-

Critical buy zones for Bitcoin are worth looking at right now

Bitcoin whales have accumulated 358,000 BTC in July, marking an “unprecedented” transfer of wealth

As a dedicated researcher with extensive experience in cryptocurrency markets and trends, I find the recent developments in Bitcoin particularly intriguing. The volatility we have witnessed over the past few days, with critical price zones being tested, is not an uncommon occurrence in this market. However, the parallels between Bitcoin’s movements and those of the stock market are worth noting and merit close attention from traders and investors alike.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin (BTC) underwent significant price swings in a short timeframe. The value dipped from approximately $67,000 to below $65,000 within the past 24 hours. This volatility has piqued the interest of traders and analysts alike, as they closely monitor the market to understand the underlying causes and potential implications for future price movements.

Indeed, Zen, a well-known figure in the crypto world for trading and analysis, pointed out on his platform that the drop in Bitcoin’s price was remarkably similar to shifts in the stock market. His observation was that,

“Bitcoin, mirroring the stock market’s downturn, plunged significantly. The support level of $64,500 to $65,000 I previously highlighted was bypassed in just one hourly candle, making it unsuitable for fixed limit orders and necessitating closer attention at shorter timeframes.”

As a cautious crypto investor, I strongly advise keeping a keen eye on price fluctuations and being prepared to act swiftly to avoid making hasty buy orders before the market has fully moved in your favor.

Zen pinpointed essential price levels, indicating that investors could consider purchasing Bitcoin between $61,400 and $61,800 as a solid starting point. An alternative buying opportunity might emerge near the CME gap, roughly ranging from $58,500 to $60,500.

Accumulation by Bitcoin whales

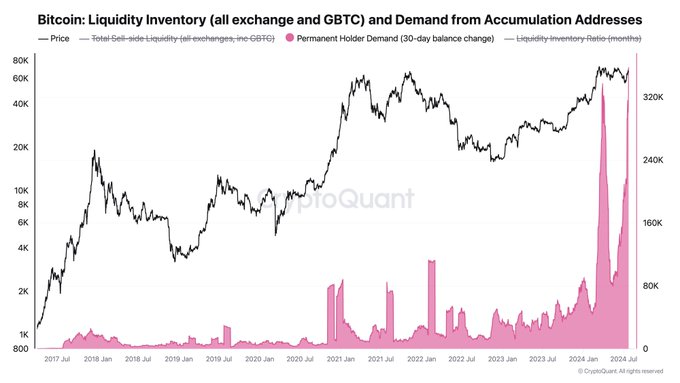

Furthermore, according to data from crypto analytics platform CryptoQuant, there has been a significant increase in Bitcoin purchases by large-scale investors or “whales.” This trend was brought up by CEO Ki-Young Ju in a recent post, who characterized the inflow of coins to these investors as “unmatched” or “unprecedented.”

Over the last month, approximately 358,000 Bitcoin have been transferred to long-term storage wallets. In July specifically, there was an influx of 53,000 Bitcoin into global spot Exchange Traded Funds (ETFs).

Although not all bitcoins are stored in custodial wallets, it’s clear that an accumulation stage is taking place. This is evidenced by a significant shift of crypto wealth within the Bitcoin market.

At the moment of reporting, the price of Bitcoin was at $64,222, and during the last 24 hours, there were trading volumes amounting to $37.44 billion. This represented a decrease of approximately 3.35%.

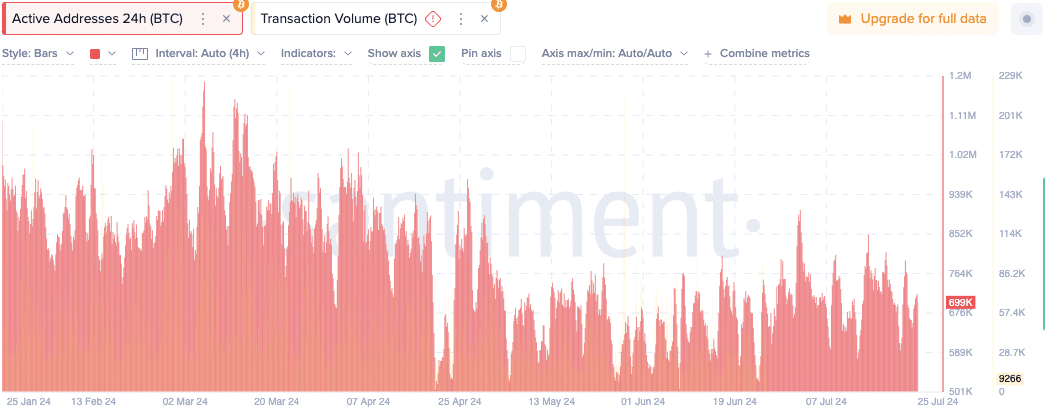

Additionally, the count of actively used Bitcoin addresses has exhibited some fluctuation, ranging between roughly 500,000 and 1.2 million.

Currently, there are approximately 699,000 active Bitcoin addresses, representing a decrease from the peak numbers observed in late February and early June. The total transaction volume amounts to 9,266 Bitcoins.

The Bitcoin market saw a TVL of approximately $701.92 million, demonstrating continuous involvement and financial commitment from investors.

The behavior of active addresses and transaction volume in the market offer significant clues about market trends and investor actions.

Impact of potential political developments

The forthcoming Bitcoin 2024 conference is creating a great deal of buzz, mainly because Donald Trump, a potential 2024 presidential candidate, will be participating in it.

Trump has openly expressed his backing for Bitcoin, suggesting its integration into the U.S. dollar reserves. This bold proposal intends to designate Bitcoin as digital gold. The prospective impact of Trump’s presidency on Bitcoin’s value continues to generate significant buzz within the cryptocurrency community.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-07-26 10:15