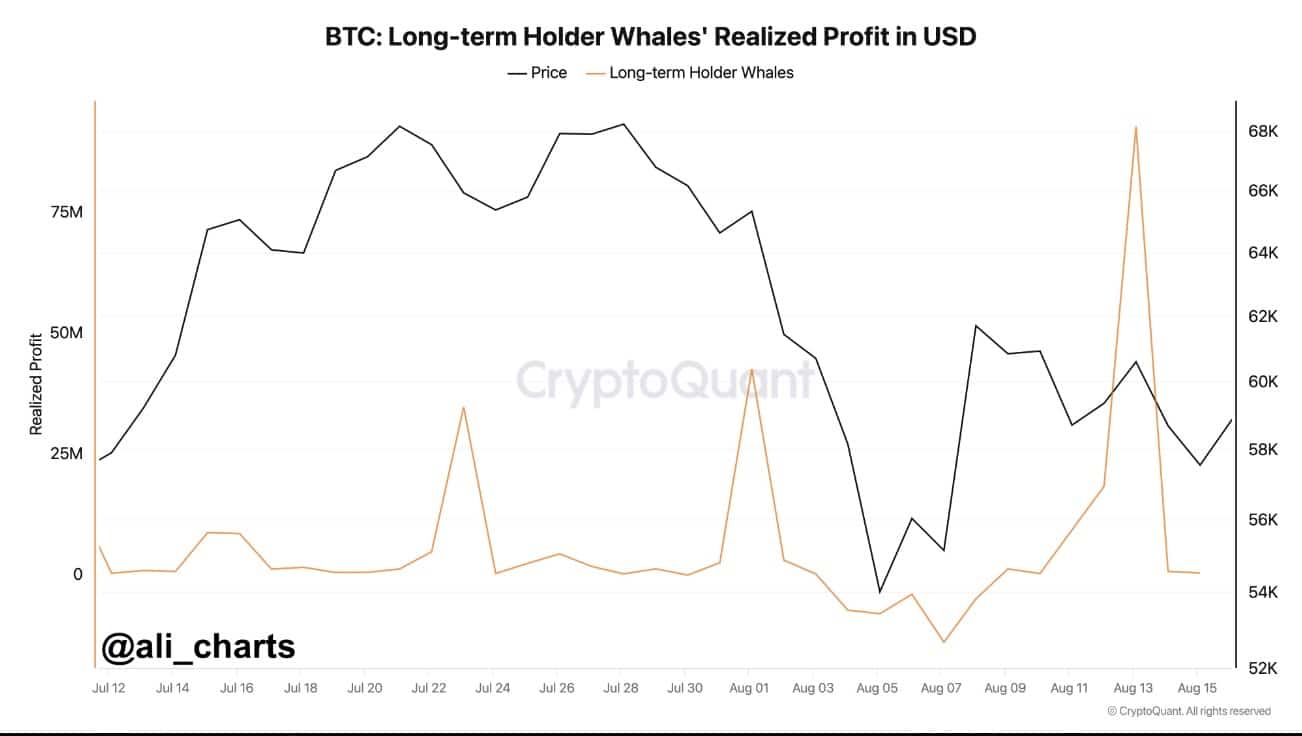

- Bitcoin long-term holders realize a significant 92.7 million in profits.

- Metrics and indicators point to potential short-term price corrections.

As a seasoned researcher with years of experience in the crypto market, I can confidently say that the current Bitcoin landscape is shaping up to be a rollercoaster ride. The recent profit-taking by whales, as indicated by the whale realized profit data, is a cautionary signal, suggesting potential short-term corrections. However, it’s essential to remember that these players have been known to return when they see an opportunity for higher profits.

At the moment of reporting, Bitcoin [BTC] was approximately valued at $58,185. The leader among cryptocurrencies was examining a crucial support level of around $56,427 at press time. This very significant level aligns with an essential trendline that has demonstrated resilience as a robust support in the past.

Whales cash in, caution ahead?

