-

Bitcoin breaks $60K, with bullish momentum suggesting a potential rise toward $70K.

El Salvador continues daily Bitcoin purchases, boosting its total holdings to 5,851 BTC.

As a seasoned researcher who has witnessed Bitcoin’s rollercoaster ride over the years, I find myself increasingly optimistic about its future trajectory. The latest surge above $60,000 and the bullish momentum are reminiscent of past price spikes that have always proven to be temporary setbacks before another bull run.

Following several tough days, Bitcoin [BTC] has surpassed the significant $60,000 threshold and is now being traded at levels above it. As per the latest figures from CoinMarketCap, BTC is currently valued at approximately $63,762, showing a minimal decrease of 0.32% over the past day.

Saylor’s Bitcoin optimism

Consistently, Michael Saylor, Bitcoin advocate and co-founder of MicroStrategy, has reiterated his belief in the digital currency’s potential, highlighting its persistent value and expansion.

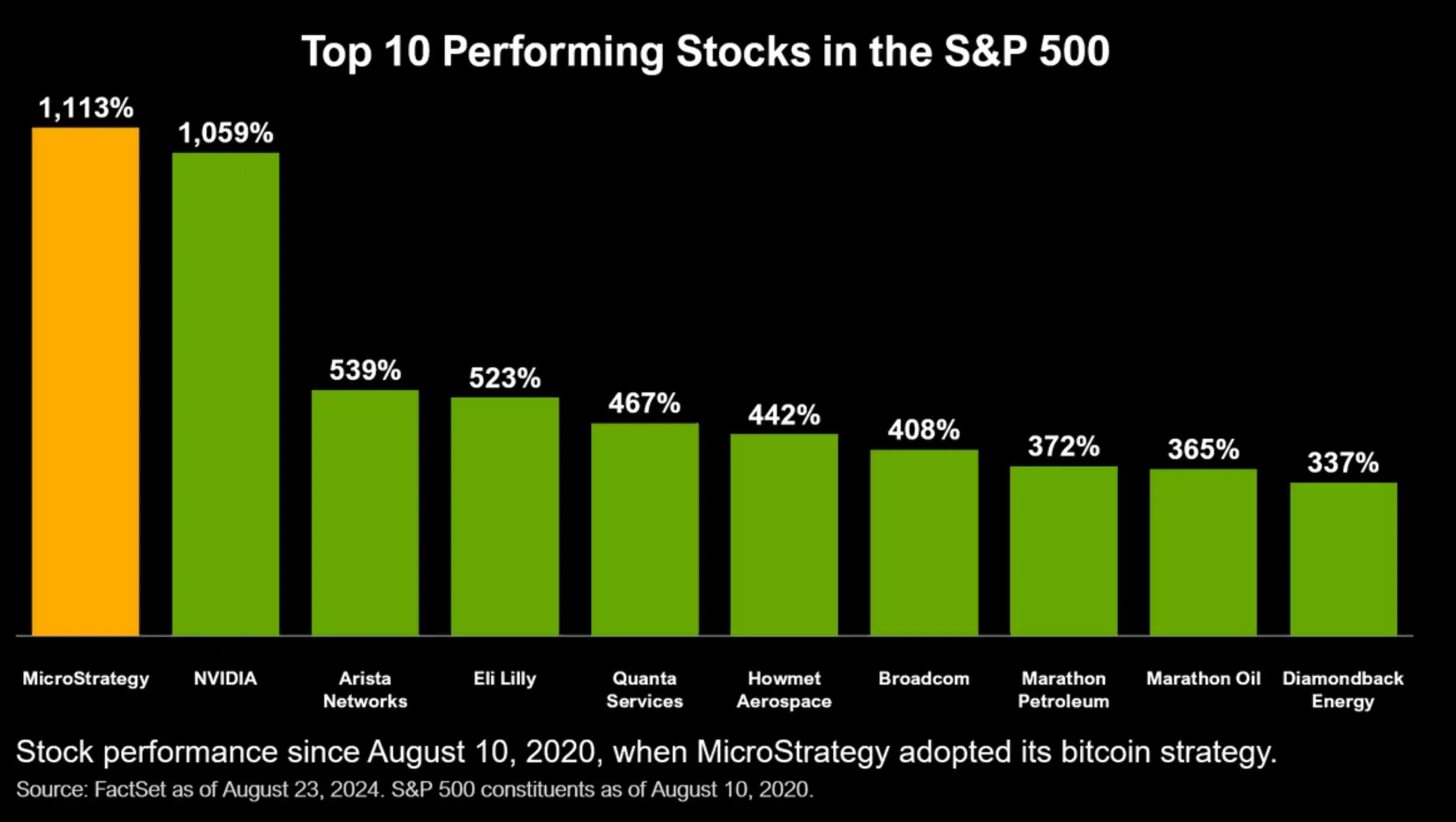

If you’ve been invested in Bitcoin for the past four years, it would have given you a better return than any company in the S&P 500.

