- Bitcoin was trading close to the $59,000 range at press time

- There seemed to be some miner capitulation, but large miners still accumulated

As a seasoned researcher who has witnessed the cryptocurrency market’s tumultuous waves for years now, I can say that this latest Bitcoin miner capitulation episode was as predictable as the tides. The price dip, combined with increased mining difficulty and narrowing profit margins, was a recipe for distress among miners. However, the recent signs of stabilization and the accumulation by large miners give me hope that we might be nearing the end of this capitulation cycle.

Bitcoin faced significant miner capitulation last week as its price dipped, leading to heightened outflows from miners. This occurred alongside a spike in mining difficulty, with the same reaching its highest level in years and putting additional pressure on miners. However, recent metrics indicate that this capitulation may be nearing its end as Bitcoin showed signs of stabilizing somewhat.

Bitcoin sees miner capitulation

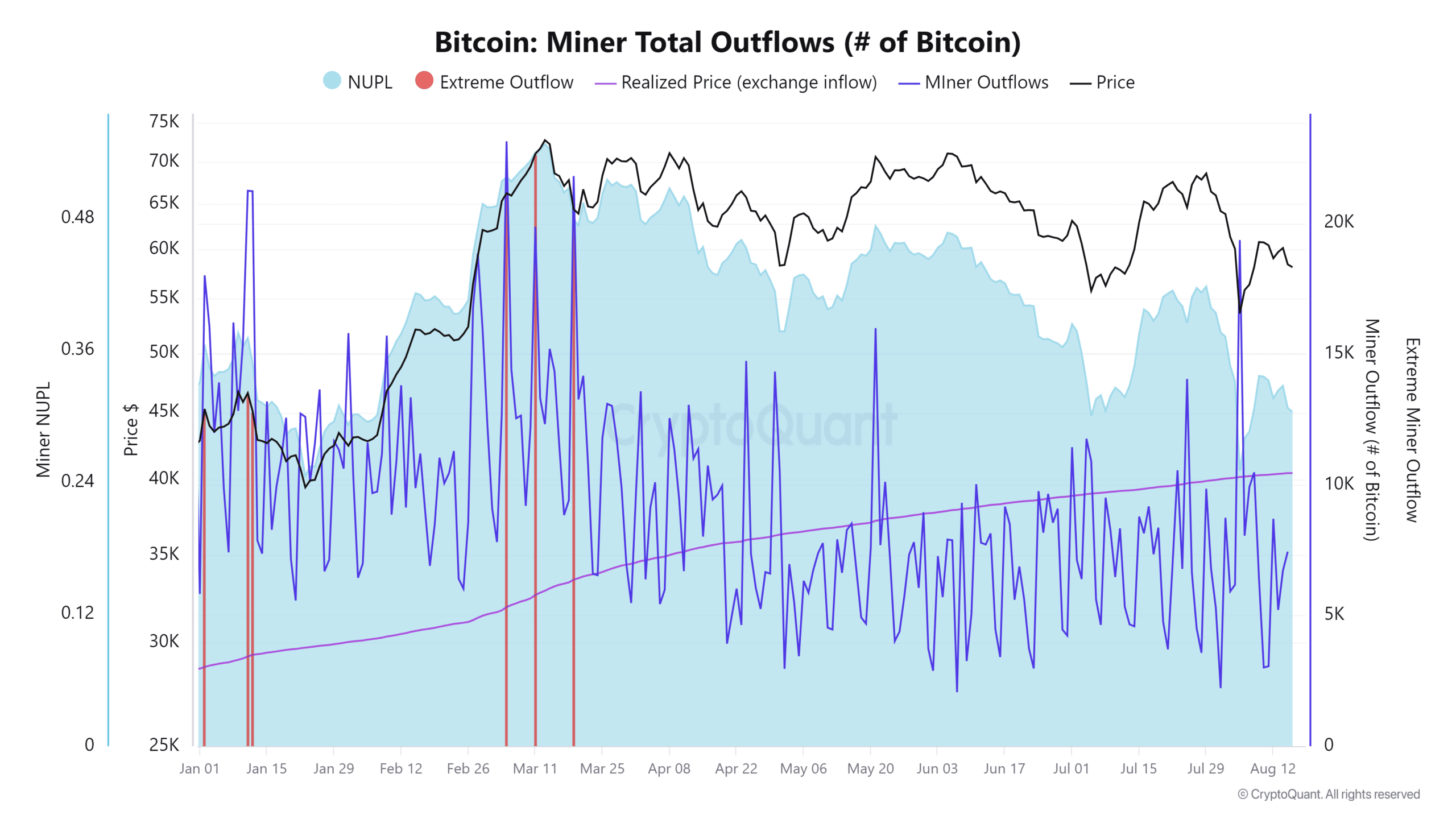

According to CryptoQuant’s data analysis, Bitcoin experienced a substantial miner sell-off last week due to its price decline to around $49,000. On August 5th, the daily amount of Bitcoins leaving mining pools increased dramatically to approximately 19,000 BTC, which is the highest level since March 18th.

