-

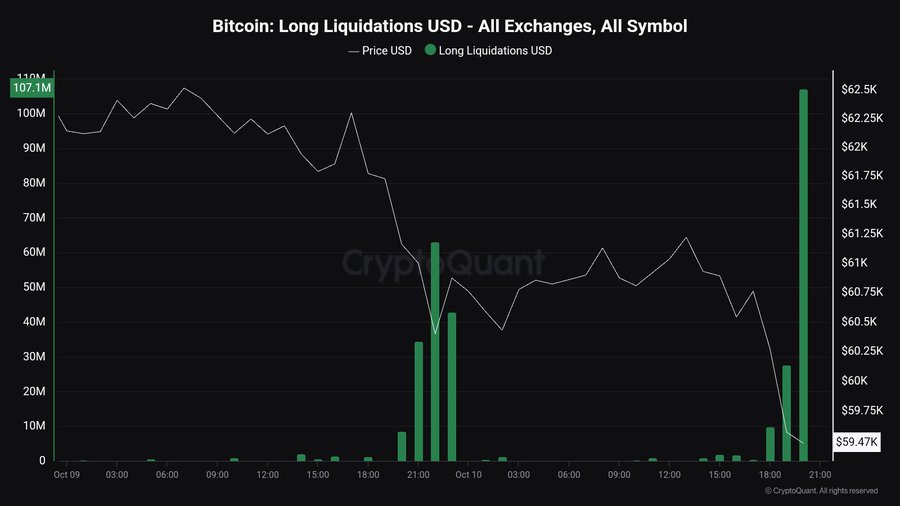

BTC’s recent volatility resulted in total liquidations worth $107 million

Analyst sees $60,600 as the critical level that will determine BTC’s trajectory

As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I find myself constantly intrigued by the rollercoaster ride that is Bitcoin. The recent volatility we’ve seen has been nothing short of breathtaking, with the $107 million worth of liquidations serving as a stark reminder of the risks involved in this space.

Starting from October, Bitcoin‘s value has experienced significant ups and downs. During this timeframe, BTC reached an all-time high of $66,500 and plummeted to a recent low of $58,800, with the latter being a price point that was just touched in under 24 hours.

The decline beneath the $60,000 mark significantly affected Bitcoin holders, resulting in numerous forced sell-offs. In reality, approximately $107 million worth of positions were forcibly closed.

Under the present market circumstances, with volatility on the rise, there are growing doubts regarding Bitcoin’s future course. That’s why well-known crypto analysts like Rekt Capital advise that Bitcoin needs to stay above the $60,600 level for a possible price increase.

What does market sentiment say?

According to RektCapital’s assessment, Bitcoin appears to be testing the $60,600 price level as a potential support area for the second week in a row.

Based on this examination, Bitcoin (BTC) could potentially experience an upward trend if it finishes above this specific threshold on its weekly graphs. Consequently, to capitalize on any imminent growth, Bitcoin should maintain this particular price range, as doing so will set the stage for more increases.

On the other hand, the analyst pointed out that should the cryptocurrency fail to maintain its current level of support, it might trigger a new phase of declines.

What do the charts say?

Currently, Bitcoin is being traded for approximately $60,573. This represents a decrease of 0.58% in the daily price movement and a more significant drop of 1.01% over the past week, suggesting an ongoing bearish trend.

Given the recent market trends, the forecast by RektCapital might raise some concerns due to its prediction of possible price decreases.

Hence, it’s essential to determine what other market fundamentals suggest.

