As a seasoned crypto investor with scars from previous market cycles etched deep into my trading journal, I find myself cautiously optimistic about Bitcoin [BTC] approaching another All-Time High (ATH). The long/short ratio data on Binance, revealing nearly 60% of traders holding short positions, is a classic case of the herd mentality.

Although Bitcoin [BTC] currently trades around $104,500 and seems to be on an upward trajectory, the long/short ratio on Binance shows that almost 60% of traders are betting on it dropping in price. However, with Bitcoin trading above significant moving averages, the bulls still hold sway, ready to drive prices up further if they manage to break through the resistance at $105,000.

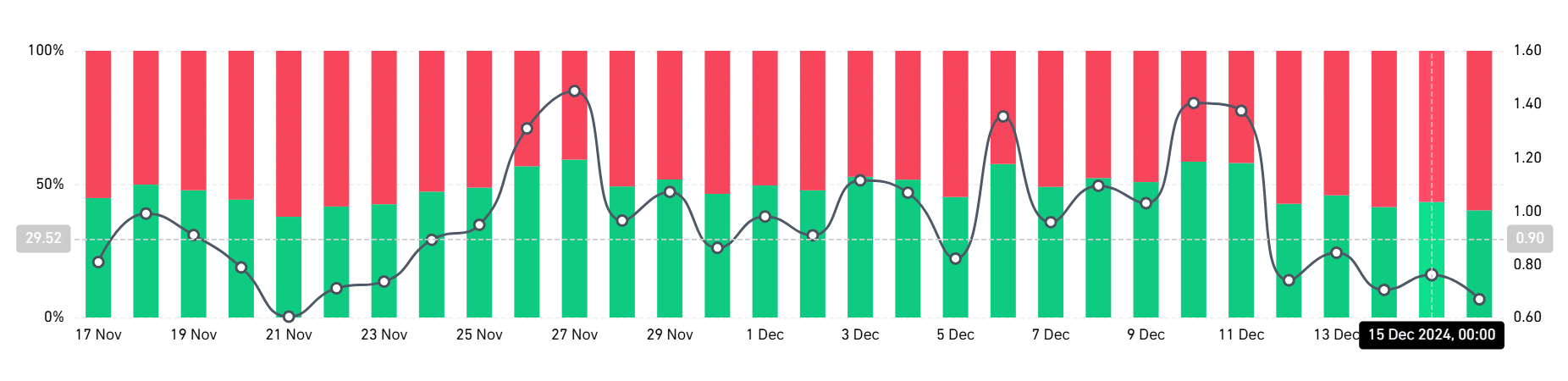

Long/short ratio signals growing bearish bias

According to the most recent analysis from Coinglass, approximately 60% of traders on Binance are currently betting against Bitcoin by taking short positions. This high proportion of bears suggests a degree of caution among investors, despite Bitcoin’s ongoing price increase.

Over the past two trading days, the balance has heavily favored short positions in the long/short ratio charts, indicating that numerous traders are taking precautions by short-selling to protect themselves from potential price corrections or oversold market conditions.

It’s worth noting that despite the pessimistic outlook, Bitcoin has been holding its ground, currently hovering near $104,500.

Such a divergence between sentiment and price performance may hint at underlying market strength, with bears potentially setting themselves up for liquidation in the event of further upside momentum.

