Seventeen years, my dears, since the enigmatic Satoshi Nakamoto mined Bitcoin’s genesis block. What began as a quaint little experiment has blossomed into a global financial juggernaut, darling, reshaping markets, baffling policymakers, and capturing the world’s attention in ways even the most audacious of us could scarcely have imagined on that fateful January 3rd, 2009. 🌍✨

Bitcoin’s 17th Anniversary: A Timeline of Price, Power, and Persistent Panache

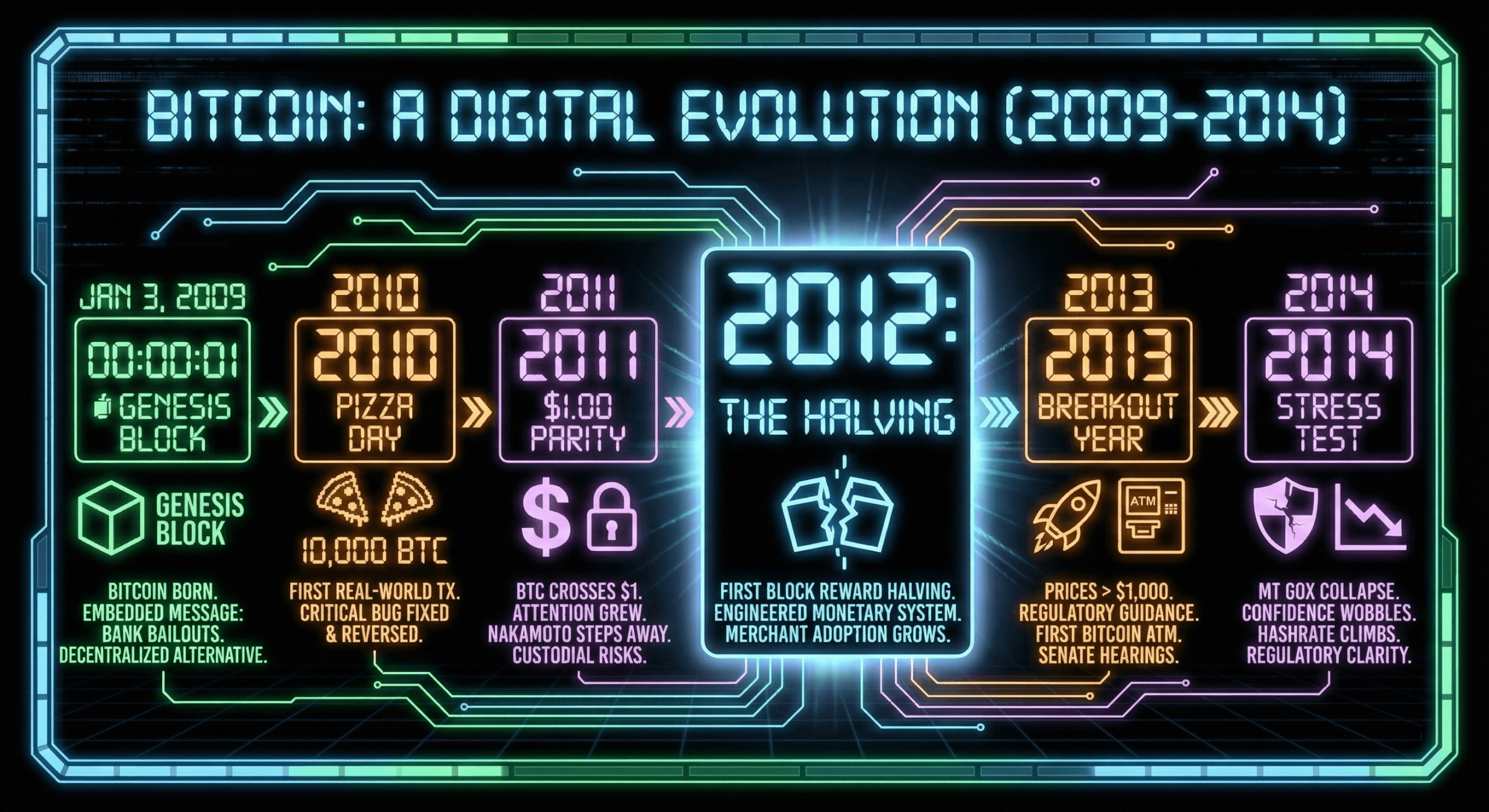

Ah, Bitcoin, born in the quietude of January 3rd, 2009, when its mysterious creator tucked a cheeky little message about bank bailouts into the first block of a brand-new blockchain. The financial system was in tatters, darling, and along came Nakamoto’s brainchild-decentralized, permissionless, and governed by code rather than those tedious committees. How utterly divine! 💻🔥

