- Bitcoin has surged by 39.72% over the past month.

- An analyst predicted a December rally to up to $140k, citing historical performances.

As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of market cycles and trends. The recent surge in Bitcoin (BTC) has certainly caught my attention, especially given its historical performance following U.S. presidential elections.

Following the U.S. presidential election, the price of Bitcoin experienced a dramatic increase, soaring from a record low of $66,000 to an unprecedented peak of $99,800.

Despite reaching a peak at around $100,742, the market has since undergone a correction and dropped back to approximately $90,742. This increased market instability has left crypto analysts divided, with some predicting a surge beyond $100k and others foreseeing a possible decline instead.

One of these optimistic analysts is the popular crypto analyst Ali Martinez, who has suggested a December rally, citing U.S. presidential elections.

Bitcoin’s historical performance

According to Martinez’s interpretation, it’s been observed that Bitcoin tends to increase in value following the U.S. presidential elections, particularly in December.

In my research, I’ve observed substantial growth patterns in Bitcoin (BTC) over the past two cycles. Specifically, during 2020, BTC experienced a remarkable surge. After hitting a low of $17,570, it soared to a peak of $29,300, representing an impressive increase of approximately 66.84%.

In 2016, BTC increased from $740 to a high of $981. This was a 32.56% increase.

The historical trend indicates that Bitcoin tends to see price surges in December, typically after the U.S. presidential elections.

Based on historical trends, it’s possible that Bitcoin (BTC) may experience significant increases in value throughout the month. Notably, analyst Martinez foresees the leading cryptocurrency reaching anywhere from $125,000 to $140,000.

What the charts say

Even though Bitcoin has dropped from its recent all-time high, it still seems to be following a positive trend. This suggests that there could be more increases in its price in the near future based on current market conditions.

