-

BTC has declined by 10.85% on monthly charts.

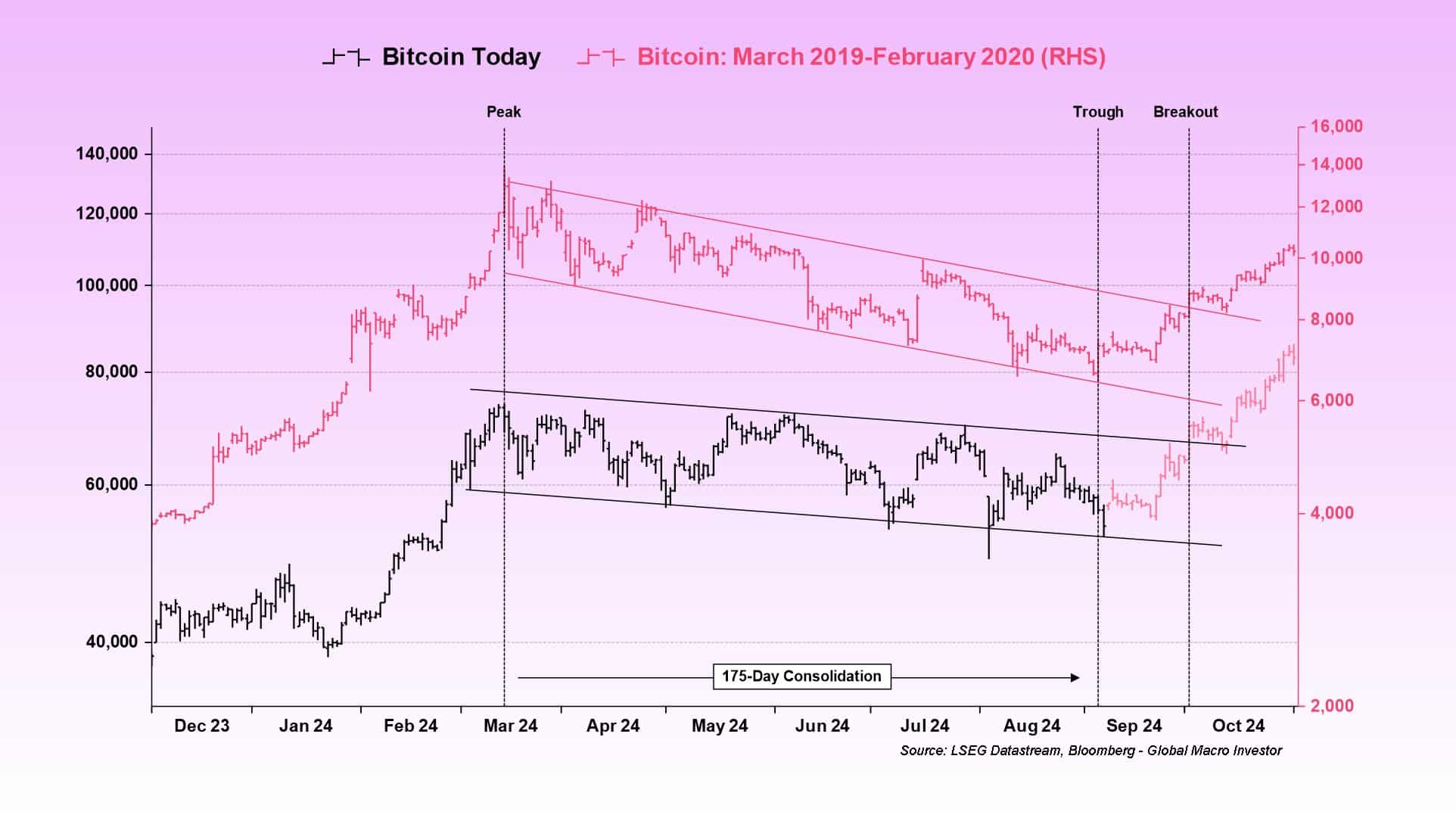

An analysts cites 2019 consolidation cycle as a sign for upcoming uptrend.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen more than my fair share of market fluctuations and cycles. The recent decline in Bitcoin (BTC) has been particularly intriguing given the optimistic market sentiment.

For the past month, Bitcoin [BTC] has gone against all forecasts from the market. Surprisingly, rather than bouncing back as anticipated by many, it has actually shown a downward trend.

