- Bitcoin price set to surge as global liquidity rises.

- Assessing next liquidity clusters for Bitcoin.

As a researcher with extensive experience in the crypto markets, I find myself increasingly optimistic about the near-term prospects of Bitcoin (BTC). The recent surge in global liquidity, coupled with favorable macroeconomic conditions, creates an environment ripe for cryptocurrencies to thrive.

Bitcoin (BTC) persists in its robust display, propelled by increasing worldwide liquidity and beneficial macroeconomic circumstances.

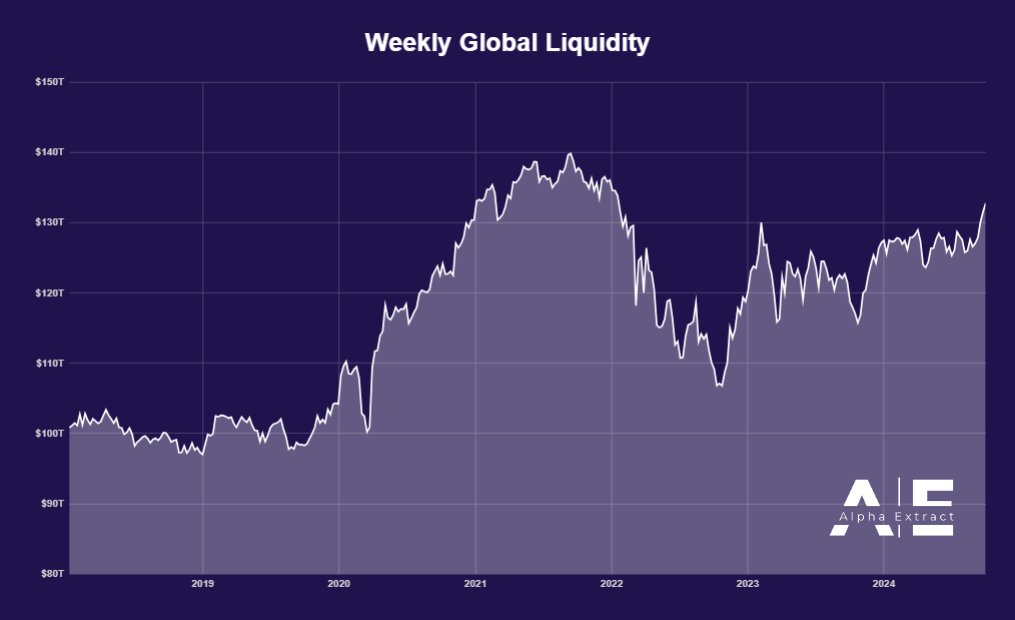

As the worldwide liquidity rises by 0.92%, reaching an unprecedented $132.8 trillion since early 2022, it’s anticipated that Bitcoin will reap the rewards of this trend.

Enhanced security for loans and increased bank activities from China’s central bank have played a role in this increase. While the U.S. Federal Reserve hasn’t initiated a stimulus package yet, financial markets remain hopeful about potential interest rate reductions in the future.

It appears these elements indicate a potential rise in Bitcoin’s price, which might make Q4 an exceptionally optimistic period for the overall cryptocurrency market, suggesting increased bullish sentiments.

Bitcoin’s price action and key levels

The cost of Bitcoin just rebounded from a significant Fibonacci retracement point, which is now around $66,000. Throughout 2021, this particular level has shown to be a crucial signal, indicating both increases and decreases in price.

Respecting this trend demonstrates that Bitcoin follows worldwide liquidity movements. As liquidity increases further, a likely upward movement is anticipated, with the next significant goal being a break above $66,700.

It’s expected that an increase in global liquidity could positively impact Bitcoin, given its role as a key safeguard against rising money supply, similar to gold.

Impact of September’s bullish close

As a seasoned cryptocurrency investor who has been following BTC since its early days, I can confidently say that this September has been one of the most exceptional months for Bitcoin in my personal experience. The 7.35% increase we witnessed at the end of the month not only broke records but also solidified a bullish sentiment that has been building up throughout the year.

Contrary to the general market forecasts of a downturn, the AI models developed by Spot On Chain surprisingly indicated a rise, observing a bullish trend in the following months.

It is likely, approximately 69%, that we’ll see another record high for Bitcoin this month. Additionally, there’s about a 54% probability that the price of Bitcoin could potentially reach $100,000 by the end of this year.

It’s anticipated that the overall cryptocurrency market will gain positively from advantageous global economic conditions, especially if interest rates are reduced by the Federal Reserve and the European Central Bank.

The Federal Reserve is now prioritizing job creation over controlling inflation, and there’s approximately a 42% chance they might reduce interest rates by half a percentage point in November.

