- Bitcoin formed a smaller range within the range.

- Bullish conviction has weakened considerably, and selling pressure could soon dominate.

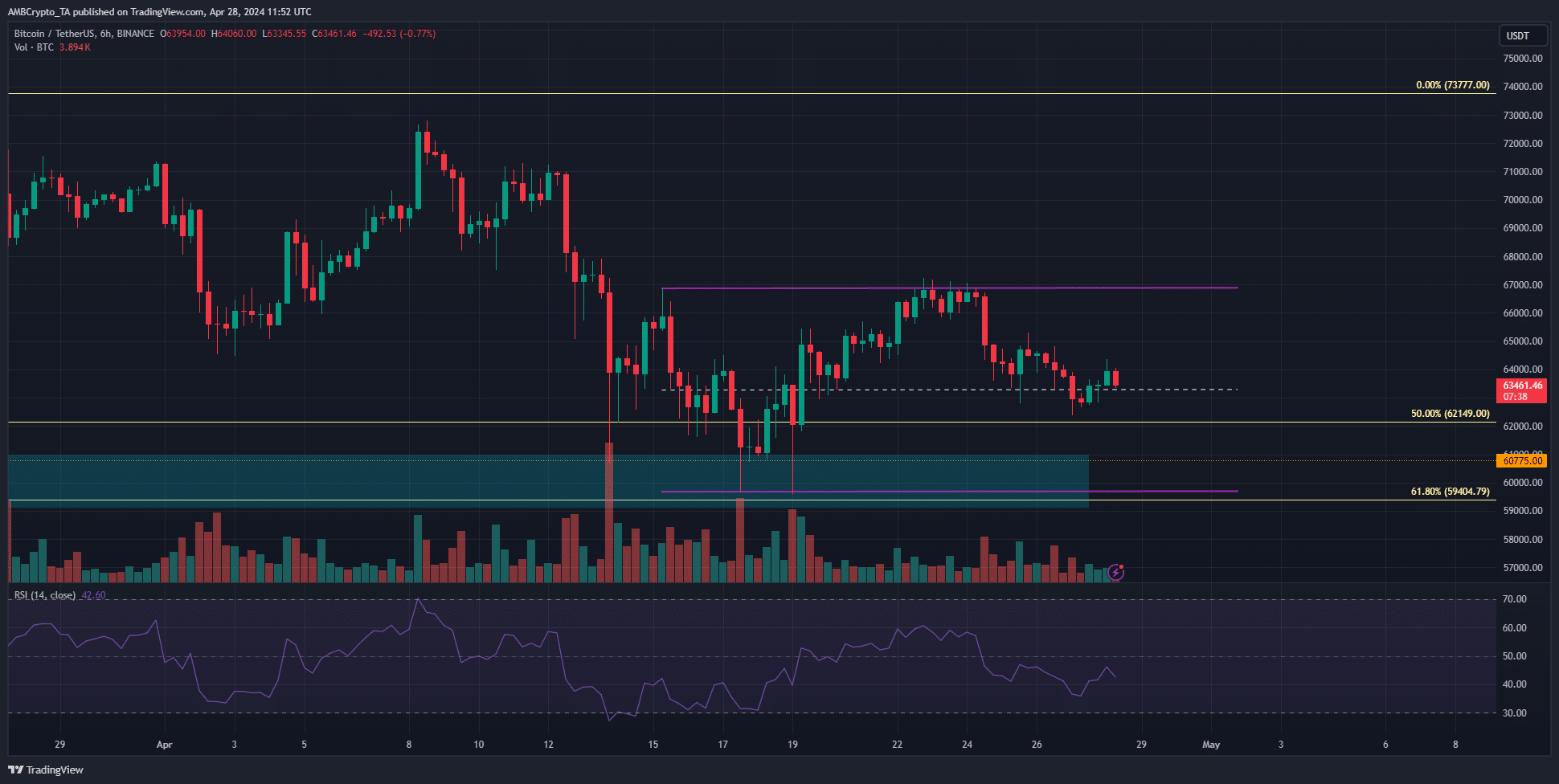

Bitcoin has been trading between $73k and $60.7k recently, forming a smaller range. Bullish conviction has weakened significantly, and selling pressure may take over soon. In my earlier analysis for AMBCrypto, I mentioned that bulls needed to defend the $64.5k support level to push above the $66k resistance. However, we didn’t see this occur, instead, Bitcoin dropped to $62.8k. This happened as whale activity and ETF inflows started to slow down.

