- Analysts see $60K as the 2024 cycle’s correction bottom.

- However, price consolidation could extend for longer.

The previous week presented significant challenges for markets, particularly for riskier assets such as Bitcoin [BTC]. US stocks ended the week with declines.

In April, BTC experienced weekly losses similar to before, reaching a low of $59.6K. This occurred during the time of Bitcoin’s halving, the US tax season, and heightened tensions in the Middle East.

Bitcoin’s price has bounced back and surpassed $66K, signaling a potential reversal from its recent downturn. Furthermore, the cryptocurrency market no longer needs to contend with the halving event and the US tax season. Tensions in the Middle East have also shown some signs of easing.

This begs the question: Is the Bitcoin halving sell-off over? Some market watchers think so.

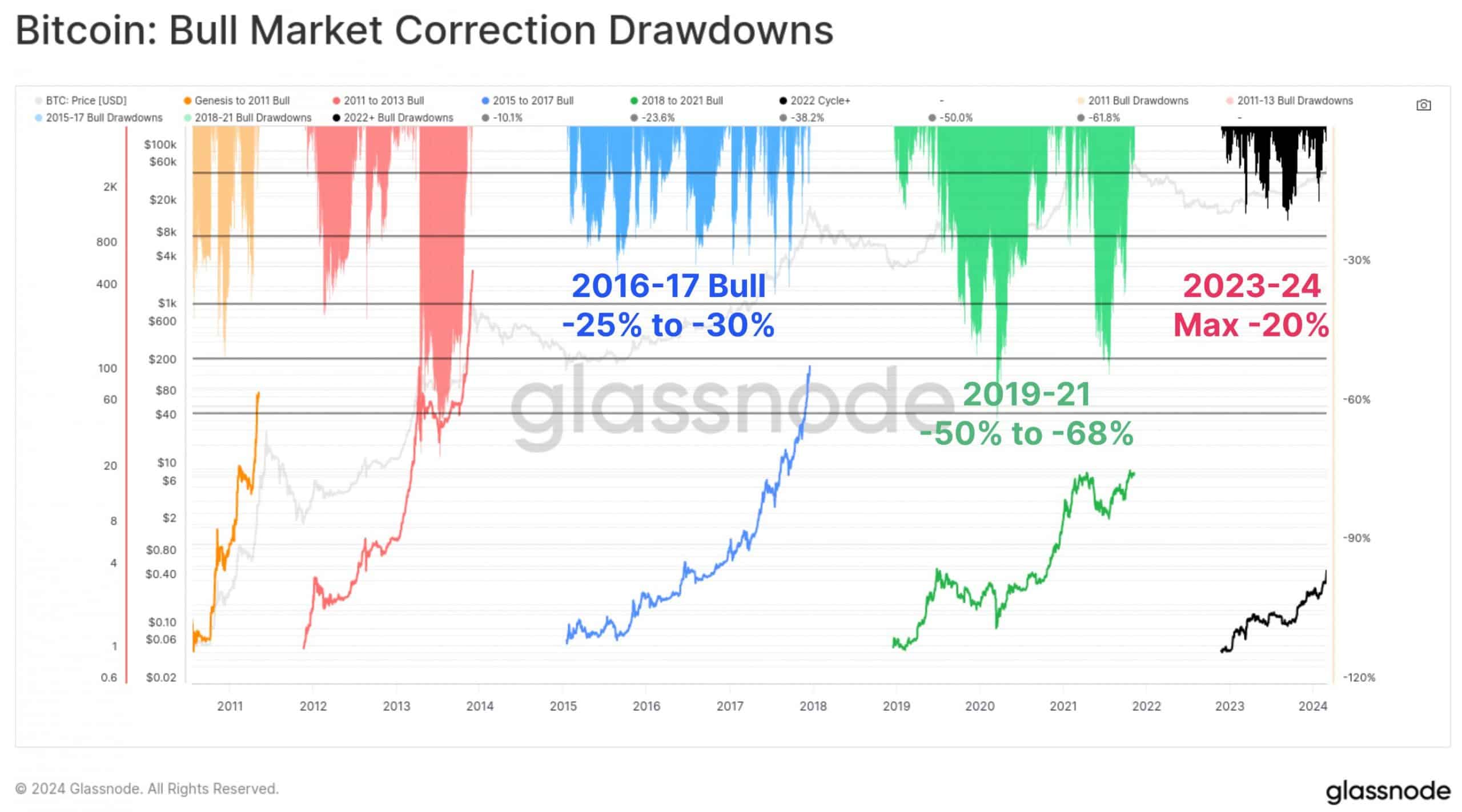

Famous cryptocurrency expert Tuur Demeester has suggested that the current correction in prices might have reached its lowest point at around $60,000, aligning with Glassnode’s present bull market indicators.

In simple terms, I believe that $60,000 could mark the end of Bitcoin’s current price drop, representing a 20% decrease from its previous peak.

What next for BTC price post-halving?

A cryptocurrency expert named McKenna, who writes under a pseudonym, agreed with Demeester’s assessment that the Bitcoin price bottom might have been reached at $60,000. In McKenna’s opinion, the selling pressure from Bitcoin halvings could have ended, and we may see a prolonged period of sideways price movement instead.