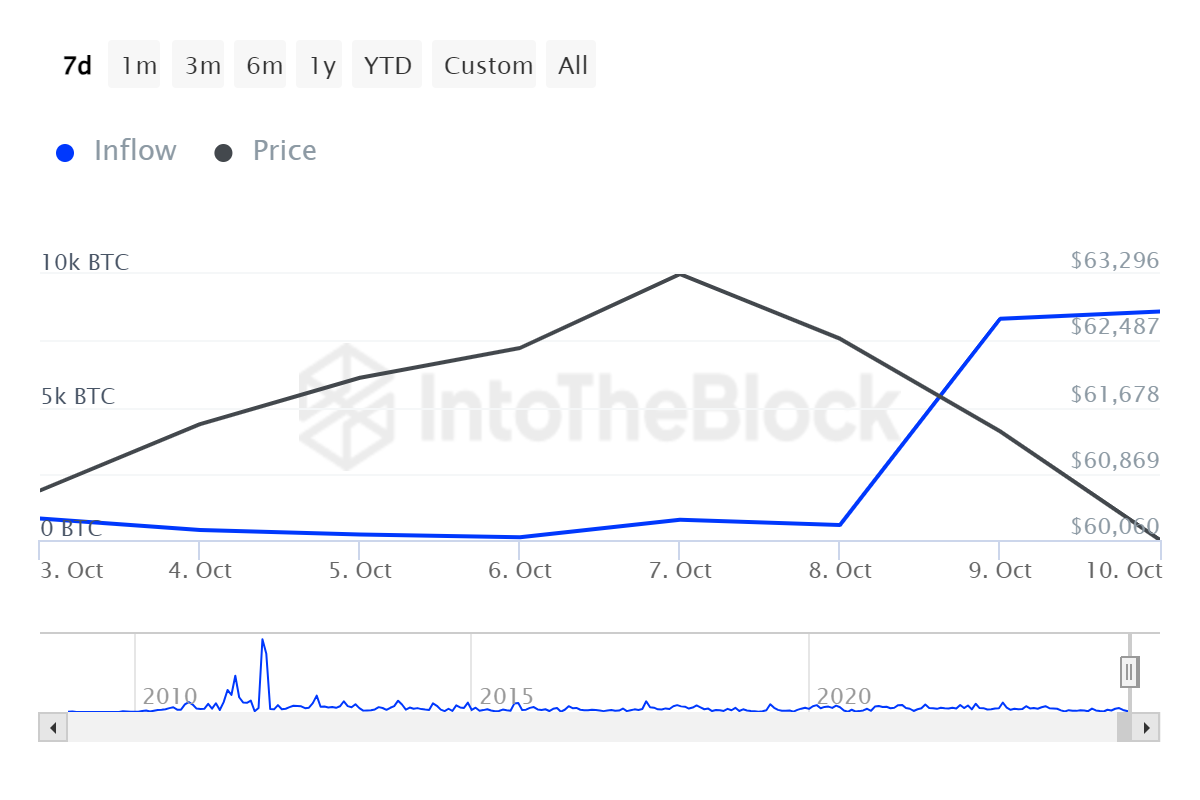

Initially, there’s been a significant increase in the influx of substantial Bitcoin holders, rising from approximately 560.95 to 8,590 over the last few days. An uptick in these large holders indicates that investors are actively purchasing during market dips and adopting long-term investment strategies.

This type of market action indicates that major investors expect prices to increase over the coming period.

