-

BTC long-term investors accumulated over 21,000 BTC.

Long and short-term investors are holding at a loss.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless cycles of bull and bear runs, and this latest chapter with Bitcoin is no exception.

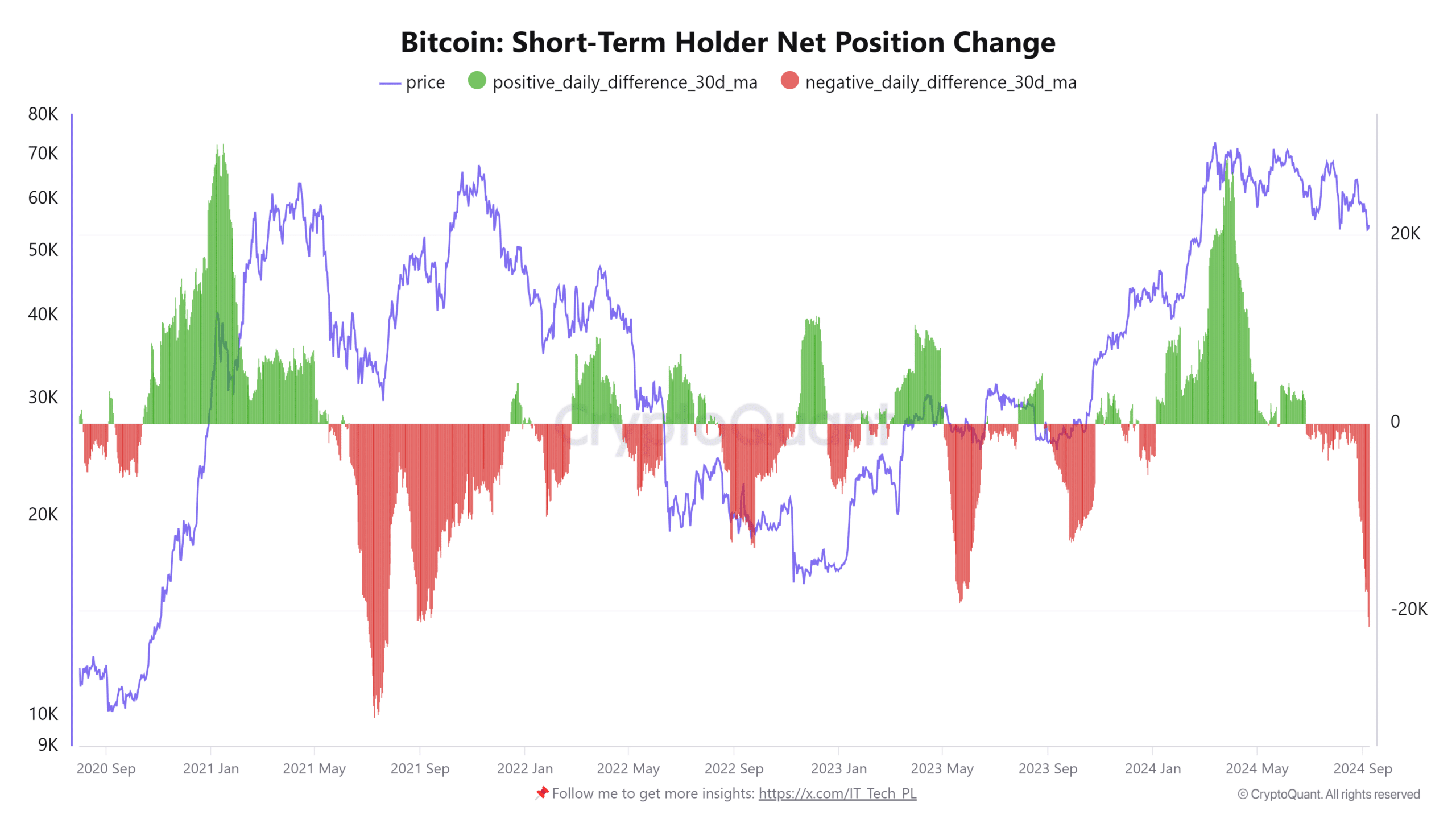

Over the past three months, numerous short-term Bitcoin [BTC] investors have adjusted their approach due to the coin’s unpredictable price fluctuations. As a result, a significant number of them have decided to cash out their holdings.

