- Bitcoin extended its downside, leading to concerns that bears are back in full swing.

- Exchange flows revealed limited impact, but there’s something more underneath the surface.

As an experienced crypto investor who has weathered multiple market cycles, I must admit that the recent downturn in Bitcoin has given me a sense of déjà vu. The bearish week followed by aggressive sell pressure over the weekend is reminiscent of past corrections we’ve seen, leading some to question whether we’ve reached the cycle top yet.

Bitcoin (BTC) had a bearish week ending, which was further intensified by increased selling activity over the weekend. This caused a wave of fear, uncertainty, and doubt (FUD), leading some to question if the peak of the cycle had already been reached.

Previously, some investors and traders drew comparisons between the peaks of Bitcoin’s marches in March and June, and the double top seen during the height of the earlier bull market.

In light of the recent developments and Bitcoin’s unsuccessful breakout attempt in July, there might be a deeper dampening effect on investor confidence.

It’s clear that emotions have changed significantly, as the balance between fear and greed in the market has swung drastically from greed to fear. This rapid shift has led to a notable decline in Bitcoin’s performance this week, marking the steepest drop since last June.

This has many wondering if this could be the end of the current bullish season.

Can Bitcoin bounce back from the weekend depths?

As a crypto investor, I had high hopes that Bitcoin would rebound within the range of $59,500 to $62,000, given its recent performance trends.

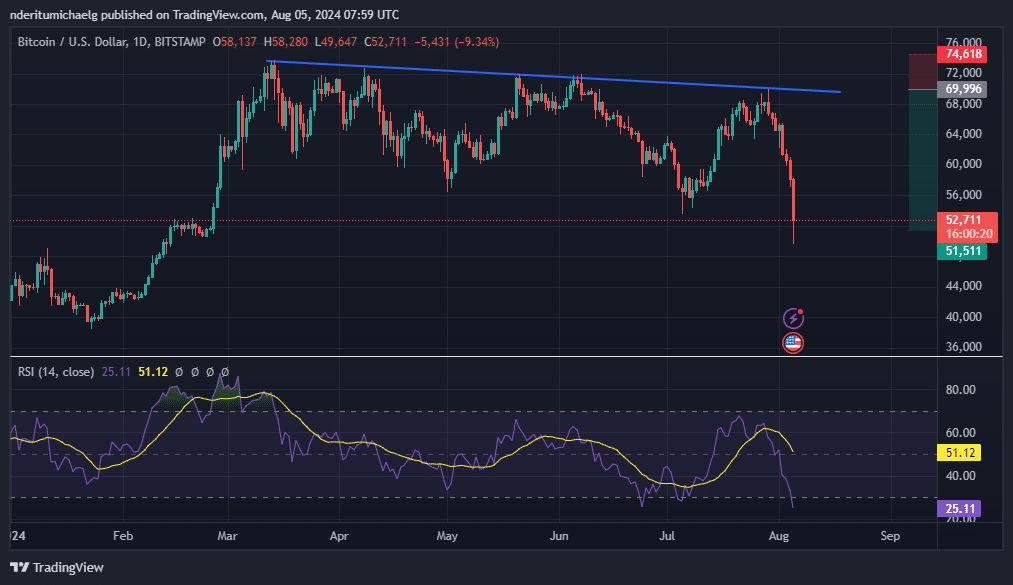

Initially, the strategy followed Fibonacci levels, but intense selling pressure caused prices to drop below these levels. Lately, the price hit a low of $49,647 and subsequently bounced back up to $52,688 as of the current report.

At the moment of analysis, Bitcoin’s Relative Strength Index (RSI) indicated a significantly oversold state. This could imply reduced potential for further price decline, possibly explaining why the price experienced a modest pullback.

Nevertheless, there remained a considerable potential for further drops. The extent of purchase activity at these low levels might suggest either readiness for market recovery or lingering concerns that prices could continue to fall.