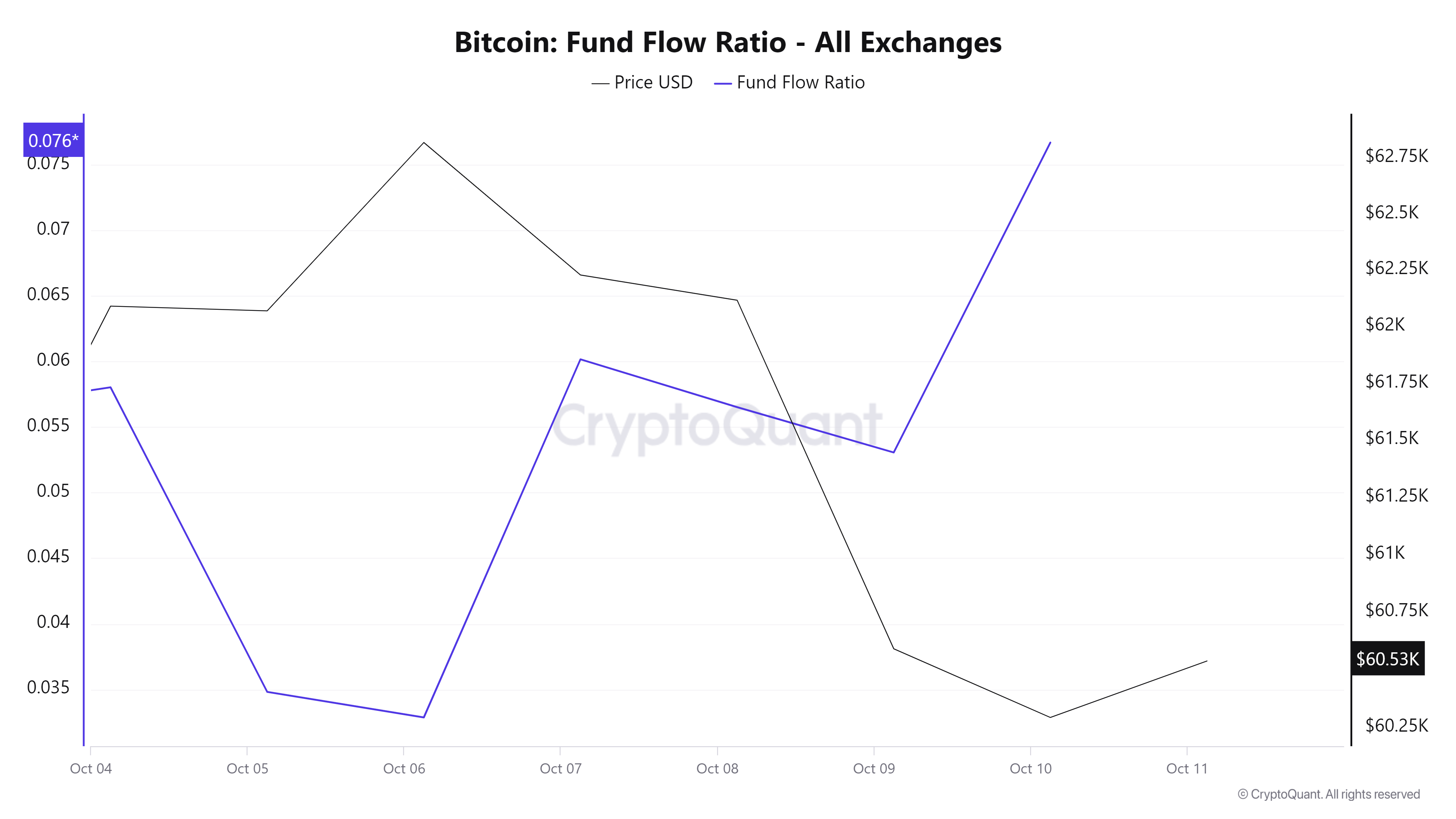

Furthermore, the Bitcoin Fund Flow Ratio surged from a minimum of 0.032 to 0.077, suggesting an increase in purchasing enthusiasm since investors are transferring funds for BTC acquisition.

Such behavior is usually associated with bullish market sentiment.