Bitcoin [BTC] continued to trade between $73k and $60.7k, forming a range.

As a crypto investor, I’ve taken note of an earlier analysis by AMBCrypto where they identified two crucial price levels for Bitcoin: a supportive zone at $64,500 and a resistant level at $66,000. To see further gains, bulls must successfully defend the $64,500 mark in order to break through and conquer the $66,000 resistance.

At $67,000, an event unfolded that wasn’t the occurrence we anticipated; instead, there was a decline to $62,800. This turn of events transpired when the pace of whale transactions and ETF investments were both on the wane.

Therefore, an argument for continued short-term consolidation was valid.

The larger-picture metrics that fueled BTC growth have declined

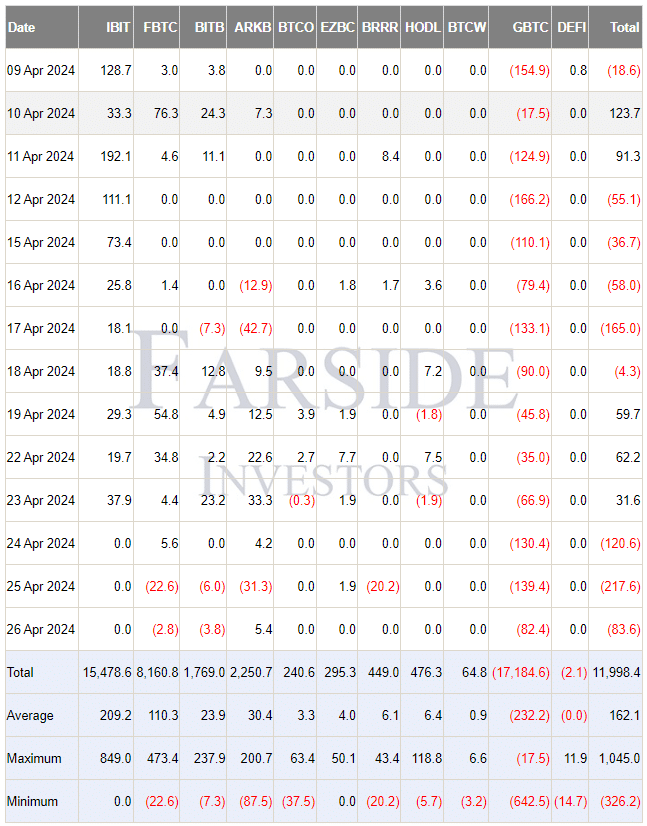

As a researcher studying cryptocurrency market trends, I came across a recent observation made by Whale Panda on their X platform (previously known as Twitter). They reported that for three successive days leading up to the 26th of April, Bitcoin ETF flows showed a negative trend.

For the past three consecutive days, Blackrock’s ETF IBIT has experienced no new investments, following significant inflows it received earlier in the month.

Here, a noticeable decrease in demand is evident. specifically, the Grayscale Bitcoin ETF (GBTC) experienced regular outflows, with ARKB following suit on the 25th of April.

This was a reflection of the lack of bullish conviction after the halving.

As a crypto analyst, I’ve noticed an intriguing development: the number of large transactions, or “whale” transactions, has decreased significantly since mid-March.

The price of Bitcoin also lost its higher timeframe bullish impetus during the past month.

What do the futures markets reveal about Bitcoin market sentiment?

