-

Bitcoin’s weekly trend over the past six months has been concerning

An investigation of its on-chain metrics revealed that BTC’s top might be a year away

As a seasoned analyst with over two decades of experience in financial markets, I find myself cautiously optimistic about Bitcoin’s current trend. While the past six months have shown a concerning downtrend, a deeper dive into on-chain metrics suggests that we might be only halfway through this cycle.

Since the start of June, Bitcoin [BTC] has seen a gradual decline, as it’s been recording lower peaks and troughs on its weekly graph. Yet, despite this downtrend, the Founder and CEO of CryptoQuant, Ki Young Ju, remains optimistic, asserting that we are currently in the middle phase (mid-cycle) of Bitcoin’s development.

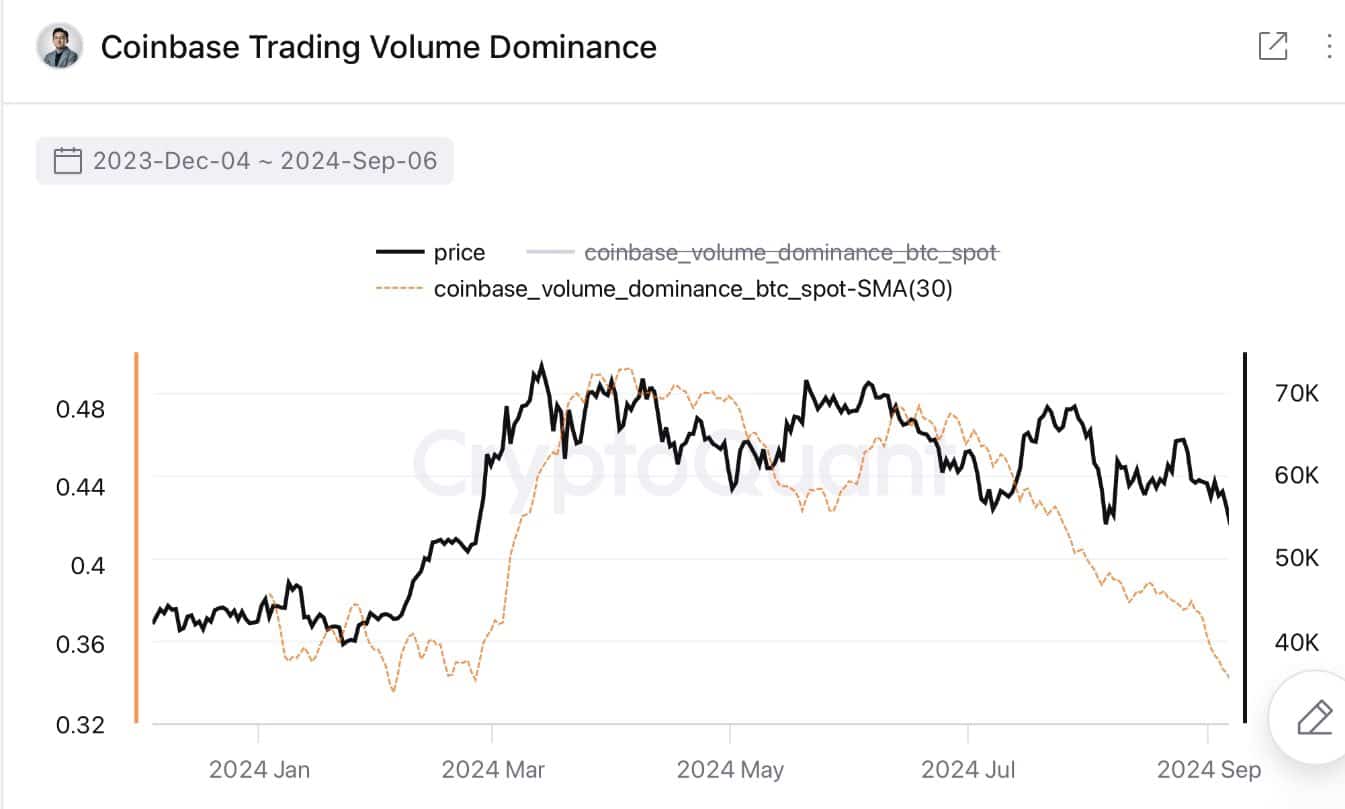

As I observed on platform X, the dominance of BTC Coinbase spot volume has returned to reminiscent levels of early 2024, a time when approval for spot Bitcoin ETFs was still pending. This trend, however, isn’t a positive sign and requires an uptick in U.S investor participation to drive Bitcoin prices back up to their previous peaks.

As an analyst, I delved into on-chain metrics to ascertain whether the current crypto cycle was indeed halfway through, and the findings were encouraging.

