- Bitcoin experienced a significant decline over the past month.

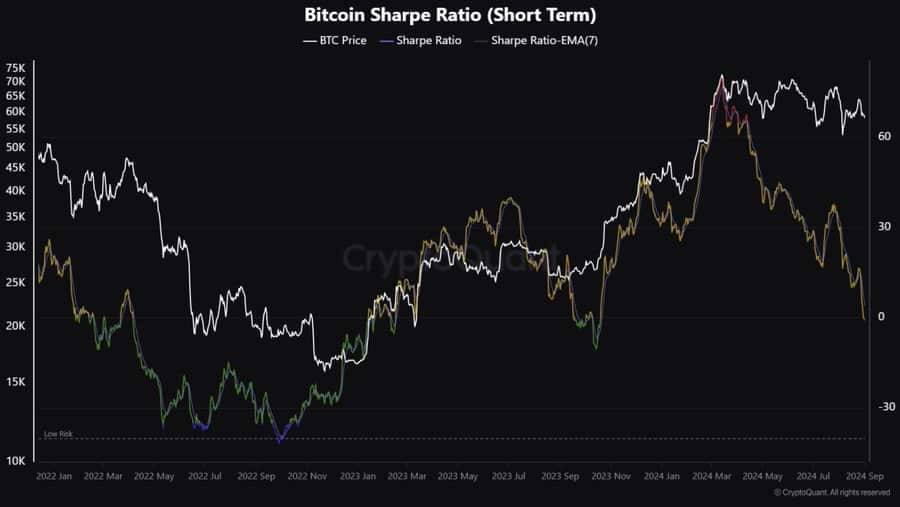

- The declining short-term Sharpe ratio left analysts eyeing a rebound.

As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I’ve learned to weather the storms and ride the waves of market volatility. Bitcoin [BTC], my trusted steed, has been on a rollercoaster ride lately, experiencing a significant decline over the past month, but showing signs of recovery.

Over the past 30 days, Bitcoin (BTC), the largest digital currency in terms of market value, has been on a downward trend. However, in the last 24 hours, it has shown some slight increases

As of this writing, it was trading at $58,820 after a 1.10% increase over the past day.

Previously, the King Coin had been on a downward trajectory, falling by 6.32% over the last week. Similarly, it has experienced a decrease of 4.37% over the past month

Although BTC has seen some increases daily, it is still about 20% lower than its all-time high (ATH) of $73,737 that was reached earlier in the year

Even though the recent performance of cryptocurrencies has been disappointing, the main stakeholders, such as financial analysts, continue to maintain a positive outlook on the future trajectory of these digital assets

As a crypto investor, I’m keeping a close eye on my investments, particularly the ‘downside’ or short-term Sharpe ratios in the current market trend. KryptoQuant analysts are indicating that the market might be due for a potential rebound soon, based on the recorded data and historical patterns

Market sentiment

According to Mevsimi’s interpretation, he referenced the 2023 cycle, suggesting that the present short-term Sharpe ratio appears to echo the pattern seen in the previous year

In the previous market cycle, as the short-term Sharpe ratio decreased, Bitcoin (BTC) prices skyrocketed from a low of $26675 to a high of $35137

Based on this historical performance, those who are bullish view it as a possible rebound signal.

On the other hand, the analyst presented an opposing perspective for cautious investors, suggesting that a bearish outlook could signal prolonged market turbulence

Overall, the declining short-term Sharpe ratio indicates an increase in market volatility, but without a corresponding rise in investment returns. This suggests that investments may become less appealing due to the higher risk and uncertainty involved

If we’re looking at historical patterns in terms of the short-term Sharpe ratio for BTC, it could potentially show signs of a recovery

As a result, the bullish evaluation becomes even more convincing with Santiment’s analysis showing that Bitcoin (BTC) is doing well independently of the S&P 500, indicating its separation from stock market equities

What BTC’s charts suggest

Based on this analysis, there appears to be optimism about future price trends. So, it’s crucial to consider what other factors might indicate as well