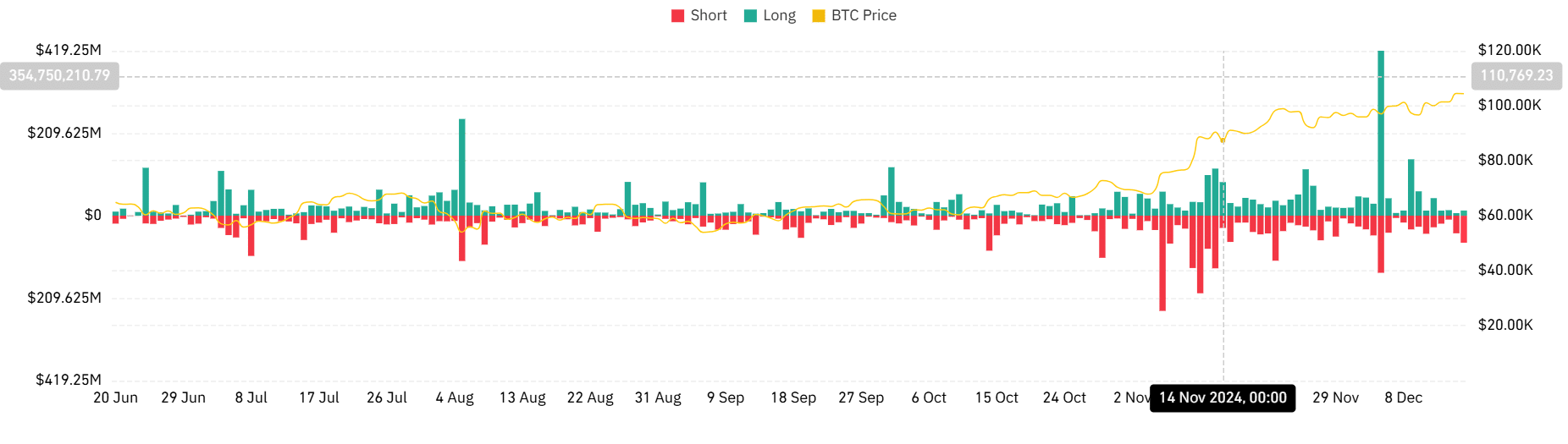

Liquidation trends: Shorts face increasing risk

In the last two trading periods, it appears that short positions have experienced more forced closures (liquidations) compared to long positions. Notably, the most recent session witnessed a significant increase in short liquidations, amounting to approximately 68.78 million for shorts, while longs saw just $13 million in liquidations.

This increase suggests that traders betting on Bitcoin’s decline, expecting it to dip below significant milestones, were taken aback by its robust performance above these key psychological thresholds.

As an analyst, I’ve observed a striking correlation between the increasing liquidation trend and the high proportion of short positions in Bitcoin (BTC). This observation suggests that Bitcoin’s bullish run has been exerting considerable pressure on leveraged bear traders.

As an analyst, I would advise keeping a keen eye on the liquidation levels of BTC trades. Should prices continue to rise, it may lead to additional short squeezes, possibly driving Bitcoin even higher.