Based on recent data about whale’s earnings, it appears that they accumulated more than $92.7 million in profits just a short while back. This significant profit-making activity suggests caution from these investors and could potentially signal a downward market trend in the future.

In historical context, when major market participants decide to withdraw their funds, it could potentially lead to a temporary increase in selling activity. This heightened selling activity might then cause unpredictability in the Bitcoin market.

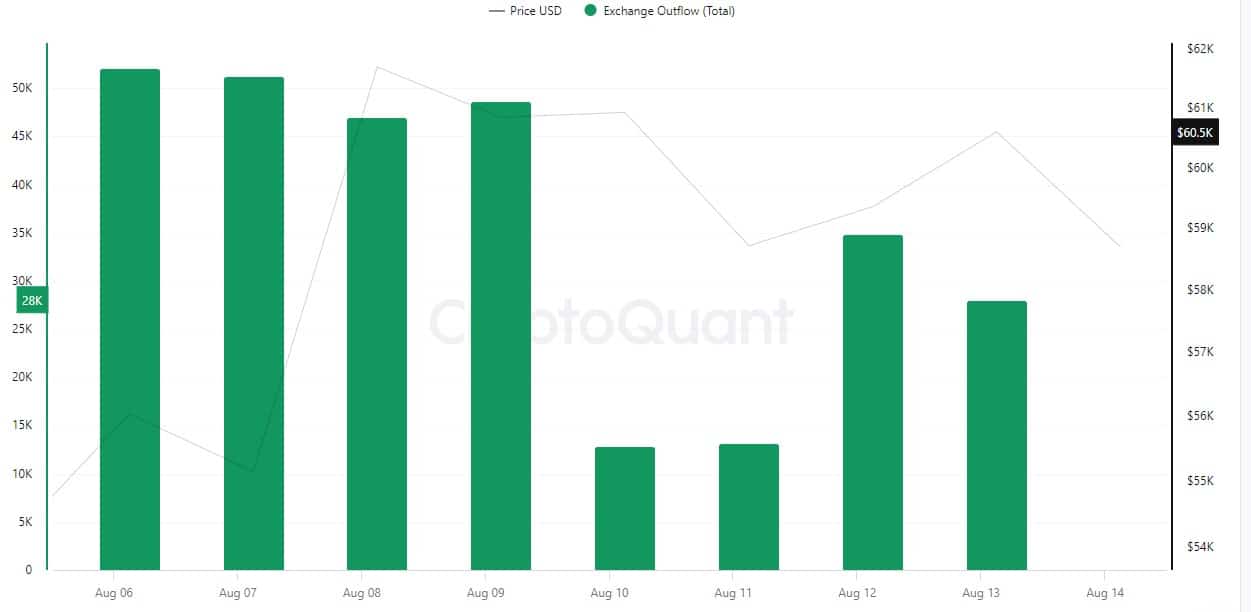

Exchange outflow points to bullish sentiment

Instead, the flow of Bitcoin leaving exchanges suggests a significant amount was withdrawn, reaching approximately 50,000 Bitcoins at its highest point on August 9.

Generally speaking, this situation is viewed favorably as it implies that investors are transferring their cryptocurrencies into offline wallets (cold storage), reducing the likelihood of quick coin sales in the near future.

Generally speaking, when Bitcoin’s quantity is lowered across multiple trading platforms, this often leads to less urgency to sell, which can help maintain or even boost prices due to reduced supply and increased demand.