This sell-off occurred as miners faced increasingly narrow profit margins. The margin fell to 25%, the lowest since 22 January.

The analysis further indicated that some miners sold portions of their reserves, realizing a loss of $22 million – Marking the largest daily loss since 29 May. A sharp hike in hashrate and network difficulty drove this wave of capitulation.

Over the last week, I’ve observed that the metrics hit unprecedented peaks, which undeniably added extra stress to mining operations. Confronted with these arduous circumstances, miners were compelled to sell off their holdings just to meet their expenses, thereby underscoring the intense pressure they experienced during this timeframe.

Current state of miners’ holdings

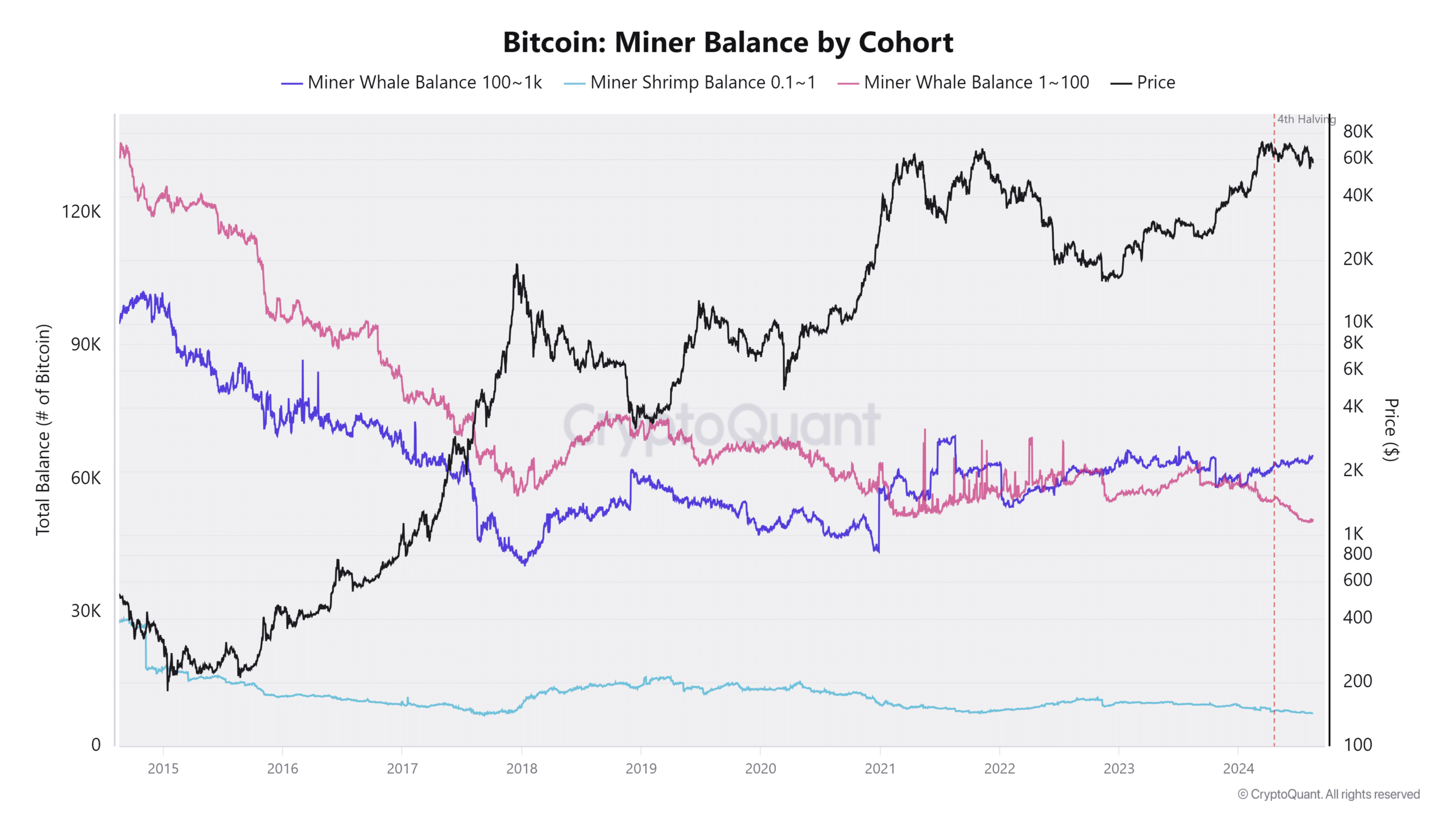

Additionally, it’s worth noting that the smaller miners saw their holdings hit a bottom as a result of the recent sell-off in the Bitcoin market.

