Blackrock, that grand maestro of finance, has deemed bitcoin worthy of a standing ovation in its 2025 investment gala, placing the Ishares Bitcoin Trust (IBIT) on the marquee with all the fanfare of a debutante at Buckingham Palace.

IBIT’s Capital Haul Helps Bitcoin Crack Blackrock’s 2025 Theme List

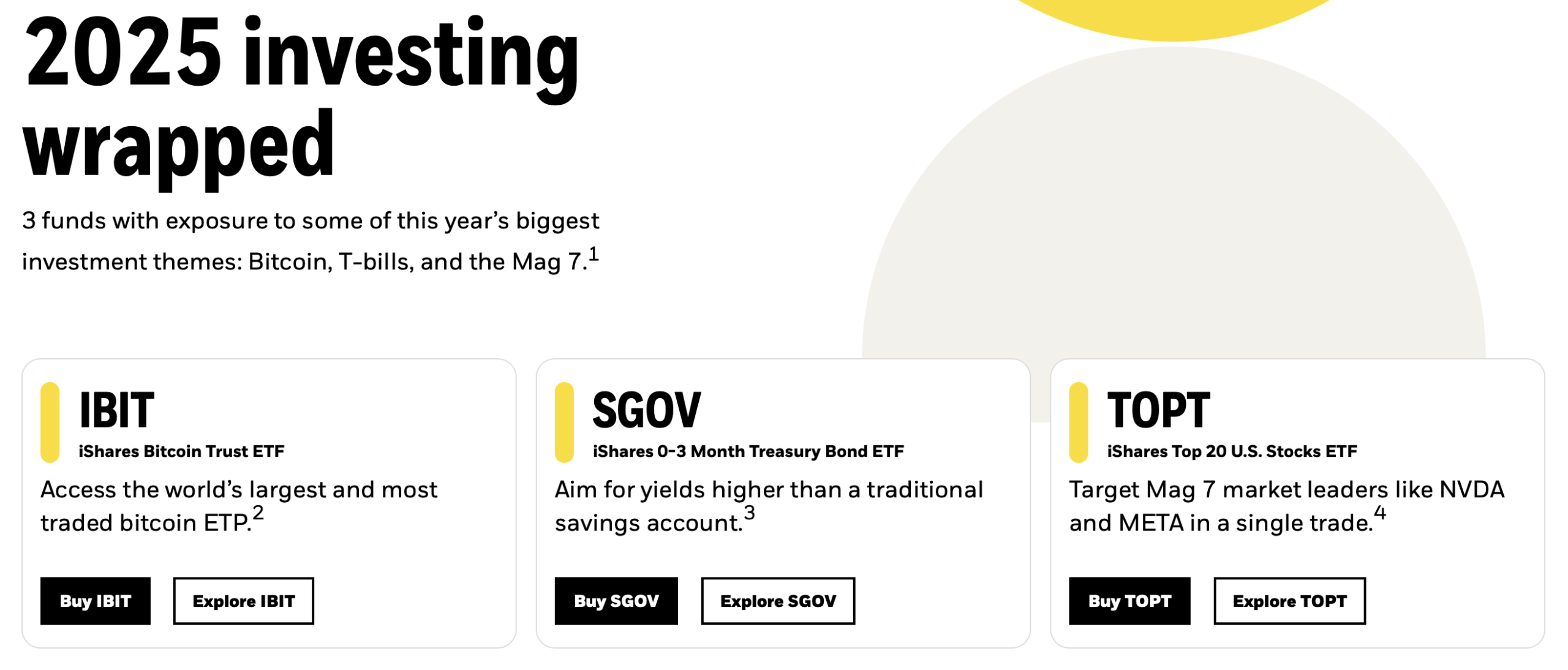

The feature marks a dramatic pivot from the world’s largest asset manager, treating bitcoin not as a rogue guest at the ball but as the host with the most. The “2025 investing wrapped” section pairs IBIT with short-term Treasurys (SGOV) and large-cap U.S. equities (TOPT), as if to say, “Yes, even the traditionalists have succumbed to the siren song of crypto.”

By elevating bitcoin to this triumvirate, Blackrock declares it less a speculative trinket and more a cornerstone of portfolios, much like a well-tied cravat or a perfectly timed quip. And what of IBIT? It danced atop global ETF inflow tables in 2025, outshining even the most seasoned financial veterans with a charm offensive that would make a Victorian poet weep.

Only a few ancient equity and bond products managed to outpace IBIT’s $25 billion in net new allocations-a feat akin to outdrinking a sailor at a pub quiz. Investors poured money into IBIT not for a quick thrill but for a seat at the table, as if saying, “We’re here for the long game, even if the scorecard looks suspiciously like a rollercoaster.”

