-

Analysts project a possible BTC rise after a record uptick in US money supply.

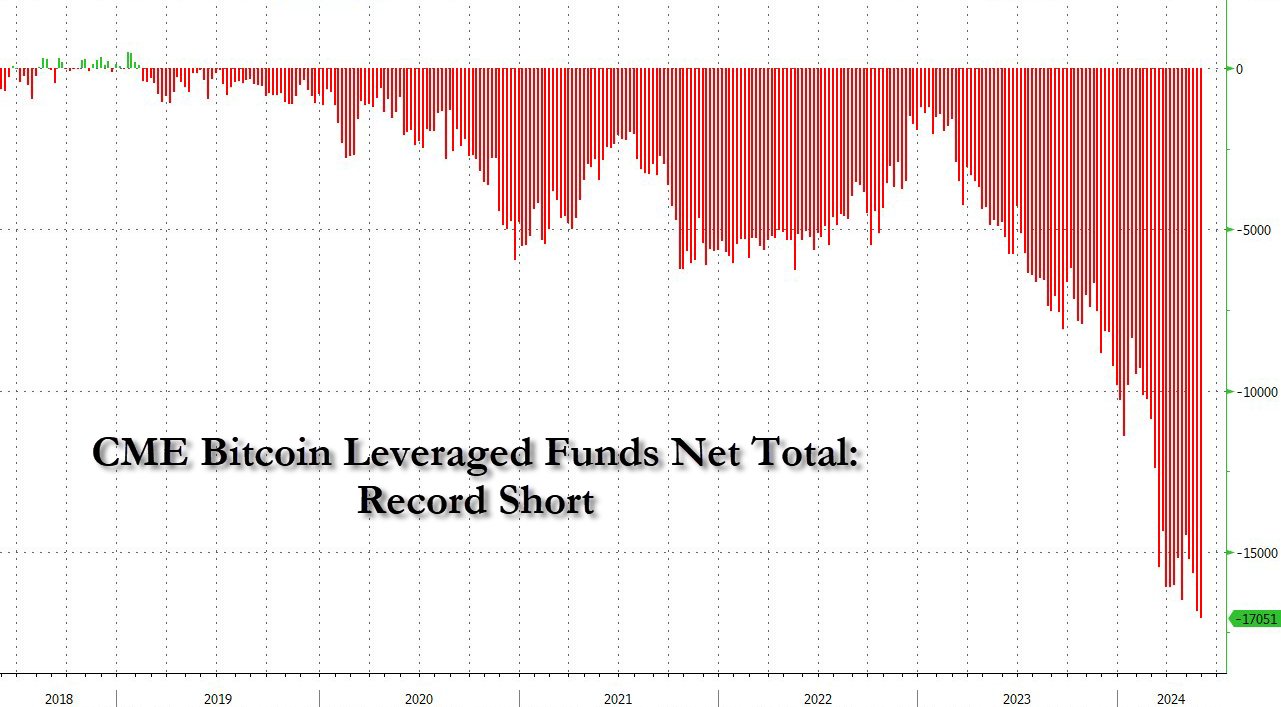

However, short positions against BTC have spiked, raising fears of a price correction.

As an experienced analyst, I’m keeping a close eye on Bitcoin (BTC) and the latest developments in its price action and underlying market conditions. The recent consolidation between $60K and $70K has been a dull setup for some speculators, but there are new emerging narratives that could potentially tip the scales.

For several weeks, Bitcoin‘s [BTC] price has hovered within the relatively narrow band of $60,000 to $70,000, making for a less exhilarating experience for investors who derive excitement from market swings.

After the April halving, this lateral shift in trend continued, with demand from US Bitcoin spot ETFs appearing relatively unchanged.

But there’s a new developing narrative for the King coin—an uptick in the US money supply.

Bitcoin’s path forward

Based on the perspective of TechDev_52, an entrepreneur and cryptocurrency analyst, there’s a possibility that Bitcoin (BTC) might experience a significant price surge or bubble following the historic high in the BTC versus M1 (money market) liquidity ratio.

In the year 2021, $BTC failed to reach new peaks despite M1 reaching unprecedented levels. However, bitcoin was unable to establish a new high in contrast to M1’s surge. Now that $BTC has breached its 2-month moving average (supertrend), we are possibly headed for the blowoff move it has historically indicated.

As a researcher studying the cryptocurrency market, I attributed the absence of a significant price surge, or “blowoff,” in Bitcoin during 2021 to the persistent fear and uncertainty brought about by the COVID-19 pandemic and its impact on M1 liquidity. The similar breakout in Bitcoin’s price against the money supply in that year was not accompanied by the usual exuberance and buying frenzy due to these external factors.

As an analyst, I would explain that M1 represents the most easily convertible segment of the money supply. This includes currency and assets that can be quickly turned into cash, such as checking accounts. In contrast, M2 expands the definition to include some less liquid components, specifically savings deposits within the money supply.

