-

BTC and the S&P 500 have been seeing a high correlation lately

Cryptocurrency has continued to trade above $65,000 on the price charts

As a seasoned analyst with over two decades of experience in financial markets, I find it fascinating to observe the evolving dynamics between Bitcoin (BTC) and traditional stocks like the S&P 500. The correlation we’re seeing now is a testament to how digital currencies are increasingly becoming integral parts of the global financial system.

In more straightforward terms: The price of Bitcoin (BTC) has just surpassed a major resistance point, indicating a continued upward trend on the graphs. Remarkably, Bitcoin’s connection to U.S stocks has grown stronger than it has been in two years. This suggests that Bitcoin is starting to follow the movements of traditional financial markets more closely.

Bitcoin’s correlation with U.S stocks hits two-year high

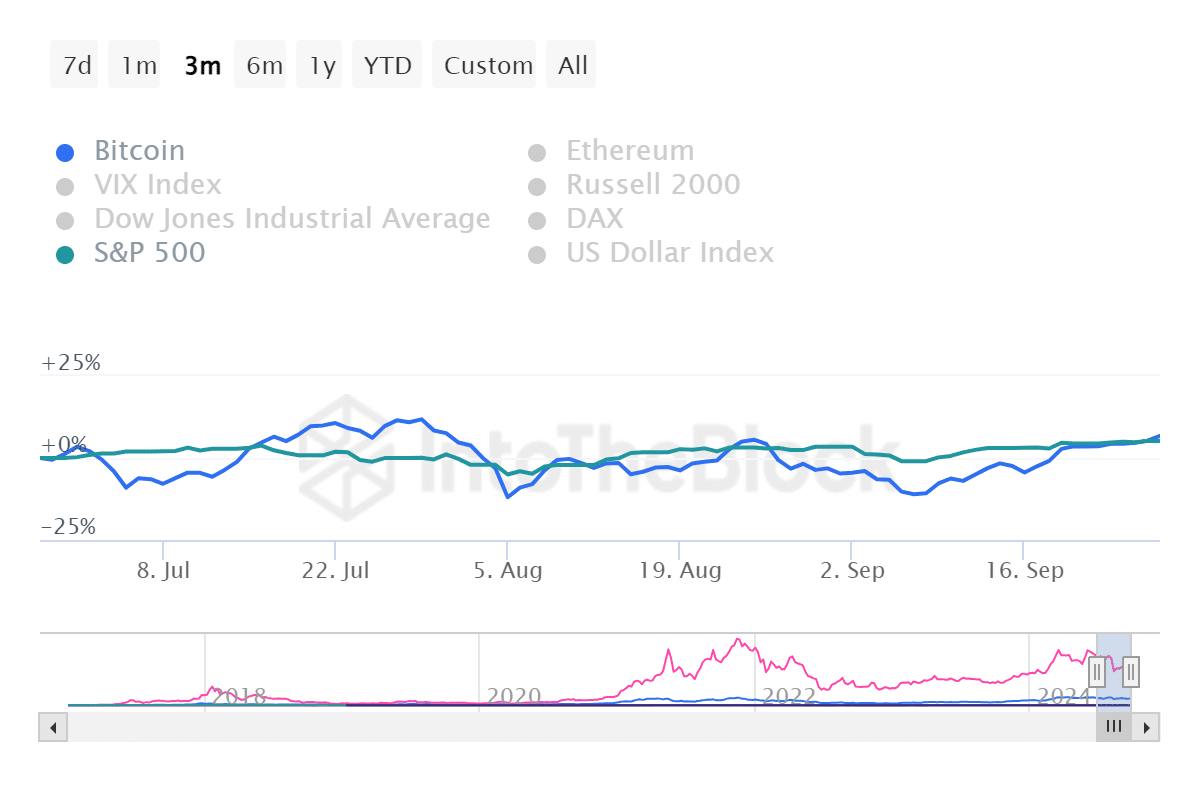

As an analyst, I’ve recently noticed some fascinating trends in the correlation between Bitcoin and U.S. stocks, as reported by IntoTheBlock. Over the past three months, Bitcoin has exhibited a moderate level of volatility, experiencing slight upward and downward fluctuations that have kept it largely within its initial value range. This stability, despite the market’s turbulence, is quite intriguing.

From my analysis, I’ve observed that Bitcoin’s price fluctuations have generally remained steady throughout the month, though there’s been a hint of a gradually ascending trend noticeable as we approached the end of September.

Instead, it’s worth noting that while Bitcoin tends to show more volatile behavior, the S&P 500 has demonstrated a steadier performance with less dramatic fluctuations. Interestingly, both Bitcoin and the S&P 500 have generally responded in a similar manner to market trends, indicating shared sentiments among investors.

Despite Bitcoin’s tendency for larger fluctuations due to its volatile nature, its current trajectory suggests it functions much like a high-risk investment asset. It closely tracks broader economic conditions and investor moods.

Implications for Bitcoin investors

As a crypto investor, I’ve noticed that Bitcoin’s price trajectory aligns with a “risk-on” climate – one where investors choose to either keep or slightly boost their holdings of conventional stocks and digital currencies. If the S&P 500 maintains its current robust performance or improves further, Bitcoin might bask in the optimistic atmosphere. However, it’s essential to remember that any adverse events impacting traditional equities could potentially influence Bitcoin too, given their interconnected movements during this period.

Whenever I observe the ongoing link between Bitcoin’s price fluctuations and traditional stocks, I can’t help but notice that when the market is on an upward trend, it tends to be a positive sign for Bitcoin. This bullish sentiment often sparks increased interest in Bitcoin and other cryptocurrencies, as investors view this time as a chance to take on more risk and pour their funds into these assets.

Bitcoin continues its upward momentum

Looking at the day-by-day Bitcoin chart, we noticed that its closing price increased by a modest 0.99% in the previous trading period.

Initially, the price peaked at roughly $66,000 but soon stabilized around $65,789. Currently, Bitcoin is being traded at about $65,660, showing a minor decrease of almost 1% according to the latest data on the charts.

To elaborate, an examination of its Average True Range (ATR) revealed a figure roughly equal to 2,099.44. In simpler terms, this signifies that Bitcoin’s average price fluctuation (from the highest to the lowest point) across the past 14 trading sessions is approximately $2,099. Notably, the ATR has been trending downward since mid-August, suggesting a decrease in Bitcoin’s price volatility over the period.

In simpler terms, it suggests a decrease in the intensity of price fluctuations in the market, as compared to earlier months.

– Read Bitcoin (BTC) Price Prediction 2024-25

If the Asset Turnover Ratio (ATR) is low, it could suggest that the asset might be preparing for a breakthrough, moving either upward or downward.

Read More

2024-09-28 20:07