Currently, Bitcoin is being transacted at approximately $54,439 following a 6.5% decrease over the past week. Similarly, within the last month, Bitcoin has experienced a 10.85% downfall. This recent slump in value has led to a significant drop in daily trading volume, which now stands at around $16.1 billion, representing a decline of approximately 65.23%.

Although there’s been a decrease, overall market feelings remain hopeful, with analysts consistently anticipating a recovery. For example, well-known crypto analyst Bittel Julien predicts a surge in the near future based on the 2019 pattern.

Prevailing market sentiment

In his examination, Julien emphasized the ongoing period of market stabilization, which he noted has persisted for approximately 175 days, as per his analysis.

Similar to the pattern seen in 2019, Bitcoin appears to be going through a period of consolidation again. If history repeats itself as it often does with Bitcoin, this could lead to an uptrend.

According to our study, Bitcoin rose from $7,200 to $10,000 in the year 2020 following a prolonged period of stability. Despite a subsequent drop, this was primarily due to the impact of the pandemic. Consequently, analysts are predicting an upturn following the extended consolidation.

Given past trends, it’s possible that we are at the edge of a significant surge or else a prolonged phase of stability.

What BTC charts suggest

Instead of Julien emphasizing one significant sign hinting at a possible reversal, the point becomes, does the rest of the data align with this suggestion?

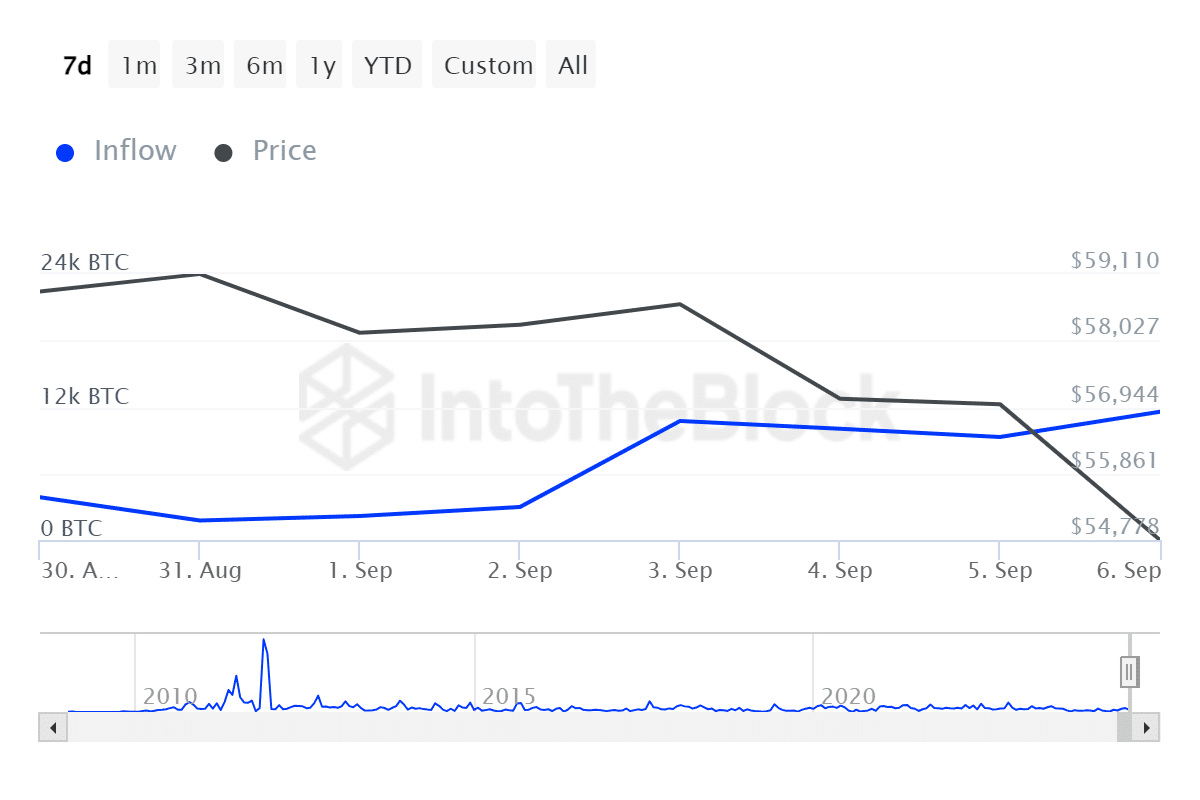

Over the last seven days, there’s been a substantial increase in the influx of large holders, with numbers climbing from a minimal 1.76k to 11.57k at present. This trend indicates that investors are actively purchasing during market downturns, which could be interpreted as them ‘buying the dip’.