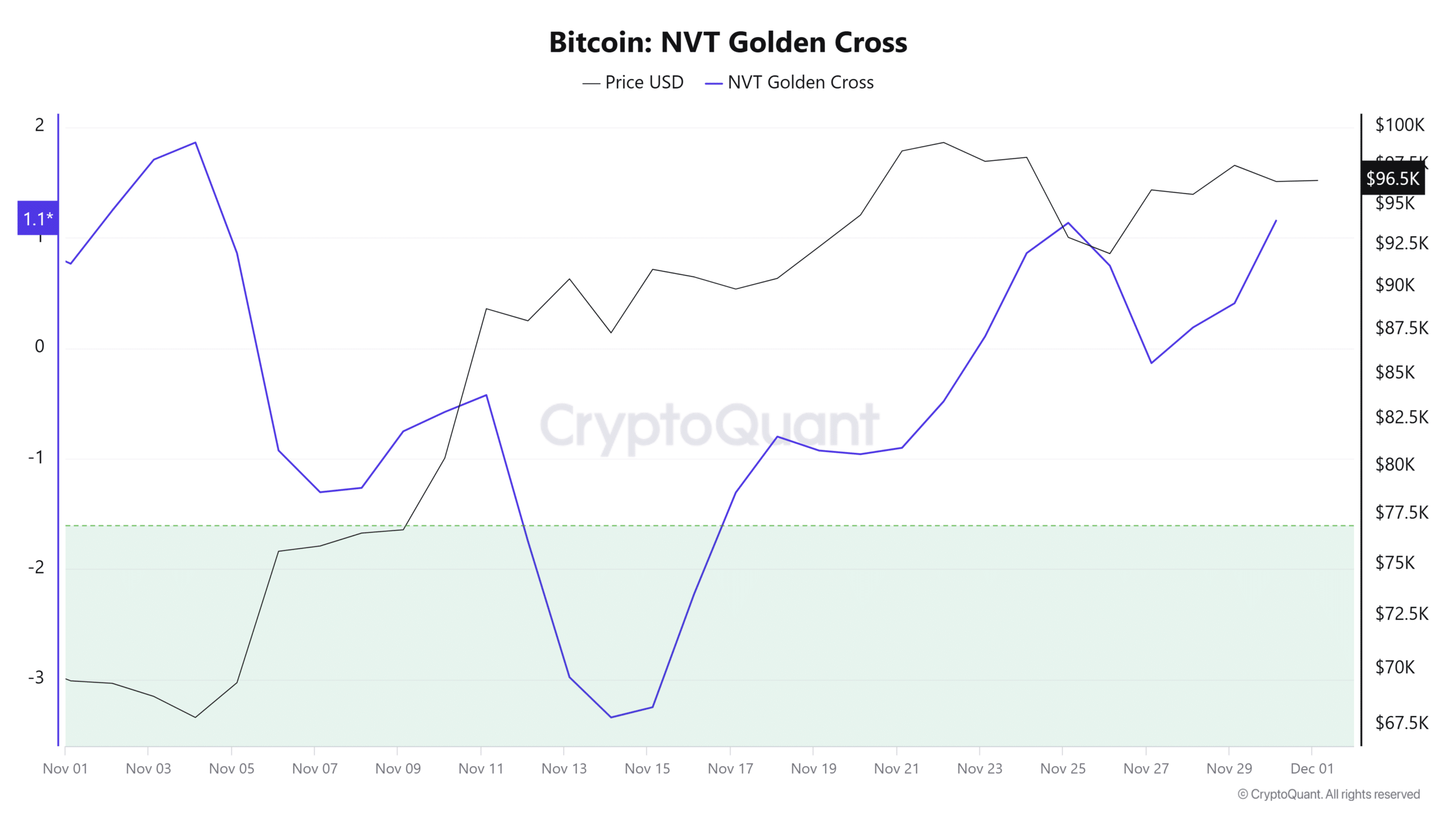

At the current moment, the Bitcoin Network Value to Transactions (NVT) Golden Cross has significantly increased from a value of -0.13 to 1.1. An increase in the NVT Golden Cross indicates a growing confidence in the long-term potential for the asset’s growth path.

Instead, investors are looking at the network’s worth not just based on its current on-blockchain actions, but they also perceive its future growth possibilities, irrespective of the number of transactions being made.