As a researcher, I’m keeping a close eye on the upcoming U.S. unemployment figures. If these numbers turn out to be lower than anticipated, it might boost the likelihood that interest rates will decrease even further. Historically, rate cuts have been indicative of a more favorable investment climate for riskier assets such as Bitcoin. Consequently, this could potentially drive up its market price.

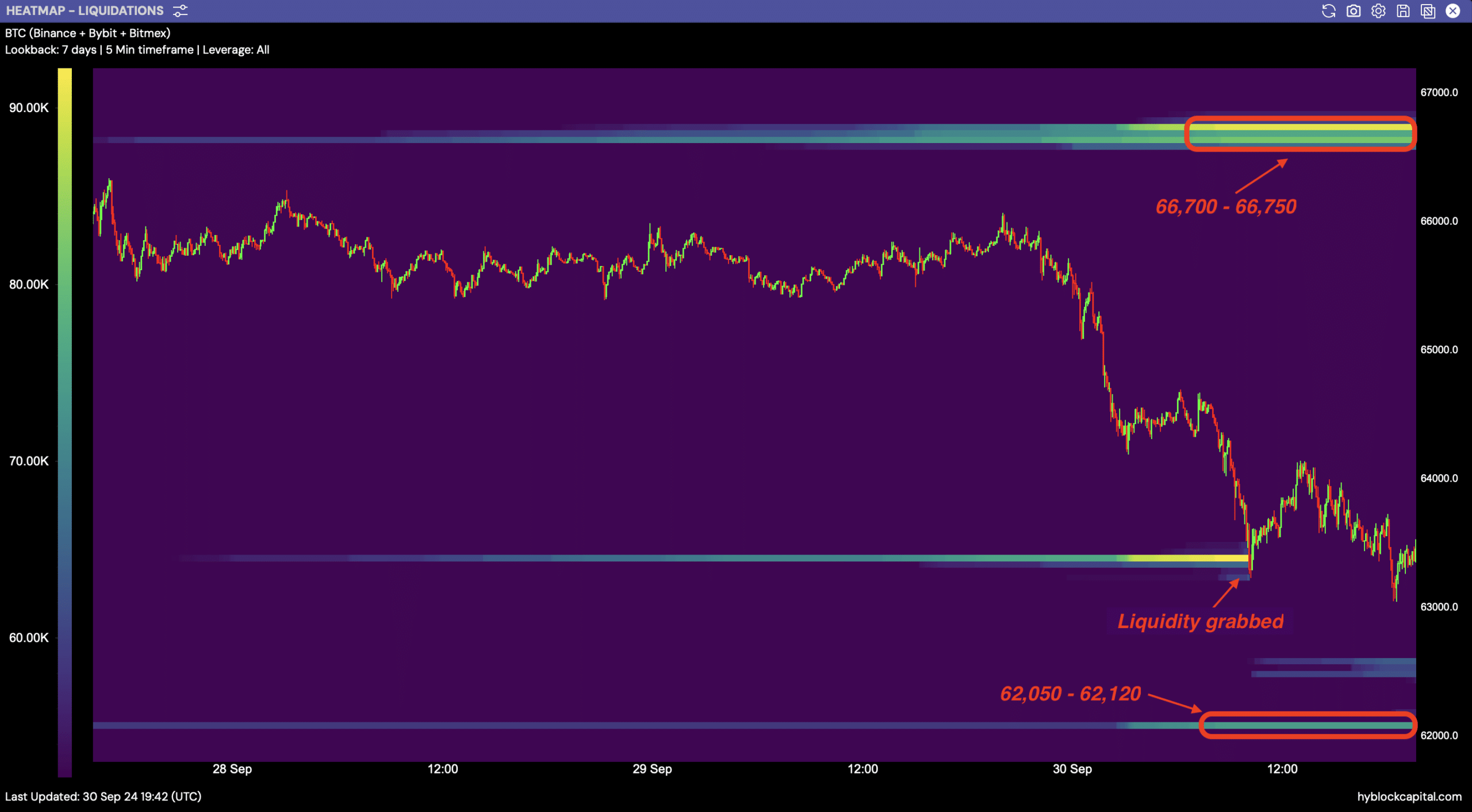

Liquidity clusters to watch

Emerging groups of market liquidity related to Bitcoin are becoming more apparent as its price rises. Dips back to approximately $63,225 have provided an opportunity for Bitcoin to absorb liquidity, potentially signaling a forthcoming shift in its direction.

Clusters with a higher volume of trades are located approximately between $66,700 and $66,750. On the other hand, areas offering more support can be found around $62,050 to $62,120 where there is lower liquidity.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Keeping an eye on these stages is crucial since the growth trajectory of Bitcoin might indicate a surge towards even greater prices, possibly resulting in a price escalation.

With an increase in worldwide available funds, optimistic technological trends, and favorable economic indicators, it seems likely that the price of Bitcoin will rise in the near future.

Read More

2024-10-02 01:44