- Bitcoin has surged by 34.39% over the past month.

- An analysts sees potential market correction citing four reasons.

As a seasoned crypto investor who has weathered multiple market cycles, I must admit that the recent surge of Bitcoin by 34.39% over the past month has piqued my interest. However, I’ve learned to be cautious when analysts like Ali Martinez predict a potential market correction.

After reaching a local minimum of $66,798 earlier this month, Bitcoin (BTC) has soared and reached a new all-time high of $93,483.

Despite some market enthusiasts predicting Bitcoin (BTC) might soar as high as $100k, there are skeptics in the mix. One such critic, Ali Martinez, has put forward four possible explanations for a potential significant drop in BTC’s value.

Reasons why Bitcoin could see a correction

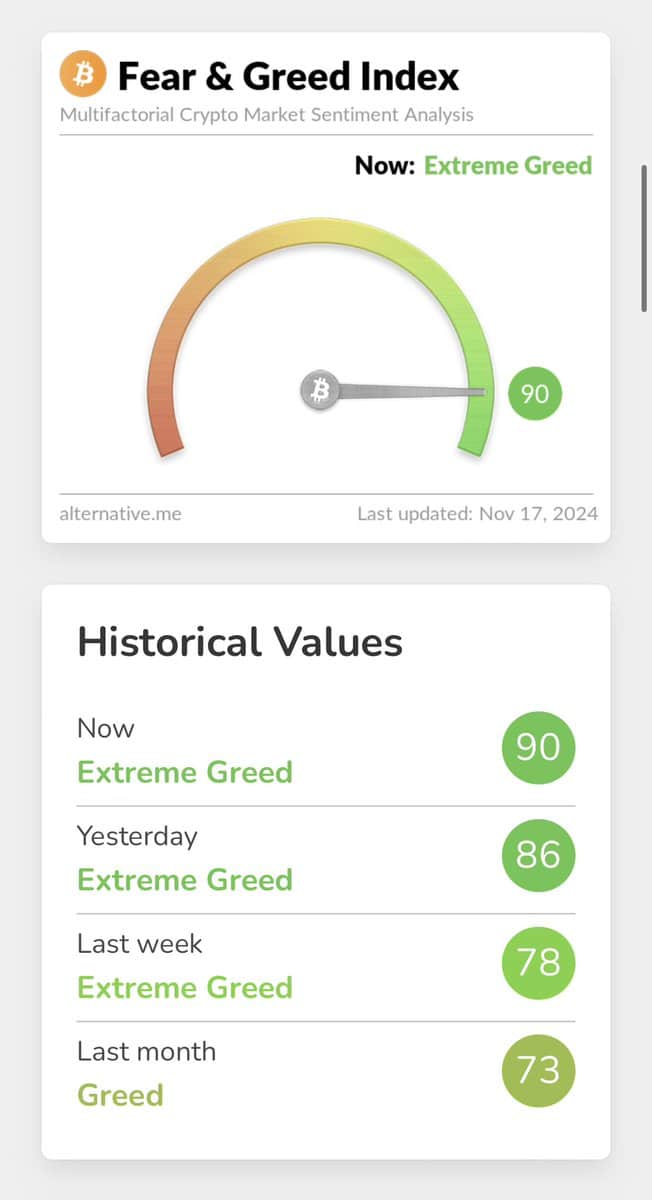

According to Martinez’s examination, there are four significant factors suggesting that Bitcoin could experience a steep drop. One of these reasons is that Bitcoin investors are excessively greedy, as indicated by a high greed index of 90%.