Profit-taking behavior has long-term bullish implications

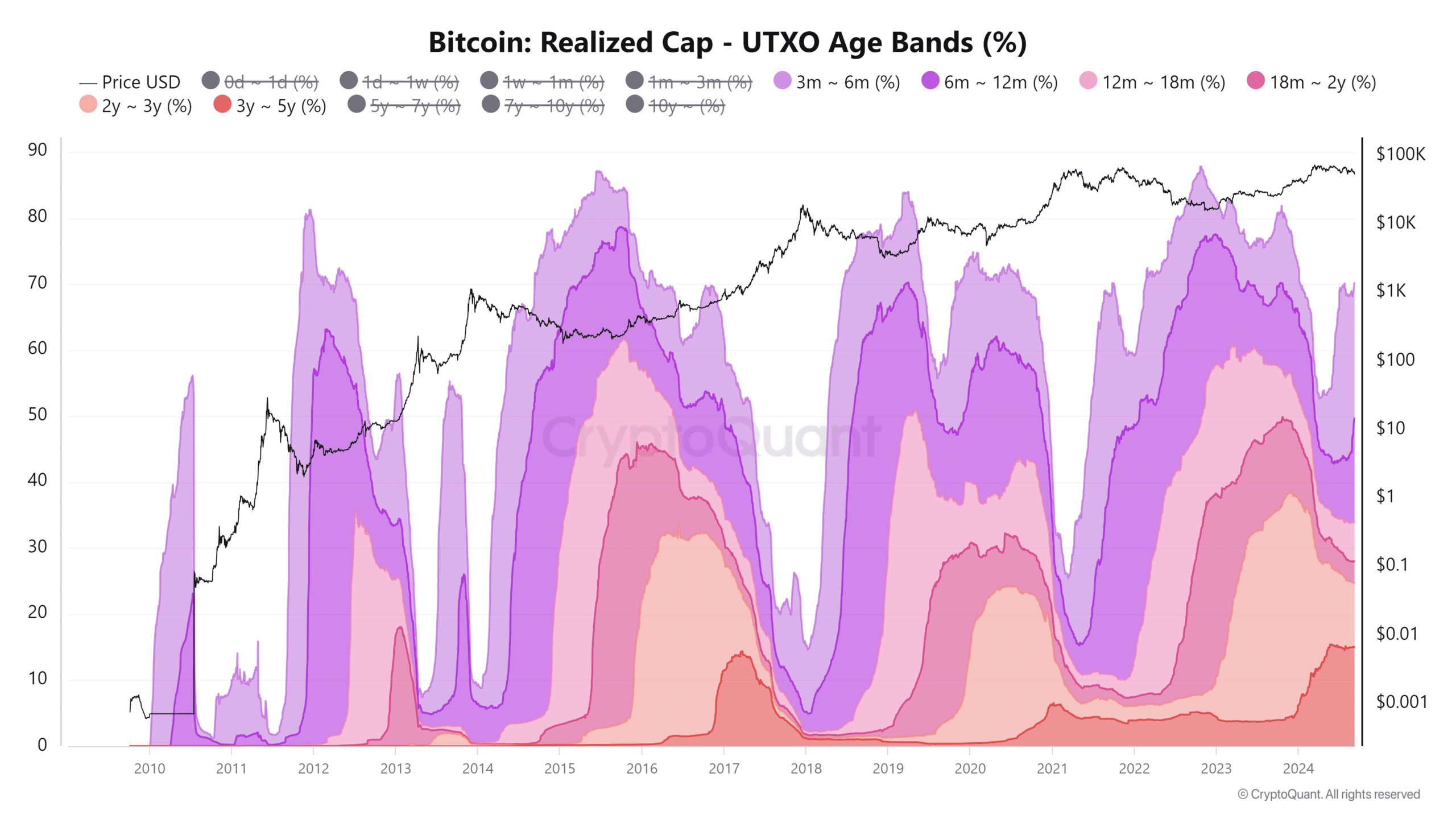

The UTXO age bands showed the percentage distribution of realized cap across different UTXO age bands. Here, the chart represents the ratio of the realized cap of spent UTXOs that were moved.

In various stages of the Bitcoin market cycle, the UTXO (Unspent Transaction Output) ages ranging from 3 months to 2 years show more pronounced rises and falls at different points. As the market approaches its peak, these age groups tend to drop significantly, creating troughs that are roughly aligned with the market top. Following this downtrend, the number of UTXOs increases, suggesting a higher number of investors re-entering the Bitcoin market as buyers.

During the intervals of market highs, there are shorter peaks and valleys that persist for a couple of months. These brief periods are not considered as market highs themselves, but they may have led investors to believe they were reaching a peak. This occurred in October 2013, October 2016, and April 2020.