In its salad days, bitcoin (BTC) was more of a curiosity than a currency, my loves. The first real-world transaction in 2010-10,000 BTC for two pizzas-has since become the stuff of legend. Not least because it highlights how utterly clueless we all were about what was to come. And then, darling, a critical software bug briefly allowed billions of bitcoins to be created, only to be swiftly fixed and reversed. The network’s credibility? Saved, of course. 🍕🛠️

By 2011, BTC crossed $1 for the first time, darling, and began attracting attention beyond those dreary cryptography circles. Its use on platforms like Silk Road brought notoriety, while exchange hacks and price swings introduced early lessons about custodial risk. Still, the system kept ticking along, and the community kept building, even after Nakamoto quietly stepped away. How very dramatic! 🎭💸

The first block reward halving in 2012 marked Bitcoin’s transition from experiment to engineered monetary system, darling. The event reinforced its fixed supply narrative and coincided with growing merchant adoption. Oh, and those mainstream cultural references? Simply delightful! 🛒🌟

Bitcoin’s breakout moment arrived in 2013, my darlings. Prices vaulted from double digits to over $1,000, governments issued their first regulatory guidance, and the world’s first bitcoin ATM appeared. Law enforcement seizures and exchange failures made headlines, but so did Senate hearings that treated this crypto asset as something more than a fringe novelty. How thrilling! 💼🚀

The collapse of Mt Gox in 2014 was a brutal stress test, darling. Prices sank, confidence wobbled, and critics declared BTC finished-again. Yet the network’s hashrate continued climbing, major retailers began accepting BTC, and regulators clarified tax treatment. A more mature ecosystem, if you will. 🛒📉