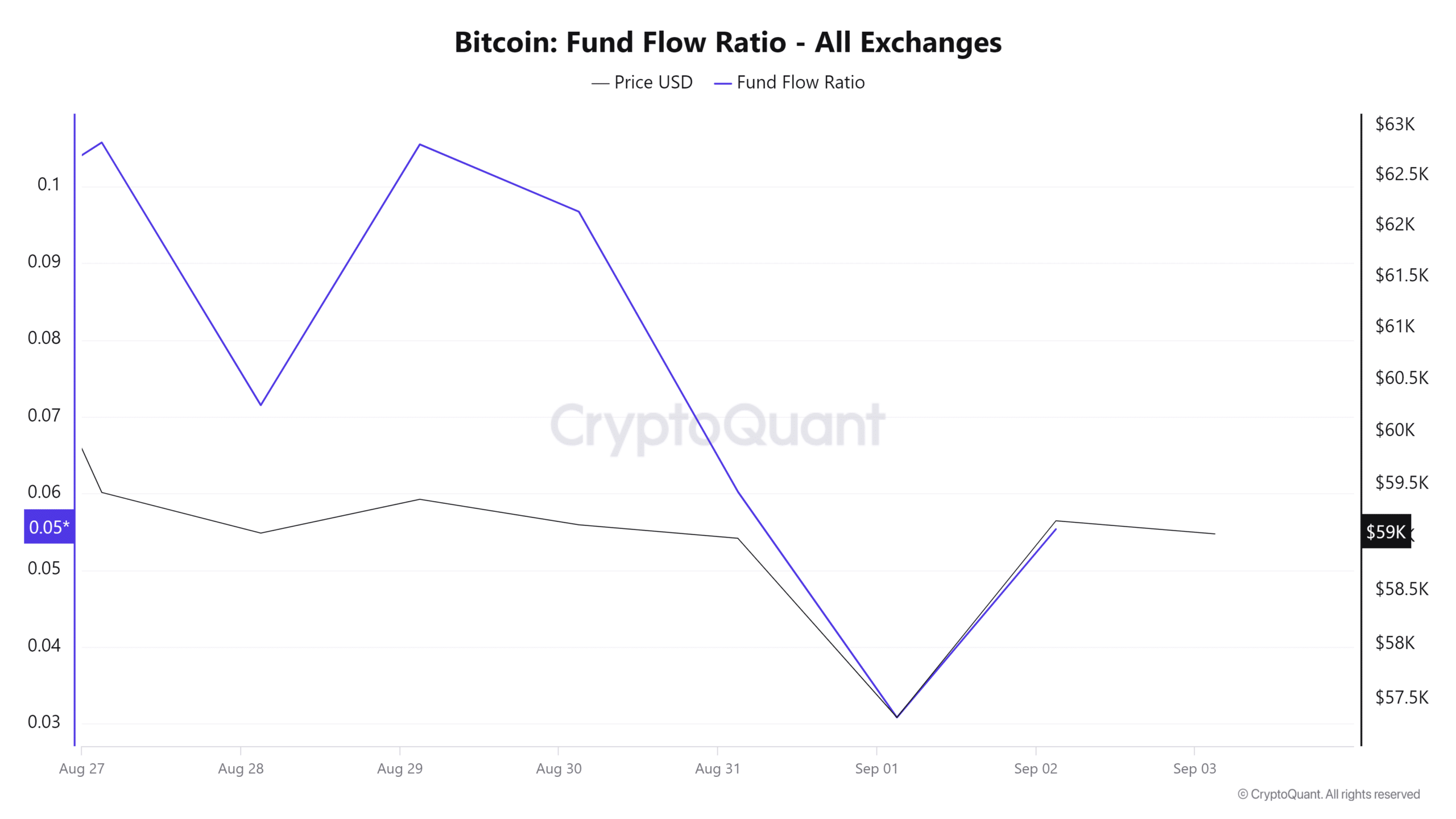

Initially, it’s worth noting that the Bitcoin Fund Flow Ratio has seen a decrease during the last week. This drop indicates that investors are more likely to hold onto their Bitcoins instead of selling them. In simpler terms, they seem to be keeping their Bitcoin investments rather than offloading them

This demonstrates a long-term sense of trust, as investors opt to keep their investments in offline wallets instead of exchanges. This kind of market activity builds up holdings in preparation for an expected rise in value

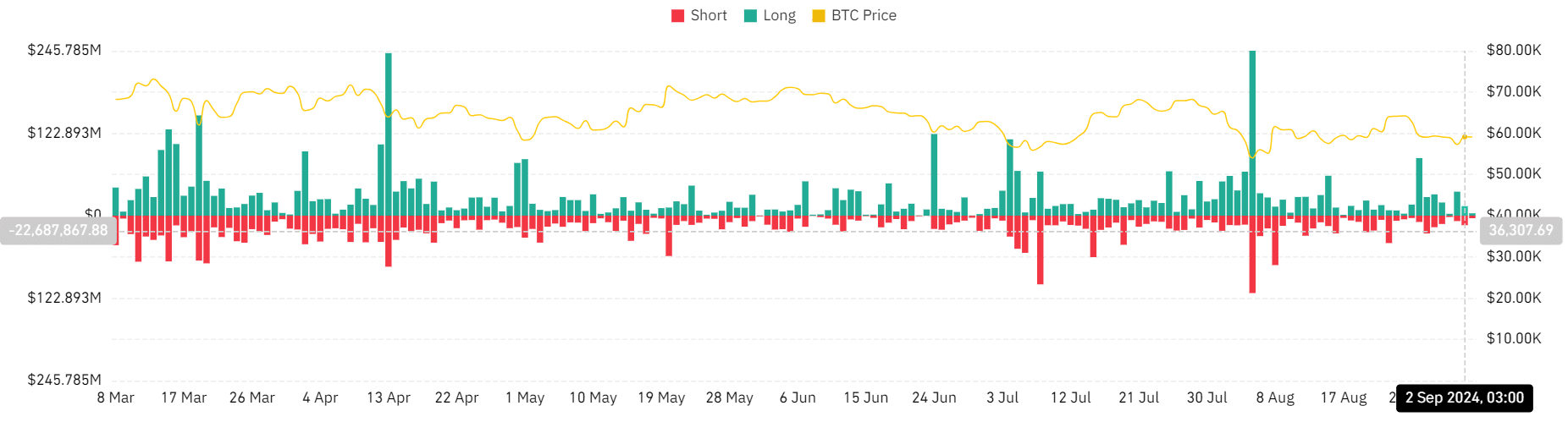

Over the last three days, the amount being liquidated for Bitcoin (BTC) has decreased significantly. The long position has dropped dramatically from $35.7 million to just $3.4 million as of the current press time