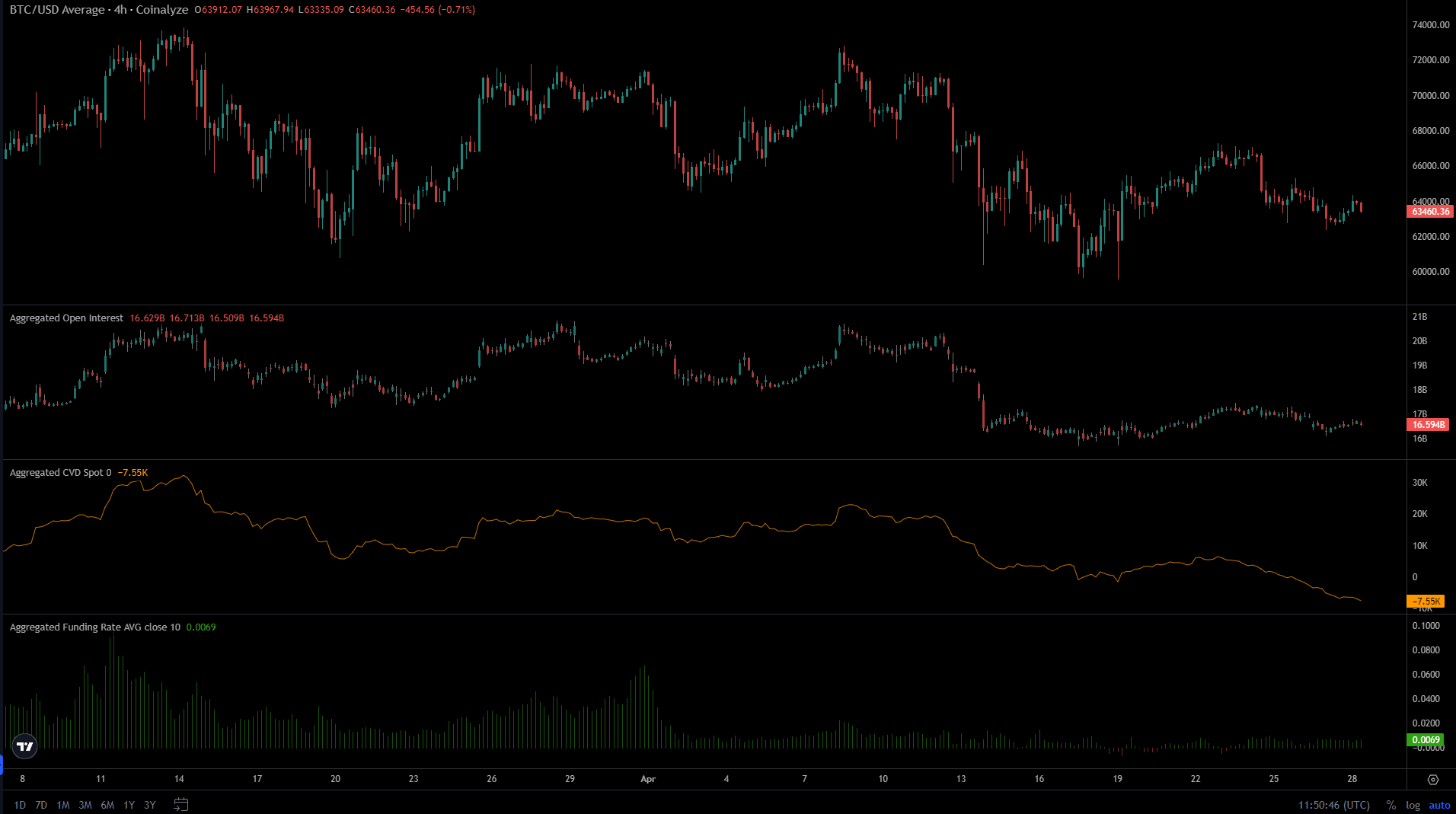

Since April 10th, the Open Interest in Bitcoin has been declining. This trend occurred concurrently with the decrease in Bitcoin’s price from over $70,000 to around $60,000, revealing a bearish market outlook. Speculators have shown reluctance to take long positions during this time.

As a crypto investor, I’ve noticed that the funding rate, which had been quite profitable for me in March, dropped to only slightly positive numbers in April. This shift indicates a decrease in speculative activity and uncertainty within the market.

From March 20th to April 10th, the price of CVD (Cardiovascular Disease) in the spot market experienced an upward trend. As a result, buyers were active during this period, providing impetus for the price to attempt climbing above $70k.

Over the past three weeks, Bitcoin has consistently declined, making it probable that we would observe further decreases or minimal fluctuations in its value.

In simpler terms, a brief price fluctuation of Bitcoin occurred, ranging from approximately $59,700 to $66,900 (indicated by the purple section). This price swing took place within the broader trading band of $60,000 to $73,000 that Bitcoin was already moving within.

Over the past weekend, the midpoint price of $63,300 was surpassed, and there’s a possibility for a further decline down to $60,000 by the end of this week.

On the six-hour chart, the Relative Strength Index (RSI) fell beneath the 50-neutral mark, hinting at downward price momentum. With insufficient buying pressure observed, a potential drop seemed imminent.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-29 04:07