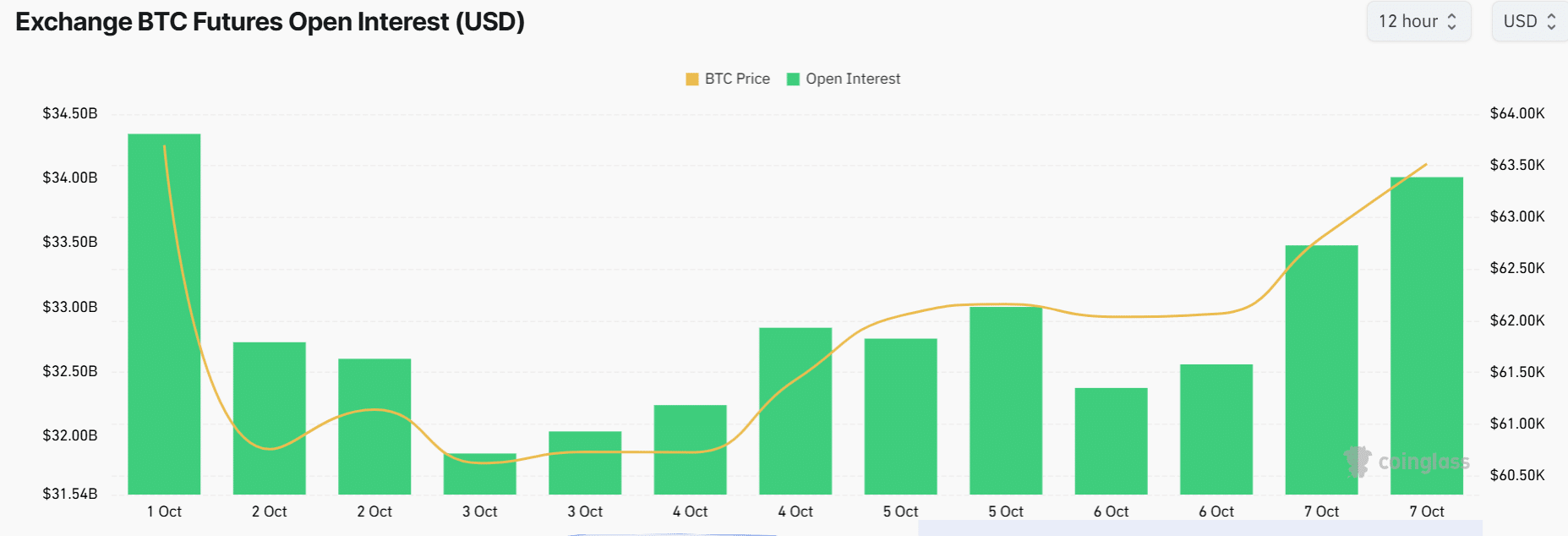

1) The following stories are influencing the Bitcoin futures market right now: As of the current report, the open interest in BTC has reached the second highest point this month at around $34 million, according to Coinglass.

This increase shows there are more traders opening positions and participating in the market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-07 21:12