- The evidence at hand shows that Bitcoin is likely headed much higher.

- Bitcoin aged 6 months and above saw reduced activity in the past two months.

As a researcher with experience in analyzing cryptocurrency markets, I’ve been closely monitoring Bitcoin’s recent price action and the activity of different cohorts of holders. Based on the evidence at hand, I believe that Bitcoin is likely headed much higher in the long term.

Bitcoin’s price advance came to a halt following its surge above the $67,000 threshold last week. Reaching an all-time high of $72,000 on May 21st, it has since retreated by approximately 5.7%, now trading at around $67,800 as reported currently.

A recent study examined the growing interest in Bitcoin investment vehicles, revealing that a large portion of the new investments originated from the US market.

As an analyst, I’ve noticed that the recent market downturn has put a halt to the bullish momentum we had been experiencing. It seemed that the bulls weren’t quite prepared to push beyond the $71.5k mark just yet.

As a crypto investor, I believe the long-term perspective is optimistic, and based on certain metrics, we’ve only reached the midpoint of this ongoing bull market.

Bitcoin’s bull run still has some fuel left

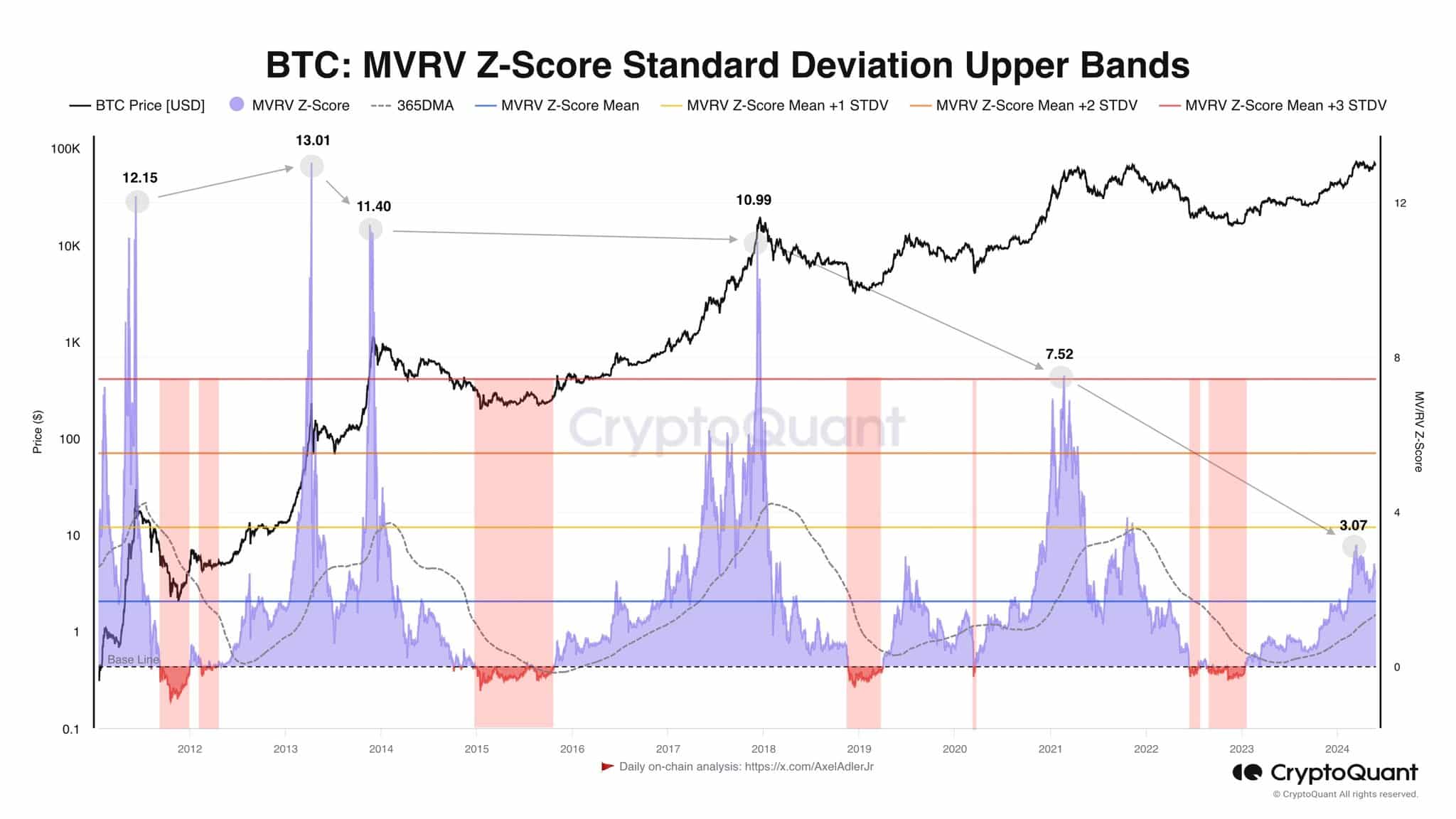

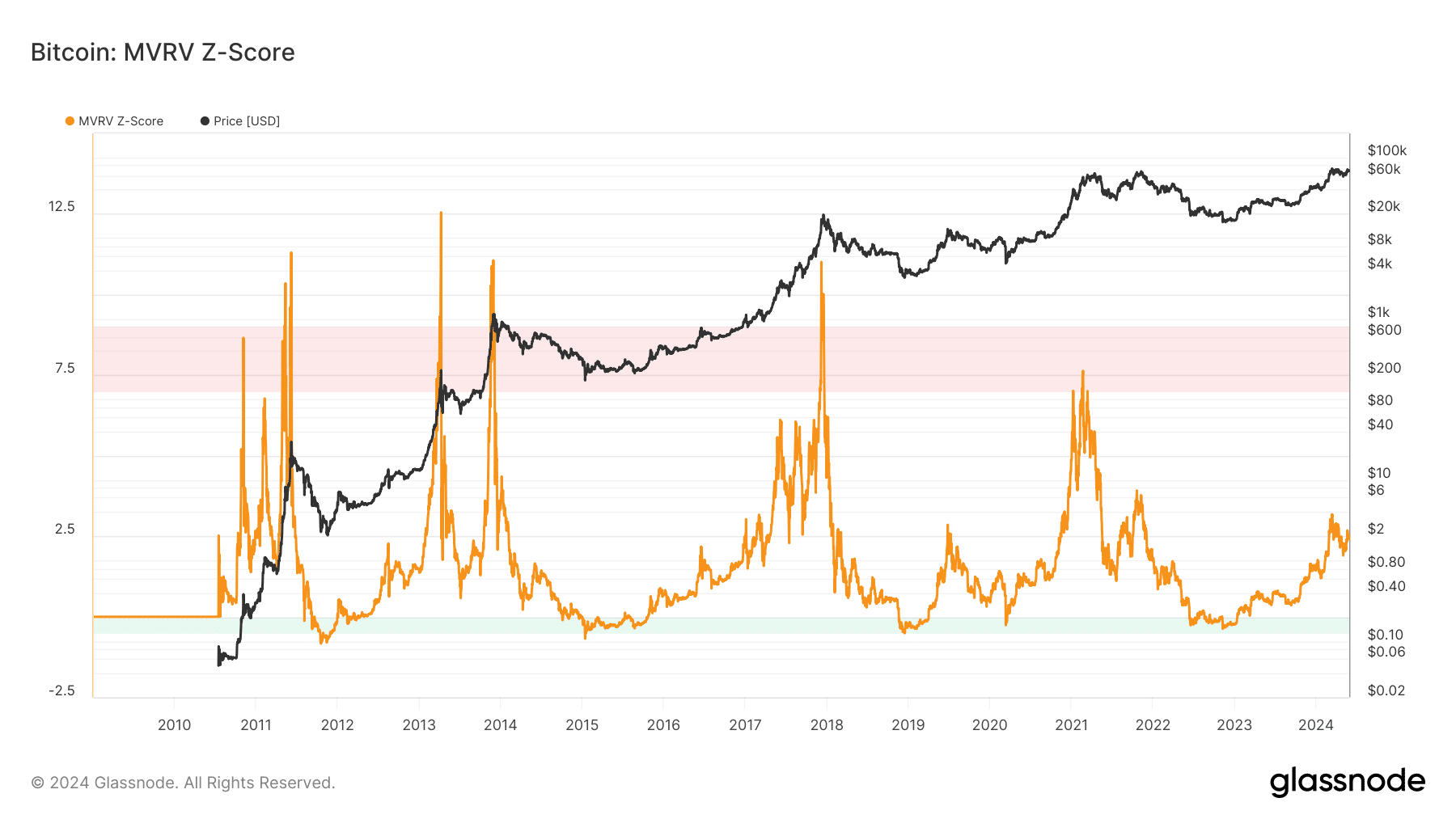

In a recent post on platform X, crypto analyst Axel Adler employed the Bitcoins MVRV Z scores to convey that the ongoing cycle is still in its midpoint.

This measurement determines if Bitcoin is relatively expensive or cheap by assessing it against its estimated worth.

One way to rephrase this in clear and conversational language is: MVR (Market Value to Realized Value) ratio is a metric that compares an asset’s market capitalization to the total amount of money investors have paid for it over time. If the market value is significantly greater than the realized value, it could be a sign that the asset has reached a peak in the market.

As a seasoned crypto investor, I’ve come to appreciate the value of various indicators in identifying potential market trends. One such valuable metric is the MVRV Z-score for Bitcoin. In simpler terms, this indicator measures the difference between the moving average price and the realized price, then compares it with the standard deviation of the market cap.

