-

Analyst projected a likely BTC breakout and rally towards $75K-$80K.

Recovering investor demand supported the outlook, but rising leverage could be risky.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the latest Bitcoin [BTC] prediction from Stockmoney Lizards. The potential for a breakout towards $75K-$80K is certainly tantalizing, especially given the improving investor demand and the positive price action trend since August. However, I can’t help but feel a sense of caution due to the rising leverage in the market.

The Bitcoin (BTC) price graphs suggest a possible change in market structure, which may lead to a breakout from the $50,000 to $72,000 price band that started in March.

Based on predictions from analyst Stockmoney Lizards, we might see a breakout within the next two weeks. If this occurs, and the recent dip below $60K holds strong as a ‘higher low,’ the analyst suggests that Bitcoin could potentially reach prices between $75,000 and $80,000.

Should the current lower high hold strong, we anticipate breaching the current resistance level within a fortnight. Our next goal could be between $75,000 and $80,000.

In simpler terms, Bitcoin’s prices have been forming lower bottoms since August, which could indicate a change in market structure, particularly if it also reaches new highs. This pattern suggests a possible transition in the market dynamics.

Rising demand vs. risk

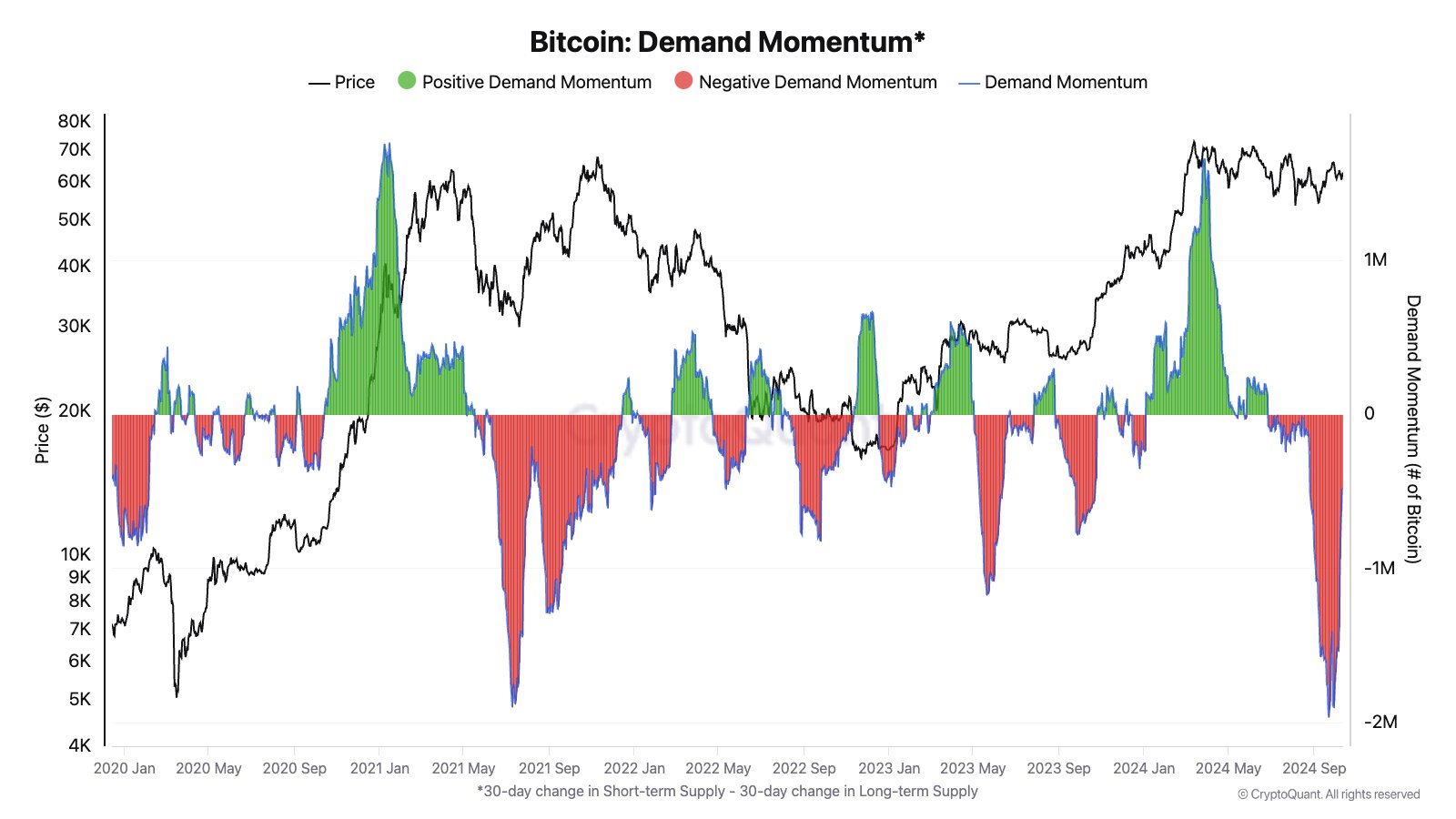

The increased interest among investors in the world’s leading digital asset indicates a gradual and persistent demand revival in Q4 as compared to Q2 and Q3.

