-

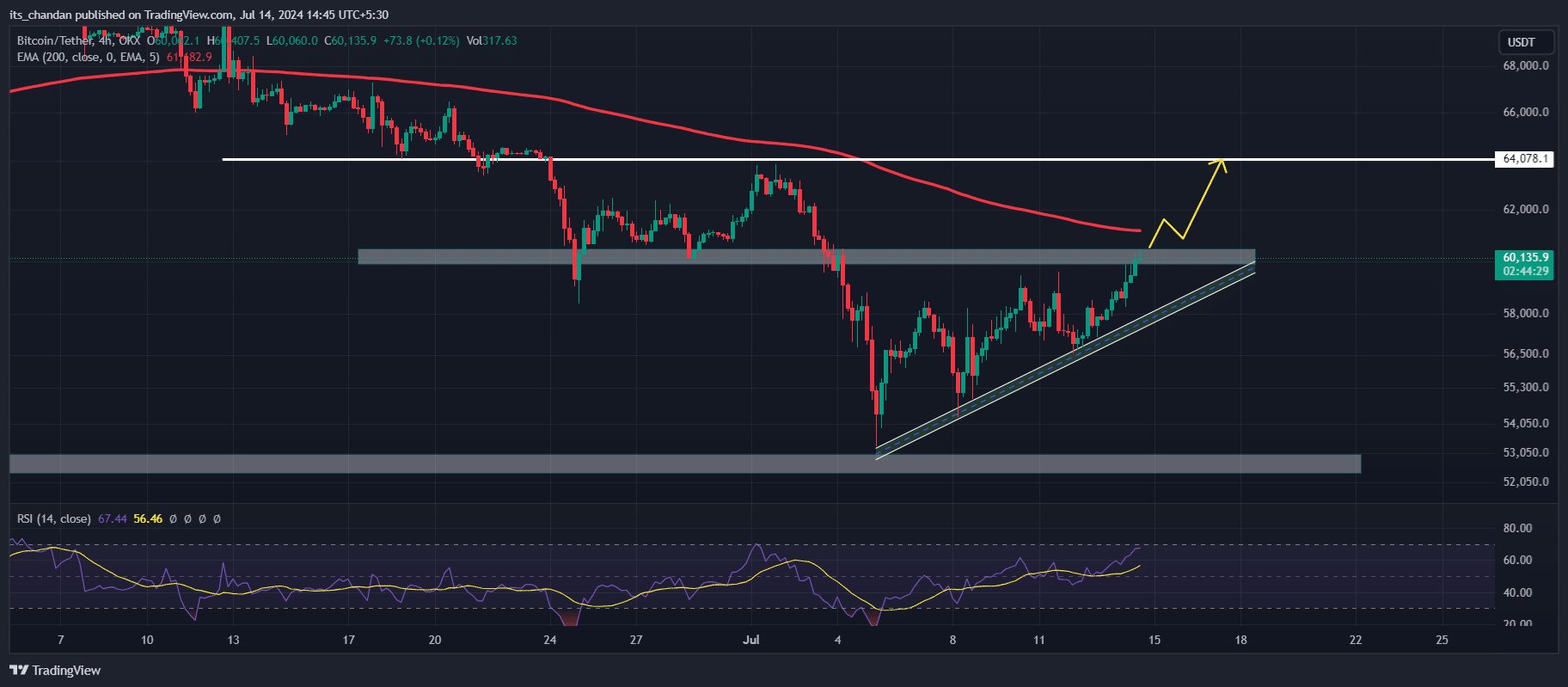

Bitcoin could hit $64,000 if BTC’s 4-hour candle closes strongly above the $60,700 level.

Long positions are comparably higher than short positions, signaling upcoming bullishness.

As a researcher with extensive experience in the cryptocurrency market, I believe that Bitcoin’s recent breach of the $60,000 resistance level is a significant development. This level had previously acted as a major hurdle for BTC, but it was weakened after multiple rejections and finally broken with strong buying pressure.

As a crypto investor, I’ve noticed a significant shift in the market sentiment following Germany’s decision to sell off its entire Bitcoin stash. This move not only caused a surge in the prices of most cryptocurrencies, turning them green, but also gave Bitcoin the boost it needed to break through the $60,000 mark.

Bitcoin breaches major resistance level of $60,000

Starting on July 3, 2024, Bitcoin (BTC) made several attempts to surpass the $60,000 mark, yet it was unsuccessful each time. The repeated refusals at this price point progressively weakened it, making it easier to fall below that level this time.

If the daily candle closes stronger than $60,700, Bitcoin could potentially reach $64,000 in the near future.