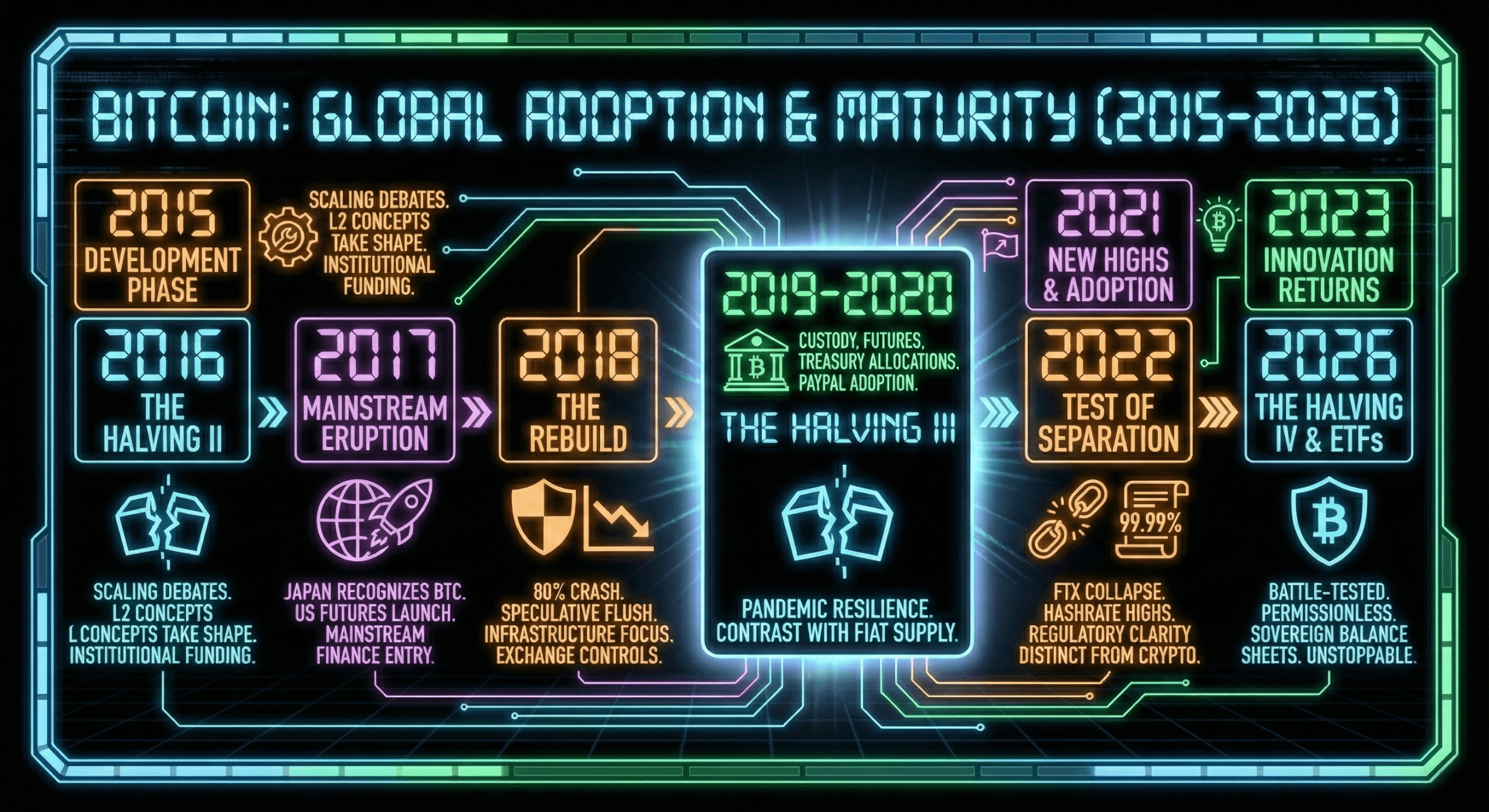

While prices drifted in 2015, development accelerated, darling. Scaling debates intensified, second-layer (L2) concepts took shape, and institutional venture funding signaled long-term interest. Bitcoin was no longer just surviving downturns; it was using them to evolve. How very resourceful! 🛠️🔧

The second halving in 2016 tightened supply further, darling, as global uncertainties pushed investors to reconsider Bitcoin’s role. By 2017, the asset had erupted into mainstream finance. Japan recognized bitcoin for payments, and futures launched on major U.S. exchanges. Simply fabulous! 🌐💹

The 2018 crash erased nearly 80% of bitcoin’s value, darling, and flushed out speculative excess. The ecosystem was forced into a long, uncomfortable rebuild. While prices languished, development shifted toward incremental, behind-the-scenes work, exchanges tightened risk controls, and miners continued scaling operations. Bitcoin? Bruised but structurally intact, darling. 🩹🔨

Institutional doors opened wider in 2019 and 2020, my dears. Custody services, futures platforms, and treasury allocations redefined bitcoin’s image. Amid pandemic-era market chaos, Bitcoin never stopped producing blocks, and the third halving reinforced its contrast with expanding fiat supply. Corporate buyers and platforms like Paypal helped bring bitcoin to the masses. How très chic! 🏦🌍

In 2021, bitcoin hit new all-time highs, darling, reached national currency status in El Salvador, and activated the Taproot upgrade. Even sharp midyear pullbacks failed to dent the network’s reliability, which maintained near-perfect uptime as mining power recovered from regulatory shocks. Bravo! 🇸🇻🚀

The following year tested Bitcoin’s separation from broader crypto failures, darling. While centralized firms like FTX collapsed and prices retreated, Bitcoin’s hashrate reached new highs, another country adopted it as legal tender, and regulators began crafting clearer frameworks. How utterly distinguishing! 📉⚖️

Innovation returned to the spotlight in 2023 with Ordinals and renewed optimism around spot bitcoin ETFs, darling. By 2024, that optimism became reality as U.S. regulators approved spot ETFs and Bitcoin’s fourth halving coincided with a move into six-figure prices. Market capitalization? Simply rarefied, my dear. 📈💎

Throughout 2025, Bitcoin settled into a phase that once seemed impossible: relative stability, darling. Institutional participation deepened, adoption expanded, and the network’s lifetime uptime hovered around 99.99%, rivaling critical internet infrastructure. What began as an outsider system had become embedded in global finance. How utterly establishment! 🏛️🌐

Now, on its 17th anniversary, Bitcoin stands as one of the most battle-tested monetary networks ever built, darling. It has weathered hacks, forks, bans, bubbles, and busts-and kept producing blocks. From pennies to six figures, from mailing lists to sovereign balance sheets, Bitcoin has come a long way without asking anyone’s permission. Cheers to that! 🥂✨

FAQ ❓

- What happened on Jan. 3, 2009, darling?

Bitcoin’s genesis block was mined, officially launching the network and embedding a message about bank bailouts. How cheeky! 💾💬 - Why is Bitcoin’s 17th anniversary important, my dear?

It marks nearly two decades of continuous operation for a decentralized financial network. Quite the feat! ⏳🌟 - How reliable has the Bitcoin network been, darling?

Bitcoin has maintained roughly 99.99% uptime across its entire history. Impressive, no? ⏱️🔒 - What role do institutions play in Bitcoin today, my love?

ETFs, corporate treasuries, and asset managers now hold and offer Bitcoin at scale. How très mainstream! 🏦📈

Read More

- Best Controller Settings for ARC Raiders

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Most Memorable Batman Covers

- These Are the 10 Best Stephen King Movies of All Time

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Star Wars: Galactic Racer May Be 2026’s Best Substitute for WipEout on PS5

- The USDH Showdown: Who Will Claim the Crown of Hyperliquid’s Native Stablecoin? 🎉💰

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

2026-01-03 18:59