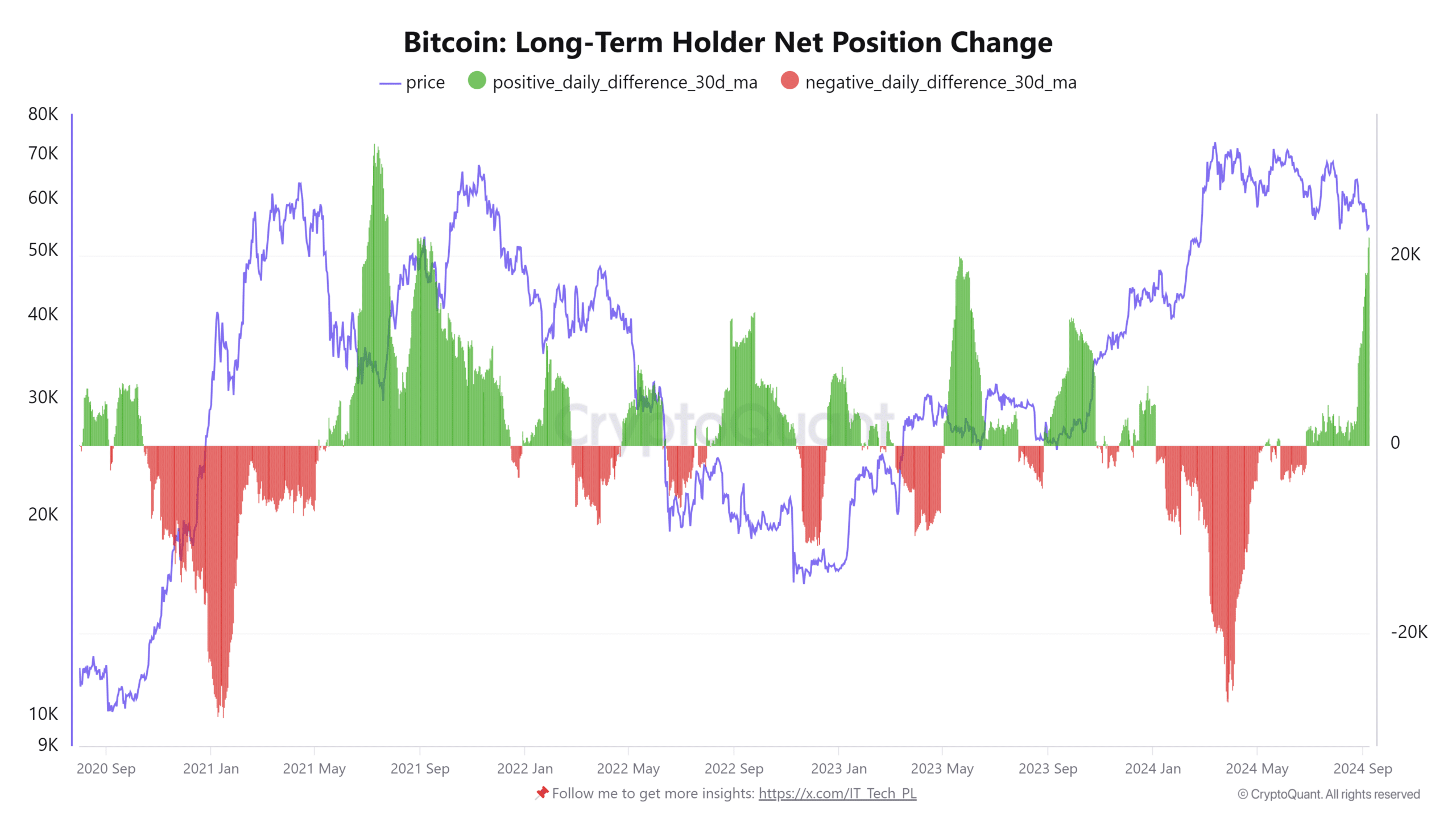

Instead, it’s worth noting that during this timeframe, investors with a long-term perspective have been steadily adding more Bitcoin to their portfolios, indicating faith in its future value.

Over time, the buildup by long-term investors has served as a counterweight to market fluctuations caused by quick-selling short-term investors. This has generally kept the market stable and balanced.