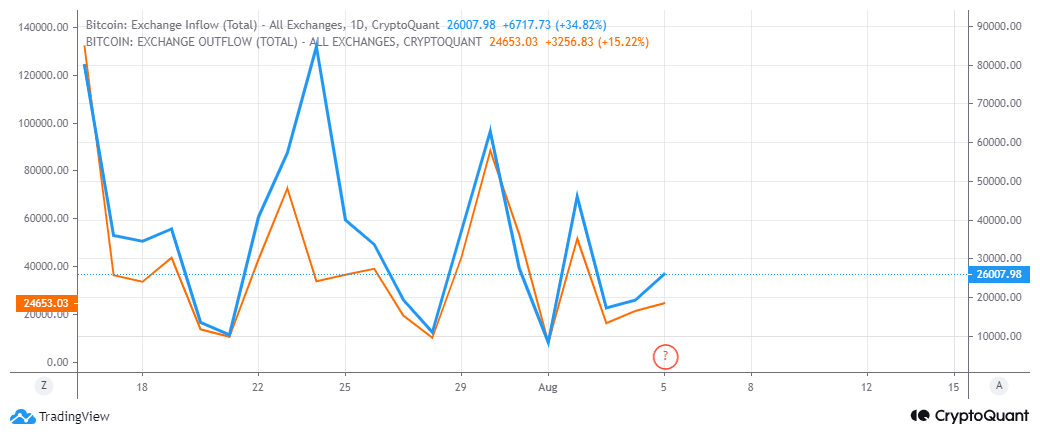

Since mid-July, there’s been a general trend of decreasing Bitcoin transactions at exchanges. Notably, the recent surges showed more Bitcoin being withdrawn (outflow) compared to deposited (inflow).

However, the latest spike in the last 24 hours had higher exchange inflows than outflows.

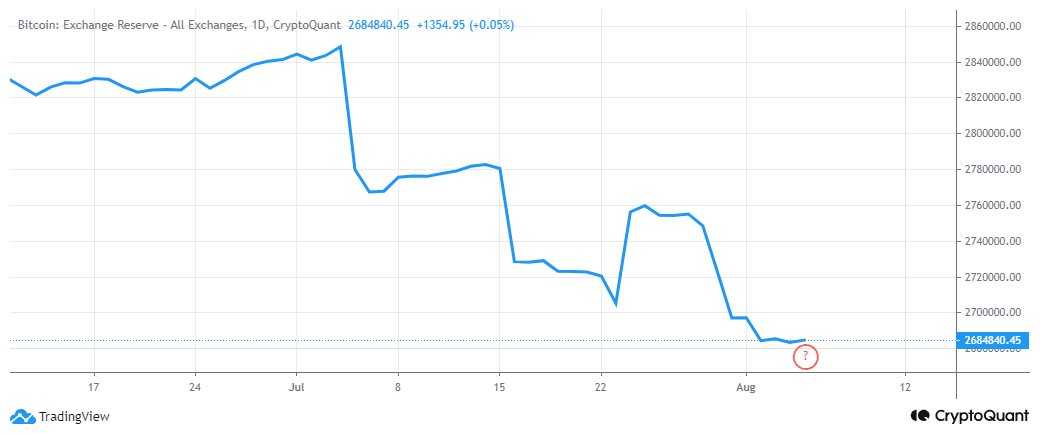

It’s reasonable to assume that Bitcoin exchange reserves should have increased substantially due to the heavy selling we saw over the past few days.

On the other hand, the minimal exchange transactions indicated that the quantity being traded was insufficient to cause a significant price fluctuation due to an intense wave of selling pressure.

Furthermore, Bitcoin exchange reserves have stayed relatively low even during the recent selling period. Interestingly, we noticed a slight stabilization following the initial drop in July.

Although the market has experienced a lot of sell pressure, these metrics signaled that buyers were also quite active.

Read Bitcoin’s [BTC] Price Prediction 2024-25

With institutional investors now able to invest in Bitcoin via ETFs, it’s likely that any potential price dips could be less severe due to increased demand from these large-scale investors. This increased interest could lead to discounted prices enticing even more buyers.

Nevertheless, the impact of the latest bearish outcome cannot be overstated. Market conditions may impact liquidity flows and limit inflows into Bitcoin.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- SOL PREDICTION. SOL cryptocurrency

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-08-05 23:04