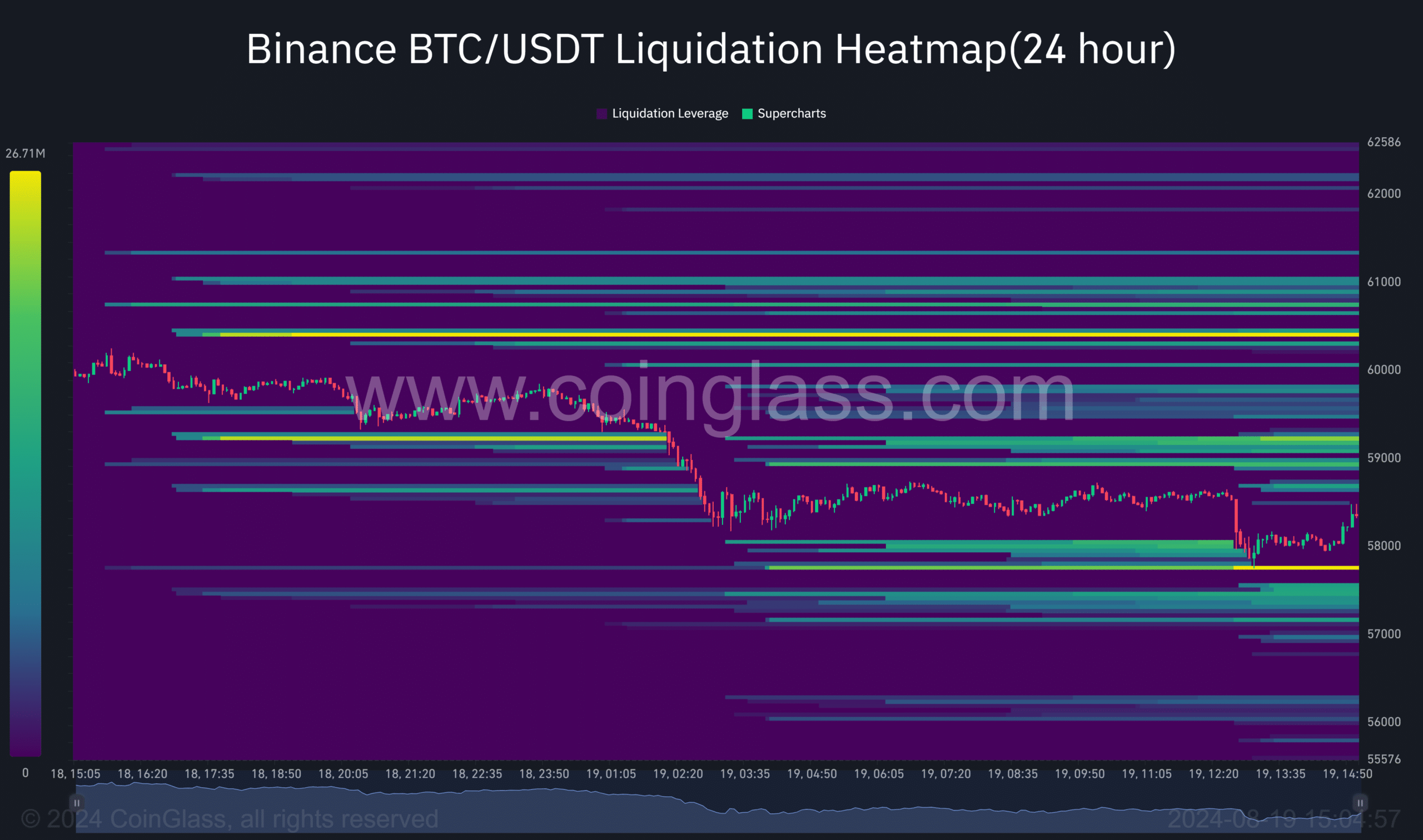

Bitcoin liquidation risks loom large

Yet there is a serious risk on the horizon. If price crosses above $60k, then the liquidation heatmap shows more than 100 million dollars’ worth of BTC will be sold off in no time at all.

Thus, any upward movement will lead to massive liquidations, causing sharp fluctuations in prices.

Volatility ahead for Bitcoin

Lastly, Bitcoin’s recent price action implies that the market may experience increased volatility.

The level of $56,427 continues to carry importance, but keep an eye on the $60,000 mark because there’s a lot of potential selling pressure building up around that area.

As an analyst, I observe that whale activities, outflow trends, and certain technical elements suggest a keen market awareness on their part. This implies they are closely monitoring the market’s movements.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-08-19 21:43