Investors’ actions suggest they are stockpiling, which shows their faith in the market’s upward movement in the future. This optimistic outlook, or “bullish” sentiment, leads to more purchasing, thereby creating a force that drives prices higher.

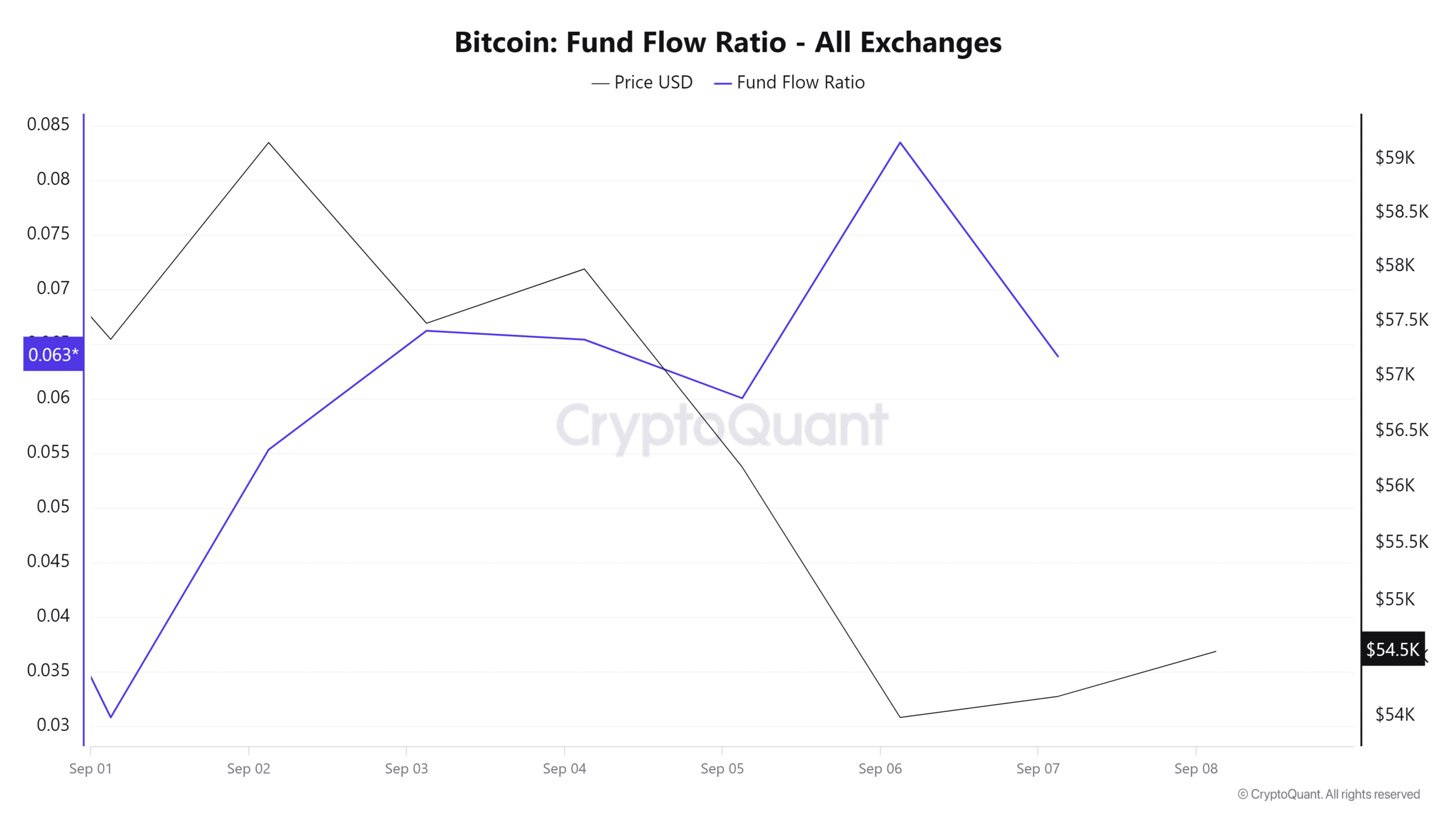

Furthermore, the fund flow ratio has grown substantially during the last seven days. A rise in fund flow implies that more capital is flowing into the market than out of it. This market behavior indicates heightened buying interest, leading to an uptick in prices.