As a crypto investor, I’ve chosen to invest in long-term price growth by willingly paying a higher price for these positions, demonstrating my conviction and confidence in their potential future value

Read Bitcoin’s [BTC] Price Prediction 2024–2025

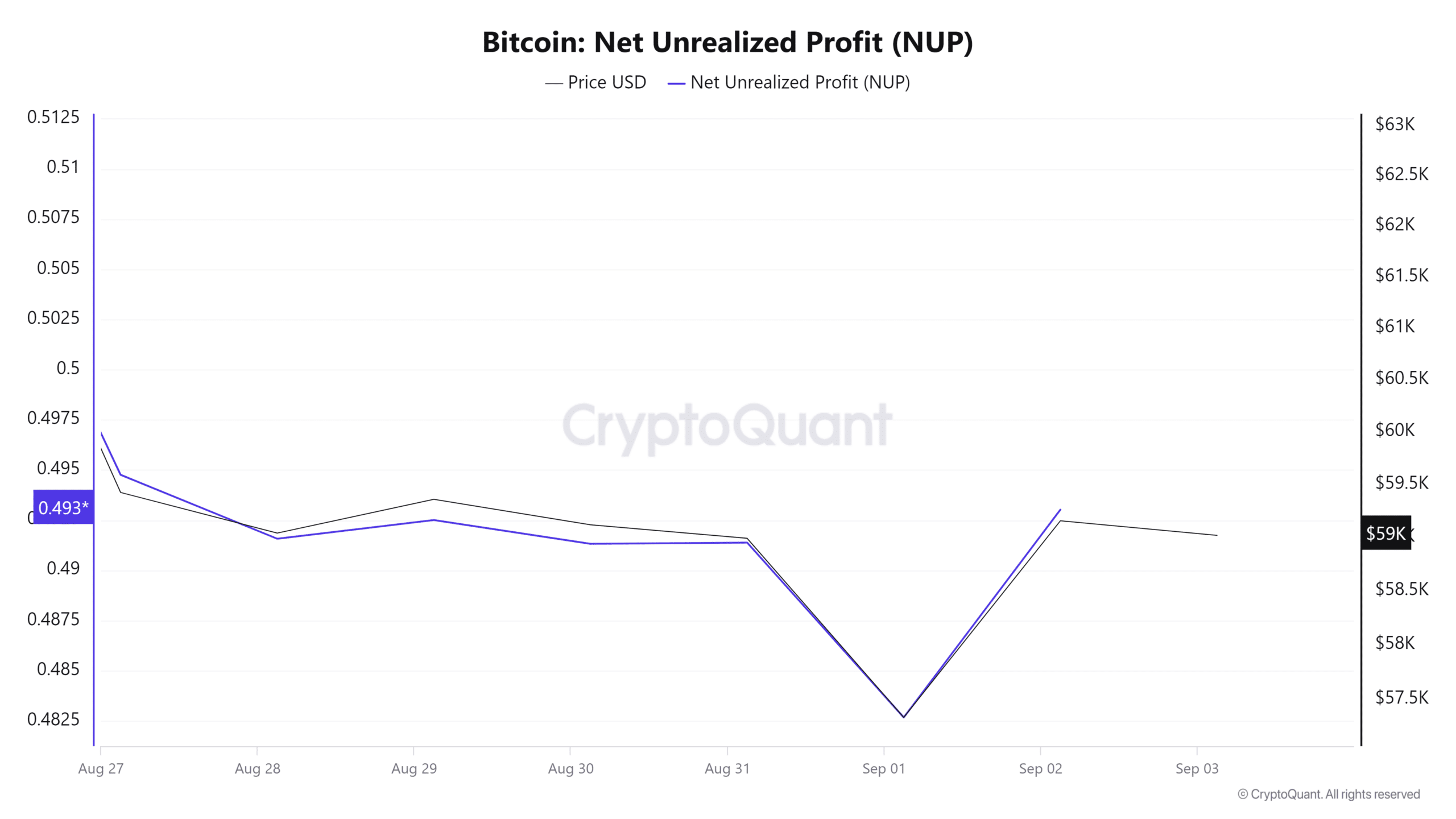

Ultimately, Bitcoin’s total unrealized gain stood at approximately 0.49, suggesting a generally positive outlook among investors. While some profit-taking did occur, it seemed unlikely that this would trigger a significant market downturn

If the current bullish market trend continues, Bitcoin appears poised to surpass the stubborn resistance at approximately $60,000 and attempt to breach the resistance at $64,752 as well

Read More

2024-09-04 13:45