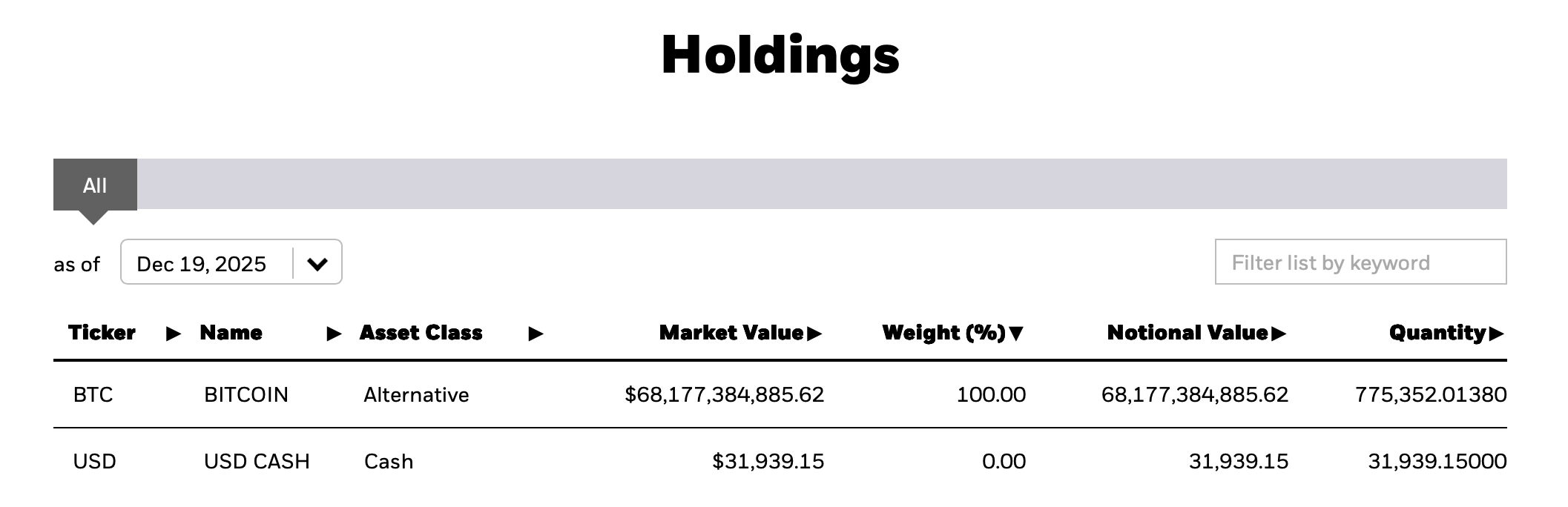

Since its January 2024 launch, sosovalue.com metrics reveal IBIT’s net inflows hit $62.49 billion, a sum so staggering it makes the word “dominant” seem almost modest. As of Dec. 19, 2025, the fund held 775,352.01 BTC, granting Blackrock custody of a Bitcoin hoard that would make Scrooge McDuck faint. 💰

The fund’s prominence on Blackrock’s website isn’t mere decoration-it’s a declaration. Traditional finance now whispers bitcoin’s name with the same reverence once reserved for tulips in 1637. Even as IBIT finished 2025 down 9.6% (a performance that would make a stockbroker sigh like a deflated balloon), investors clung to it like vultures to a feast.

Why? Because in 2025, bitcoin became less a trade and more a thesis-a long-duration love letter written in code. Its 5.6% annual decline? Merely a comma in the novel of its adoption. 📖

Regulatory tailwinds in mid-2025-permitting in-kind creations and redemptions for crypto ETFs-smoothed the path for institutional investors, who now treat crypto like a well-aged Bordeaux: complex, valuable, and slightly misunderstood by those who still think it’s just a fancy calculator app.

By anointing IBIT as a 2025 theme, Blackrock isn’t just playing defense-it’s waltzing into the future with bitcoin in hand, declaring, “This is no passing fancy. This is the new normal.” And if the numbers are to be believed, even the skeptics are now humming along to the tune. 🎶

FAQ ❓

- What is IBIT?

IBIT is Blackrock’s glittering bauble of a Bitcoin ETF, where one can invest in digital gold without leaving the comfort of traditional markets. - Why did Blackrock feature IBIT in its 2025 investment themes?

Because even the most stoic asset managers have finally succumbed to the siren song of Bitcoin, pairing it with Treasurys and equities like a Victorian hostess matchmaking her guests. - How much investor demand did IBIT attract in 2025?

Enough to make Fidelity and Grayscale weep into their tea, with IBIT’s $70.8 billion AUM dwarfing its rivals like a peacock strutting past a sparrow. 🦜 - How much bitcoin does IBIT hold?

775,352.01 BTC-enough to fill a vault the size of a small castle. Or, as the British might say, “Quite the collection.”

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Controller Settings for ARC Raiders

- Resident Evil Requiem cast: Full list of voice actors

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- How to Build a Waterfall in Enshrouded

- The 10 Best Episodes Of Star Trek: Enterprise

- AMINA Bank’s Crypto License: What Could Possibly Go Wrong?

2025-12-22 23:01