Data from the Miner Balance by Cohort revealed that even before this latest capitulation, smaller miners (pink line) were experiencing a steady decline in their Bitcoin holdings – A trend that intensified following the halving event in Q2.

Instead of reducing their Bitcoin holdings, as one might expect, the larger miners have actually been growing them. As per the analysis previously mentioned, these larger miners (represented by the violet line) have consistently added to their Bitcoin reserves, now totaling approximately 66,000 BTC.

The buildup of Bitcoin by bigger miners has played a role in reducing the overall Bitcoin seller exhaustion or ‘capitulation.’ As the value of Bitcoin slightly rebounds, this trend becomes more apparent.

Resistance at $60,000 despite recent gains

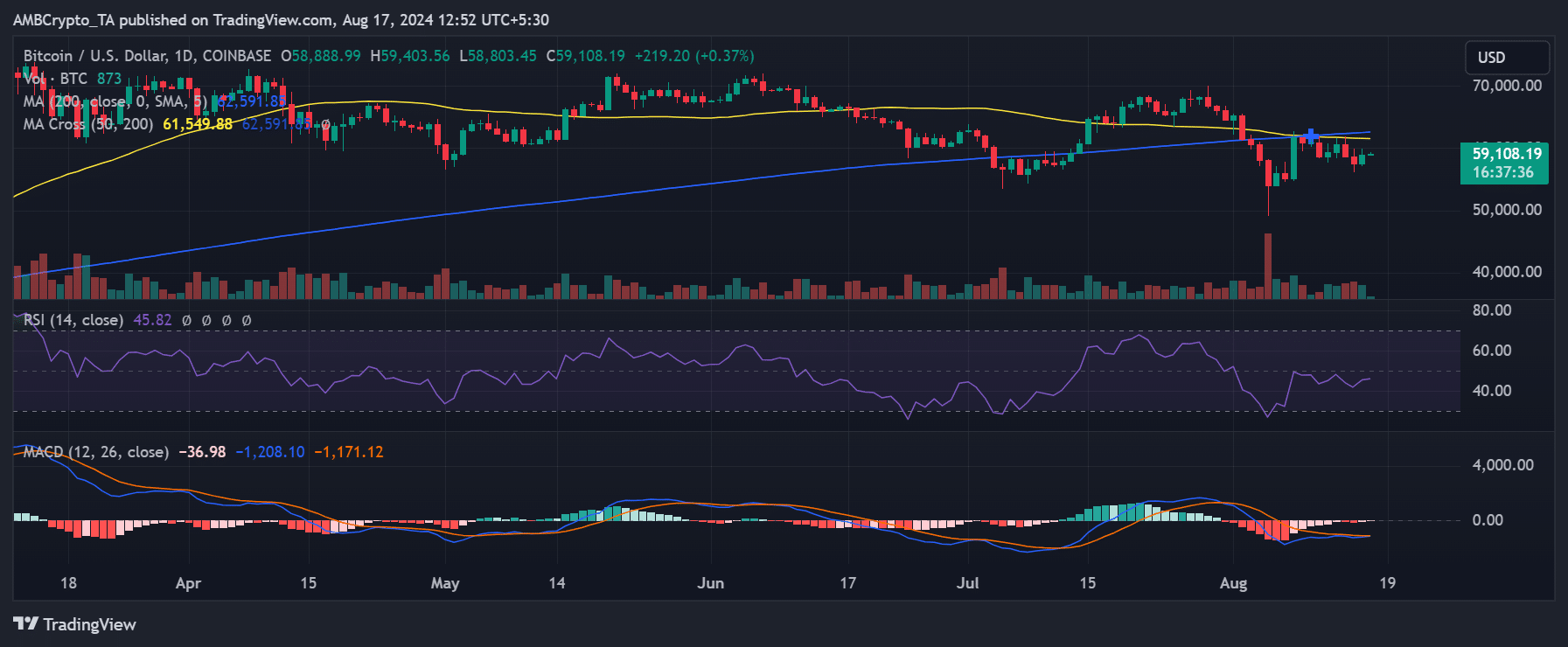

When Bitcoin dipped below both its short-term and long-term moving averages (represented by the yellow and blue lines), it has repeatedly faced strong resistance in the $60,000 price range. Examining the daily chart, we can see that the yellow line offers resistance around $61,000, while the blue line suggests another potential resistance point around $62,000.

Currently, as I’m typing this, Bitcoin experienced a rise of more than 2% during its latest trading session, ending the day at prices exceeding $58,000.

Although we’re not yet back to past record levels, this upward trend follows a drop to around $49,000 that sparked a wave of miner sell-offs, indicating a positive shift in the market direction.

– Read Bitcoin (BTC) Price Prediction 2024-25

Despite not yet surpassing the significant resistance at $60,000, this recent increase could trigger a slow and steady rebound in its value.

To regain a more powerful upward trend and approach its past peaks, Bitcoin needs to surmount these crucial resistance points.

Read More

2024-08-18 04:08