- Bitcoin formed an encouraging chart pattern as it did in March 2020.

- The trade volume and fear factor are not the same, but this drop could still be a good buying opportunity.

As a seasoned analyst with vivid memories of the crypto winter of 2020 and the subsequent bull run, I find myself intrigued by Bitcoin’s recent downturn. The chart pattern we are witnessing bears striking resemblance to the one that preceded the dramatic surge in March 2020, which I remember as a time when the crypto market was on its knees but showing signs of life.

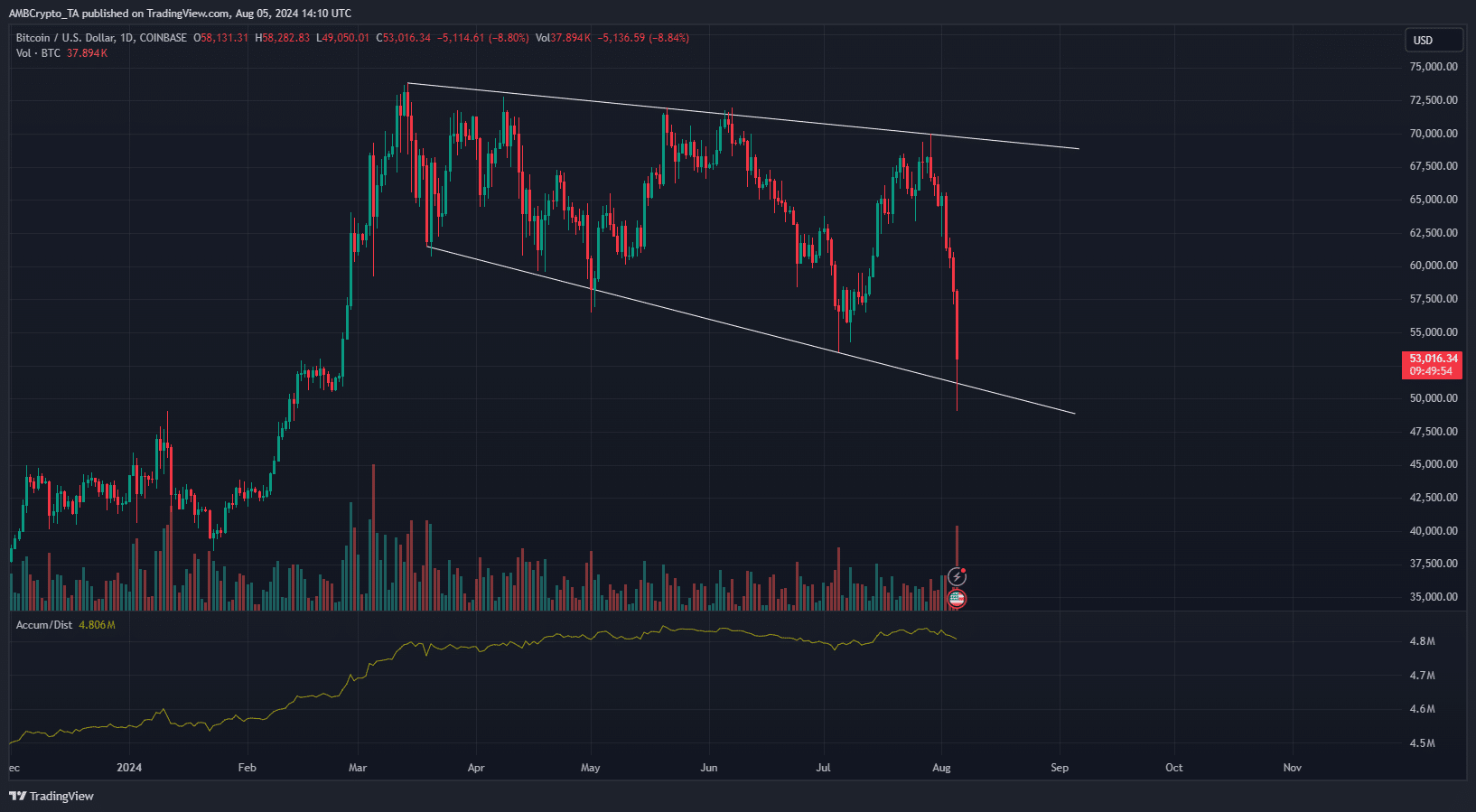

Bitcoin (BTC) experienced another significant dip during the weekend, starting from approximately $65,000 on Friday, 2nd August, and reaching a low of around $49,000 in the early hours of Monday, 5th August. This sharp decline was sparked by reports of Mt Gox’s actions and Germany selling Bitcoin.

The announcement that the Federal Reserve will maintain its current interest rates in September dealt another significant setback, following last week’s news about the Bank of Japan increasing their own rates by 15 basis points to 0.25%.

Some market participants were reminded by recent distressing news reports of the global market collapse that occurred in March 2020 due to the increasing number of coronavirus cases worldwide.

There were similarities and differences between the current crash and the Bitcoin Covid crash.