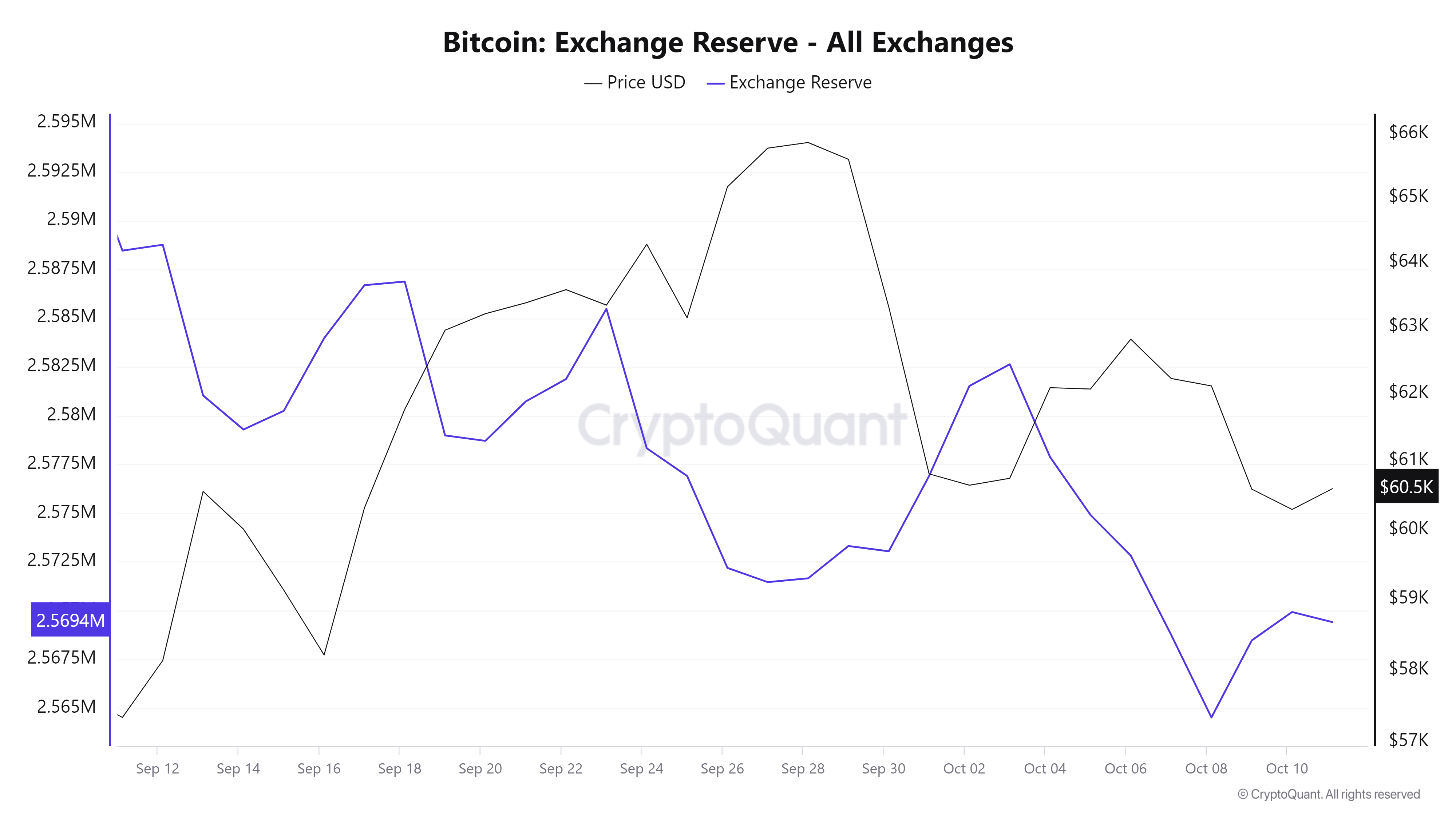

From my analysis perspective, I’ve observed that Bitcoin’s exchange reserves have been consistently decreasing over the past month. This trend suggests a long-term holding strategy among investors, indicating they are less inclined to offload their BTC in the immediate future. Essentially, this is a bullish sign because it reduces the amount of Bitcoin available for sale on exchanges, thereby diminishing potential selling pressure.

In simpler terms, the current decrease in price has slowed down and there’s a possibility that Bitcoin might continue rising. If the optimistic market feelings persist, Bitcoin could break through the resistance at around $61,875. However, if it fails to hold this level, we might see Bitcoin falling back to approximately $58,272.

Read More

2024-10-11 14:15