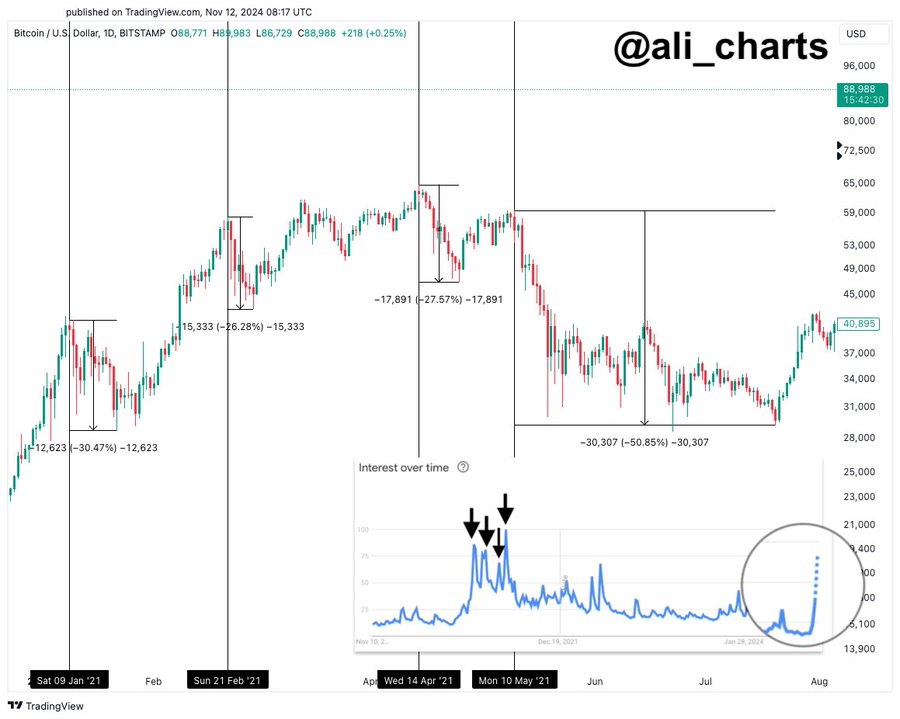

The intense desire for profit, as indicated by the surge in people searching for Bitcoin on Google, was noticeable among individual investors who trade through retail outlets.

As he explained, even though increased retail interest in Bitcoin might indicate more money flowing into it, a rise in people searching for it tends to coincide with a drop in its price. For instance, during 2021, the highest spikes in Bitcoin search activity led to corrections of approximately 30%, 26%, 27%, and an astounding 50%.

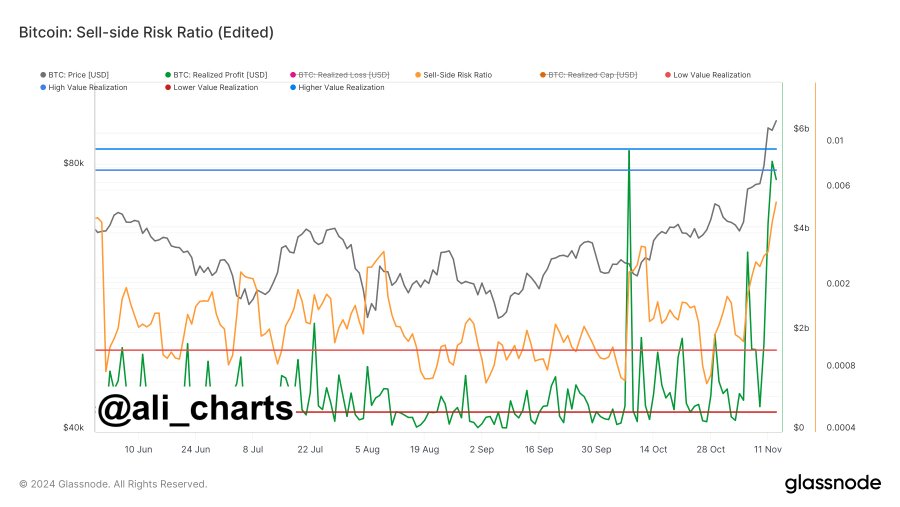

Investors who are skilled with Bitcoin (BTC) have pocketed a total of $5.42 billion in profits, which indicates an increase in the sell-side risk ratio. This suggests that these investors are offloading their holdings to reap maximum gains.

In a technical analysis viewpoint, the TD Sequential indicator suggests a sell signal on daily charts, indicating that the upward momentum may be running out and a potential downward shift in trend could occur. This is more likely given that many investors are now cashing out their gains.

The main explanation lies in the Relative Strength Index (RSI) reading of 75.91 for Bitcoin, which indicates that it’s currently in the overbought zone. When RSI surpasses the overbought threshold, it hints that the asset might be overpriced and the purchasing momentum could be waning.

In other words, the analyst noted that if there’s a drop in price, Bitcoin could potentially find stability at levels approximately around $85,800, $83,250, and even as low as $75,520 before reaching a minimum of $72,880.

What BTC charts say

Meanwhile, the analysis given earlier serves as a reminder for investors, it’s crucial to examine other market signals and understand their implications as well.

Based on my own analysis, it seems like there could be a possible correction ahead for Bitcoin, as it appears to be overvalued at the moment.

