- Bitcoin is currently trading at around $87,000.

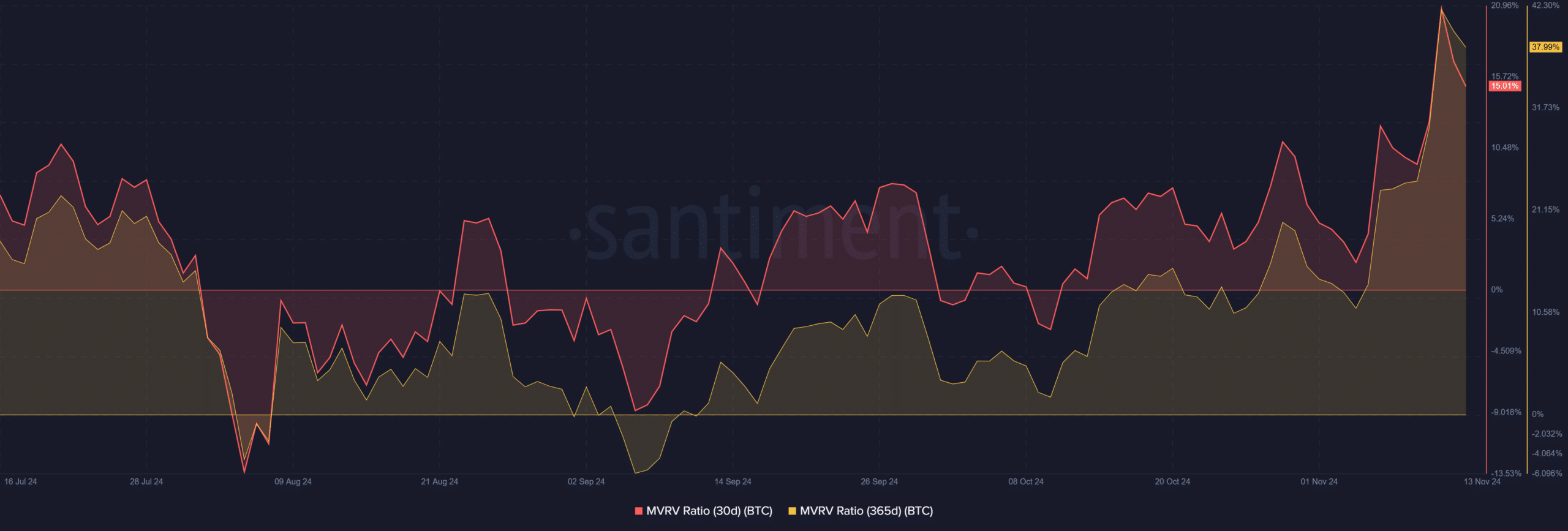

- The MVRV is at its highest in over a year.

As a seasoned researcher who has witnessed Bitcoin’s rollercoaster ride since its early days, I find myself intrigued by the current state of this digital gold. The MVRV ratios suggest that we are dealing with a heated market, and history tells us that such periods can lead to either fireworks or a cooling-off phase.

As a crypto investor, I’ve found myself drawn to Bitcoin (BTC) lately due to its skyrocketing all-time highs and intriguing changes in its underlying data.

Among these metrics, the Market Value to Realized Value (MVRV) ratio sheds light on possible market trends, while the Global In/Out of the Money (GIOM) information gives an understanding of investor profitability.

Together, these metrics reveal an interesting picture of Bitcoin’s current state.

Bitcoin MVRV ratios indicate a heated market

Currently, the 30-day MVRM (Market Value to Realized Value) ratio for Bitcoin is approximately 15.01%, whereas the 365-day ratio hovers around 37.99%. These figures suggest that most Bitcoin owners have made substantial profits on their investments, as they are holding onto assets with high unrealized gains.

Historically, high MVRV ratios tend to coincide with times of increased market action, which can result in either cashing out for profits or further bullish growth.

As a long-term crypto investor, I’ve noticed that the 365-day MVRV ratio is indicating a high level, which suggests that I and other long-term holders are experiencing significant returns on our investments. This positive trend might boost overall market sentiment, but it also could lead to increased selling pressure, as more investors may decide to cash out their profits.

Majority of Bitcoin addresses are profitable

Approximately 53.61 million Bitcoin wallets (or about 99.35% of all existing wallets) currently hold Bitcoins that were purchased at a price lower than the current market value. This means that approximately 69.58% of these wallets are ‘in the money’ (their Bitcoin is worth more than they paid for it), while an extremely small fraction, around 0.11%, are ‘at the money’ (their Bitcoin is exactly equal to their purchase price). The remaining 30.30% of wallets are ‘out of the money’, meaning the value of their Bitcoin is less than what they paid for it at the time of purchase.

This analysis underscores robust areas of resistance, given that a significant number of “in the money” Bitcoin addresses indicate a substantial foundation offering strong resistance for Bitcoin.

Holders who are making a profit are generally reluctant to sell when prices drop, whereas the 30.30% of bitcoin holders who are currently ‘out-of-the-money’ might provide resistance as the price rises towards levels where these investors break even. This is especially true near historical price ranges.

