-

BTC could be at risk as carry trade unwind persists.

Will the risk-on mode from US BTC ETF investors continue?

As a seasoned crypto investor with a keen eye for market trends and a knack for navigating volatile waters, I can’t help but feel a sense of deja vu when I see the carry trade unwind persisting. Having weathered the August storm that was triggered by this very same unwinding, I find myself bracing for potential turbulence once again.

Based on what specialists are saying, the potential risks associated with Bitcoin (BTC) might increase as the ongoing unraveling of the Japanese carry trade continues. Earlier in the week, Bitcoin surged to $58K, providing some relief. However, its gains were partially erased following the Trump-Harris US presidential debate.

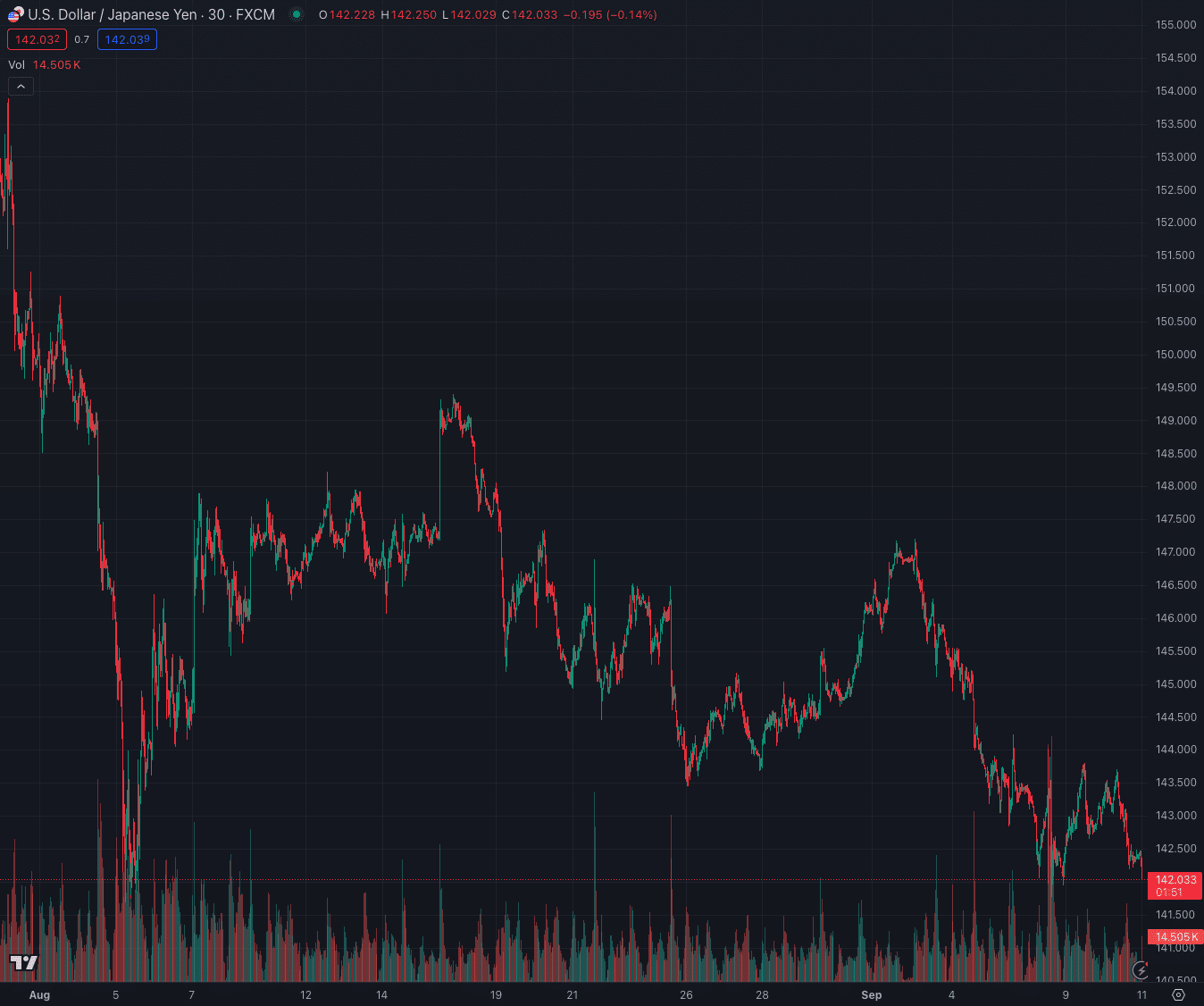

In addition to the U.S. elections, the continuing unwinding of the carry trade may impact Bitcoin. This unwinding, which took place in early August and caused Bitcoin’s price to drop to $49K, is associated with a strengthening of the Japanese Yen compared to the U.S. dollar.

Will carry trade unwind affect BTC?

A pattern reminiscent of past occurrences has emerged, leading BitMEX founder Arthur Hayes to issue a caution about potential risks. In his own words, he warned…

The USDJPY pair is showing signs of a decline, potentially indicating turbulent times in the financial markets once more, as it nears the 140 mark. We’ll have to watch and see if Bitcoin can maintain its stability.