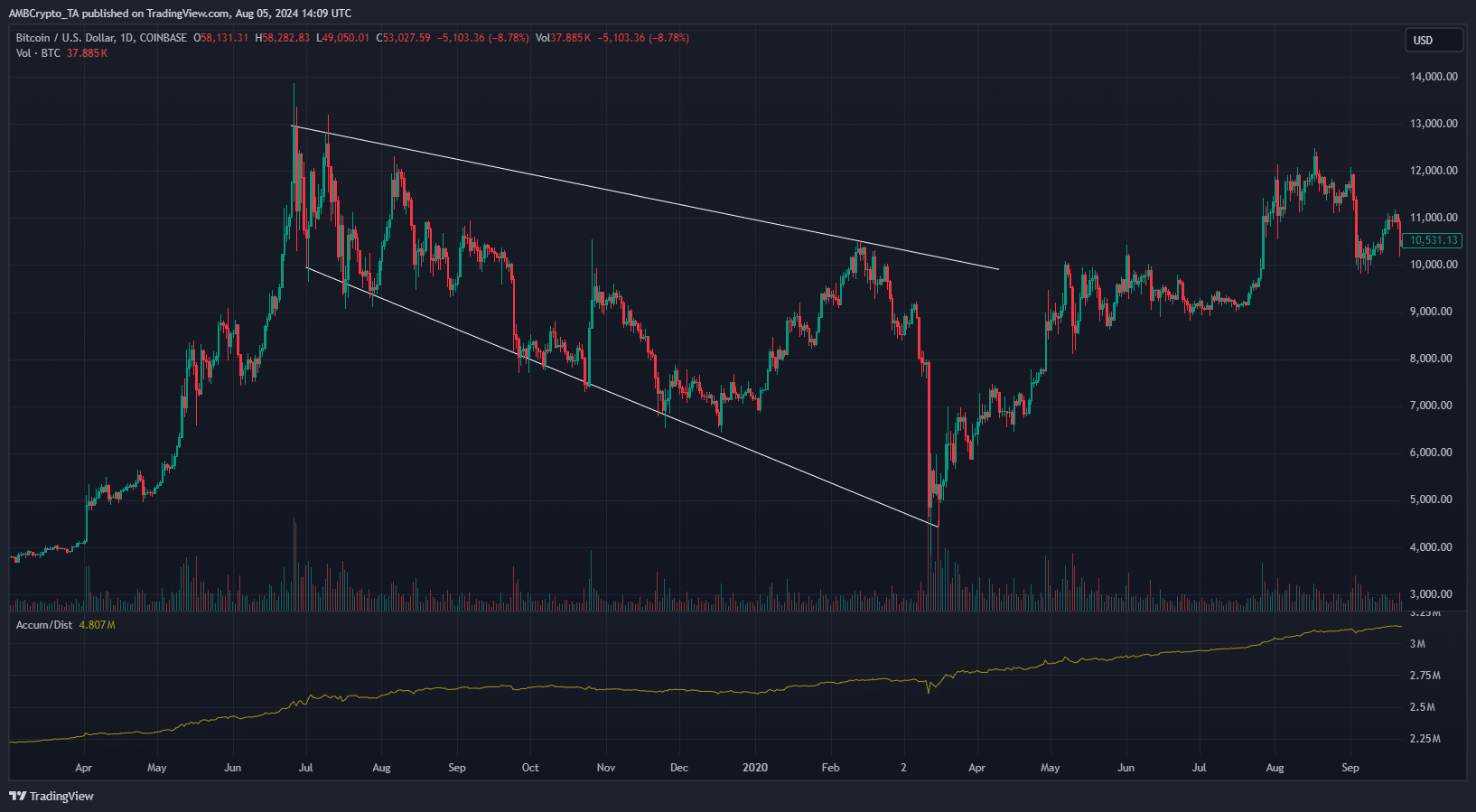

The chart pattern and recovery implications

In the daily chart view for both Bitcoin graphs, we see the formation of a widening descending channel known as a “descending broadening wedge.” After testing this pattern one last time, Bitcoin started an uptrend over the subsequent two months and broke decisively above the $9k resistance level, indicating a bullish move.

Since March, the price trend has mirrored a similar chart configuration, indicating undervaluation based on the metrics we’ve observed for Bitcoin.

As an analyst, I’m currently observing that the trendline support for Bitcoin (BTC) stands at approximately $51,200 as we speak. It is crucial for BTC not to close a daily trading session below this level to maintain the validity of the wedge pattern we have been tracking. If it were to breach this support, the significance of the wedge pattern could potentially be undermined.

Despite the market-wide panic, the Bitcoin Covid crash was worse

On Binance, the BTC/USDT trading pair recorded its highest trading volume associated with the market crash on March 13, 2020. This massive volume equated to approximately 402,200 Bitcoins.

On Monday, 5th August, the Bitcoin trading volume was approximately 125.5k BTC, with more trades expected to take place later in the day.

What stood out most is that we lacked significant institutional investment, and retail interest wasn’t as strong as it was in 2024 when Bitcoin and Ethereum [ETH] ETFs were approved.

Is your portfolio green? Check the Bitcoin Profit Calculator

According to experienced cryptocurrency trader DonAlt, Bitcoin and the crypto sector found themselves in a battle for existence.

In this instance, the wider acceptance resulted in Bitcoin’s value falling under $50,000, which was a tough blow, but it nevertheless kept Bitcoin as a digital currency with a market capitalization of over one trillion dollars.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-08-06 10:15