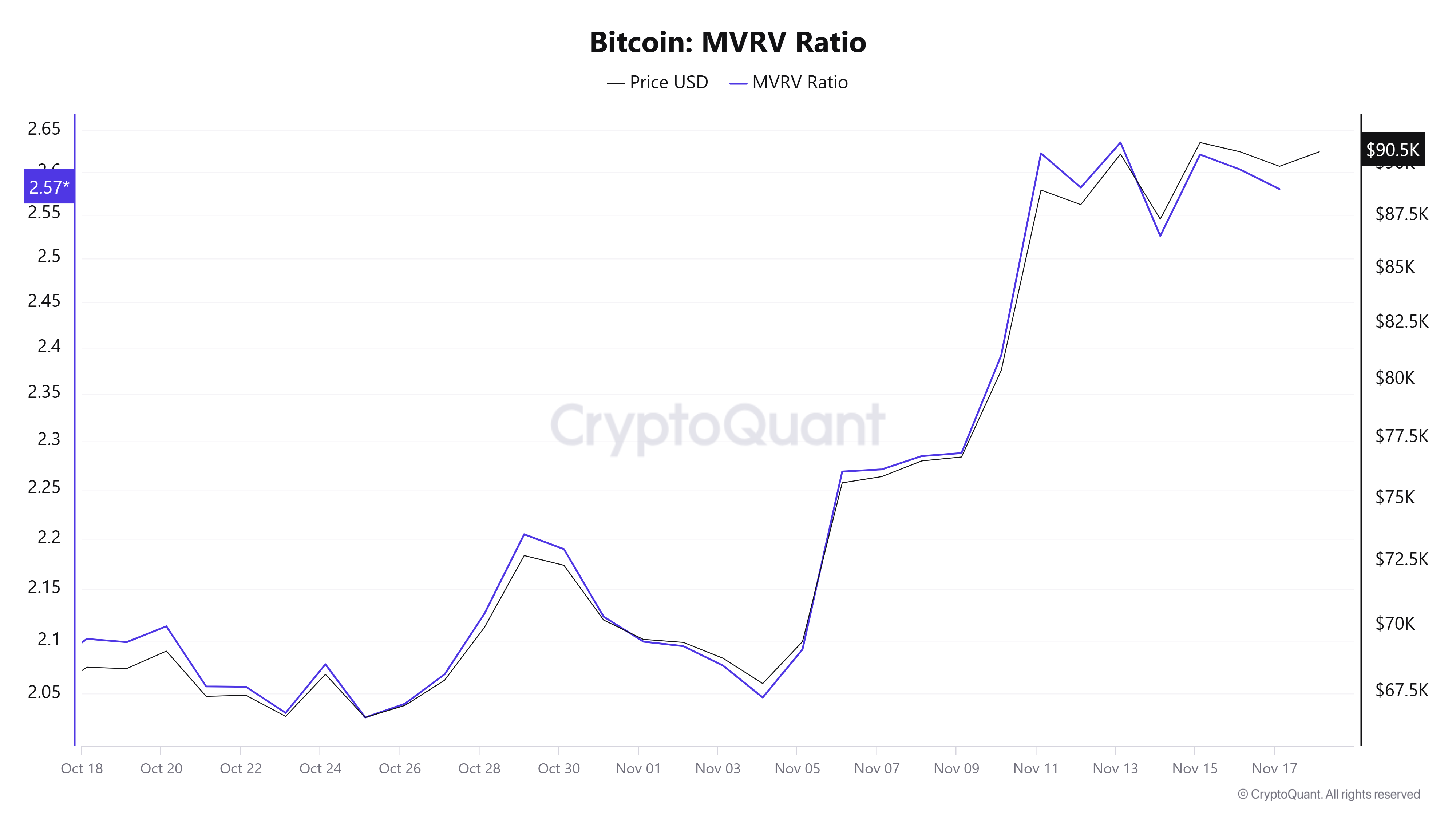

The MVRV ratio for Bitcoin has been consistently increasing and reached a peak of 2.5, which typically indicates the market is overbought.

historically, when the MVRV (Majority Valuation Ratio of Verified Transactions) has been high, there’s often been a subsequent drop in price due to early investors cashing out to realize their gains.