As a crypto investor, I’ve noticed an intriguing trend in this particular digital asset’s performance. Lately, its key metric has surged as high as 3.07. This significant increase suggests that there’s a strong possibility of further price growth in the upcoming months.

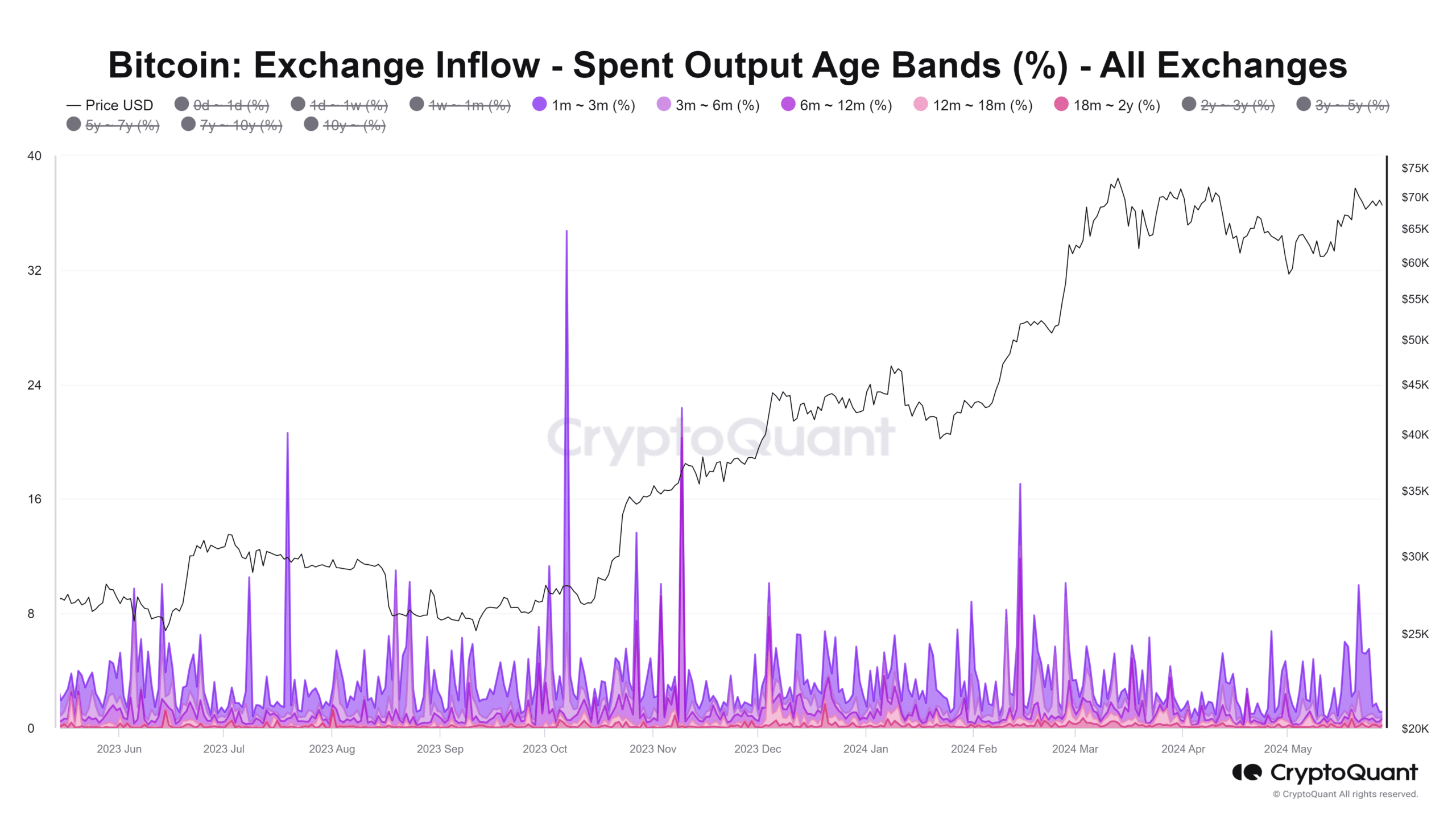

Long-term holders have been diamond hands in the past two months

On February 28th, there was noticeable excitement among Bitcoin investors who had held their coins for at least six months. The age bracket of investors between three to six months showed the most activity, signaling profitable transactions from this segment.

Over the last two months, I’ve noticed that investors with a holding period of one to three months have been quite active in the crypto market. They showed increased selling activity on May 21st when Bitcoin prices surpassed $70,000.

In April and May, the majority of older crypto holders experienced minimal selling pressure towards exchanges. This can be attributed to the widespread belief that a price surge would occur following the halving event. This anticipation remains strong among holders.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-30 04:07