Bitcoin and Ether ETFs Pour Money Like It’s Going Out of Style – Seriously! 🚀💸

In a move that could only be described as delightfully predictable, Bitcoin ETFs ended the week with a staggering $260 million snatched up by investors who presumably thought “why not?” Blackrock and Fidelity, the dynamic duo of finance, led the charge while the rest of the crypto world applauded from the sidelines. Meanwhile, Ether ETFs quietly amassed a modest $22 million — because if there’s one thing the crypto market loves, it’s teasing us with hope and barely noticeable inflows.

Crypto Funds End Week in the Green — Or Perhaps Just Looking Slightly Less Red

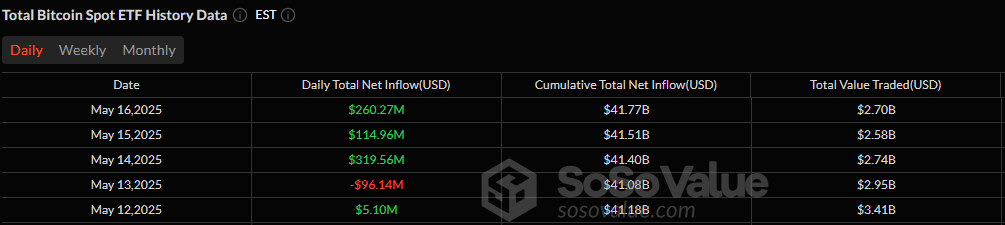

Bitcoin exchange-traded funds (ETFs) wrapped up the week with a confidence boost that made economists question their life choices, locking in a shiny $260.27 million net inflow. Blackrock’s IBIT led the parade with a dazzling $129.73 million, probably dreaming of a tropical island already. Fidelity’s FBTC managed to squeeze in $67.95 million, while ARK 21Shares’ ARKB joined the party with $57.98 million, proving that even finance giants can’t resist shiny new toys.

A tiny $4.61 million slipped into Grayscale’s Bitcoin Mini Trust, because who doesn’t love a good mini? The volume was a jaw-dropping $2.70 billion, suggesting that someone is still very much interested in waving around their money like a caffeinated squirrel. Total net assets climbed to a healthy $122.67 billion, giving the market that warm, fuzzy feeling — or maybe just confusion.

Ether ETFs also decided to play along, scooping up a modest $22 million with a hint of optimism that probably just means “we’re all pretending this makes sense.” Fidelity’s FETH led the tiny army with $13.57 million, and Grayscale’s Ether Mini Trust added a charming $8.55 million — because who doesn’t want a mini trust? Like their Bitcoin relatives, all nine ether ETFs remained happily unflustered by outflows, instead choosing to keep their balances perfectly boring. Trading volume was a gentle $213.90 million, and net assets closed at a respectable $8.97 billion. Not bad, really, for something that sounds like a fancy cocktail.

All in all, the numbers paint a picture of a bullish week for crypto ETFs, especially Bitcoin, which continues to attract enough inflow to make economists wonder if they should start researching new hobbies. Ether’s late-week momentum offers a tiny but hopeful sign that perhaps… just perhaps… the market isn’t entirely dead inside.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2025-05-19 19:59