From a different angle, the demand for Bitcoin has been less than supply since May, meaning more people have been selling it off than buying. But, according to CryptoQuant, the rate at which this imbalance is occurring appears to be slowing down.

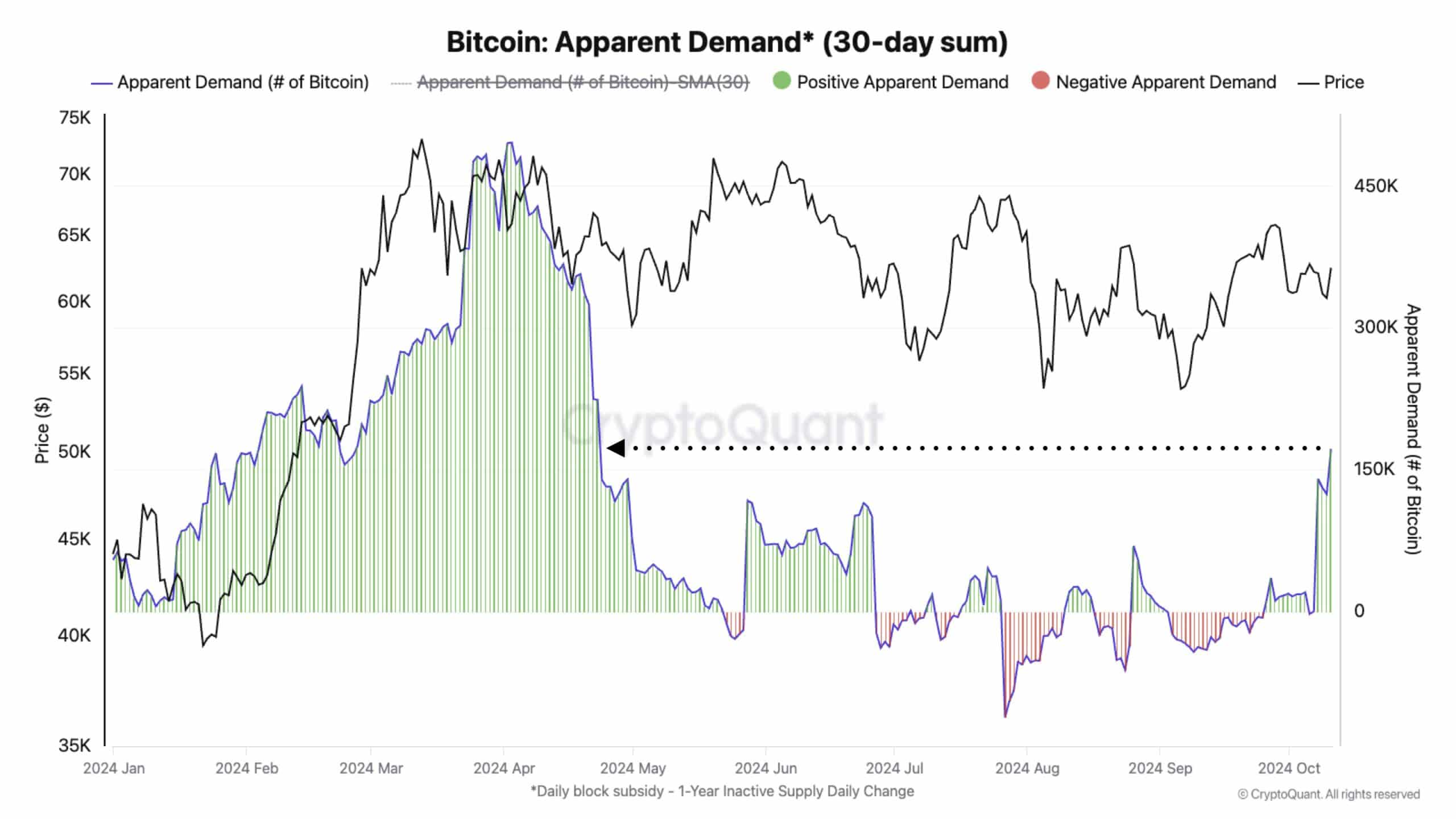

Over the past month, the observed interest in Bitcoin has reached levels similar to those witnessed in May, suggesting a high level of investor appetite.

Investors managed to acquire around 150,000 Bitcoins, with a total value of about $9.4 billion, during the period from late September to mid-October.

If this trend continues for the next fortnight, the increasing demand might justifiably bolster Stockmoney Lizards’ forecasted price surge.