Investors engage in carry trades by borrowing funds from countries with low or nearly non-existent interest rates and using those funds to purchase assets that offer higher returns. Over a period of approximately 17 years, the Japanese Yen has had very low interest rates, making it an attractive option for investors looking to generate better returns in US markets.

However, things shifted when the Bank of Japan increased interest rates in August, leading to a liquidation of carry trades (closing positions) and a subsequent sell-off that extended to cryptocurrency markets as well.

As per Yardeni Research’s latest findings, the carry trade might persist, considering the anticipated 50 basis point reduction in Fed interest rates next week and the injection of liquidity. A portion of their recent report suggests this possibility.

As a crypto investor, I find myself intrigued by the anticipation that the Federal Reserve might decrease our interest rates, coupled with the Bank of Japan’s potential increase in their interest rates. This intriguing dynamic seems to be significantly strengthening the Japanese yen and compelling traders to reconsider their carry trades, as they are forced to unwind these positions.

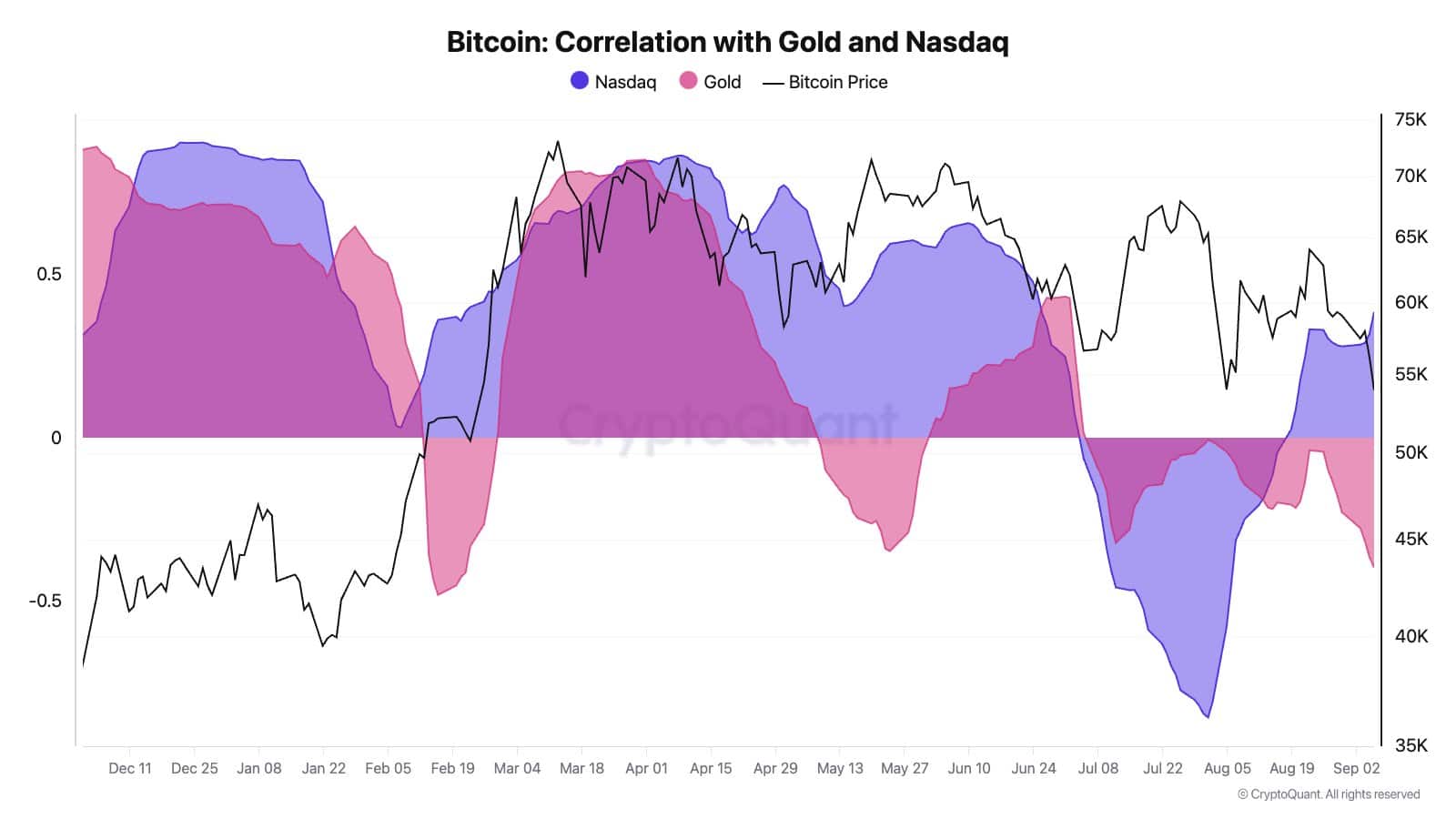

To put it simply, due to a stronger connection between Bitcoin and the Nasdaq compared to gold, the unwinding of carry trades could have a more significant impact on Bitcoin. This means that if there’s another market sell-off, Bitcoin might also experience a downturn.

Over the last couple of days, investors in U.S.-based Bitcoin ETFs have taken on a more aggressive stance, mirroring the current Bitcoin recovery. These investments have seen net inflows, marking a change from nearly continuous outflows totaling over $1.2 billion previously.

Whether investors will maintain confidence amid carry trade unwind risks remains to be seen

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-11 14:47