The information provides additional support for a positive future trend in Bitcoin, since the majority of its holders currently have advantageous positions. This situation could strengthen market trust.

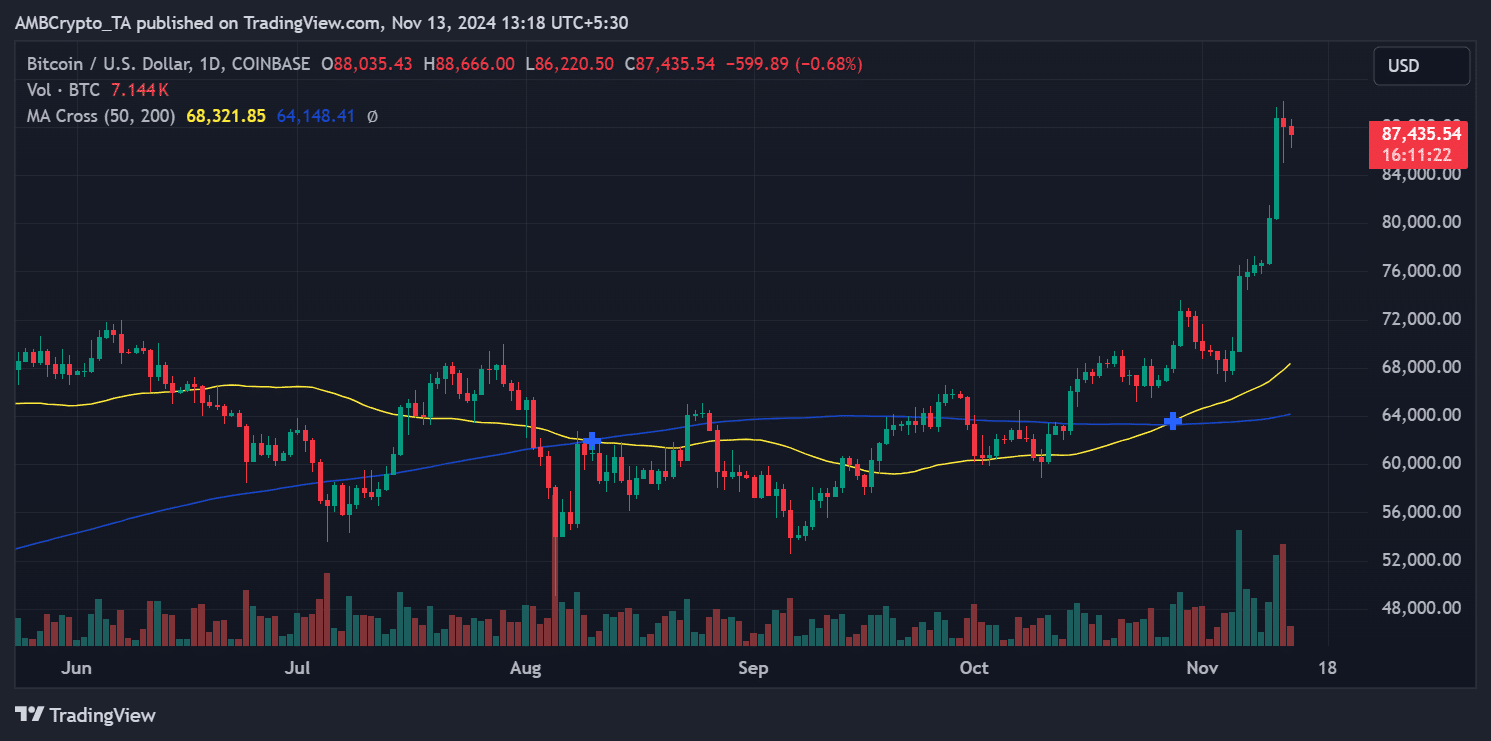

BTC price action reflects growing volatility

At this moment, Bitcoin’s price has dipped slightly from a high of approximately $88,666 down to $87,435. This fluctuation suggests that the asset is becoming increasingly volatile as it surges upward, having broken bullishly out of its period of consolidation around $68,000.

Each day’s graph underscores a robust uptrend backed by both the 50-day and 200-day average lines, which stand at $68,321 and $64,148 as of now.

In simpler terms, the current surge in Bitcoin’s price has made it appear overvalued, as shown by its Relative Strength Index (RSI) at 84.88. This could mean a temporary slowdown or correction is imminent before any more significant increases, especially if people start to cash out their profits.

Keep an eye on potential support at around $85,000 and $80,000, while be aware of possible resistance close to $90,000 and $95,000 as Bitcoin approaches the significant milestone of $100,000.

Market outlook: Caution or continuation?

A strong Bitcoin outlook is suggested by the mix of elevated MVRV ratios and an abundance of highly profitable wallets.

Read Bitcoin (BTC) Price Prediction 2023-24

Even though certain accounts that haven’t yet reached their break-even point might show some reluctance to leave, overall, the general feeling about the market is positive.

As Bitcoin ventures into unexplored regions, investors are expected to pay close attention to certain key performance indicators, as they anticipate Bitcoin reaching a significant landmark of over $90,000.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

2024-11-13 21:12