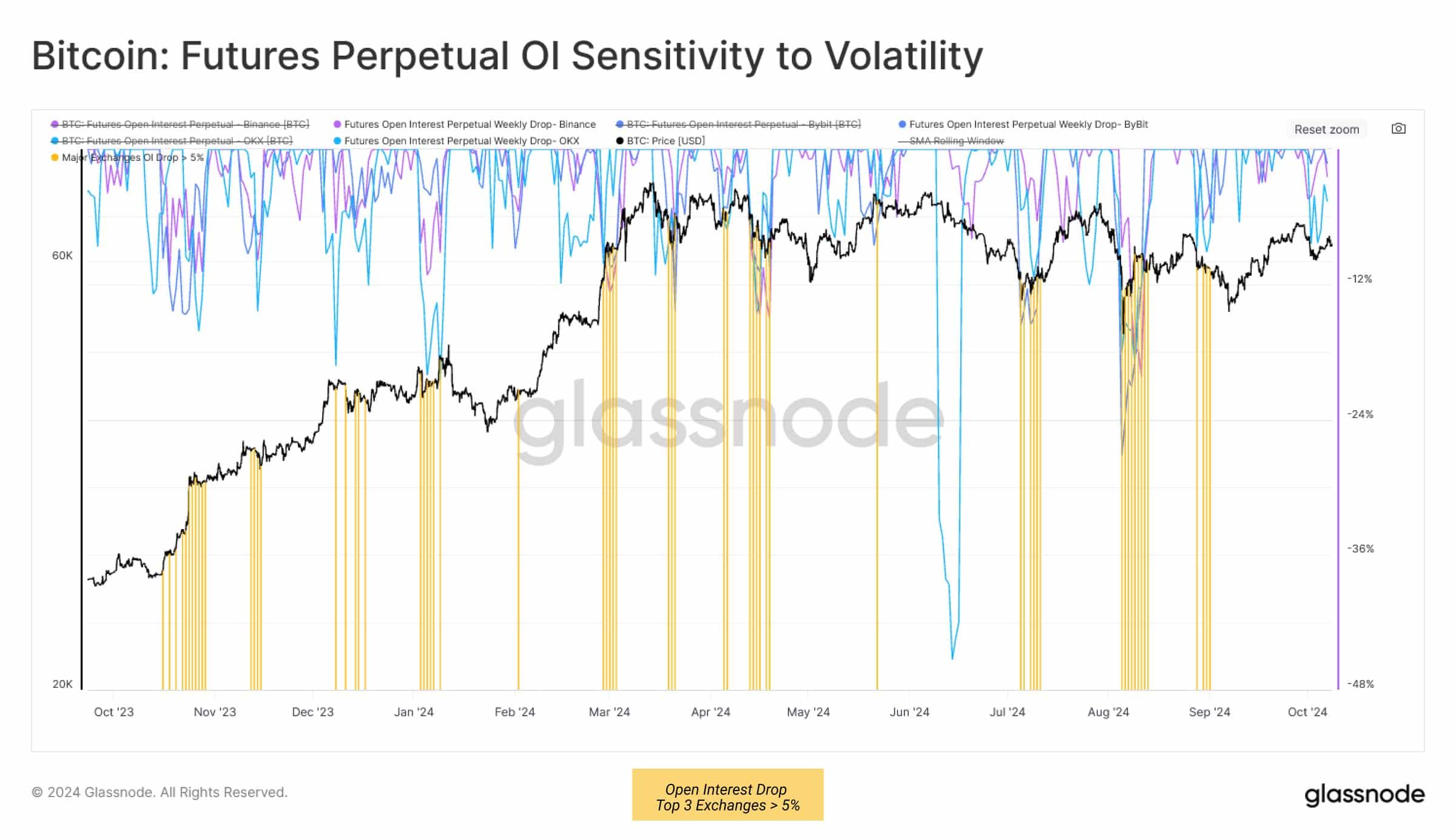

However, increasing reliance, indicated by a rise in Open Interest (OI), could potentially threaten the anticipated breakout.

If you’re new to this context, an increase in leverage implies that traders are taking on more risk because they’re borrowing funds to buy Bitcoin for futures contracts, effectively magnifying their potential profits (and losses).

As per Glassnode’s analysis, a surge in price from approximately $58,900 to $63,400 over the weekend has forced out short-sellers to the tune of around $2.5 billion in open interest.

On the other hand, the analysis company observed that the decrease in Bitcoin options (OI) did not exceed 5%. This percentage is typically significant because when it’s reached, Bitcoin often experiences a prolonged rally if it occurs.

Simply put, high market volatility and potential losses (liquidation risks) from any direction could disrupt the anticipation of a breakout in prices.

Currently, Bitcoin’s value stood at approximately $62,800, and it held steady below its 200-day Moving Average as of the latest report.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-13 15:03