Regardless of temporary variations, MicroStrategy’s decision to invest in Bitcoin has proven fruitful, as Bitcoin’s returns have surpassed those of every company in the S&P 500 index, highlighting its exceptional potential for long-term growth.

What are the metrics saying?

By examining TradingView data, AMBCrypto ascertained that the Relative Strength Index (RSI), currently sits comfortably above the non-committal point of 57, suggesting a potentially positive direction for Bitcoin’s upcoming trend.

This suggests a persistent upward trend continues. Moreover, with the MACD line positioned above the signal line and showing green bars, it underscores the idea that buyers are currently exerting more influence over sellers in the market.

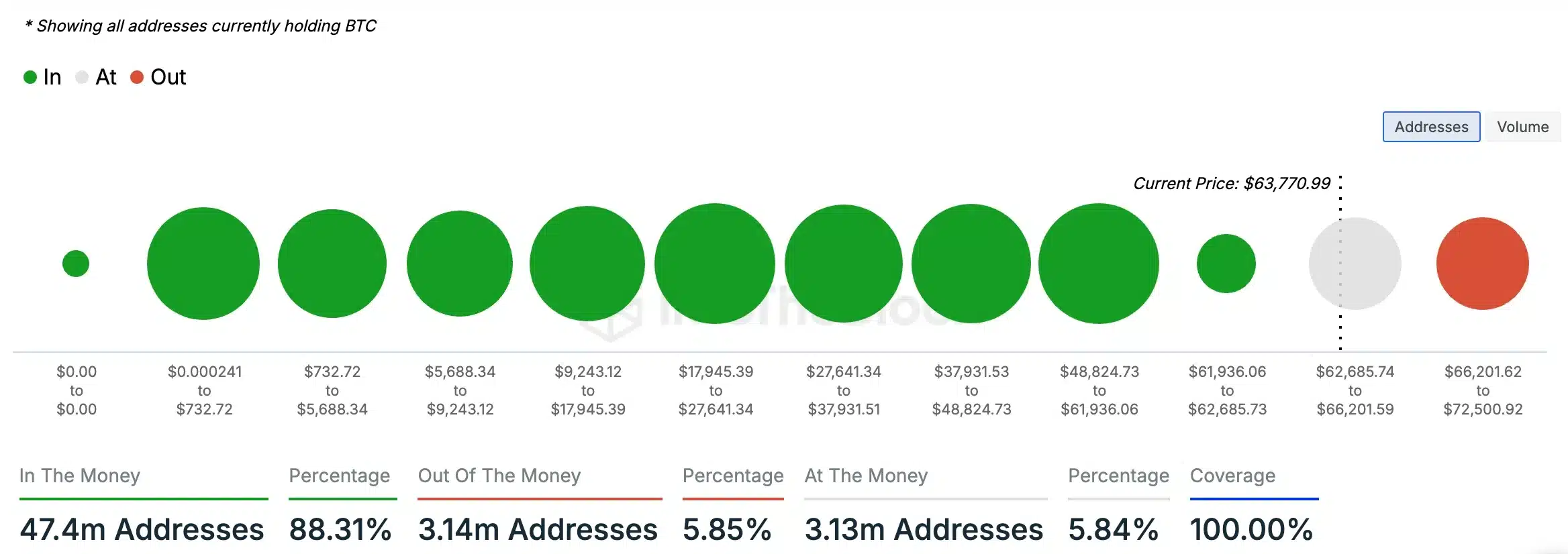

According to the findings from IntoTheBlock, it’s not surprising that a significant number (approximately 88.31%) of Bitcoin holders now own more Bitcoin than what they initially paid for it, which suggests they are currently profitable or “making a profit.”

On the contrary, about 5.85% of people currently hold Bitcoin at a price below what they originally paid for it, meaning they are “underwater” or “out of the money.”

This suggested that Bitcoin might be gearing up for a bull run in the coming days.

Bitcoin’s future outlook

According to predictions made by Cathie Wood’s Ark Invest, Bitcoin could potentially soar to an astonishing $1.5 million by the year 2030 if it maintains its current trend.

Joining the conversation, Jan Happel and Yann Allemann, co-founders of Glassnode, expressed their belief that Bitcoin could once more challenge and possibly surpass the $70,000 mark.

They caution that traders who are betting against BTC (by shorting it) when it’s around $68,000 or $69,000 could face significant losses if Bitcoin’s price continues to rise and hits $70,000, leading to forced liquidation of their positions.

Moreover, El Salvador, having become the first nation to make Bitcoin a recognized form of currency, has progressively grown its holdings of Bitcoin.

Starting from March 16th, the Salvadoran government has consistently bought one Bitcoin each day, leading to a total of 162 Bitcoins being added to their existing reserves.

Currently, El Salvador owns a total of 5,851 Bitcoin, which translates to around 356.4 million US dollars when considering the current market value.

As I observe Bitcoin’s upward trajectory nearing unprecedented heights, I can’t help but ponder whether it will successfully surpass the significant $66K barrier.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-26 17:12