The last two peak points occurred approximately during the months following Bitcoin’s halving, indicating yet another phase of accumulation close to the halving event. This accumulation, in turn, is likely to result in a distribution period after a prolonged bull market.

Therefore, if we see a comparable high point following the halving in April 2024, it suggests that the market’s peak or top could be approximately one year later.

Puell Multiple and BTC market’s timing

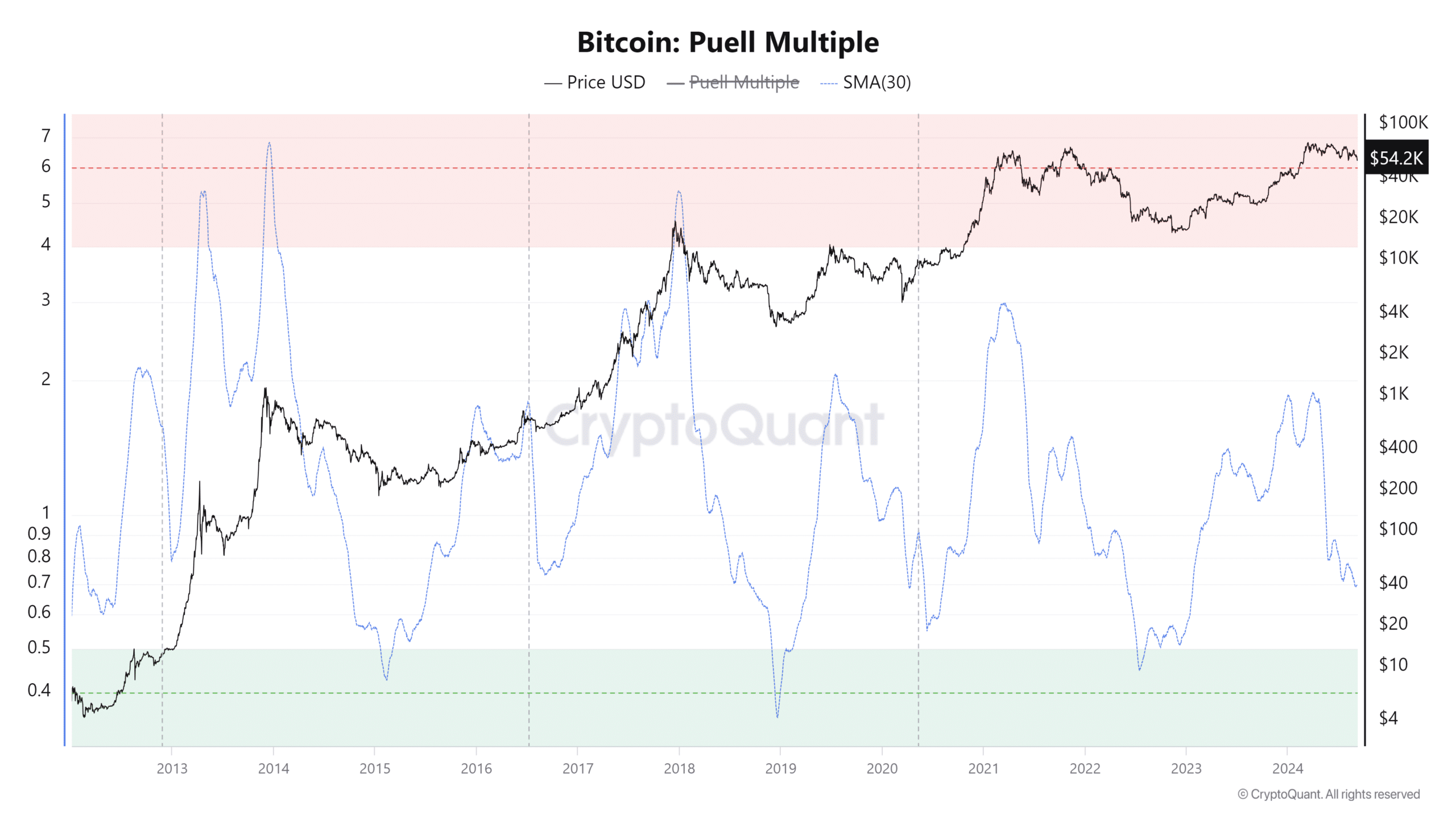

As an analyst, I’ve found that the Puell Multiple serves as a valuable tool for predicting market tops and identifying increased selling pressure from miners. Similar to the UTXO bands, this metric often forms peaks between cycles, suggesting that miners are taking profits before halvings in order to maintain their operations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The latest high point was reached in March 2024, further supporting the notion that Bitcoin is likely still midway through its ongoing cycle.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-08 08:07