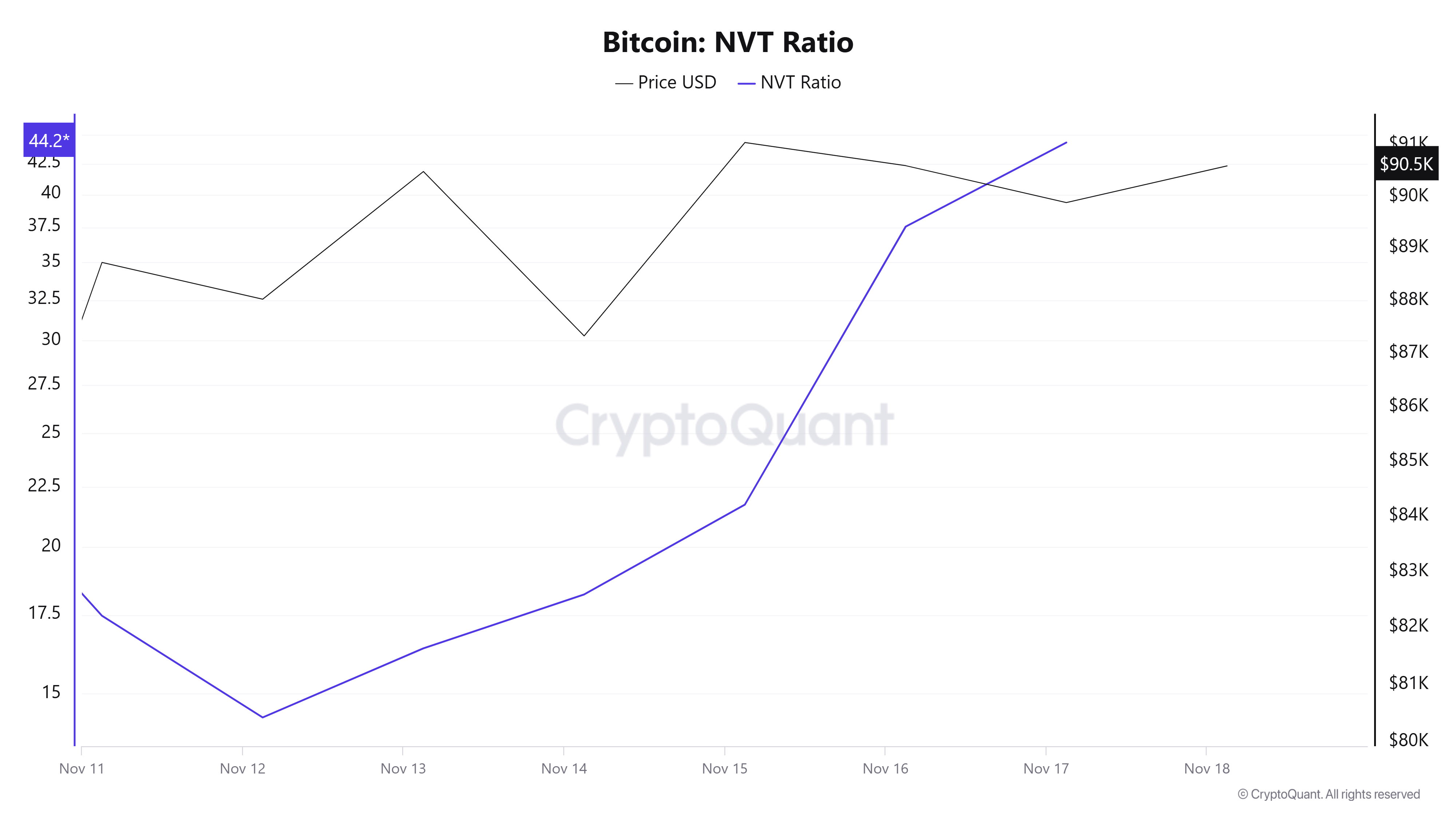

Moreover, the NVT (Network Value to Transactions) ratio of Bitcoin has increased from a minimum of 14 to 44, indicating that though the market value is escalating, the level of transactions isn’t proportionately increasing at the same rate.

Read Bitcoin (BTC) Price Prediction 2023-24

This suggests a possible increase in Bitcoin’s price without a matching boost in the network’s worth. In other words, if the Bitcoin price is rising faster than its on-chain activity, it might be overvalued.

In simpler terms, the cost of Bitcoin (BTC) might drop to align with its genuine market demand. If it falls, a potential support level would be around $87,140. Conversely, if the $91,000 support is maintained, Bitcoin could potentially continue on its upward trend towards $100,000.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-18 20:24