“I believe we could have seen the bottom of the halving selloff, but it’s also possible that we’re in the process of forming a new accumulation range. In other words, we might experience extended sideways price movement for a longer period than anticipated.”

McKenna suggested that a potential sideways move in Bitcoin could boost the performance of other cryptocurrencies. however, according to a recent analysis by AMBCrypto, the market conditions are not yet favorable for a surge in altcoins.

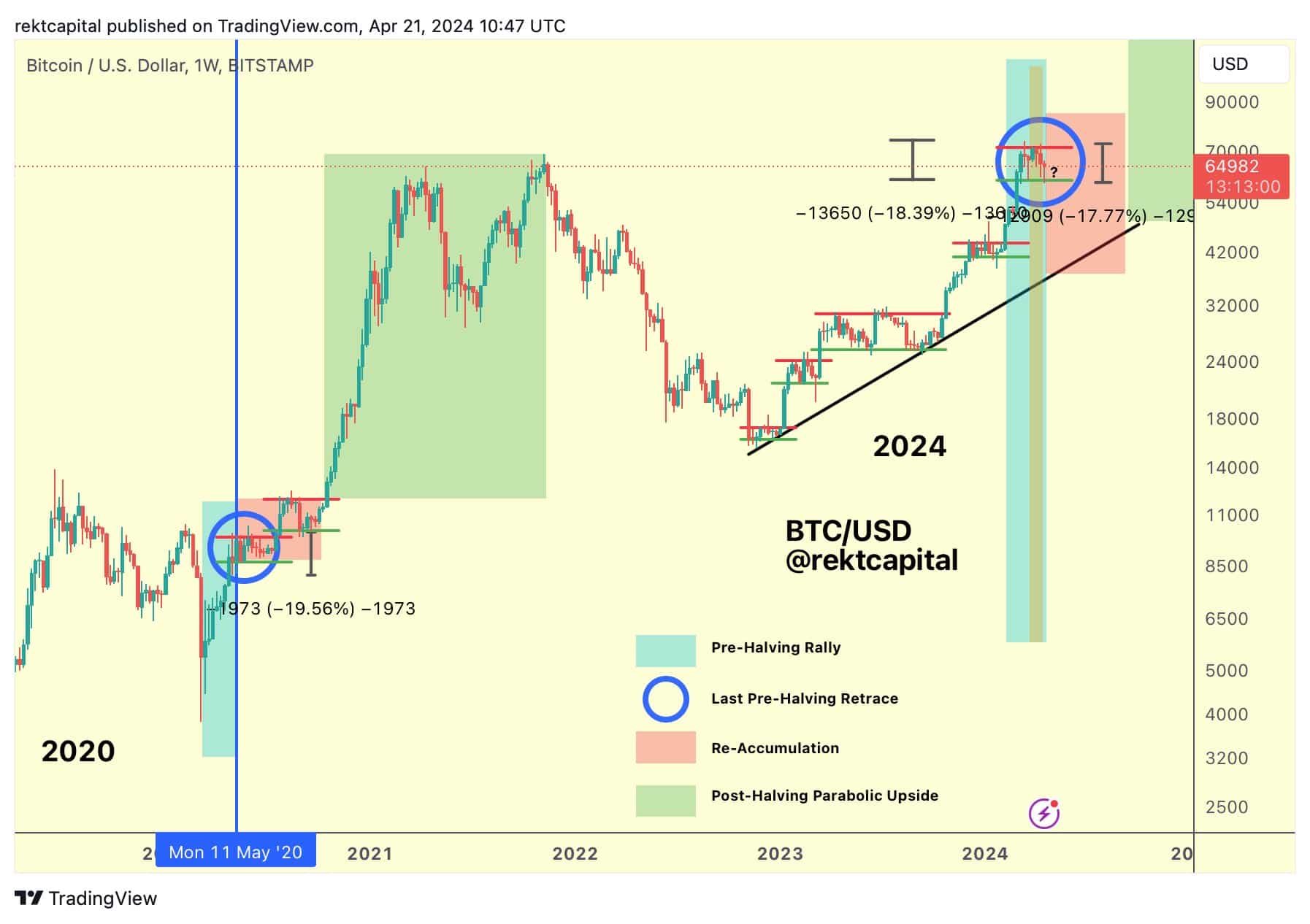

According to Rekt Capital, a well-known trader and market analyst, the current Bitcoin prices could represent a great buying opportunity if we’re experiencing the re-accumulation phase.

“If Bitcoin has already reached the highest and lowest points of its price range after halving, then the current prices represent the best deals we can get before a potential post-halving price surge.”

Some market watchers expect better conditions starting in May.

According to Arthur Hayes, the founder of BitMEX, he predicted that market conditions for Bitcoin could potentially get better in May. He based this projection on two factors: first, the end of the US tax season in April, and second, the upcoming halving event for Bitcoin.

“The timing of the halving adds further weight to my decision to abstain from trading until May.”

If the lateral price movements continue and market circumstances become more favorable in May, the current price range between $60,000 and $71,000 may serve as significant reference points for future price movements.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

2024-04-22 13:11