Instead of “Apart from the German government’s BTC sell-off, another potential reason that turned market sentiment slightly bullish is the continuous inflow into spot Bitcoin Exchange Traded Funds (ETFs),” you could say:

During this time, as the broader market experienced significant losses, traders investing in Bitcoin through exchange-traded funds (ETFs) demonstrated robust faith and enthusiasm, as evidenced by their purchases during price dips, based on data from the analytics company Spotonchain.

Technical analysis of BTC and key levels

Based on the technical assessment of experts, Bitcoin’s price trend appears positive as it currently hovers above the 200-day Exponential Moving Average (EMA) on the daily chart. When the price sits above the 200 EMA, this is a bullish sign in the chart.

In addition to the bullish trend evident on the larger time scale, the price action in the 4-hour chart displays a bullish ascending triangle formation. A robust candle closing above $60,700 could lead us to anticipate a bullish surge potentially reaching $64,000.

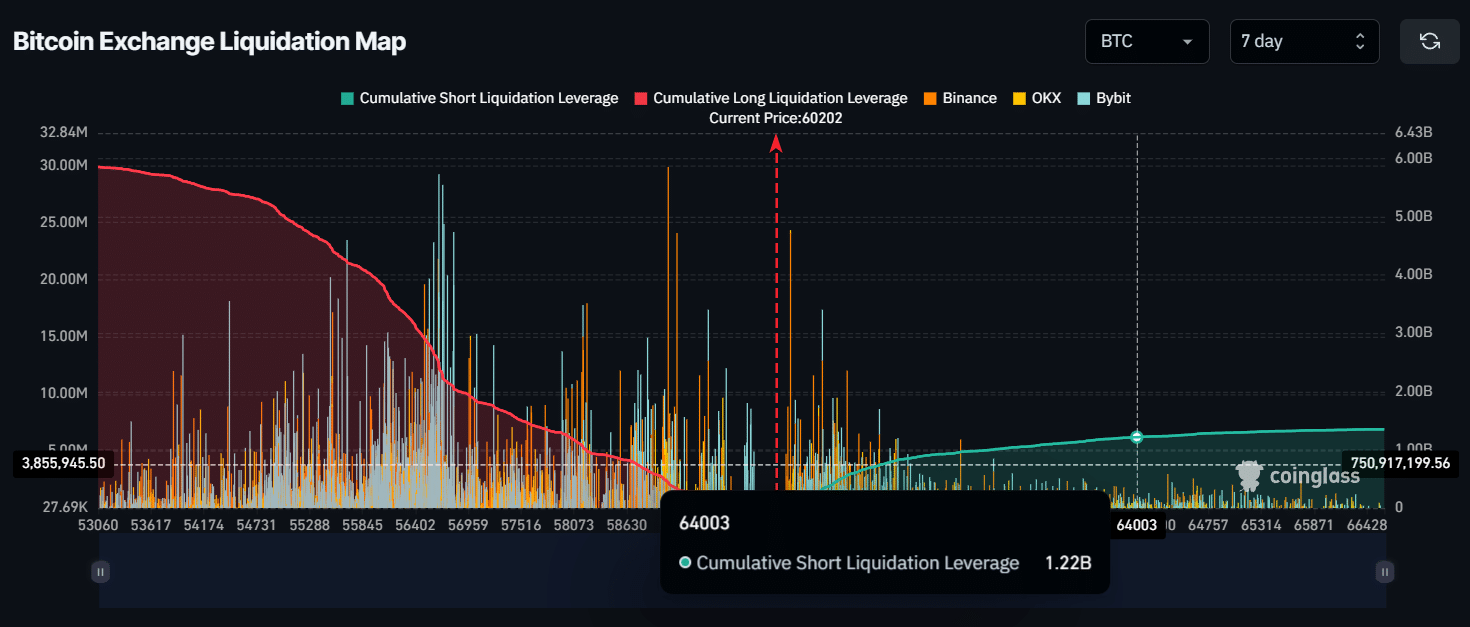

As a researcher studying the cryptocurrency market, I’ve found that if Bitcoin (BTC) were to surge past the $64,000 mark, it would trigger the liquidation of approximately $1.22 billion worth of short positions.

According to recent data from CoinGlass, a leading on-chain analytics firm, the number of long positions held by bulls has been significantly greater than the number of short positions held by bears over the past week.

As I pen down these words, Bitcoin (BTC) is hovering around the $60,140 mark in the cryptocurrency market. Over the past day, it has exhibited a robust performance with a noteworthy increase of approximately 3.5%.

In the meantime, there’s been a notable increase of 5.3% in open interest (OI), indicating robust confidence and engagement among investors and traders as per coinmarketcap’s figures. Simultaneously, Bitcoin (BTC) has experienced a significant price rise of more than 4.6% over the past week.

These cryptocurrencies, such as Ethereum (ETH), Solana (SOL), Cardano (ADA), and XRP (XRP), have experienced comparable surges in value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-14 17:11