It’s worth noting that according to another analyst, Willy Woo, M2 has experienced a growth of 0.7% in recent times. Historically, increases in the money supply have been associated with rising Bitcoin values when expressed in US dollars.

It’s uncertain if Bitcoin (BTC) will surpass its current price range after breaking through its liquidity on the M1 market and experiencing expansion on the M2 level.

Based on the latest data, I’ve noticed that leveraged Bitcoin funds have reached new highs in their short positions towards BTC. This strategy could represent hedging against possible Bitcoin price decreases or an attempt to profit from a correction in the market.

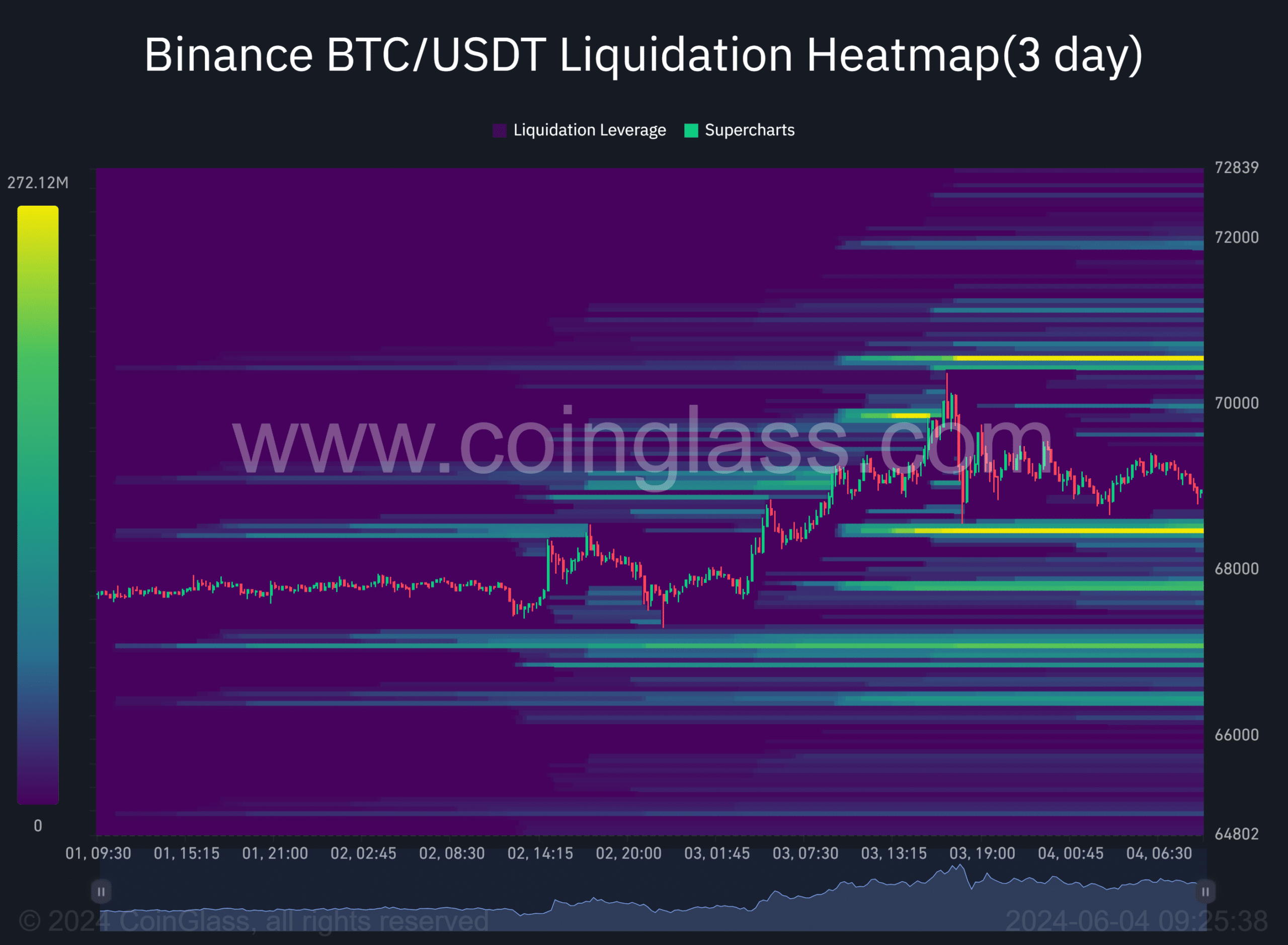

Before reaching $70.5K, it seemed more probable that the price would take a brief detour and clear out the liquidity around $68.4K first.

Based on Coingecko’s data analysis, I identified two significant levels, denoted by the orange marks, which served as focal points for liquidity clusters and potentially attracted price movements.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-04 14:15