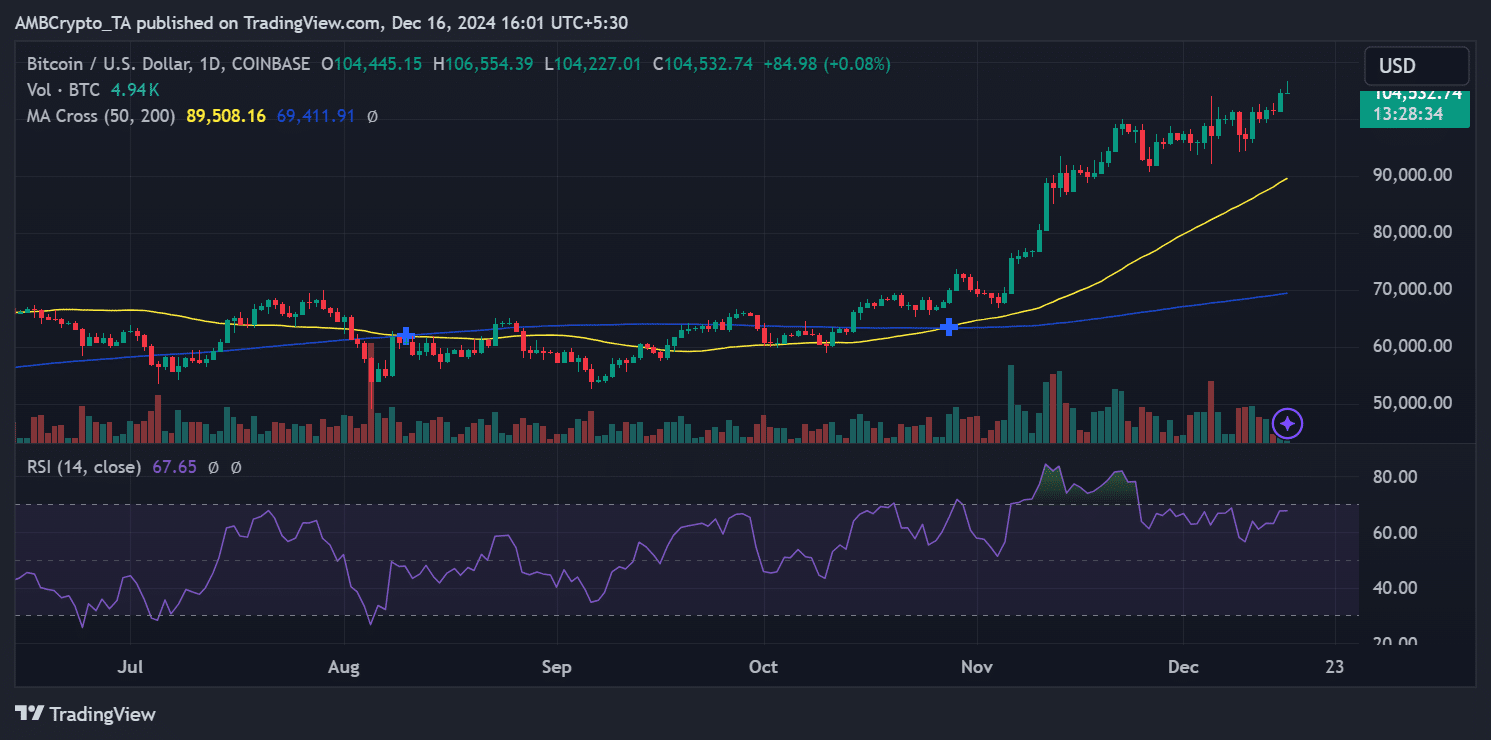

Bitcoin bulls in control amid RSI and moving average signals

The trend of Bitcoin’s price continues to be bullish on a daily basis, bolstered by technical signals suggesting robust upward movement. At present, the Relative Strength Index (RSI) stands at 67.65, suggesting that Bitcoin is approaching an overbought state but still has potential for additional gains.

Historically, when Relative Strength Index (RSI) values approach 70, there’s often a brief market correction. Yet, the resilience of Bitcoin in maintaining its current level might disprove immediate bearish predictions.

Moreover, Bitcoin’s current price sits significantly higher than both its 50-day and 200-day moving averages, which adds credence to the optimistic viewpoint. The Golden Cross is still providing robust backing for the persistent upward trend.

If the price climbs slightly above $105,000, it might initiate a test for further growth towards $110,000. However, the closest resistance is found at roughly $100,000, where potential support could be sought if there’s a downturn.

Can bears withstand BTC’s momentum?

It seems that traders’ negative stance on Bitcoin doesn’t match its robust uptrend at the moment. As the number of short positions grows and Bitcoin holds onto crucial support points, there might be more potential for growth if those who have bet against Bitcoin give up their short positions.

Read Bitcoin (BTC) Price Prediction 2024-25

The relationship among Bitcoin’s long/short ratio, market liquidations, and price fluctuations indicates that currently, the buyers (or Bitcoin bulls) are holding the upper hand.

For traders, determining whether the market can handle selling without losing its upwards momentum is essential. It would be wise for investors to keep an eye on Bitcoin’s potential resistance around $105,000 and support at $100,000, as these levels may provide clues about its upcoming trend shifts.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-12-17 05:12