This usually reflects growing optimism among investors as they expect further gains.

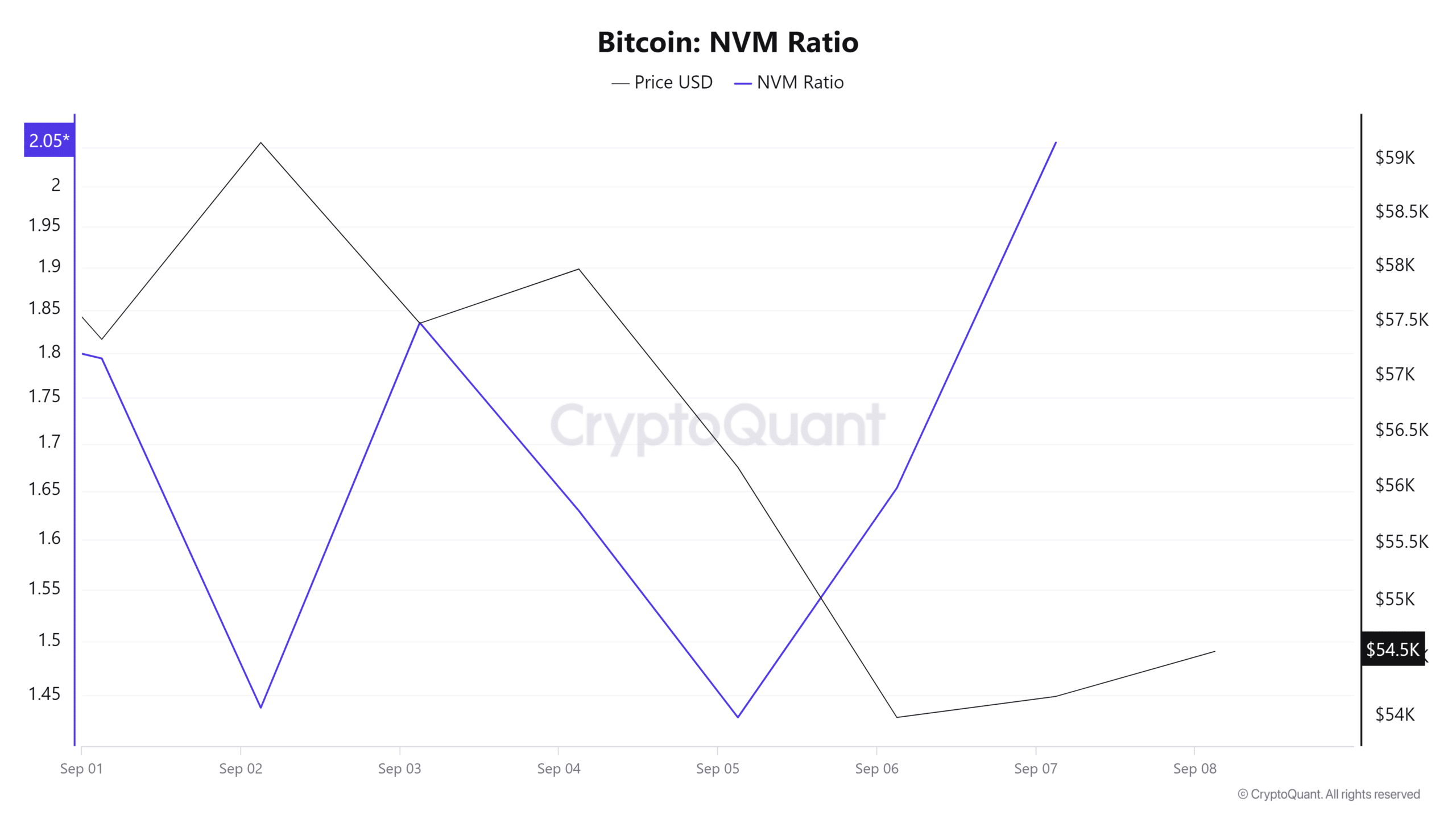

Over the last seven days, the NVM ratio has climbed from 1.4 to 2.05. This suggests that long-term investors continue to hold onto their assets even as prices decrease.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Such market behavior suggests confidence among long-term investors.

With the present bullish trend in the market, Bitcoin seems poised to break through the $56K barrier it currently faces as resistance.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-09-08 23:03