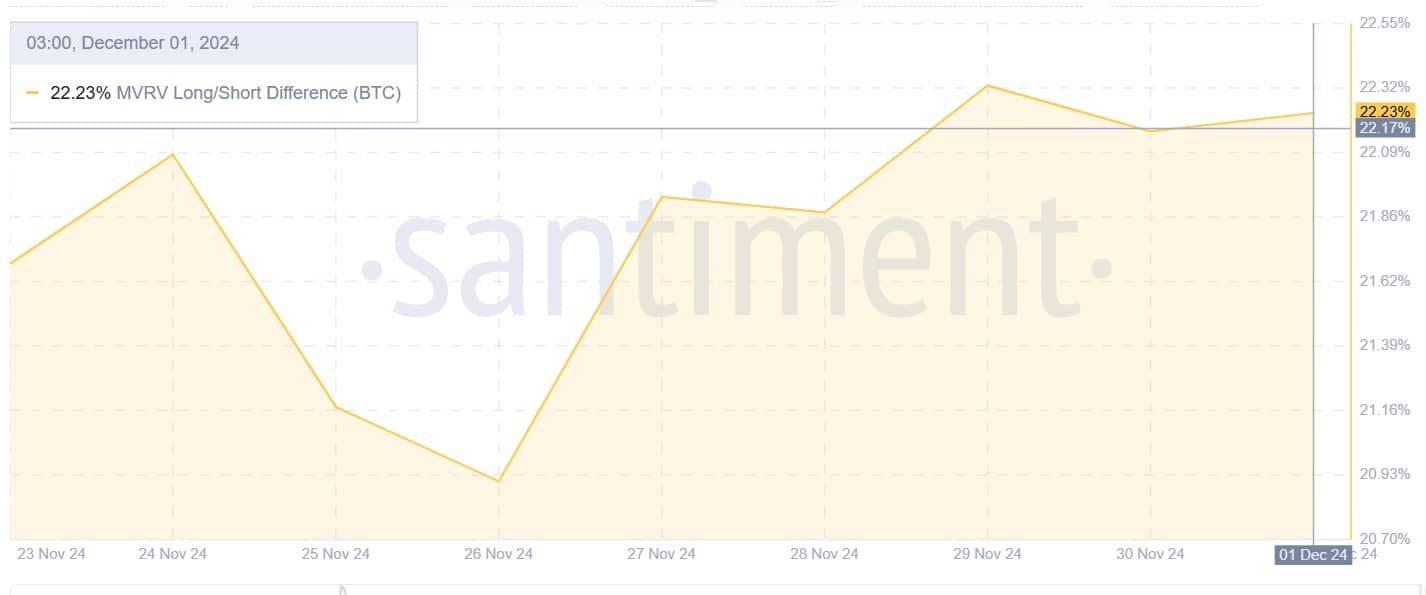

Furthermore, this long-term certainty is also supported by the increasing gap between MVRV (Maker’s Value Realized to Maker’s Value) in long and short positions.

An increase in this particular metric indicates that those holding long positions are growing more optimistic, despite already realizing profits.

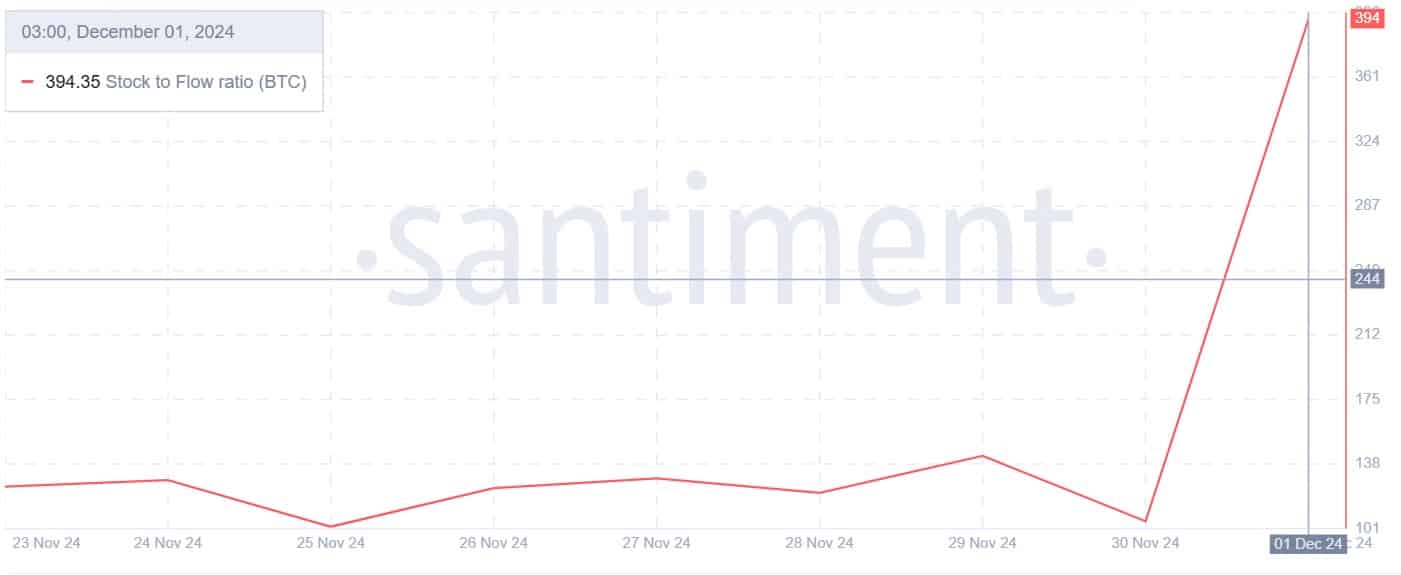

To put it simply, the Stock-to-Flow Ratio (SFR) of Bitcoin has significantly increased from 105 to 494 at present. An increase in SFR indicates that Bitcoin is experiencing a scarcity due to its decreased supply.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Generally speaking, the real worth of Bitcoin lies in its scarcity. When its supply becomes limited and there’s a growing interest, prices tend to increase.

As a researcher examining the Bitcoin market, I find myself optimistic about its future performance. The current market dip seems to be just a temporary adjustment, paving the way for an upcoming bullish trend.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-12-02 09:12