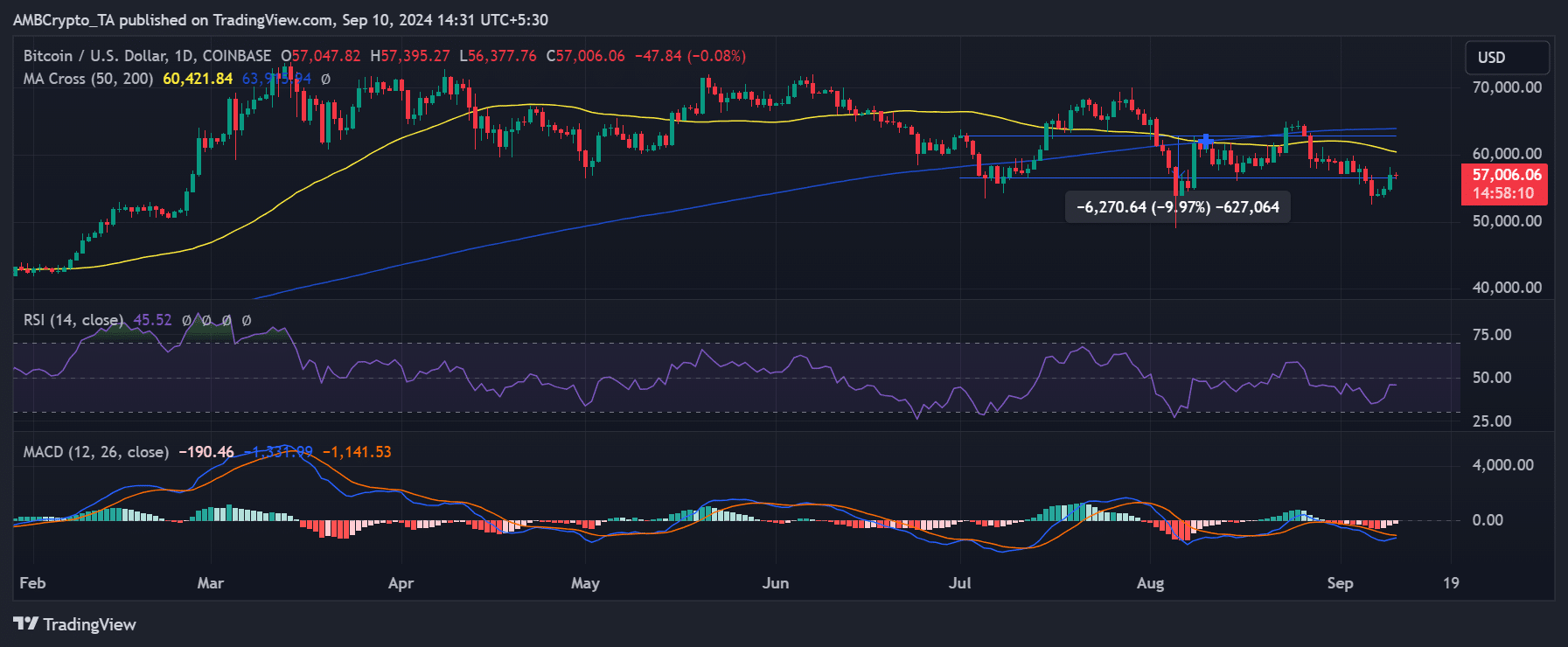

Bitcoin loses almost 10%

According to AMBCrypto’s analysis over a daily period, Bitcoin had declined by almost 10% from July up until the present moment.

Starting from June 1st, Bitcoin’s trading value has seen its fair share of ups and downs, reaching as high as approximately $62,830 initially, but subsequently experiencing various price swings in either direction.

In this span, the price peaked at roughly $65,000, and dipped down to nearly $53,800 as the lowest point.

Currently, Bitcoin is being exchanged for approximately $57,340, demonstrating a minimal rise of almost 1% during the present trading session.

Over this time frame, there have been notable changes in both long-term and short-term positions.

In times of market turbulence, short-term investors often choose to decrease their Bitcoin investments, whereas long-term investors tend to boost their stockpile instead.

Long vs. short Bitcoin investors

The analysis by AMBCrypto on fluctuations in Bitcoin’s short-term and long-term investors’ collective position over the last quarter reveals a significant divergence in their actions.

According to the short-term chart analysis, there was a shift from a positive trend to a negative one approximately on June 1st. Following this change, the negative trajectory strengthened further.

Based on the latest available figures, it was sitting at a level of -21,000, suggesting that numerous short-term investors were choosing to leave the market.

Starting in July, long-term investors have been shifting their positions positively. This trend has persisted, with the latest data indicating an accumulated increase of more than 22,000.

It’s clear that while short-term investors are dumping and leaving Bitcoin, long-term investors are not only holding on but also increasing their ownership of Bitcoin.

During this timeframe, changes in behavior seemed to align with the unpredictable fluctuations in Bitcoin’s price. As the price swayed up and down, short-term investors, who were primarily focused on immediate price swings, tended to sell off to minimize potential losses.

At the same time, long-term investors viewed the price fluctuations as a chance to buy Bitcoin at reduced costs.

Long and short holders remain at a loss

As I delved into the analysis of Bitcoin’s Market Value to Realized Value (MVRV) ratio over 90-day and 180-day periods, it became evident that long-term holders find themselves in a situation where they are currently experiencing a loss.

Over the past 90 days, the MVRV (Market Value to Realized Value) ratio has been roughly -5.80%, indicating that individuals who bought Bitcoin within the last three months have seen a drop of about 5% in the worth of their investments.

Additionally, the 180-day MVRM (Market Value Realized to Market Value Ratio) stood at approximately -9.2%. This suggests that these investors have experienced a loss of about 9% on their investments.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The low MVRV values indicated that Bitcoin might be underpriced, as both short-term and long-term investors were incurring losses. Typically, these MVRV levels have pointed towards a potential market turnaround in the past.

Since these long-term investors boosted their investments during the slump, they are expected to reap greater returns as the market recovers.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-09-10 16:40